Hey, it’s Marc.

Stop calling Coinbase a crypto exchange. As of yesterday, that label is dead.

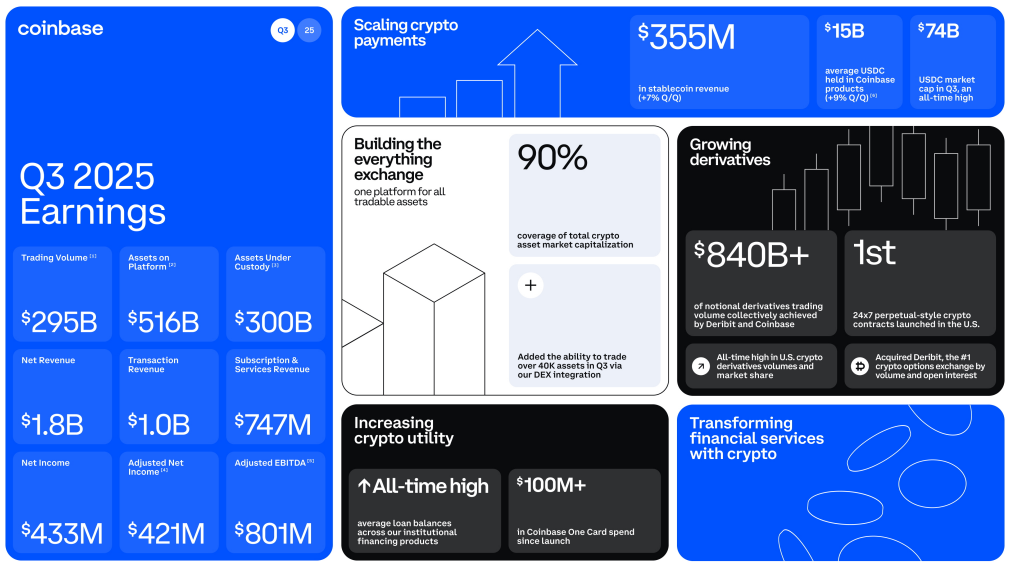

At its System Update event, Coinbase did not launch features. It dismantled categories. Stocks, derivatives, prediction markets, stablecoins, and tokenized real-world assets were all pulled into a single on-chain environment, settled on Base, collateralized by USDC, and distributed through one wallet. [MORE]

Let’s unpack. (full PDF at the bottom)

Get your brand in front of 100k+ decision makers in digital assets.

What happened

On December 17, 2025, Coinbase introduced a series of incremental features. Their advanced five core initiatives are:

Zero-Fee Stock & ETF Trading (24/5)

– U.S. equities and ETFs, with thousands more planned

– Designed for distribution, not margin captureInternational Equity Perpetual Futures (ex-U.S.)

– Perps for stocks, launching early 2026

– Unlocks global, continuous liquidity for equitiesRegulated Prediction Markets (via Kalshi)

– Elections, macro outcomes, rates, and events as tradeable contracts

– Structured as financial markets, not gamblingCoinbase Tokenize (Institutional Tokenization Stack)

– End-to-end issuance, custody, compliance, and secondary trading

– Designed for off-chain assets moving on-chain at scaleStablecoin-as-a-Service (“Custom Stablecoins”)

– Enterprises can issue branded digital dollars

– Fully backed 1:1 by USDC, custodied and compliant at Coinbase

These launches are tightly coupled. None are standalone products.

Zooming in: The “System Update” announcements reveal a deliberate strategy to converge three historically distinct asset pillars:

Spot Equities & ETFs: The traditional ownership of corporate cash flows, representing the bedrock of household wealth.

Digital Assets: Sovereign-grade cryptocurrencies (BTC, ETH) and utility tokens, representing the new internet economy.

Event Contracts (Prediction Markets): Instruments for hedging against real-world outcomes, representing the “information economy.”

The strategic value lies in the cross-collateralization of these assets. In today’s system, stocks can’t be used as instant collateral for things like election or sports contracts because markets settle slowly and don’t connect. Coinbase’s on-chain setup is designed to let assets move and be reused in real time, making that kind of cross-market use possible.

Be smart: Unlike competitors such as Robinhood, which rely on traditional clearinghouses and third-party crypto custodians, Coinbase is building its own vertical stack with Base blockchain. The blockchain serves as the settlement layer, while USDC acts as the medium of exchange.

The revenue mystery: Coinbase has explicitly stated that zero-commission stock trading is a permanent offering but has declined to detail the revenue model.

Three revenue paths stand out:

Subscriptions: Free stock trades pull users into Coinbase One, where monthly fees cover crypto trading perks, data tools, and account protection, turning transactions into a relationship business.

Interest on cash: Keeping more customer dollars on the platform lets Coinbase earn interest on idle balances, a proven profit engine for brokerages in higher-rate environments.

Order flow economics: Zero-fee stocks usually rely on routing or internalizing trades; whether Coinbase uses this or avoids it to protect its brand will determine how much pressure falls on subscriptions and interest income.

The alpha: Coinbase’s move into prediction markets through its partnership with Kalshi may be its boldest step yet. By using a federally regulated venue, Coinbase can offer U.S. users a legal way to trade on real-world events, something that has driven huge demand offshore but remained off-limits at home.

The most exciting thing in our view? Stablecoin-as-a-service. Here’s why + our alpha + the full PDF