Hey, it’s Marc,

Stablecoins are becoming an operational layer of global finance.

$283B in circulation. $27.6T moved in 2024. $2.3T moving monthly. Instant settlement, real yield, enterprise-grade use cases.

Our new flagship report “Digital Dollar, Real Yield” is our most practical, enterprise-focused stablecoin briefing yet.

And we give it out for free to all our subscribers.

Why now

Once dismissed as a niche, programmable money is now enabling critical infrastructure for Fortune 500 giants and modern fintechs.

With 90% of financial institutions actively building, acquiring, or launching stablecoin solutions, the question is no longer if this will reshape finance, but who will capture the $10+ trillion opportunity.

This report is an actionable guide for fintech leaders, corporate treasurers, and institutional investors on how to move from exploration to implementation.

Special thanks to our insight contributors and vendor partners featured in the report, including OpenTrade, Agora, Rain, and Ava Labs.

The great convergence

The narrative of stablecoins has evolved beyond simple transactions. The convergence of regulatory clarity, institutional validation, and mature infrastructure creates a new reality.

Institutional Adoption is Here: 90% of financial institutions are taking action on stablecoins, with 48% citing speed as the primary benefit. JPMorgan is processing $1B daily via JPM Coin, while BlackRock’s tokenised fund BUIDL surpassed $1B in assets, becoming the fastest-growing tokenised fund in history.

Regulatory Green Light: The EU's MiCA regulation is live, the US GENIUS Act is approved, and Hong Kong’s licensing framework is taking effect. The primary barrier to enterprise adoption has been removed.

The Infrastructure is Ready: This report spotlights the three core financial primitives powering the new wave of fintech:

Issuance Infrastructure (Agora): Enabling any company to launch its own branded, yield-generating stablecoin in days, not months.

Yield Generation (OpenTrade): Delivering 3-9% APR on USD/EUR holdings via tokenised money market funds, powering over 5M users in Latin America and Europe.

Global Spending (Rain): Powering Visa-backed payment cards that settle transactions instantly using stablecoins across 100+ countries.

The use cases driving real value

Programmable money is delivering quantifiable impact now.

Treasury as a Profit Centre: Enterprises are eliminating 66% of working capital requirements and turning idle cash into a yield-generating asset with tokenised money market funds.

Instant Global Settlement: Companies like WorldPay have achieved a 50% improvement in settlement times, while PayPal has reduced cross-border B2B payment fees by up to 90% using PYUSD.

Slashing Transaction Costs: Stablecoin rails reduce transaction costs from 2.9% (credit cards) to less than 0.3%, unlocking billions in savings for large-scale enterprises like Amazon and Walmart, who are actively exploring their own stablecoins.

The New Infrastructure Layer: Stripe’s introduction of Stablecoin Financial Accounts in 101 countries is supercharging "Payment Finance," enabling everything from on-chain invoice financing to global BNPL for the unbanked.

Who’s winning

The leaders are those building the foundational layers, the new rails for the global financial system.

Infrastructure Enablers: Companies like Agora, OpenTrade, and Rain are providing the critical "stablecoin stack as-a-service," allowing fintechs and enterprises to embed issuance, yield, and payment capabilities with simple APIs.

Institutional Heavyweights: JPMorgan, BlackRock, Societe Generale, and Deutsche Bank have moved past pilots and are launching their own deposit tokens and MiCA-compliant stablecoins.

Purpose-Built Blockchains: Avalanche has positioned itself as the leading layer-1 for institutional finance, offering a customizable infrastructure that provides the scalability, compliance, and privacy that enterprises demand.

What’s happening now is a fundamental replatforming of financial services. The conversation has shifted from "digital payments" to "programmable yield."

What’s next

What was once a speculative corner of the crypto market has matured into a formidable infrastructure layer for the global financial system, processing trillions of dollars and surpassing the transaction volumes of legacy payment giants.

The convergence of regulatory clarity, institutional adoption, and robust technology has shifted the conversation from risk mitigation to strategic opportunity.

The evidence is clear: programmable money is no longer a distant concept but a present-day reality, enabling faster, cheaper, and more efficient financial services. The foundational rails have been laid, not by crypto-native idealists, but by the world's largest financial institutions and most innovative fintechs.

The transition to a programmable financial stack is creating a market window where early movers will capture disproportionate value. This is about building new business models and creating the financial infrastructure for an automated, internet-native economy.

The question leaders must ask is whether they will be the ones to capture this opportunity or be disrupted by it.

Take care,

Marc

What's in the full report

The Programmable Money Revolution

Why Now: Three Macro-Forces Colliding

Enterprise Use Cases: The Three Financial Primitives

The Blockchain Tech Stack: Choosing Your Rails

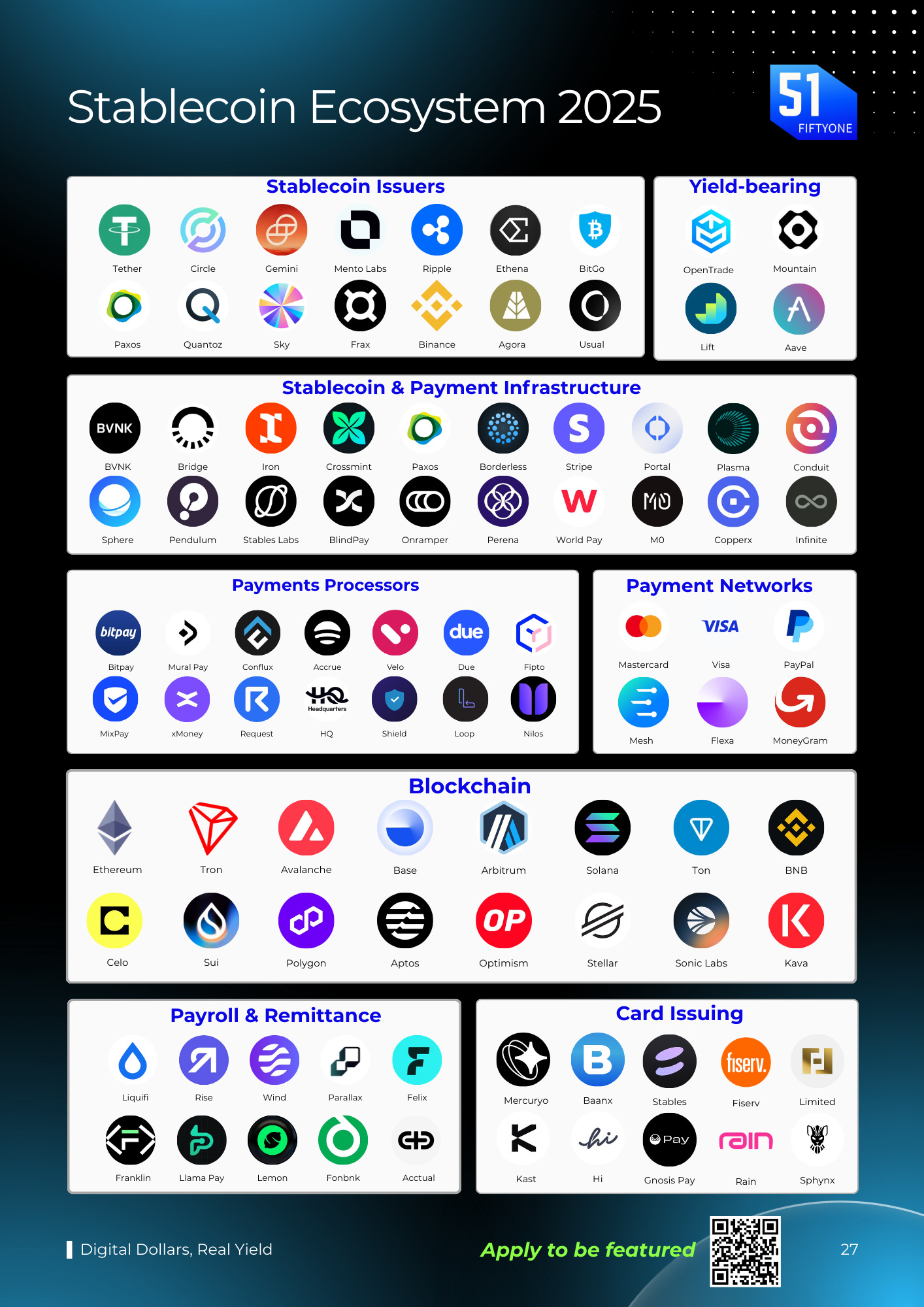

The Stablecoin Ecosystem 2025 Map

What To Do Now: Strategic Playbooks for Business Leaders

What we cover:

Our complete Stablecoin Ecosystem 2025 map with the key players in issuance, infrastructure, and payments.

Deep dives into the "stablecoin stack" leaders: Agora, OpenTrade, and Rain.

The Institutional Stablecoin Tracker, detailing the latest moves from BlackRock, JPMorgan, Citi, and Visa.

Why Avalanche is purpose-built for institutional and enterprise-grade financial applications.

How tokenized money market funds are turning corporate treasuries into profit centers.

The 90-day playbook for launching your first stablecoin initiative, from a low-risk pilot to a full-scale rollout.

Actionable frameworks for Neobanks, Global Corporations, and Traditional Banks.

Work with us

We create pioneering thought leadership that helps digital asset and technology companies lead the conversation, earn trust and win business.

Question: are Stablecoins subject to https://en.wikipedia.org/wiki/Gresham%27s_law and network effects will see consolidation to 3-5 stables and the rest having a redemption discount?

Looking over the past, banking runs (financial panics) are inevitable, cf Asian crisis, S&L, Terra/Luna. Not all stablecoins have access to a lender of last resort so there is the trilemma between stability, liqudity (free flows) and independent monetary/inflation policy. Read https://a16zcrypto.com/posts/article/how-stablecoins-become-money/

the problem (and opportunity) is unbundling the risks - monetary inflation vs fiscal payment (rails). If you look carefully at the legal mumbo-jumbo, some of the niche tokens are actually receipts or vouchers, not really redeemable at par much less legal tender. For example USTC redemption has a lower limit of $100k from memory which means only mainstream banks/fintech can knock on door and insist on legal tender.

My conjecture is that without some market discipline, some idiot a few years later will experience a reserve impairment and in panic run to the Fed and there's a non-zero chance they'd be turned down, leading to cascading unwinding ...