Hey, it’s Marc.

2026 didn’t wait. Last week, we shared our top 12 narratives for 2026.

Seven days later, the market started confirming them.

On January 5, Bank of America opened the door for 15,000 advisors to recommend Bitcoin ETFs. Forty-eight hours later, Morgan Stanley crossed a bigger line: filing to launch its own Bitcoin and Solana ETFs. You’re right: Not distribution, but issuance.

Coincidence? No. It’s regulation finally doing its job. These are the regulatory drivers that will shape 2026:

Genius Act: Federal framework for payment stablecoins in the U.S..

MiCA: The transition period ends July 1, 2026. From that point on, no license means no business in the EU.

OCC expansion: The Office of the Comptroller of the Currency (OCC) became the primary regulator for non-bank stablecoin issuers in the U.S.

CARF: Effective January 1, 2026, forcing global crypto platforms into full tax reporting mode.

CLARITY Act: poised for a Senate vote next week, finally resolving the SEC vs CFTC tug-of-war and giving clear market structure rules.

🚨 Don’t miss our New Year offer: 20% off PRO subscriptions, ends January 14.

Our highlights this week:

United States seized 3% of Bitcoin

Morgan Stanley files for crypto ETFs

Real-estate enters prediction markets

A deeper look at XXI after it became public

Let’s jump in 👇

Top Boardroom Reads

Report: 2026 Digital Asset Outlook: Dawn of the Institutional Era (Grayscale)

Report: 2026 look ahead (Fidelity)

Report: Crypto infrastructure for banks (BitGo)

Report: Crypto payments 2025 (Orochi)

Why the application layer is crypto’s next $10T opportunity, with Richard Galvin, CIO of DACM (51)

Stone Ridge 2025 Investor Letter (Stone Ridge)

Prediction Markets: An Important Financial Primitive (U.S. District Court)

Top Signals This Week

United States seized 3% of Bitcoin

U.S. military operations in early January 2026 detained Nicolás Maduro on narco-terrorism and corruption charges. This creates a clear legal path: by labeling the regime a criminal enterprise under the International Emergency Economic Powers Act (IEEPA), it allows the Treasury to seize all illicit proceeds, including cryptocurrency holdings. [NEWS]

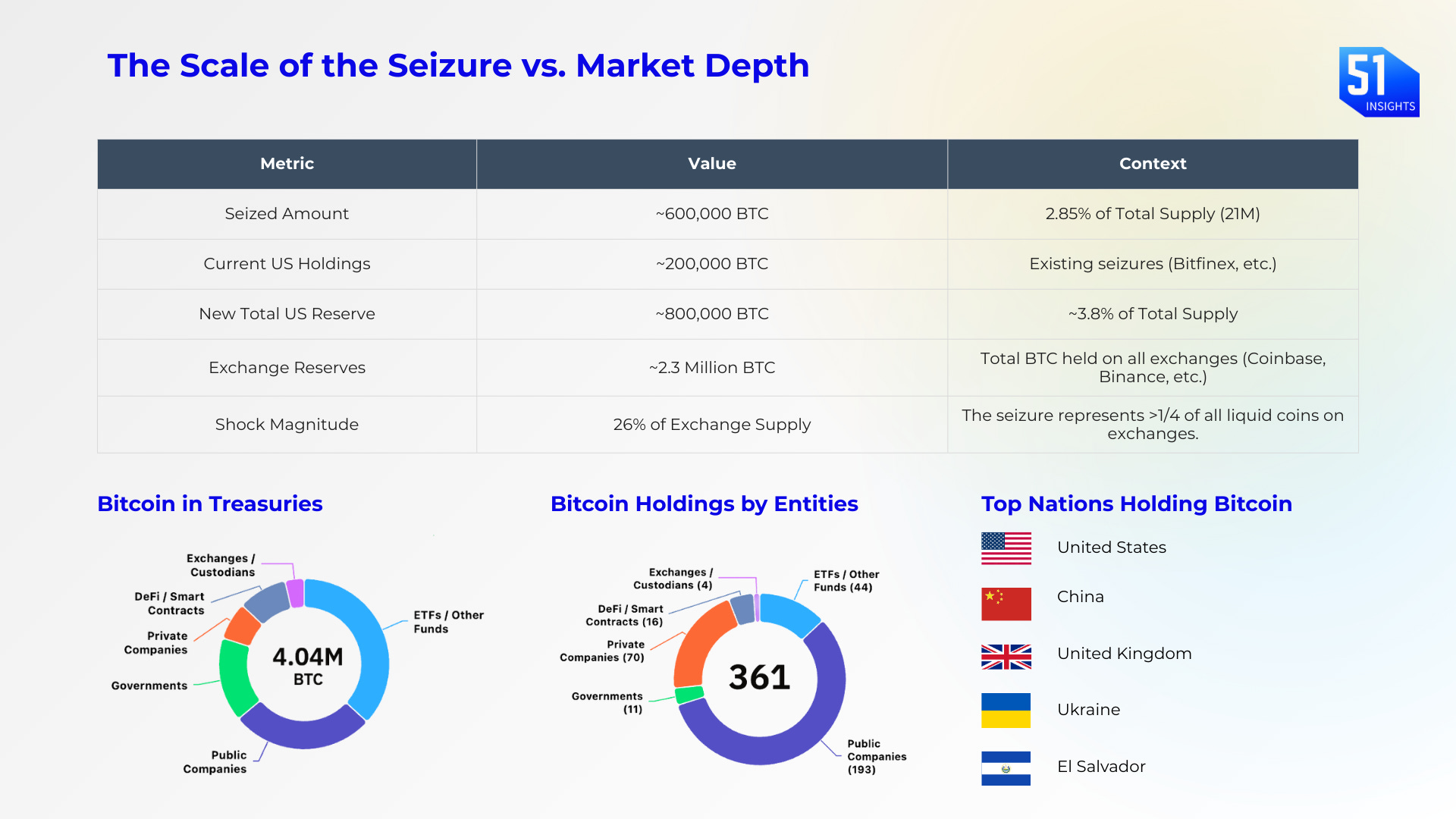

The estimated seizure of Bitcoin is 600,000 BTC (~$55–67B) along with 303B barrels of crude oil.

Why it matters: The U.S. now controls approximately 4–5% of total Bitcoin supply when combining existing holdings (~200,000 BTC from prior seizures) with the Venezuelan acquisition.

Zoom out: This concentration of the world’s most powerful entity into digital assets triggers a geopolitical game theory problem: rival nations cannot afford to leave the U.S. as the sole hegemon of the crypto ecosystem. China’s Ministry of Foreign Affairs immediately condemned the seizure as a violation of international law. Russia (holding >50K BTC) views it as an escalation of “hybrid warfare.” Both nations hold cryptocurrency from their own seizures (China: ~190,000 BTC from PlusToken).

Our take: In March 2025, Trump signed an executive order establishing the Strategic Bitcoin Reserve. The policy is explicit: seized Bitcoin “shall not be sold and shall be maintained.”U.S.-controlled seizure of Venezuela’s Bitcoin isn’t a sell-off risk. It’s the ultimate supply shock.

Read more below.👇

Morgan Stanley files for crypto ETFs

Morgan Stanley ($1.5T in wealth management assets) just became the first major U.S. bank to issue its own crypto ETFs, Bitcoin and Solana, not just distribute it. By moving to capture issuance fees, custody economics, and staking yields directly, the bank has signaled that the era of agency is over; the era of vertical integration has begun. [SEC filing]

Be smart: The SEC’s 2025 “Generic Listing Standards” changed everything. Approval timelines for new crypto ETFs were slashed from 270 days to just 75 days. And regualtion in the US is no longer a hurdle.

Our take: While others banks focus on tokenization, custody or stablecoins, Morgan stanley went for the highest margin product. BlackRock’s IBIT with $69B AUM makes $138-172M in annual recurring revenue from a single product. Morgan Stanley wants that 0.20-0.25% management fee on EVERY dollar of AUM.

More below.

Real-estate enters prediction markets

Polymarket, the largest decentralized prediction market, partnered with Parcl Labs to bring real-time, settlement-grade real estate contracts to crypto. Instead of tinkering with old systems, they rebuilt the data layer entirely. And in doing so, they’ve unlocked the world’s largest asset class, real estate, as a liquid, tradeable market. [RELEASE]

So what? Parcl updates daily and includes cash sales, new construction, and listing changes, unlike Case-Shiller, which lags 60+ days and excludes 60% of market activity in places like Boston and Miami.

Read more below.

🚨 We just opened new sponsorship slots for our newsletters & podcast. Want to reach 35k+ digital asset leaders? Contact us here.

Twenty One Capital is a monetary stack play

On December 9, 2025, Twenty One Capital began trading on the NYSE under the ticker “XXI” as the third largest Bitcoin holder (~$4B). [RELEASE]

Be smart: Everyone sees Twenty One Capital as another MicroStrategy clone. The market saw it too: XXI dropped 25% on its NYSE debut to $11, trading at 0.80x NAV. But, the catch is its investors: Tether, Cantor Fitzgerald, and SoftBank.

Zoom in: Howard Lutnick was confirmed as U.S. Commerce Secretary on February 18, 2025, after divesting his Cantor positions. But his family still controls Cantor Fitzgerald, which controls XXI's structure. As Commerce Secretary, Lutnick oversees semiconductor export controls and GPU/ASIC supply chains, directly impacting both AI datacenter builds (Stargate) and Bitcoin mining equipment availability. This creates a potential competitive moat for U.S.-aligned firms like XXI/Cantor/SoftBank. Whether intentional or not, XXI now has implicit policy protection that no other Bitcoin treasury enjoys.

Our take: while investors fixate on the Bitcoin treasury playbook, they're missing what Tether, Cantor Fitzgerald, and SoftBank actually built: a closed-loop monetary infrastructure disguised as a public company.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

News Flash

BoA started advising crypto ETPs to clients. Link

J.P. Morgan will bring USD JPM Coin (JPMD) to Canton. Link

MSTR will remain in MSCI indexes. Link

Vitalik shares Ethereum roadmap. Link

Maduro Polymarket win triggers bill to bar government officials from insider trading. Link

Polymarket partners with Dow Jones, the publisher of The Wall Street Journal. Link

Nike quietly sold its digital products subsidiary RTFKT in December 2025. Link

Tether launched Scudo, a new unit of account for Tether Gold (XAU₮). Link

That’s all for now, folks.

PRO Readers: Read our alpha insights below!

– Marc & Team