Hey, it’s Marc & the 51 team.

After last week’s brutal sell-off that pushed BTC toward the low around $60k (2024 level), the market has finally staged a calm. Institutions are back in business buying the dip;

BitMine bought 40,613 ETH ($79M) while Strategy added 1,142 BTC ($90M).

Binance’s Secure Asset Fund for Users (SAFU) added about 8,770 BTC ($600M).

Goldman Sachs’ recent SEC filing showed about $2.36B in crypto exposure through ETFs, including Bitcoin ($1.1B), Ethereum ($1B), XRP and Solana (we assume that most of it is trading on clients’ books)

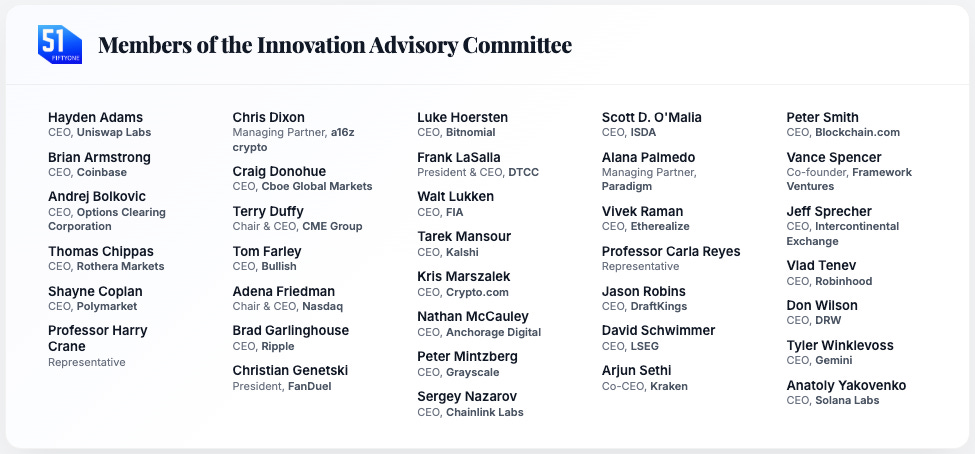

Regulatory momentum: The U.S. Commodity Futures Trading Commission (CFTC) formed the Innovation Advisory Committee (IAC) — a 35-member panel including crypto CEOs and industry leaders tasked with shaping U.S. rules around blockchain and AI in financial markets. [RELEASE]

Meanwhile, U.S. Securities and Exchange Commission Chairman Paul Atkins told the Senate Banking Committee that while the agency can introduce temporary crypto rules, durable policy must come from Congress through legislation such as the Digital Asset Market Clarity Act.

“We need a firm grounding in statute so we can’t have any backsliding in the future.” — Paul Atkins, SEC Chairman

This push toward structured rulemaking comes as institutional adoption continues to deepen.

BlackRock BUIDL is now tradable on UniswapX and made a strategic purchase of UNI tokens. [RELEASE]

“This collaboration with Uniswap Labs alongside Securitize is a notable step in the convergence of tokenized assets with decentralized finance. The integration of BUIDL into UniswapX marks a major leap forward in the interoperability of tokenized USD yield funds with stablecoins,”

— Robert Mitchnick, Global Head of Digital Assets at BlackRock.

That’s what we can tell you here. A lot more is going on that we’ll tell you in our upcoming PRO briefing.

Our highlights this week:

LayerZero announced a Zero blockchain

State of the crypto market analysis

BlackRock BUIDL is tradable on UniswapX

Robinhood Chain public testnet is now live

Franklin Templeton and Binance collaboration

Let’s jump in 👇

Top Boardroom Reads

Ethereum, AI, and the end of trust, with Joseph Lubin, co-founder of Ethereum (51)

Vitalik Buterin’s vision for Ethereum x AI (V. Buterin)

Stablecoins vs. Tokenized Deposits (FRB of NY)

Something Big Is Happening (Matt Shumer)

Top Signals This Week

LayerZero announced Zero blockchain

On February 10, 2026, LayerZero launched Zero, a Layer 1 blockchain with backing from Citadel Securities, the DTCC, the New York Stock Exchange, Google Cloud, ARK Invest, and Tether. It will launch in fall 2026. Citadel Securities (processes one-third of U.S. retail equity orders) and ARK Invest (with Cathie Wood joining the advisory board) bought ZRO tokens directly. [RELEASE]

Why this matters: For the first time, major Wall Street infrastructure players like Citadel Securities, DTCC, ICE, and Google Cloud are directly backing a new public Layer 1 blockchain, signaling that traditional financial markets are seriously shifting toward on-chain settlement and need to maintain interoperability across fragmented blockchain ecosystems through zero blockchain. Citadel’s decision to acquire $ZRO tokens rather than equity represents direct economic alignment with network success.

Get all the alpha below👇

📩 Work with us. We take 3 sponsor slots per quarter. Two are filled. We're selective because our readers are 35,000+ executives (75% C-level or founder). If you have a product that actually solves a problem for institutional crypto, [let's talk →]. If you're looking for cheap impressions, we're not the right fit.

State of the crypto market

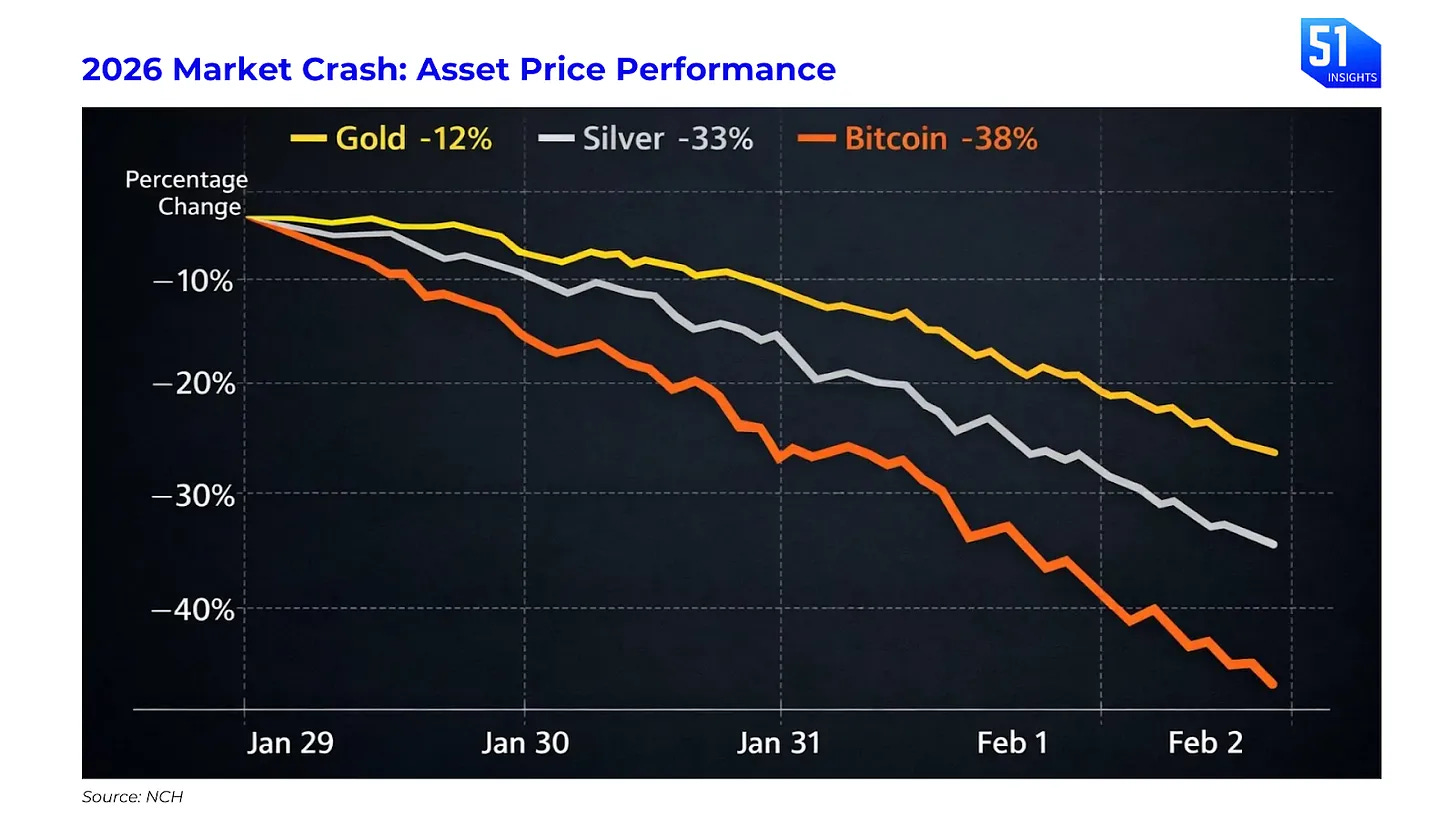

In January-February 2026, three major macro shocks occurred at the same time.

The U.S. Treasury removed $200B from bank reserves.

The Bank of Japan increased rates to 0.75%, and unwound over $500B in carry trades.

The AI disruption from Anthropic’s autonomous agents led to a crypto sell-off.

This pushed Bitcoin’s price down 45% from $126K to below $62K, erasing $800B in market value. [CEO NOTES]

Why this matters: Roughly 20–35% of Bitcoin ETF inflows came from hedge funds running cash-and-carry basis trades, not long-term allocators. These flows do not provide price support because they are fully hedged. The same institutions showing up as ETF buyers also appear as CME futures shorts. Net exposure: zero. Net price support: zero. This capital doesn’t “hold through volatility”. ETF redemptions rise, futures shorts are covered, and spot selling accelerates. What looks like a sentiment-driven drawdown is, in reality, a forced unwind. For allocators, this breaks the ETF signal. Inflows no longer equal conviction. Outflows no longer signal panic, but simply yield math. A dovish Fed, falling rates, or easing financial conditions can now increase selling pressure, not relieve it, by further collapsing the basis. Until the basis trade is fully flushed, Bitcoin is not trading on adoption or macro narratives.

Get all the alpha below👇

🚨 Want more intelligence and understand what this means for your institution? Subscribe to PRO below:

BlackRock BUIDL is tradable on UniswapX

On February 11, 2026, Uniswap announced that BlackRock $2.4B BUIDL fund (tokenized U.S. Treasuries) is tradable on UniswapX. Facilitated by Securitize, the integration allows whitelisted institutional investors to swap BUIDL shares for USDC 24/7 with near-instant settlement. Simultaneously, BlackRock also purchased an undisclosed amount of UNI governance tokens, causing the asset to surge as much as 40% in a single day. [RELEASE]

Why it matters: While BlackRock has explored private ledgers, like JPMorgan’s Onyx, their move to public infrastructure highlights that private blockchains may not be effective for liquidity. Public DeFi platforms like Uniswap ($3B liquidity and $700M daily transaction volume) are cheaper, faster, and more liquid than what they could create on their own. By launching BUIDL on Ethereum and integrating with UniswapX, BlackRock is acknowledging that public blockchains are the best settlement layer. This move also validates Uniswap’s decision to prioritise compliance, and we can expect to see more DeFi protocols build compliance into their systems.

Punchline: For years we were debating whether institutions would ever touch DeFi. In 2026, it’s clear that the convergence is coming. This was the first big step.

👉Subscribe to PRO for our our institutional-grade analysis that drops on Monday

Robinhood Chain public testnet is now live

On February 11, 2026, Robinhood officially launched the public testnet for Robinhood Chain, its proprietary Ethereum Layer 2 built on the Arbitrum Orbit tech stack. Designed as a “financial-grade” ecosystem, the network allows developers to test tokenized real-world assets (RWAs), including simulated stocks like Tesla and Amazon, and integrates directly with the Robinhood Wallet. [RELEASE]

Why this matters: Coinbase’s Base has championed a general-purpose ecosystem for memes, NFTs, and identity, but this model is increasingly viewed by the Ethereum community(including Vitalik) as redundant to the mainnet. Robinhood effectively sidesteps this critique by focusing on the RWA niche, adopting the same application-specific logic that made Hyperliquid a giant in the perpetuals sector. As this thesis proves, we can expect to see a wave of more specific Layer 2s focused on distinct niches.

Franklin Templeton and Binance collaboration

On February 11, 2026, Franklin Templeton and Binance launched an industry-first “Institutional Off-Exchange Collateral Program”. This initiative allows institutional traders to use Franklin Templeton’s tokenized money market fund shares issued via Franklin Templeton’s Benji Technology Platform as collateral for trading on Binance, without ever moving the assets onto the exchange (that’s the key!). Instead, the tokens remain held in regulated custody via Ceffu (Binance’s institutional partner), while their value is mirrored on the trading platform to margin positions. [RELEASE]

Why it matters: With this program, institutions have no reason to hold non-yield-bearing stablecoins as margin. Why hold USDT at 0% yield when you can hold Benji (FOBXX) at ~4.5% yield and still have the exact same trading power on Binance? Historically, exchanges like Binance made massive profits not just from trading fees, but from holding user deposits and earning interest on them. With “Off-Exchange Settlement,” the assets sit with the custodian, not Binance. Binance becomes a pure matching engine business.

News Flash

BBVA Joins Banking Consortium to Issue European Stablecoin. Link

Bitcoin ETFs inflows for first time in a month. Link

Rumours HK entity behind the crypto dump. Link

Hong Kong proceeds with stablecoin plans despite Beijing’s reservations. Link

Approval grant to launch first UAE dirham-backed stablecoin DDSC. Link

Chainlink to participate in the Bank of England’s Synchronisation Lab. Link

China to ban RWA tokenisation. Link

Bithumb puts South Korea regulators on alert. Link

That’s all for now, folks.

PRO Readers: Read our alpha insights below!

– Marc & Team