Hey, it’s Marc.

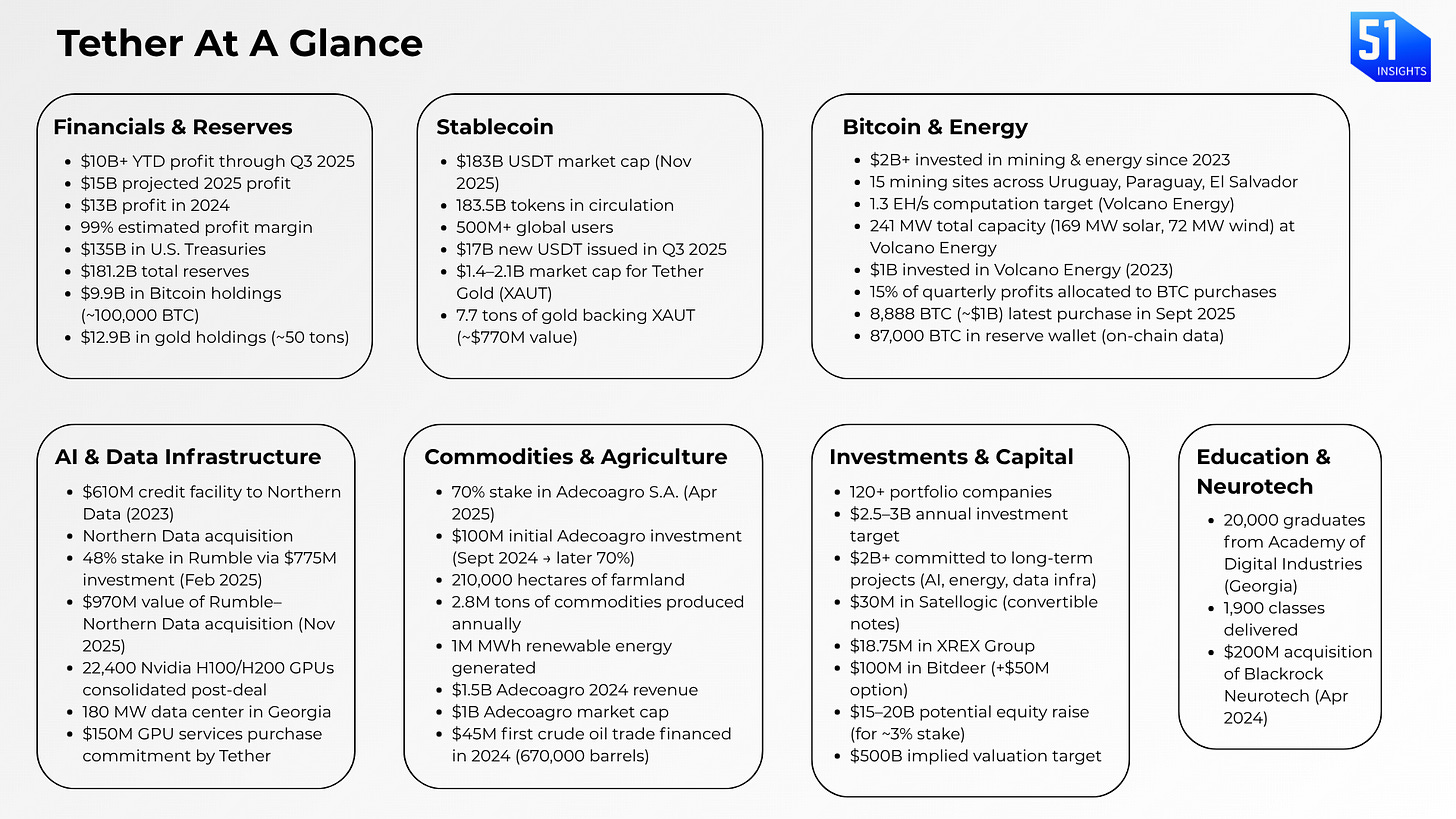

When a stablecoin issuer starts calling itself “the best ally for the United States,” you pay attention. When it backs that claim with 500M users, $135B in Treasuries and $13B in yearly profits with a 99% profit margin, you listen harder.

Most people still think Tether is just a stablecoin company. That’s wrong.

At Cantor’s Crypto & AI/Energy Infrastructure conference in Miami this week, Tether’s CEO, Paolo Ardoino, painted a picture of a company evolving far beyond its stablecoin origins. Tether is building what might become the most important digital infrastructure company of the decade, spanning finance, energy, communications, and AI for the 1.4-3B unbanked people in emerging markets:

“We’re not just exporting dollars. We’re exporting resilience. […] We are bringing forward the concept of the US for hegemony... we are protecting the USA... We are making the dollar so rooted in all the wallets in all the businesses in all these emerging markets... in a way that cannot be eradicated.”

— Paolo Ardoino, CEO, Tether

Tether is quietly becoming one of the most powerful companies in crypto and beyond. And you should pay attention.

Let’s unpack.

👉PRO Readers: Download the PDF at the bottom

What happened

In his first U.S. conference appearance, Tether CEO Paolo Ardoino unveiled a sweeping strategy to reframe the company from a crypto utility to a global infrastructure provider. He described Tether not as a fintech company, but as:

“The largest monetary distribution network in the history of money.”

Ardoino detailed Tether’s transformation from a crypto-centric company to what he termed a “stable company”.

His long-term thesis: a stable society requires stable infrastructure across four layers:

Finance: USDT, USAT (Genius Act-compliant), XAUT (gold-backed), Rumble Wallet

Communication: Keet (fully peer-to-peer messaging, no central servers)

Energy: Tether kiosks — 500 live in Africa, 100k planned, powering up to 150M people; Tether is also the world’s biggest Bitcoin miner.

Intelligence: QVAX — a peer-to-peer AI runtime that runs LLMs locally, even on low-power phones

Tether is building all of this via 140+ portfolio companies, tightly integrated into its expanding distribution rails.

“We are creating such a consolidated distribution network that not only can transport USDT or Tether Gold, but can transport values — information, education — that are outside of a simple exchange of money. This is about resilience.”

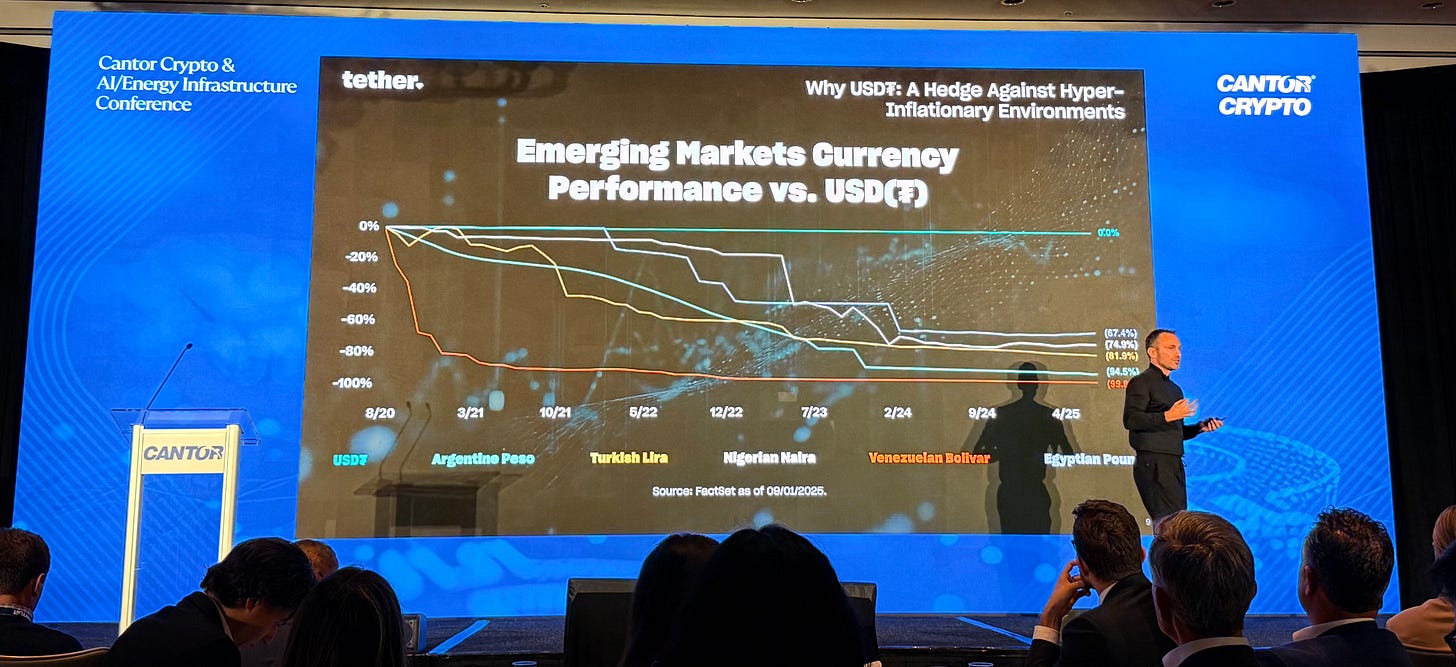

He framed Tether’s colossal growth as a direct consequence of global failure: the rapid devaluation of national currencies in emerging markets.

“The Venezuelan bolívar lost 99.8% in the last 10 years against the US dollar... That is in one simple chart the reason why Tether is successful.”

This is why 37% of USDT’s supply is held by savers in Argentina and Turkey, not traders, but everyday users turning to stablecoins as inflation hedges.

“Tether is the biggest financial inclusion success story in human history. Wherever banks fail to support local communities, Tether is present.”

Zooming in: Ardoino lays out a powerful thesis: The traditional financial system is failing billions, exporting inflation, and leaving half the world’s population behind. What many see as a crypto asset, Tether views as the most effective monetary distribution network in history, capable of transporting the US dollar, and the values it represents to the farthest corners of the globe.

“If half of the population in the world is left behind from the traditional financial system and it’s not financially included, how the world can move forward?”

🚨 We just opened new sponsorship slots for our newsletters & podcast. Want to reach 35k+ digital asset leaders? Contact us here.

Why it matters

Ardoino’s vision presented Tether as a force for global stability and a champion of the U.S. dollar’s hegemony. By embedding the dollar in the financial fabric of emerging markets, he argued, Tether is creating an “eradication-proof” network that will benefit the U.S. economy for the foreseeable future.

“We are making the dollar so rooted in all the wallets, in all the businesses, in all these emerging markets — in a way that cannot be eradicated.”

This narrative positions Tether not as a rogue offshore entity, but as a strategic partner to the United States. This is a significant shift in tone for a company that has historically had a contentious relationship with U.S. regulators.