hey, it’s Marc.

S&P Global downgraded Tether to “Weak” on Wednesday, citing a balance sheet that defies traditional risk management. The math is stark: Tether’s exposure to Bitcoin now exceeds its equity cushion.

With $180B in assets and zero deposit insurance, Tether is running the boldest liquidity experiment in finance. Here is why the U.S. Treasury might be forced to save a company it can’t even regulate.

Let’s unpack.

(💎PRO readers: PDF below)

What happened

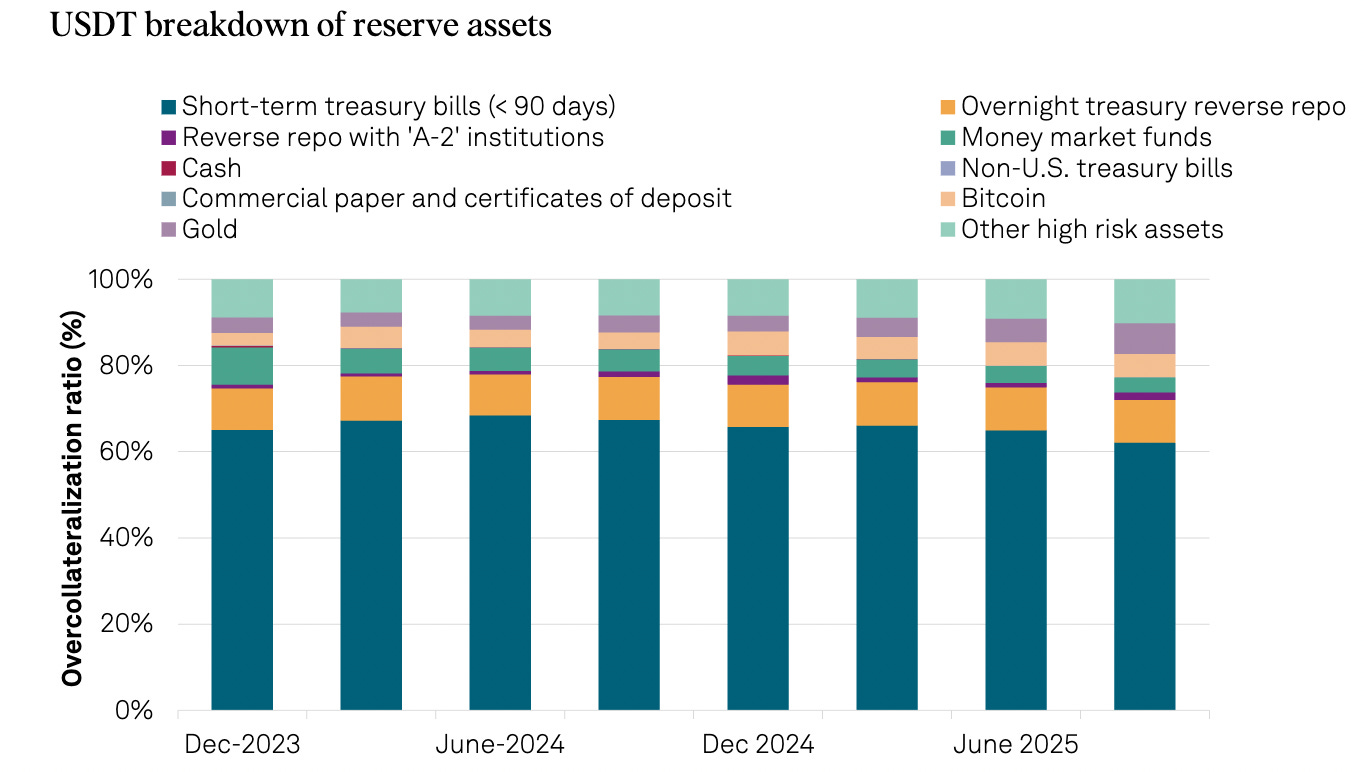

On November 26, 2025, S&P Global Ratings downgraded Tether (USDT) from “Constrained” to “Weak” (4 on a 5-point scale). The primary trigger was a shift in balance sheet composition: Tether’s holdings of Bitcoin now account for 5.6%of tokens in circulation, while its equity buffer (excess reserves) sits at just 3.9% ($6.8B). [see the report]

The math is simple: Tether’s exposure to volatile assets now exceeds its capacity to absorb a shock without dipping into customer funds.

S&P’s view: 100% reserve coverage isn’t enough for a stablecoin issuer holding volatile assets without a lender of last resort. A 70% drop in BTC would render USDT technically undercollateralized.

Tether’s view: CEO Paolo Ardoino dismissed the rating, citing $10B in annual profits and a massive portfolio of U.S. Treasuries ($135B) and gold. He framed the Bitcoin allocation as a strategic hedge against fiat debasement, not a liability.

The framework: S&P Global Ratings does not rate stablecoins using the traditional corporate bond scale (AAA to D). Instead, it employs a specialized “Stablecoin Stability Assessment” scale ranging from 1 (Very Strong) to 5 (Weak). This framework is designed to evaluate a single, binary outcome: the ability of the stablecoin to maintain its peg to a fiat currency or basket of assets.

Zooming in: Tether runs a fractional-reserve model where its assets exceed its liabilities, creating a small equity cushion. In Q3 2025, it reported $181.2B in assets against $174.4B in liabilities, leaving about $6.8B in “excess reserves.” That sounds large, but it’s only a 3.9% buffer, a thin margin for an instrument that underpins so much of crypto’s day-to-day liquidity.

Ardoino claims Tether is “the first overcapitalized entity in financial history”.

Banks: Hold ~10% of deposits in liquid reserves but are protected by central-bank backstops and deposit insurance.

Tether: Holds ~104% of liabilities in assets, but with no lender of last resort and no insurance safety net.

So even though Tether’s capital ratio looks higher than a bank’s, it has no safety net. Its 4% buffer is its only protection. S&P’s downgrade is basically saying that 104% coverage isn’t enough for a firm that can’t print money and still holds about a quarter of its assets in volatile instruments.

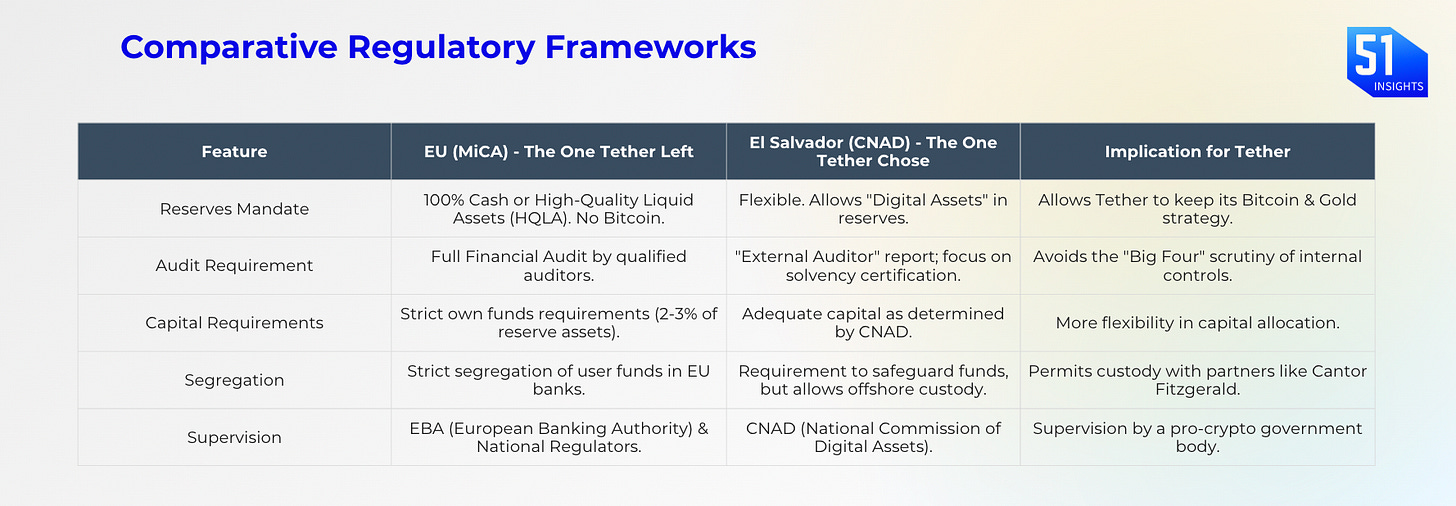

Simultaneously, Tether has finalized its regulatory migration from the Caribbean to El Salvador, effectively sidestepping the EU’s stringent MiCA regulations (which require 100% cash reserves) in favor of a jurisdiction prioritizing sovereign Bitcoin adoption.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.