Hey, it’s Marc.

“Public blockchains are more transparent than any legacy financial system ever built... crypto could become the most powerful financial surveillance architecture ever invented.”

— Paul Atkins at SEC crypto task force roundtable

The real action this weeks are infrastructure updates: Coinbase, DTCC, SoFi, JP Morgan. The winners? Ethereum, Canton, and Solana.

On top of that, the OCC has approved five national trust bank charters for digital asset entities. Now, these entities will be reviewed under the same standards used for traditional banks.

Our highlights this week:

JPMorgan launches its first tokenized MMF “MONY” on Ethereum

Coinbase launches tokenization and stablecoin as-a-service

SoFi becomes the first national bank to issue a public stablecoin

DTCC picks Canton to tokenize U.S. Treasuries

OCC grants federal bank charters to Circle, Ripple, and Fidelity

Visa launches 24/7 USDC settlement for U.S. institutions

Let’s jump in 👇

PS: We have a series of killer podcasts coming up & just opened new sponsorship slots. Grab your spot here!

Top Boardroom Reads

Why altcoins will be bigger than Bitcoin, with Yat Siu, Co-founder of Animoca Brands (51)

Stablecoins, Financial Stability, And Treasuries (S&P Global)

The End Of Interchange (AVC)

Top Signals This Week

JPMorgan’s $100M “MONY” Move on Ethereum

JPMorgan just launched MONY, a $100M tokenized money-market fund live on the Ethereum mainnet. Powered by their Kinexys Digital Assets platform (formerly Onyx), the fund is seeded with JPM’s own capital and marks their most aggressive step into public DeFi rails to date. [NEWS] [ANALYSIS]

Why it matters: While BlackRock’s BUIDL fund ($1.8B) and Franklin Templeton’s BENJI led the way, JPM’s entry signals that the largest bank in the U.S. now views Ethereum as a legitimate settlement layer. But the real “innovation” isn’t the fund itself, it’s the funding mechanism. Investors can subscribe and redeem using USDC. By integrating Circle’s stablecoin into the plumbing of a major MMF, JPM is admitting that private bank coins can’t compete with the liquidity and reach of public stablecoins.

Our view: By treating public blockchains as settlement rails, JPM is commoditizing the infrastructure while maintaining the customer interface.

The First Nationally Chartered Stablecoin: SoFiUSD

SoFi Bank, N.A. (an OCC-regulated, FDIC-insured institution) officially launched SoFiUSD, a fully reserved stablecoin on the public Ethereum blockchain. Unlike JPMorgan’s “JPM Coin” which exists on a private ledger, SoFiUSD is permissionless, meaning it can interact with the broader DeFi ecosystem while maintaining “bank-grade” oversight. [NEWS]

Why it matters: By issuing a stablecoin from a national charter, SoFi eliminates the two biggest hurdles for institutional adoption: counterparty risk and regulatory ambiguity. Because SoFi holds its reserves directly at the Fed, it has zero liquidity or credit risk, something even USDC (Circle) and USDT (Tether) cannot claim as non-banks. This creates a “Triple-A” equivalent stablecoin that can move 24/7 with instant finality.

Our view: SoFi isn’t just launching a product; they are offering “Stablecoin-as-a-Service.” Through its technology arm, Galileo, SoFi can now…. (continue below)

Coinbase is no longer a crypto exchange

On December 17, 2025, Coinbase rolled out a coordinated set of upgrades aimed at becoming a full-spectrum financial platform, aka the “everything exchange”:

Trading of major stocks & ETFs, 24/5. zero fees. Thousans more coming.

Perpetual futures for stocks (outside of US). Massive for global liquidity. Coming early 2026.

Prediction markets: together with Kalshi, Coinbase is turning the world’s events – elections, Fed rates, sports – into tradeable assets.

Tokenization as-a-service

Stablecoins as-a-service

…marking a clear move to bring traditional assets and payments onto a single, regulated digital stack. [RELEASE]

Why it matters: By using the Base blockchain as the settlement layer and USDC as the medium of exchange, they are bypassing legacy clearinghouses. This allows for cross-collateralization: you can now theoretically use your Nvidia stock to instantly hedge an election outcome or a sports contract.

Be smart: For a decade, Coinbase was a "leveraged bet" on crypto volatility; when trading slowed, revenue vanished. The “Everything Exchange” strategy breaks that dependency.

Our view: The most slept-on part of this? Stablecoin-as-a-Service. Coinbase is now (continue below)…

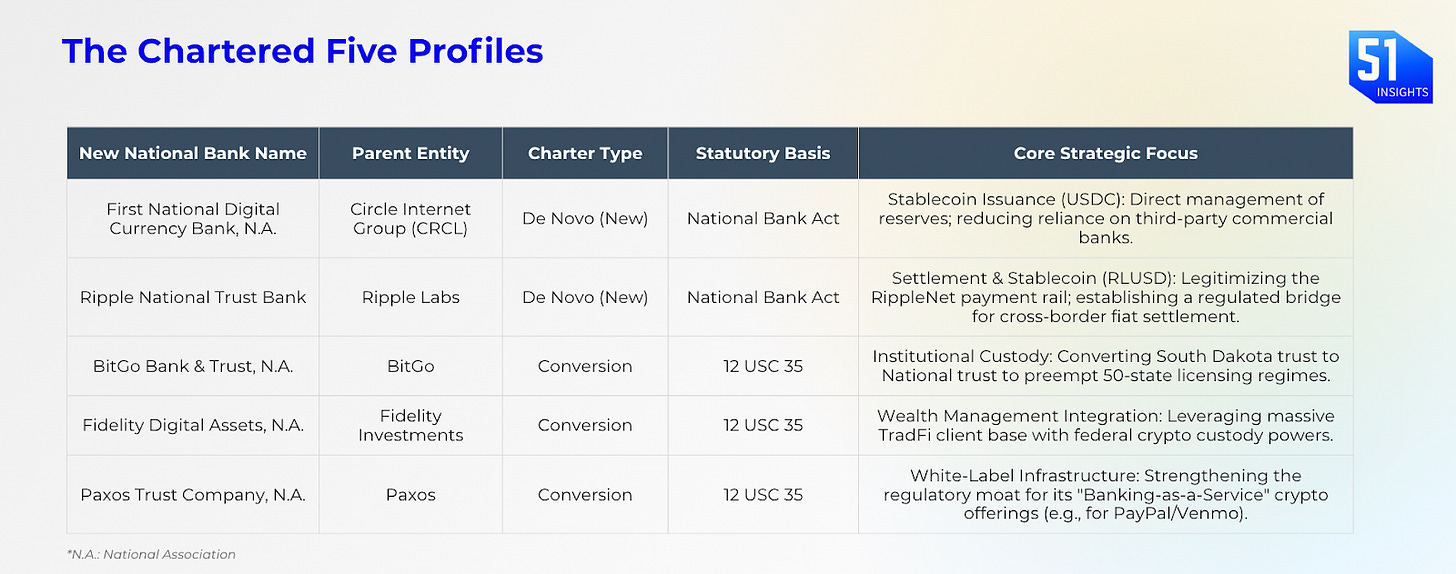

Crypto just became the banking system

The U.S. banking regulator OCC (Office of the Comptroller of the Currency) approved five crypto-focused firms to operate as national trust banks, pending final conditions. Two are brand new banks (Ripple and Circle), and four: BitGo, Fidelity Digital Assets, and Paxos are upgrading from state to federal oversight. [RELEASE]

The OCC’s actions are the executive implementation of the GENIUS Act, passed by the 119th Congress on July 18, 2025.

So what? This puts major digital-asset players under the same federal framework as traditional trust banks. The regulator is signalling that crypto custody and settlement can sit inside the mainstream banking system, not outside it. This opens an $85T institutional custody market without traditional banks’ permission.

Canton won the $100T settlement race

DTCC announced that it will begin tokenising U.S. Treasury securities that are already held at DTC, its core custody arm. This will happen on the Canton Network, with a live production MVP targeted for the first half of 2026. [RELEASE]

So what? DTCC is the core utility of U.S. capital markets. Its subsidiaries process securities transactions valued at approximately $3.7 quadrillion annually and maintain custody of assets valued at $99T. By choosing Canton, a permissioned, privacy-preserving network designed for regulated institutions, DTCC is also signalling how it thinks tokenisation should happen: inside existing rules, with known participants, and without exposing sensitive trading activity to the public.

🚨 We just opened new sponsorship slots for our newsletters & podcast. Want to reach 35k+ digital asset leaders? Contact us here.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

Visa launches 24/7 USDC settlement for U.S. institutions

Visa has officially launched USDC settlement for U.S. financial institutions, moving its stablecoin program from a global pilot into the core of the American payment system. U.S. issuers and acquirers, starting with Cross River Bank and Lead Bank, can now settle their obligations using Circle’s USDC on the Solana blockchain. Additionally, Visa is a design partner for Arc, Circle’s new Layer 1 blockchain, where it plans to operate a validator node and further scale its onchain settlement. [RELEASE]

So what? The traditional banking system operates on a “business day” schedule, leaving a 48-hour liquidity gap every weekend. By using USDC, Visa enables seven-day settlement, letting banks move money and manage liquidity without waiting for Fed systems to reopen. With Visa’s stablecoin volumes already running at a $3.5T annualized pace, this is a live upgrade to the plumbing of global commerce.

News Flash

Trump administration says "we are closer than ever to passing the landmark crypto market structure legislation." Link

Visa launched a Stablecoin Advisory Practice for bank clients. Link

Interactive Brokers allows stablecoin funding. Link

Tether considers tokenising stock at $500b value. Link

Bitcoin hoar ding company Strategy remains in the Nasdaq 100. Link

SEC has concluded its investigation into the Aave Protocol. Link

Exodus, MoonPay to launch US dollar stablecoin in early 2026. Link

Strategy buys $980m BTC, BitMine buys $321m ETH. Link

That’s all for now, folks.

PRO Readers: Read our alpha insights below!

– Marc & Team