hey, it’s Marc

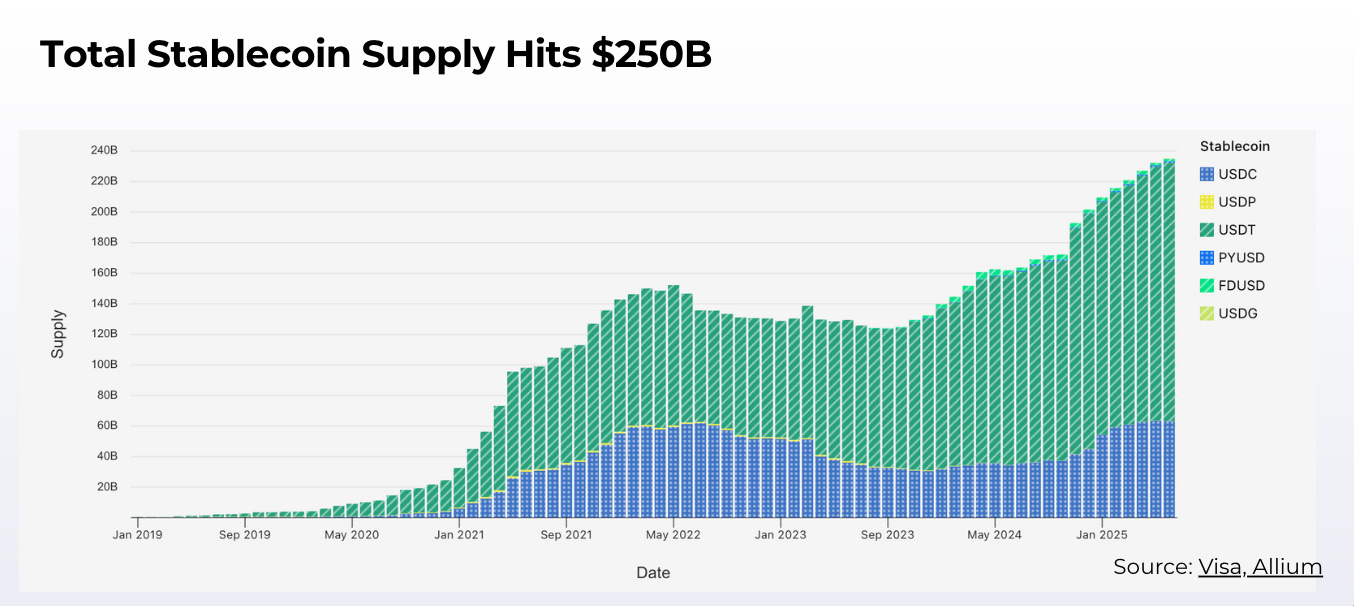

Money is moving – and this time, it’s real. $250B in circulation, moving $2.3T monthly. Stablecoins aren’t crypto speculation. They’re becoming an active, growing infrastructure layer of the global financial system.

This is why today we’re launching our most comprehensive stablecoin report yet.

Once dismissed as speculative or peripheral, they’re now enabling critical financial functions at companies like Stripe, JPMorgan, PayPal, Visa, and Circle. For the first time, we’re seeing blockchain-based money being used at institutional scale and in enterprise-grade contexts.

This report is designed as both a strategic primer and an actionable guide for financial institutions, enterprises, fintech operators, and policy leaders.

Special thanks to our co-publishing parter Fintech Blueprint, and our insight partners Kaiko, Reown, and Keyrails for their contributions.

The Tipping Point

The adoption curve is accelerating beyond crypto speculation into enterprise infrastructure.

$248B+ in stablecoin circulation is up 60% year-to-date, moving $2T+ monthly—rivaling traditional payment networks like Visa.

Public market validation: Circle's 6x stock surge post-IPO signals institutional hunger, while Stripe's $1.1B Bridge acquisition and launch of stablecoin accounts in 101 countries proves product-market fit.

The regulatory green light finally arrived: the SEC clarified digital dollars aren't securities, the GENIUS Act passed the US Senate creating federal frameworks, and Treasury Secretary Scott Bessent declared "we will use stablecoins to keep the U.S. the dominant reserve currency."

Top retailers collectively waste $47B annually on payment processing fees that add zero operational value. Amazon burns $18.5B yearly at 2.9% + $0.30 per transaction, Walmart wastes $3.5B, and the top five retailers combined pay over $47B to move money at 1970s speeds.

Both Amazon and Walmart are now building teams to launch corporate stablecoins in 2025—not as crypto experiments, but as direct attacks on Visa and Mastercard's revenue streams. This represents infrastructure inefficiencies that stablecoins eliminate entirely, creating a strategic opening for any company processing billions in payments annually.

Five use cases that matter

These use cases are already unlocking or saving billions:

International business payments represent a $60T opportunity by 2030, with companies currently wasting $120B annually on cross-border fees while losing millions in trapped liquidity during 3-5 day settlement windows. Stablecoins processed $6T in cross-border payments in 2024, offering 90% cost reductions and instant settlement.

Key developments:

Visa partnered with Circle to enable instant global stablecoin settlement.

PayPal processes cross-border B2B payments using PYUSD, reducing fees by up to 90%

Stripe embedded USDC payouts across 50+ countries, letting businesses pay international suppliers instantly

Mastercard teamed up with MoonPay to support global stablecoin payments.

Worldpay is enabling stablecoin payouts to 180+ countries, powered by BVNK.

JP Morgan’s Kinexys Digital Payments enables 24/7 , cross-border stablecoin transactions.

DP World (global logistics) deploys stablecoin payment rails for international suppliers

Corporate treasury operations are parking idle cash in yield-bearing stablecoins for 4%+ returns while maintaining instant payment capabilities—BlackRock holds $2.9B in their BUIDL tokenized Treasury fund.

Key developments:

Citi launched 24/7 tokenized cash service to help businesses move money instantly across global branches

Modern Treasury launched stablecoin payouts via partner Brale, enabling 24/7 global money movement

BlackRock holds $2.9B in their BUIDL tokenized Treasury fund

Circle works with 300+ banks to provide instant treasury settlement capabilities

Capital markets settlement eliminates the T+2 bottleneck that ties up billions in unnecessary capital, with Goldman Sachs, UBS, and Standard Chartered all testing blockchain settlement.

Key developments:

JP Morgan’s JPM Coin allows blockchain-based payments by wholesale clients and handles $1B transactions daily

Goldman Sachs uses blockchain settlement for select institutional trades

DTCC pilots distributed ledger technology and tokenized collateral, including for U.S.

Societe Generale-FORGE launched a US dollar stablecoin on Ethereum and Solana for trading and cross-border payments. BNY Mell

Standard Chartered partnered with Animoca Brands and HKT to issue a HKD-backed stablecoin.

Global payroll is seeing 65% of crypto transactions already using stablecoins, with companies like Deel processing millions for 35,000+ companies across 150+ countries, achieving 60% cost reductions and 48-hour time savings.

Finally, AI agent commerce is emerging as software needs money that moves at internet speed—Coinbase's x402 protocol embeds payments directly into HTTP requests, enabling autonomous transactions without human intervention.

Who's winning

Stripe leads the infrastructure land grab with a 730 51 Trust Score™, having acquired Bridge and Privy to own the wallet, rails, and payout stack across 4M+ merchants.

This isn't crypto integration, it's a $1.4T payments heavyweight rebuilding the entire financial stack onchain.

Circle commands the regulated standard with $61B USDC market cap, 98% reserves in U.S. Treasuries, and a successful IPO that 6x'd in two weeks, while launching Circle Payment Network to directly rival Visa and Mastercard.

Tether dominates with $155B USDT and $5B annual profit—more than most fintech unicorns—controlling 64% of global stablecoin market share and recently launching Tether AI for agent-to-agent payments.

Traditional players are catching up: JPMorgan processes $1B daily through JPM Coin, Bank of America/Citi/Wells Fargo are building joint USD stablecoins, and Visa launched the Tokenized Asset Platform while Mastercard partners with MoonPay for stablecoin-linked cards.

The AI Commerce convergence

The convergence of AI and stablecoins is creating an autonomous economy where software transacts at internet speed.

Google's Gemini 2.5 eliminates traditional e-commerce checkout entirely—AI finds, compares, negotiates, and buys automatically—while traditional payment systems fail on four critical requirements:

speed (credit cards settle in 3-5 days vs. instant blockchain confirmation),

geography (cross-border requires currency conversion vs. global stablecoin accessibility),

authorization (every payment needs human approval vs. autonomous systems),

and pricing (monthly subscriptions don't work for micro-transactions).

Stablecoins solve all four simultaneously by making money work like internet data—instant, global, programmable, always-on.

The infrastructure players are positioning aggressively: Coinbase launched x402 for HTTP-embedded payments, Tether AI enables peer-to-peer agent networks, and startups like Skyfire and Payman equip agents with pre-funded USDC wallets governed by policy controls.

The real talk

What’s happening in payments resembles the early internet: obvious in retrospect, overlooked by incumbents, transformative for early movers.

Circle and Stripe aren't building incremental improvements to SWIFT. They're constructing parallel financial infrastructure that bypasses traditional payment rails entirely.

The $250B in stablecoin circulation represents early stages of fundamental replatforming: programmable money replacing static account balances, instant settlement replacing batch processing, global accessibility replacing correspondent banking networks.

Winners will be technology platforms embedding stablecoin functionality and early enterprise adopters building supplier network lock-in, while losers face margin compression as companies control financial infrastructure directly. Central banks fear the "privatization of money"—the ECB President recently warned about stablecoins eroding monetary policy control.

The adoption curve is accelerating. Companies late to the party risk missing significant competitive advantages. The winning move: start with low-risk, high-impact use cases, test fast, measure everything, scale aggressively. Stablecoins aren't just better payments—they're programmable money for an AI-driven economy. Internet money for internet speed. The future of commerce runs on both.

Take care,

Marc

What's In The Full Report

Why Now

Stablecoin 101

The Stablecoin Ecosystem 2025

Stablecoin's Killer Use-Cases

4 Ways Stablecoins Are Quietly Transforming Business

Money, at Internet Speed: How Stablecoins Are Disrupting Commerce

What to Do Now

What we cover:

Stablecoin ecosystem map with 200+ vendors and our proprietary 51 Trust Score rankings

Circle's 6x IPO surge and what it signals for institutional adoption

Why Amazon & Walmart are secretly building corporate stablecoins

Stripe's $1.1B Bridge acquisition strategy to own payment rails

Tether's $5B profit machine and surprise AI infrastructure play

Coinbase's x402 protocol embedding payments directly into HTTP

How Google's Gemini 2.5 just killed traditional e-commerce checkout

The 5 killer use cases already saving enterprises 60%+ on costs

90-day implementation playbook from pilot to scale

Strategic vendor selection framework and compliance roadmap

Love how you trace money’s shift from cash to code highlighting stablecoins and programmable rails as its DNA rewrite. Payments aren’t just faster ⚡️they’re smarter🧠, more global, and composable. Brilliant lens. 🤌🏾

Thanks!