Hey, it’s Marc & the 51 team.

While Blackrock took a quiet $100M stake in Canton, BitGo IPO’d at $2B and Tether launched its US stablecoin USAT, the biggest shift in crypto this week came from Capitol Hill:

“Advancing this bill brings us closer to a U.S. regulatory framework that protects consumers while allowing American innovation and businesses to thrive.”

— John Boozman, U.S. Senate Committee on Agriculture, Nutrition, and Forestry Chairman

The Senate Agriculture Committee advanced the first-ever crypto market structure bill, voting to give the CFTC authority over digital asset spot markets, but a full Senate vote is still pending. [RELEASE]

On Jan 28, SEC released a statement saying stocks and other securities don’t avoid U.S. securities laws just because they’re issued or wrapped as tokens. It also drew a clear line between issuer-issued tokens and third-party “synthetic” versions, signaling tighter scrutiny of tokenized markets. [RELEASE]

The SEC and CFTC formally launched “Project Crypto,” committing to work together on clear regulations. [RELEASE]

Meanwhile, Standard Chartered has issued a warning: stablecoins represent a "real threat" to bank deposits.

Our highlights this week:

BitGo’s $2.1B custody IPO

Fidelity announced the launch of the FIDD Stablecoin

Tether launches “USAT” stablecoin

BlackRock’s $100M Canton position

Coinbase rolls out prediction market

SEC taxonomy for tokenized securities

Let’s jump in 👇

Top Boardroom Reads

2026 Trends Shaping Investment Products (BlackRock)

Charting Crypto Q1 2026 (Coinbase, Glassnode)

BIG IDEAS 2026 (Ark Invest)

Navigating Crypto in 2026 (Pantera)

Market Know-How 1Q 2026 (Goldman Sachs)

Onchain finance: Future and institutional adoption. (Dfns, BCG)

The Rise of CMLNs: Crypto Crime Report 2026 (Chainalysis)

Stocks Becoming Policy, Bitcoin Becoming Money (Jack Mallers)

Top Signals This Week

BitGo $2.1B public IPO

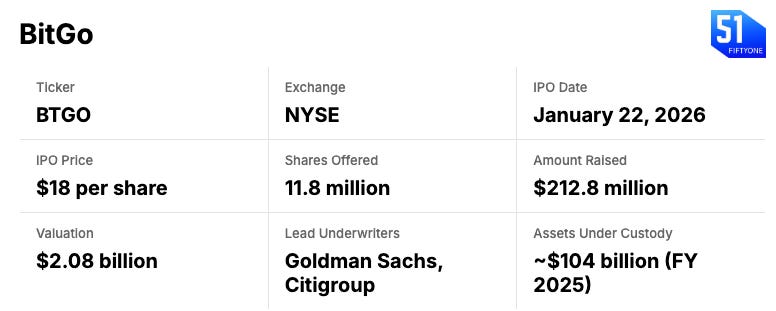

On Jan 22, BitGo Holdings (NYSE: BTGO) successfully priced its initial public offering of 11.8M Class A shares at $18.00 per share, beating the marketed range of $15-$17 according to reports and closed its first day of trading at $18.68 per share, just above its IPO price. The offering raised approximately $212.8M , with only 6.7% of the IPO’s shares being sold by existing stockholders. Goldman Sachs and Citigroup as lead underwriters.

Why it matters: BitGo’s IPO serves as the definitive litmus test for institutional crypto appetite in 2026, marking the first time a federally chartered digital asset bank has hit the public markets to bridge the gap between "wild west" volatility and fiduciary-grade stability. Also proving that the market is ready to value the "boring" but essential plumbing infrastructure of institutional custody.

Read our full analysis below:

Fidelity Investments announced the launch of the FIDD Stablecoin

On January 28, 2026, Fidelity Investments formally announced the launch of its native stablecoin, the Fidelity Digital Dollar (FIDD), marking the entry of the first major U.S. asset manager into the regulated issuance space. [RELEASE] [See analysis]

Rails: Issuance is vertically integrated through Fidelity’s National Trust Bank.

Scope: Targets active settlement infrastructure and institutional on-chain cash.

Goal: Replacing regulatory arbitrage (shadow banking) with federally compliant liquidity under the GENIUS Act.

Why it matters: Unlike crypto-native issuers, Fidelity already sits inside millions of retail accounts, retirement plans, and institutional portfolios, letting it move money on-chain without relying on banks or third parties. That means faster settlement, new yield products, and tighter integration between traditional investing and digital assets, all while keeping economics in-house. Plus, it brings its $6.8T powerhouse to vertically integrate reserves and custody under the federal GENIUS Act.

🚨 We just opened new sponsorship slots for our newsletters & podcast. Want to reach 35k+ digital asset leaders? Contact us here.

Tether launches “USAT”

On January 27, 2026, Tether officially launched USA₮ (USAT), a new dollar-backed stablecoin explicitly designed for the U.S. market. Unlike its global counterpart USDT, this token is issued by Anchorage Digital Bank, the first federally chartered digital asset bank. The token operates on Tether's Hadron platform and is backed by 1:1 reserves in U.S. currency, demand deposits, or short-term Treasuries, exactly as mandated by the GENIUS Act (enacted July 18, 2025). [RELEASE]

Why this matters: Regional banks are in trouble. Community institutions like Huntington Bancshares, M&T Bank, and Truist Financial rely on deposit bases to fund lending. Their Net Interest Margin (NIM), the spread between deposit costs and loan rates, is how they fund the credit that powers Main Street. When a corporation moves $1M from a bank account to USA₮, it is permanent. The bank loses the ability to lend that $1M as a mortgage or business loan. To attract deposits back, the bank must raise savings rates, which increases funding costs, which compresses lending. Plus, it also threatens the value proposition of Circle.

🚨 Want more intelligence and understand what this means for your institution? Subscribe to PRO below:

BlackRock’s $100M Canton position

BlackRock acquired a 2.2% passive stake in Tharimmune, Inc. (765,829 shares via Schedule 13G filing), the publicly traded Super Validator operator on the Canton Network. This stake translates to indirect ownership of approximately 75–120 million Canton Coins (valued at ~$100M). Concurrently, the DTCC received SEC approval (No-Action Letter) to tokenize U.S. Treasury securities on Canton, with production launch expected H1 2026 and broader rollout H2 2026. [FILING] [NEWS]

Why it matters: Canton is the privacy-enabled settlement layer chosen by DTCC, Goldman Sachs, BNP Paribas, Citadel Securities, and Euroclear, institutions processing $9T in monthly transaction volume and $100T in custodied assets. The DTCC co-chairs the Canton Foundation alongside Euroclear, effectively controlling governance over tokenized finance infrastructure. BlackRock's entry into the cap table of Canton's only public exposure vehicle signals institutional confidence in the migration path for Treasury securities and, eventually, all DTC-eligible assets.

Coinbase Rolls Out Prediction Market to U.S. Customers

On January 29, 2026, Coinbase (NASDAQ: COIN) officially launched its prediction market platform to users across all 50 U.S. states. The rollout, built in partnership with the CFTC-regulated exchange1 Kalshi, allows verified U.S. customers to trade "event contracts" directly within the main Coinbase app using USD or USDC. [RELEASE]

In December, they acquired The Clearing Company. [RELEASE]

Why it matters: The overlooked catalyst is a new U.S. law taking effect in 2026 that makes traditional sports betting far less tax-efficient, especially for frequent bettors, while prediction markets sit under a different regulatory regime and avoid this penalty.

Read the full analysis below👇

SEC taxonomy for tokenized securities

On January 28, 2026, the SEC’s Divisions of Corporation Finance, Investment Management, and Trading and Markets issued joint guidance clarifying the application of federal securities laws to tokenized assets. The statement categorizes the market into two distinct frameworks:

issuer-sponsored tokenization (direct issuance) and

third-party sponsored models (custodial entitlements or synthetic exposure).

The staff reaffirmed that the use of distributed ledger technology (DLT) to record ownership does not change the fundamental legal status or registration requirements of a security. [RELEASE]

Why it matters: This guidance establishes a clear regulatory preference for “issuer-led” models, where DLT is integrated into the master securityholder file, over third-party synthetic products. By classifying many third-party “linked” tokens as security-based swaps, the SEC is effectively restricting retail access to these instruments. This provides a compliant roadmap for institutional infrastructure providers, like DTCC and regulated transfer agents, while creating significant legal hurdles for DeFi platforms offering synthetic price exposure.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

News Flash

Avalanche gets first US ETF as VanEck debuts AVAX fund. Link

WisdomTree expands tokenisation ecosystem to Solana. Link

Ripple launches ‘Ripple Treasury’. Link

Revolut scraps US merger plans in favour of push for standalone licence. Link

Binance and OKX will introduce tokenised U.S. stock products. Link

The Central Bank of Iran has acquired US dollar stablecoins worth $0.5B. Link

Robinhood to enable 24/7 trading and “self-custody” with tokenized stocks. Link

Mesh hits unicorn status, raising $75M. Link

Republic Europe announces the launch of a new Kraken SPV. Link

That’s all for now, folks.

PRO Readers: Read our alpha insights below!

– Marc & Team