Hey, it’s Marc.

Russia just accused America of weaponizing crypto to "erase its $35 trillion debt." Washington will "shove debt into stablecoins, devalue it, and reset the system."

They're not wrong.

July 18 was the day the U.S. stopped playing defence and went all-in on digital assets:

President Trump signed the GENIUS Act [The law], America's first federal crypto law. The House passed the CLARITY Act 294-134.

Together, these laws transform stablecoins into a private-sector engine that funds U.S. debt while extending dollar dominance globally.

Now, America wants to become “the crypto capital of the world”.

Let’s unpack.

The Genius of the GENIUS Act

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act creates the first comprehensive regulatory framework for digital dollars in the US. That’s significant.

The law is breathtakingly simple: Private companies can now issue digital dollars, backed 1:1 by U.S. Treasuries. Every stablecoin becomes a Treasury bond buying machine. More on that later.

The law gives non-bank financial giants such as Stripe, PayPal, Robinhood, Visa, and Mastercard a green light to issue stablecoins if they register and comply.

By defining “payment stablecoins” in law and excluding them from securities and commodities regulation, the GENIUS Act offers long-awaited legal certainty. It also positions the U.S. ahead of the EU’s MiCA framework and Hong Kong’s licensing regime, which limit issuers to regulated institutions.

This regulatory clarity is already accelerating adoption among major payments companies.

Western Union, long a crypto skeptic, is now piloting stablecoin-based treasury operations and testing on/off-ramps in Latin America and Africa.

Visa expanded its stablecoin program by adding euro-backed EURC and regulated USDG and PYUSD, alongside Stellar and Avalanche support.

JPMorgan is now testing Bitcoin and Ethereum-backed loans and has partnered with Coinbase to enable Chase customers to fund their Coinbase accounts directly from bank accounts and credit cards.

PNC Bank has announced direct crypto trading through its own Coinbase integration.

Interactive Brokers is exploring the launch of a proprietary stablecoin to enable 24/7 account funding, treating digital assets as operational infrastructure.

In short: The GENIUS Act is not just policy. It’s the starting gun for a regulated, scalable digital dollar economy.

And it’s creating a powerful digital dollar engine:

Stablecoin issuers must back coins 1:1 with U.S. Treasuries + cash

They keep 100% of Treasury yields (currently 4%+)

Users get digital dollars, issuers get risk-free profits

More stablecoins = more Treasury demand = cheaper U.S. borrowing costs

Circle already makes ~$2 billion annually just from Treasury yields on USDC reserves. Scale this across $100 billion… $1 trillion… $10 trillion in stablecoins? That's a private-sector cash cow that quietly funds U.S. debt without printing money or rising taxes, while exporting digital dollars worldwide.

Private Profit Machines

Tether and Circle, the largest Stablecoins issuers, aren’t just crypto companies. They are shadow central banks. Together, they issued more than $230B in USDT and USDC. Their business model is breathtaking in its simplicity: take in dollars, issue tokens, park reserves in yield-generating assets, and pocket the spread. No lending risk. No complex operations. Just a perpetual cash engine. Tether and Circle hold $204 billion in U.S. Treasuries, more than Norway or Brazil.

The catch: this model lives and dies by Fed policy. When rates hit 4%+, Circle prints $2 billion annually in revenue. When the Fed cuts to zero (like 2020-2021), that profit engine stops cold. Circle's stock price reflects this reality—it's essentially a leveraged bet on Treasury yields.

Circle knows the risk. It barely breaks even after distribution costs and only made $156 million on $1.7 billion revenue in 2024. That's 83x less profit than Tether. That's why they're frantically building alternative revenue streams: launching their own blockchain, creating payment rails, owning the infrastructure. CEO Jeremy Allaire calls it "building the internet of money." Translation: We need revenue sources beyond rate arbitrage before the Fed cuts rates again.

Meanwhile, Tether just announced it's coming home. CEO Paolo Ardoino confirmed plans to bring USDT into the U.S. market and launch a separate U.S.-specific stablecoin under the GENIUS Act framework.

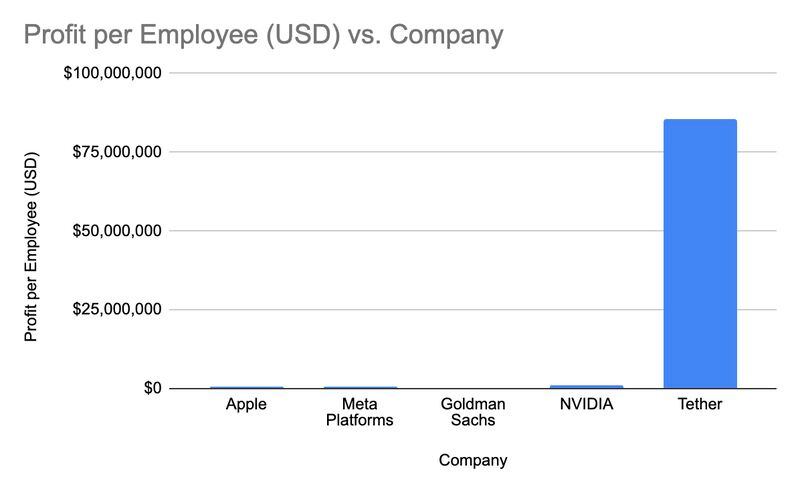

The strategic implications are massive. America pulls off another power move by bringing the world's largest stablecoin issuer under U.S. regulatory control. In 2024, Tether reported $13B in profit with just 49 employees. That’s more profit per employee than any company in history. Tether holds $160 billion in U.S. Treasuries with 500+ million global users already using USDT. The U.S. just domesticated the world's largest existing Treasury buyer.

With these Acts, these companies have the clearest, most efficient legal money-printing operation. And for blockchain networks, this is pure upside. 90% of total Stablecoins supply resides on Ethereum and Tron.

The Hidden Debt Reduction Engine

Russia's recent accusation reveals the deeper strategy. Say Treasuries yield 4%, but inflation runs at 5%. Holders of Treasury-backed stablecoins, whether Circle's USDC reserves or foreign institutions, are effectively losing 1% of purchasing power annually.

The U.S. still services its debt "on time," but in real terms, it's paying back less. No money printing. No new taxes. Just massive geopolitical leverage disguised as financial innovation.

CLARITY Act: more clarity

The regulatory mess in the US pushed crypto companies offshore for years, with "regulation by enforcement" as the norm. Now, The CLARITY Act ends years of regulatory confusion by clearly dividing oversight between the SEC and CFTC.

The Solution: The CLARITY Act creates a two-sheriff system with clear boundaries:

SEC gets securities: Investment contracts and traditional "get rich" token offerings

CFTC gets digital commodities: Bitcoin mining, Ethereum gas fees, network governance tokens

Assets can mature from security to commodity once they achieve decentralization and functionality, ending the regulatory limbo that's paralyzed the industry.

What Changes Immediately

For Exchanges: Clear registration paths with provisional 180-day onboarding. SEC-registered platforms can finally trade digital assets alongside securities.

For DeFi Builders: Safe harbor protection for protocol development, wallets, nodes, and infrastructure. Regulation focuses on fraud and manipulation, not innovation.

For Banks: Only federally supervised entities can custody digital assets, but segregation rules are clear. Customer assets remain protected in bankruptcy. Pooled assets for staking and validation are permitted with customer opt-in.

Who Regulates What?

1. SEC

The SEC cannot:

Regulate stablecoin issuers directly

Impose prophylactic rules like reporting or recordkeeping just in case

The SEC can:

Enforce anti-fraud, anti-manipulation, and insider trading rules (only when stablecoins are traded via SEC-registered platforms: broker-dealers, ATSs, national exchanges)

And there’s more:

The SEC must revise its rules to allow ATSs and exchanges to support stablecoins.

It can’t block platforms that trade stablecoins alongside securities.

Bottom line: SEC has transaction oversight, not issuer control.

2. CFTC

The CFTC can:

Regulate cash or spot transactions only if done through CFTC-registered entities (like commodity exchanges)

The CFTC cannot:

Regulate the issuer of a permitted stablecoin

Impose rules on how stablecoins work or operate

Bottom line: CFTC’s jurisdiction is platform-specific, not coin-specific.

3. Banks

For federally supervised banks, trust companies, and credit unions:

Stablecoins held in custody = not your liability

No capital requirements unless tied to custody risk

No balance sheet impact for assets you don’t own

Bottom line: Traditional institutions can safely hold stablecoins for clients, without wrecking their balance sheets.

Senate Banking Chairman Tim Scott wants legislation completed by September 30. The Senate Agriculture Committee releases their CFTC-focused draft in early September. Bipartisan momentum is building, 78 Democrats supported the House version.

The Global Stablecoin War

The US’ biggest competitors shoot themselves in the foot with centralized control and bureaucratic overreach.

China's Trap: The digital yuan has 260 million users and $7.3 trillion in cumulative transactions, but total usage since inception hit only $260 billion, compared to Alipay's $17 trillion annually. Every transaction is monitored by Beijing, making it toxic for international business and retail users. Despite massive government promotion, users won't switch from existing platforms, prompting even former Chinese central bankers to publicly express disappointment. Recognizing these limitations, Beijing now explores yuan-backed stablecoins in Hong Kong and Shanghai, essentially copying America's private sector approach.

Europe’s Regulatory Suicide: The European Union’s MiCA transforms the continent's crypto market into a compliance graveyard, driving innovation offshore while creating massive economic inefficiencies.