Hey, it’s Marc.

Bitcoin has erased its 2025 gains and the macro ghosts have returned: the Fed is hesitant on cuts and thin liquidity is amplifying every sell order into a cascade.

But if you look at the plumbing, a completely different story is emerging.

While the market flushes out leverage and panics over Strategy’s potential index eviction, Wall Street is quietly laying the rails for the next phase.

Here is what matters while the dust settles:

Strategy is at risk of losing $2B

Tether’s S&P downgrade

JP Morgan securitizes securitization

Nasdaq’s 40x Bitcoin unlock

We’ll unpack all of these highlights below 👇

🎁 Cyber-Monday-Deal: Upgrade to PRO now and safe 25% (valid for a limited time)

Top Boardroom Reads

Crypto hoarders dump tokens as shares tumble (Financial Times)

Bitcoin and the Quantum Problem – Part II: The Quantum Supremacy (Nic Carter)

Stablecoin Stability Assessment: Tether (USDT) (S&P Global)

When can a quantum computer destroy bitcoin? (Anastasia)

Part 1: My Life Is a Lie (Michael W. Green)

Top Signals This Week

Strategy is at risk of losing $2B

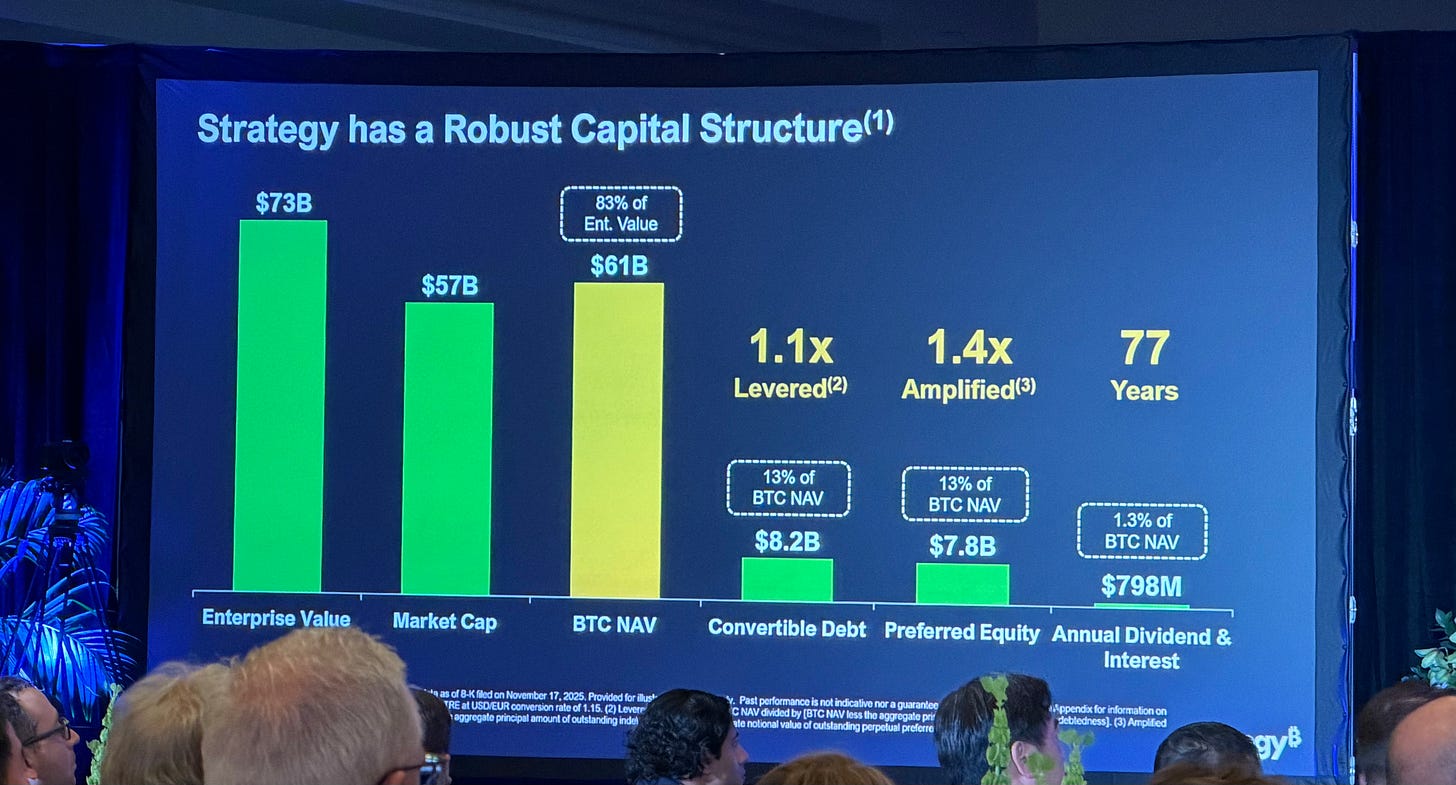

What happened: MSCI released a proposal to purge “Digital Asset Treasury” (DAT) firms from its global indexes. JPMorgan estimates this rule change, potentially effective January 2026, would trigger between $2.8B and $8.8B in forced selling of MicroStrategy (MSTR) as passive funds mechanically dump the stock. See Saylor’s response.

Why it matters: This effectively “un-institutionalizes” Saylor’s strategy. MSTR joined the MSCI World Index in May 2024, granting it access to the massive river of passive global capital. MSCI is now attempting to dam that river. This creates a structural crisis for the entire DAT sector.

Our take: While Saylor argues MSTR is an operating company, MSCI sees a disguised ETF with unquantifiable risk. If this rule passes, the premium MSTR trades at relative to its Bitcoin NAV faces an immediate, mechanical repricing shock.

🚨 We just opened new sponsorship slots for our newsletters & podcast. Want to reach 35k+ digital asset leaders? Contact us here.

Tether’s S&P downgrade

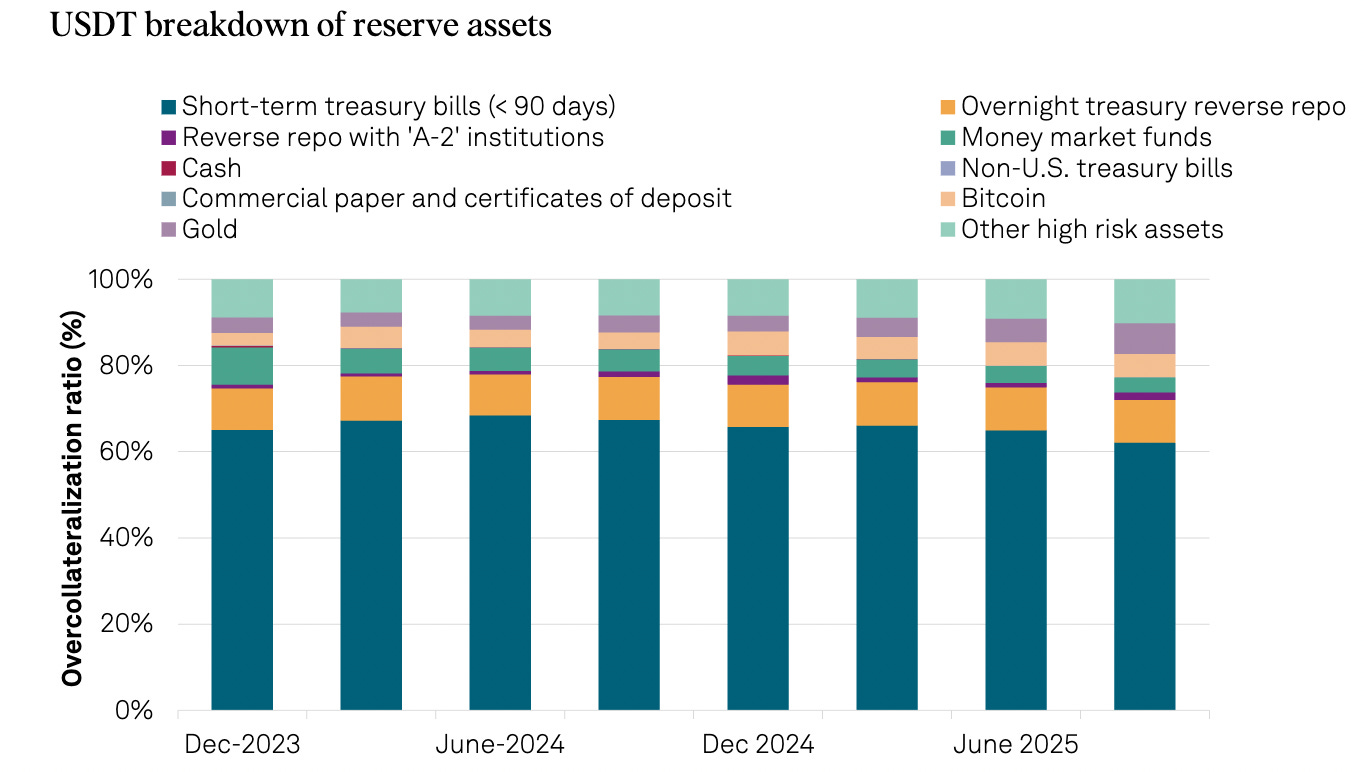

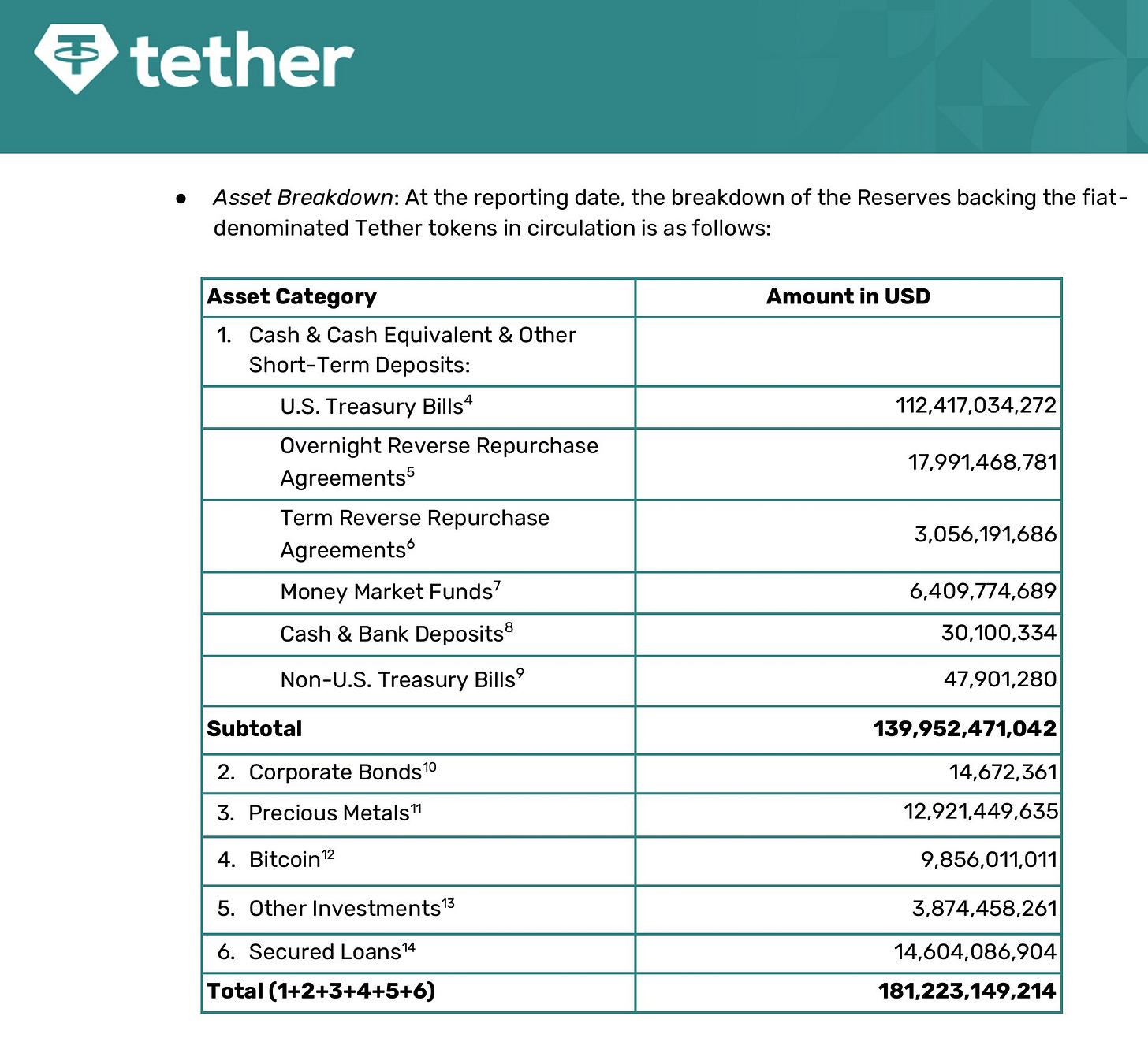

S&P Global Ratings downgraded Tether from “Constrained” to “Weak” on November 26, 2025. This is a clear warning about the strength of the collateral backing the most important liquidity token in crypto. [Assessment]

So what? Tether has inadvertently graduated from a crypto-native utility to a “shadow central bank.” With a $112B portfolio of U.S. Treasuries and Reverse Repos, it is no longer just a passive holder; it is a structural pillar of the short-term sovereign debt market. Unlike traditional banks, Tether pays 0% interest to USDT holders while harvesting yields on government paper. This generates ~$13B in pure annual profit, while effectively holding the U.S. Treasury market hostage to its own stability.

Our view: With $13B in annual free cash flow and 0% cost of capital, Tether runs the world’s most profitable carry trade. This creates a “Too Big to Regulate” paradox: Washington cannot aggressively sanction Tether without risking a liquidity shock to the short end of the Treasury curve.

Be smart: Investors shouldn’t worry about imminent insolvency. Tether is arguably more solvent than many regional banks. The real worry is regulatory friction. As Tether behaves more like a nation-state than a company, it invites nation-state level scrutiny.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

JPMorgan securitizes the securitization

JPMorgan Chase issued structured notes linked to the performance of BlackRock’s iShares Bitcoin Trust (IBIT). This is explicitly engineered around the 2024–2028 Bitcoin halving cycle, combining an early‑call coupon profile in 2026 with leveraged upside and limited downside protection into 2028. [RELEASE]

Why it matters: IBIT alone holds on the order of 700k+ BTC, more than 3.5% of eventual BTC supply; JPM is now wrapping that liquidity into yield-bearing products for the massive wealth management complex. By putting Bitcoin exposure on the same “shelf” as S&P 500 autocallables, JPM effectively transforms a volatile commodity into a programmable financial instrument for private banking clients who prioritize capital preservation over raw alpha.

Our view: The “Dimon Paradox” is officially over: while Jamie Dimon publicly dismisses crypto, his trading desk is aggressively packaging it into products that mechanically dampen volatility, turning Bitcoin from a speculative bet into liquid institutional collateral.

Nasdaq’s 40x Bitcoin unlock

Nasdaq filed a proposal with the SEC to increase position limits for BlackRock’s IBIT ETF options from 25,000 to 1 million contracts. This 40x increase aligns Bitcoin’s regulatory treatment with the most liquid ETFs in the world, such as the iShares MSCI Emerging Markets and China Large-Cap funds. [NEWS]

Why it matters: This creates massive room for institutional exposure. Until now, strict limits acted as a “speed limit” for smart money; the 25,000 contract cap prevented large volatility funds and macro desks from hedging or speculating at scale.

News Flash

Texas becomes first state to buy Bitcoin. Link

Kraken launches a 1%-cashback crypto debit card in Europe. Link

Kevin Hassett emerges as Fed frontrunner. Link

Polymarket secures CFTC approval to operate fully as an exchange. Link

Klarna launched its first stablecoin, KlarnaUSD. Link

Nasdaq plans real tokenized stock trading by 2026, opposing derivative-style alternatives. Link

Singapore completed its first live interbank settlement trial using wholesale CBDC. Link