The U.S. government just became the world’s largest Bitcoin holder without spending a dollar.

It has executed the largest digital asset seizure in history. Not just that, the United States just secured control over the world’s largest crude oil reserves: 303 billion barrels. [NEWS]

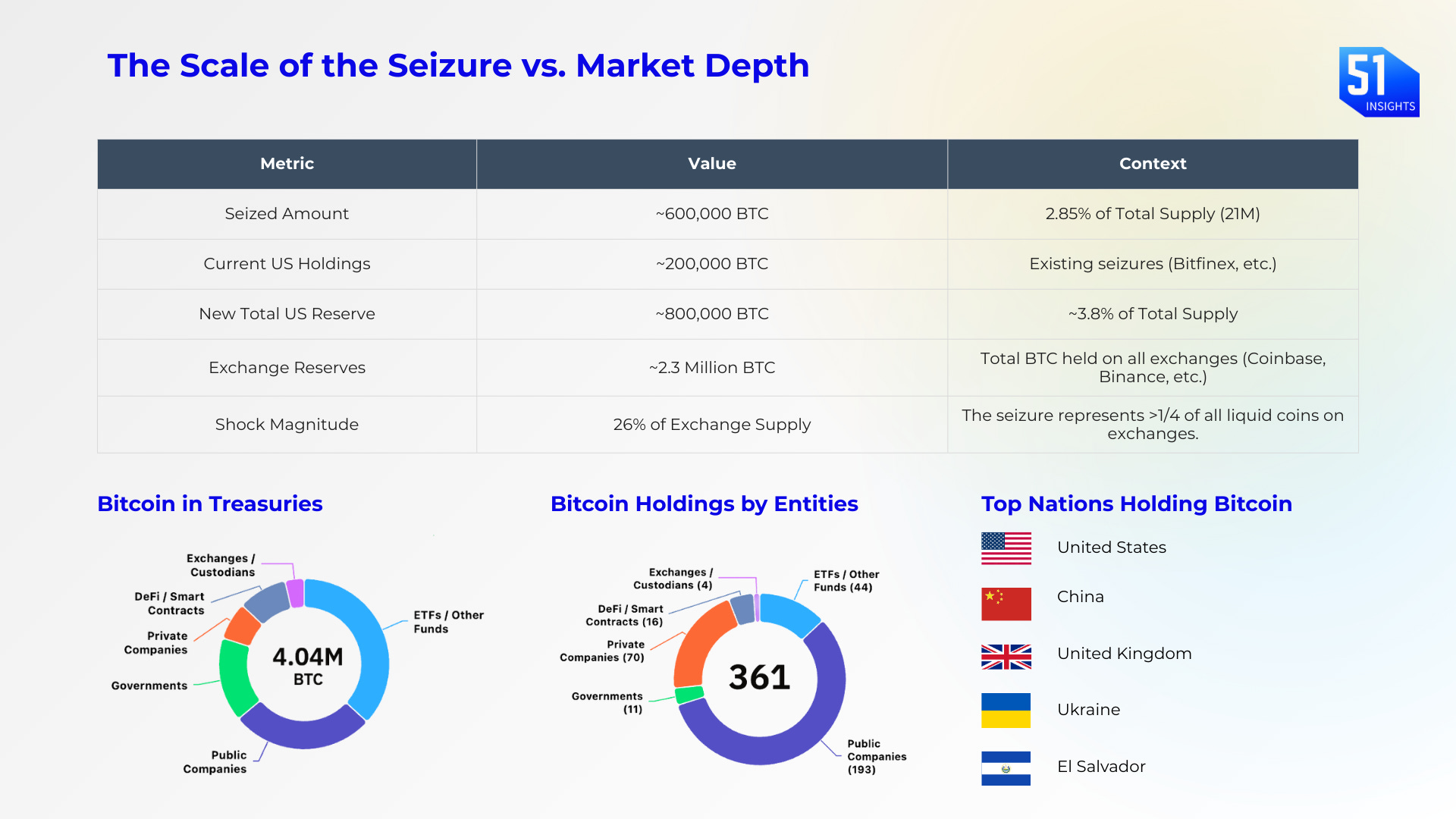

The detention of Venezuelan President Nicolás Maduro triggered the seizure of an estimated 600,000 BTC (~$55–67B), a shadow reserve accumulated through illicit gold trafficking, oil-for-crypto trades, and state mining operations.

But here’s what matters: this doesn’t get auctioned. Under the March 2025 Strategic Bitcoin Reserve executive order, these coins are locked into the U.S. Treasury permanently.

Here’s what this means for investors.

🔺PRO: Download the full PDF at the bottom

Today’s Market signals

Morgan Stanley files for bitcoin, solana ETFs, became the first US bank. Link

BoA started advising crypto ETPs to clients. Link

Polymarket launched real estate prediction markets. Link

Maduro Polymarket win triggers bill to bar government officials from insider trading. Link

🚨 Get your brand in front of 100k+ decision makers in digital assets.

What happened

U.S. military operations in early January 2026 detained Nicolás Maduro on narco-terrorism and corruption charges. This creates a clear legal path: by labeling the regime a criminal enterprise under the International Emergency Economic Powers Act (IEEPA), it allows the Treasury to seize all illicit proceeds, including cryptocurrency holdings.

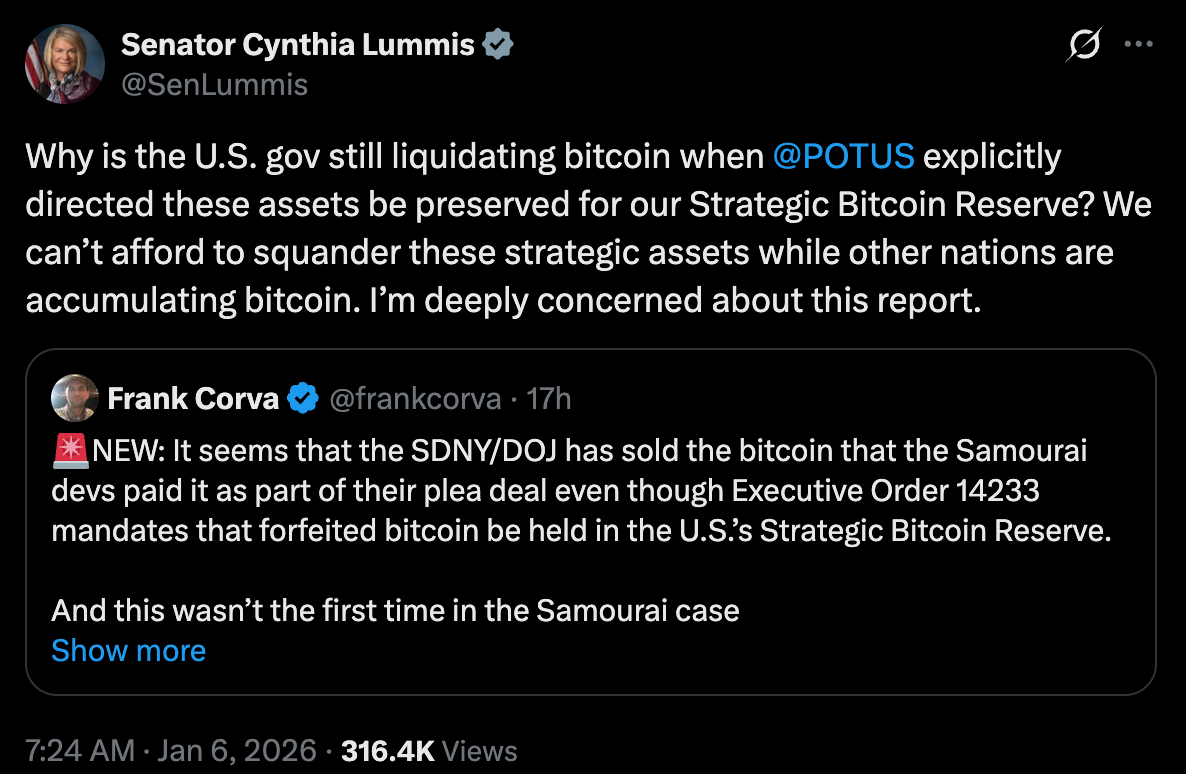

Unlike previous seizures (Silk Road, Bitfinex), these assets will not be auctioned. Under President Trump’s Executive Order 14233 and the BITCOIN Act of 2025, these funds are legally classified as “proceeds of crime” and are earmarked for the newly established US Strategic Bitcoin Reserve.

This reverses a decade of policy where the U.S. Marshals Service liquidated seized crypto at pennies on the dollar.

Backdrop: The Venezuelan government accumulated these Bitcoin holdings across three mechanisms over eight years:

👉Read below with PRO:

4 key implications for investors you shouldn’t miss

What allocators are doing now

Impact on global oil markets (spoiler: it’s not what you think)

Catalysts of the next 3 weeks