Our top 10 signals of 2025

We filtered the noise so you don’t have to.

Hey, it’s Marc.

2026 is now right around the corner, so let's look back at our 10 most important insights from this year.

Stay tuned: In 2026, we will bring you new formats, an evolved PRO offering & much more. Thank you for reading with us. As always: for feedback, reply to any of our emails.

Happy reading,

Your most important links:

👉 Advertise with us & reach 100k+ fintech leaders

👉 Co-publish or launch thought leadership campaigns with us

👉 Receive bespoke financial and market intelligence on digital assets

👉 Subscribe to our 51 AI newsletter and ur crypto asset treasury newsletter:

👉 Follow 51 on Youtube, LinkedIn and X

Top 10 from 51

1. Money Movement 2.0

This report explains why stablecoins have crossed from experimentation into core financial infrastructure. It shows how they are already moving trillions at lower cost and higher speed than traditional rails, why regulators and large institutions are now giving clear support, and how companies like Stripe, Circle, Visa, and JPMorgan are using them in real operations. Readers can expect a practical view of where stablecoins are creating immediate value—in payments, treasury, settlement, payroll, and emerging AI-driven commerce—along with clear guidance on what to adopt first and why.

2. Money’s new operating system

Stablecoins have quietly moved from the edge of finance to its operating core, and this report explains what that shift really means for decision-makers. It shows how large institutions and global fintechs are already using programmable dollars to move money faster, earn real yield on idle cash, and cut costs across payments, treasury, and settlement. For anyone responsible for capital, payments, or financial infrastructure, this is a concise guide to understanding whether stablecoins are a passing tool or the next layer of global finance.

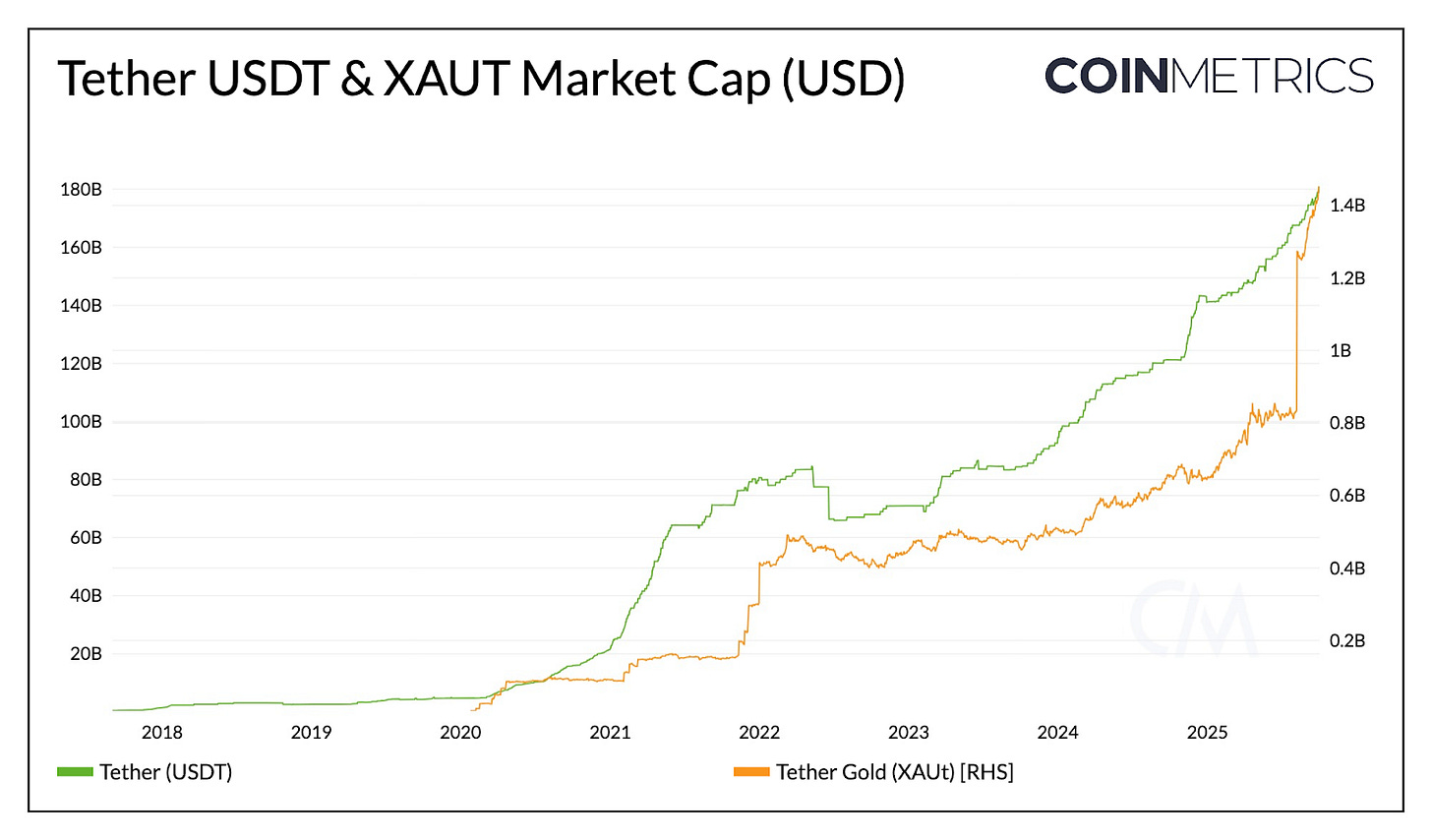

3. Tether isn’t what you think it is

These pieces explore how Tether has evolved from a simple stablecoin issuer into a full-stack "monetary operating system" for the digital age. By vertically integrating Bitcoin mining, P2P communications, energy, and AI, they are building a decentralized empire that traditional finance cannot reach. With $135B in U.S. Treasuries and a 99% profit margin, Tether is now a strategic geopolitical asset exporting dollar hegemony to billions of unbanked users. It’s no longer about tokens; it’s about owning the infrastructure of global resilience.

4. Why the U.S. Treasury can’t let Tether fail

This piece explains why a single private stablecoin has become a quiet fault line in global finance. It shows how Tether’s balance sheet now matters not just to crypto markets, but to U.S. debt, short-term interest rates, and financial stability, and why regulators may be forced to support an entity they do not control. The article helps readers understand what is actually at stake if confidence in USDT ever breaks and why this is a system-level story.

5. How America weaponized crypto

These pieces argue that the U.S. has made a decisive strategic shift: using stablecoins and clear crypto regulation to strengthen dollar dominance and quietly support government debt. It explains how the GENIUS and CLARITY Acts turn private companies into large, regulated buyers of U.S. Treasuries, creating a new digital dollar system that benefits issuers, lowers U.S. borrowing costs in real terms, and expands global dollar usage without higher taxes or overt money printing.

Readers can expect a clear view of why payments firms, banks, and stablecoin issuers are accelerating adoption, how this reshapes global competition with China and Europe, and why stablecoins are becoming core financial infrastructure.

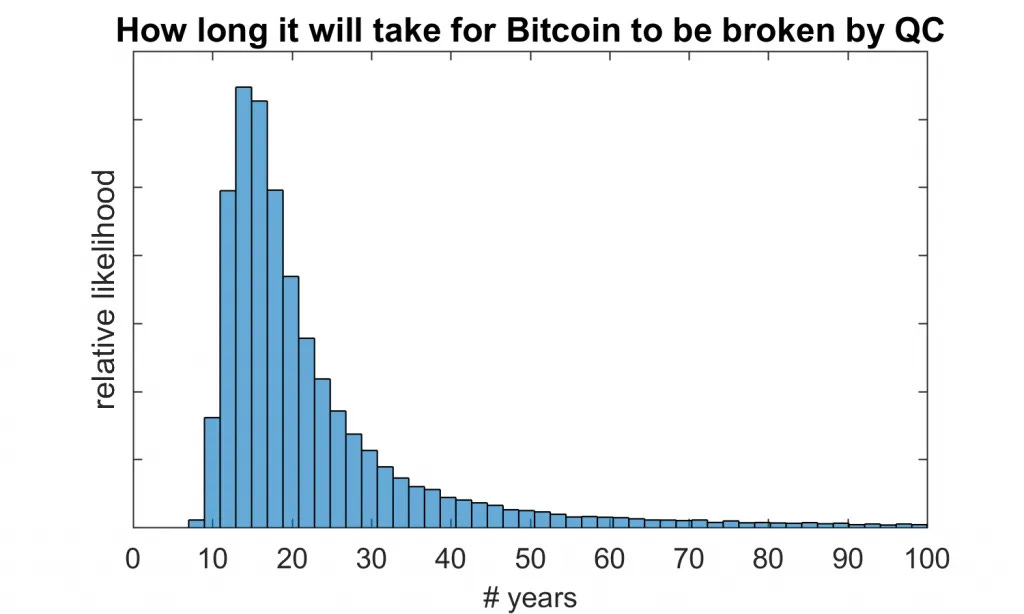

6. Quantum Threat: Solana > Ethereum > Bitcoin

This article explains why quantum computing is a near-term strategic issue that affects every major blockchain differently. It shows that the real question is not whether quantum machines arrive, but which networks can adapt fastest. The analysis compares Solana, Ethereum, and Bitcoin, arguing that flexibility in cryptographic upgrades, not brand, decentralization ideology, or market cap, will determine resilience.

Readers can expect a clear breakdown of recent warnings from Vitalik Buterin and Ray Dalio, what current quantum progress actually means in practical terms, why Bitcoin faces the hardest transition, and how institutions are already preparing private, quantum-safe alternatives.

7. Stocks will be tokenized

This article explains why Robinhood’s latest move matters far beyond a product launch. It shows how shifting stocks onto blockchain rails could quietly remove some of the most expensive and fragile parts of today’s trading system, open markets that currently close each afternoon, and expand access to assets most individuals have never been able to touch.

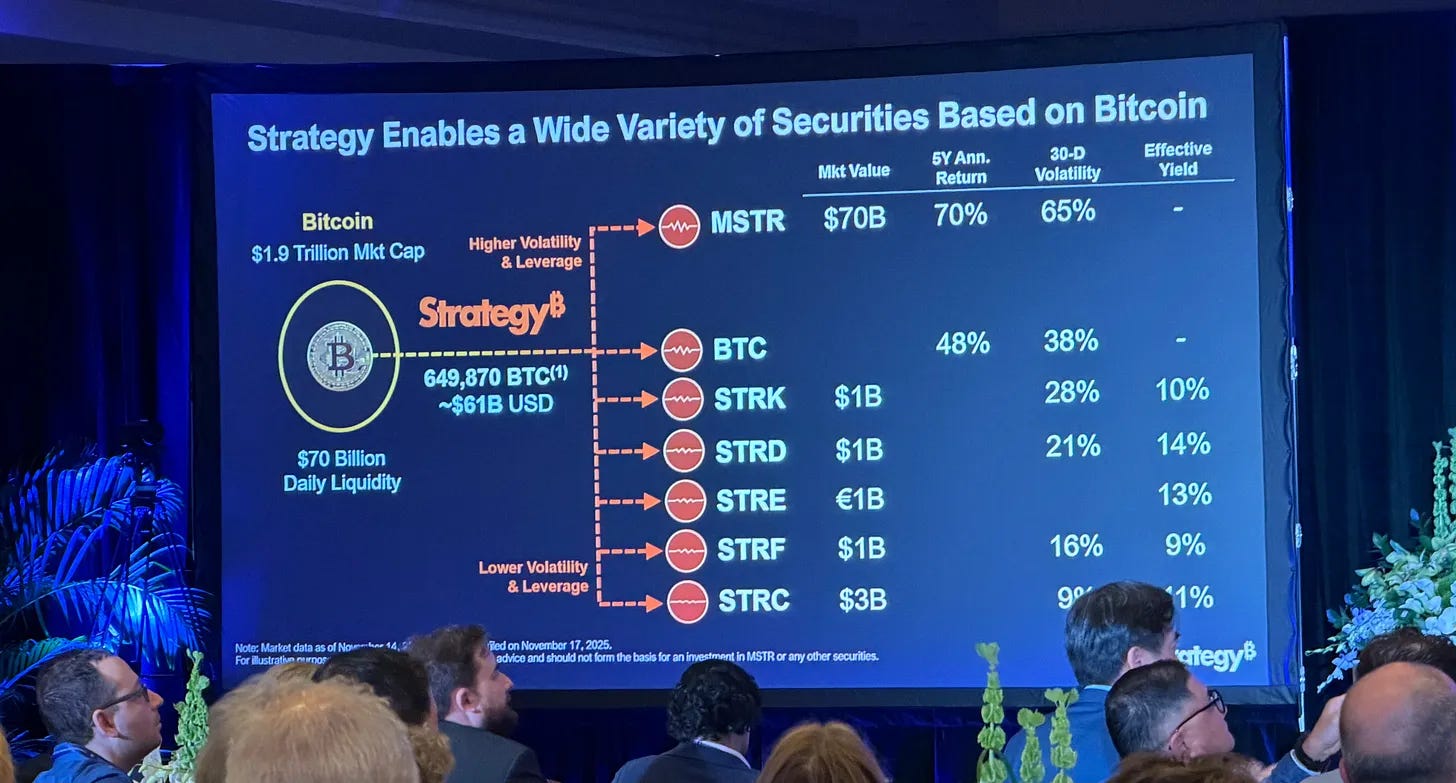

8. Will Strategy’s flywheel break?

This piece explains why MicroStrategy’s biggest risk is no longer Bitcoin’s price, but a quiet rule change in global equity indices. It shows how potential exclusion from MSCI, and possibly S&P and FTSE, could force large, automatic selling, collapse the stock’s premium to its Bitcoin holdings, and break the capital-raising loop that has powered its strategy. Readers can expect a clear view of how index inclusion underpins liquidity and cheap financing, why losing it raises borrowing costs and weakens the model, and how investors and institutions are already repositioning.

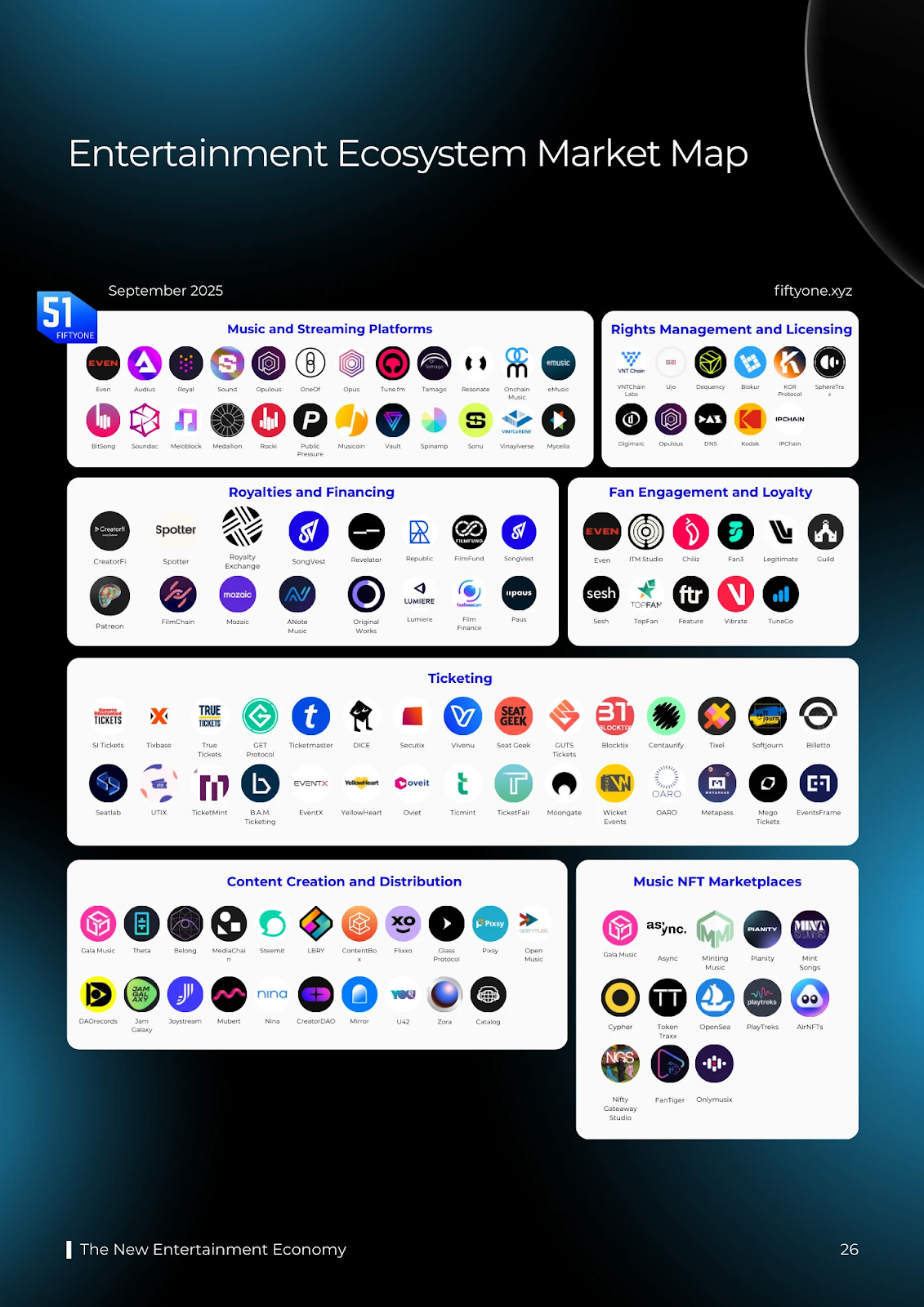

9. The New Entertainment Economy

These reports explains why music, film, and entertainment are reaching an economic breaking point and how blockchain infrastructure is already fixing it. It shows how most creator revenue is lost to slow payments, intermediaries, and platform control, and why direct fan relationships, instant payouts, and new financing models are becoming essential. Readers can expect practical case studies across music, ticketing, and film, from superfan commerce and creator financing to fraud-free ticketing and fan-funded films highlighting what is working today.

Top 5 podcasts

Top reads in AI and Crypto Treasury across the 51 network:

Your most important links:

👉 Co-publish or launch thought leadership campaigns with us

👉Subscribe to our 51 AI newsletter

👉Subscribe to our crypto asset treasury newsletter:

👉 Follow 51 on Youtube, LinkedIn and X

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

Great insights fam... We follow each other on LinkedIn... Ryan Cooper... D'Ville Crypto Solutions... https://bio.site/dcscrypto