Hey, it’s Marc & 51 team,

For 18 months, the crypto pitch to allocators was simple: ETFs brought in real money, regulation was coming, and Bitcoin had decoupled from degen retail. Mature asset class. Uncorrelated store of value. Digital gold.

Then three pipes burst at the same time: the U.S. Treasury sucked $200B out of bank reserves, Japan ended 30 years of free-money leverage, and AI’s hype cycle suddenly became a risk event, and Bitcoin did what “digital gold” isn’t supposed to do: it crashed 45% in four months, from its $126,000 peak to below $61,000 last Thursday. That’s $800B in market value erased. Ethereum did worse, down 52% peak to trough.

The scariest part? Most of the “institutional bid” that was supposed to catch the fall was never a bid at all.

Let’s unpack.

👉PRO: Download the PDF below

🚨 Want more intelligence? Work with the 51 Intel team to embed continuous, high-signal market intelligence into your organization.

What happened

Three simultaneous macro shocks hit in January-February 2026.

US Treasury borrowing: In late October 2025, the U.S. Treasury’s cash account ballooned to $1T. To do that, the government issued debt and pulled roughly $200B out of bank reserves to prepare for shutdown risk. This drained liquidity from the system, squeezing risk assets in the process. Now, Treasury plans to borrow $574B as net marketable debt in Jan–Mar 2026 and targeting an $850B end-March and $900B end-June cash balance. [RELEASE] [Quarterly Refunding Statement]

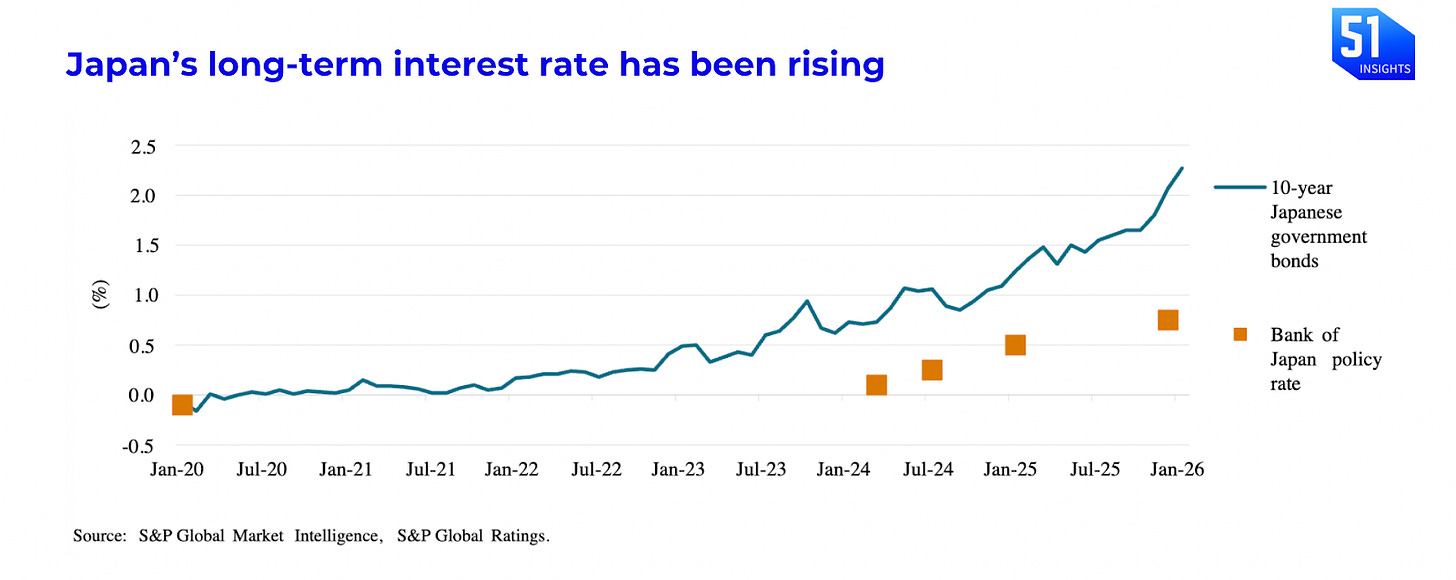

Rising interest rates of Japan: On December 19, 2025, the Bank of Japan (BoJ) raised its key policy interest rate by 25 basis points to 0.75%, the highest level in 30 years. Rates are expected to rise toward 1.25% by 2027. On January 5, Japan’s Securities Finance Co. Ltd., (JSF) published its “Announcement of the Average Outstanding Balance of Loans for Margin Transactions,” a routine disclosure. [NEWS]

Bitcoin correlation with NASDAQ: Bitcoin’s 0.75 correlation with the Nasdaq turned an AI shock into a crypto shock. When Anthropic released autonomous agents on February 4, SaaS sold off, and Bitcoin was dragged down with it. The launch of Grok 3 by Elon Musk’s xAI added a layer of retail irrationality to the market dynamics. [NEWS]

Other drivers are:

Leverage broke the market: When Bitcoin fell below key levels like $88K and $70K, forced liquidations kicked in. Between late January and early February, over $2B in leveraged positions were wiped out in single-day events, fueling a self-reinforcing selloff. [NEWS]

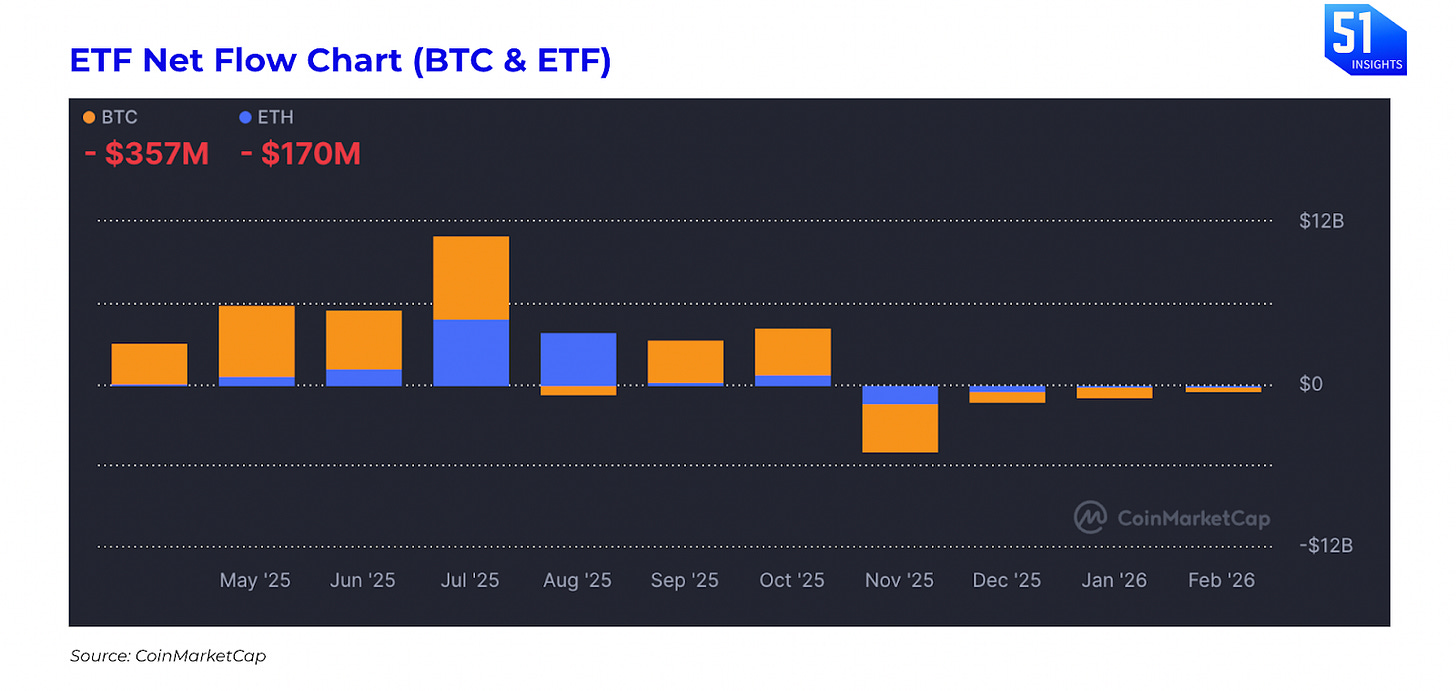

Institutional demand is fading: Hedge funds are exiting the bitcoin basis trade, buying spot ETFs and shorting futures, as yields collapsed from ~17% in 2024 to under 5% in early 2026. Since November 2025, the net ETF flow has been negative with Bitcoin ETF (-$788B) and Ethereum ETF (-$193M) in January.

Monetary and political uncertainty: The Fed is caught in a leadership standoff. Jerome Powell is still chair until May 2026 but is under investigation by DoJ, while President Trump’s pick, Kevin Warsh, to replace him is stuck in the Senate. If nothing is resolved, the Fed will shift to an interim leader, Philip Jefferson (Fed Governor and Vice Chair), adding more uncertainty for markets. [NEWS]

Also: The release of the “Epstein Files” has introduced a toxic layer of reputational risk to key industry infrastructure. Epstein tried to steer Bitcoin’s early development, funded Bitcoin Core devs through MIT, invested $3M in Coinbase in 2014, and Blockstream’s CEO Adam Back is facing calls to resign over island visit emails.

Key liquidation events in January 2026:

January 14: A mid-month price surge triggered $718M in short liquidations.

January 29: Rising macro uncertainty led to $1.68B in liquidations and roughly $800M in net outflows from spot Bitcoin ETFs.

January 31: The peak event where $2.56B was liquidated in 24 hours. Over 95% of these were long positions.

Bitcoin’s identity: Bitcoin began trading as a leveraged macro asset rather than an independent hedge.

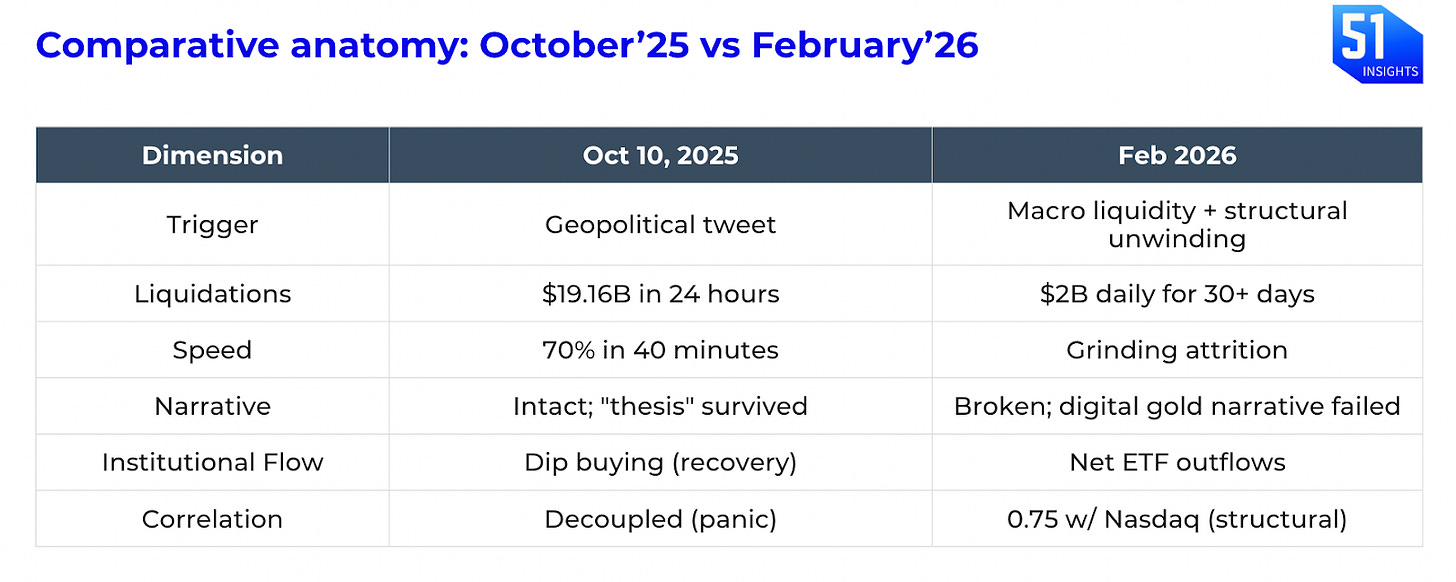

The result: Bitcoin fell from its $104,500 peak in November 2025 to below $64,000. Ethereum did even worse, dropping 52.7% peak to trough. Daily liquidations averaged $2B, but the real damage came from a slow, four-week grind that far exceeded the $19.16B October “Tariff Flash Crash,” which had recovered within hours. [Read analysis]

The Digital Asset Treasury situation

MicroStrategy reported a $12.4B Q4 net loss from mark-to-market Bitcoin accounting (new FASB rules). The firm’s stock crashed 17% on February 5. [Q4 Financial Results]

The math: When Bitcoin drops 50%, a 10× leveraged holder is effectively wiped out. MicroStrategy isn’t that leveraged, but its stock trades at a 2.5–3× premium to its Bitcoin holdings, and that premium collapses fast in selloffs. The company has $2.25B in cash through 2028, so bankruptcy isn’t the issue. The issue is that the stock now behaves like a high-beta gamble, not a clean Bitcoin proxy.

Bitmine Immersion Technologies, who became an Ethereum DAT in 2025, sits on $6.6B in paper losses. The stock is down 65% (in 6 months), reflecting fears around execution risk. Investors are betting that Bitmine may miss or delay its Q1 2026 MAVAN staking launch, which was expected to generate $374M a year. If MAVAN slips or fails, Bitmine risks being seen as vaporware.

Takeaway: Direct Bitcoin exposure is superior to Digital Asset Treasury equity during downturns.

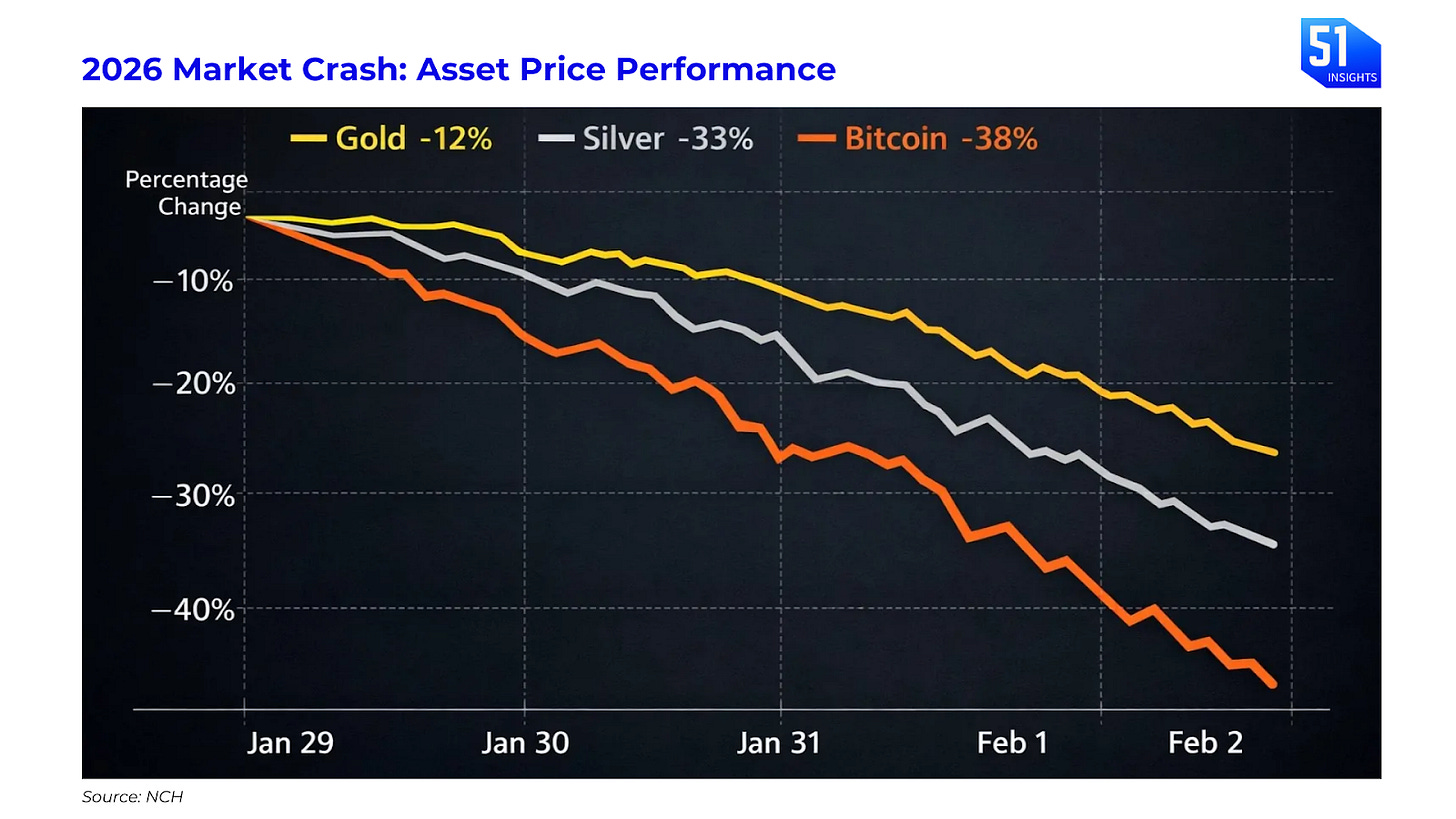

How crypto dragged down Gold: Large funds manage crypto, gold, and stocks in one margin account. When Bitcoin crashed, brokers demanded cash fast. Selling more crypto would worsen losses, so funds sold gold instead, which was easier to exit. Part of gold’s drop wasn’t about gold at all, it was a forced, mechanical sale to cover crypto losses.

Where is money going: If $1T left crypto, it didn’t vanish, it moved.

US Treasuries & Bonds: Yields are attractive again as the Fed signals stability.

Gold & Silver: Investors rotated capital from volatile crypto assets into precious metals. Ironically, the scale of crypto liquidations later forced some traders to sell their gold and silver holdings to meet margin calls.

Institutional debt repayments: Trend Research, were forced to liquidate massive holdings (including over 400,000 ETH valued at ~$800M) specifically to pay back loans.

Exchange insurance funds: Forced liquidations fed insurance pools at Hyperliquid ($598M), Bybit ($420M), and Binance ($181M), designed to keep platforms solvent during mass blowups.

Why it matters

Keep reading with a 7-day free trial

Subscribe to 51 Insights to keep reading this post and get 7 days of free access to the full post archives.