On Monday, Citadel Securities, the DTCC, the New York Stock Exchange, Google Cloud, ARK Invest, and Tether backed a single Layer 1 called Zero.

These aren’t institutions “exploring” blockchain. They’re the operating system of global capital and they just placed a bet on replacing their own plumbing. This is the most consequential infrastructure announcement in digital assets this year. Here’s why. [RELEASE]

👉PRO: PDF at the bottom

What happened

LayerZero launched Zero, a Layer 1 blockchain with backing from institutions that control the core plumbing of global finance. It will launch in Fall 2026. [Whitepaper] [Technical Positioning Paper]

Citadel Securities (processes one-third of U.S. retail equity orders) and ARK Invest (with Cathie Wood joining the advisory board) bought ZRO tokens directly. The DTCC ($3.7 quadrillion annual transaction volume) committed to evaluating Zero for its DTC Tokenization Service and Collateral App Chain.

Just three weeks ago, Intercontinental Exchange, parent of the NYSE, announced plans for a tokenized securities platform with 24/7 trading, marrying its Pillar matching engine to on-chain settlement. Google Cloud joined for infrastructure reliability and AI-driven payment systems. Tether brings $70B+ in cross-chain transfer volume.

Composition of the Zero Advisory Board: Cathie Wood (Founder and CEO of ARK Invest), Michael Blaugrund (VP of Strategic Initiatives at ICE), and Caroline Butler (former head of digital assets at BNY Mellon).

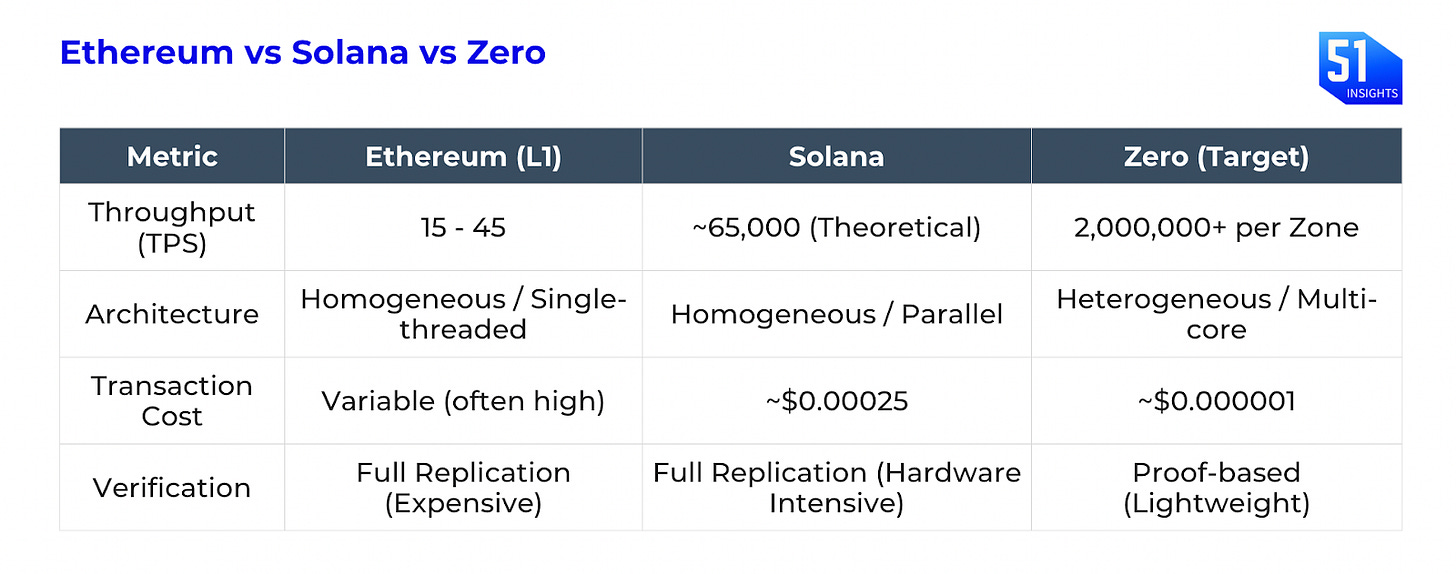

Zooming in: Unlike Ethereum or Solana, Zero utilizes a “heterogeneous architecture” (splitting Block Producers1 and Block Validators2) to target 2 million TPS3 per “Atomicity Zone” with transaction costs at ~$0.000001. Four compounding breakthroughs drive it: QMDB (state storage optimized for rapid I/O), FAFO (parallel compute scheduler), SVID (low-jitter networking), and Jolt Pro (100x faster ZK proving).

By the numbers: It’s 100,000x faster (more transactions per second) than Ethereum 500x faster than Solana with verification light enough for consumer hardware (according to Zero’s own estimates, which haven’t been verified).

Be smart: Every institution on this list has made their move in the last 120 days:

ICE invested $2B in Polymarket in October. [ANALYSIS]

The SEC issued a “No-Action Letter” to the Depository Trust & Clearing Corporation (DTCC) for tokenization in December. [ANALYSIS]

Also in December, DTCC began tokenizing the U.S. Treasuries on the Canton Network; Citadel is a part of it. [ANALYSIS]

The NYSE announced its tokenized securities platform in January [ANALYSIS]

Tether launched its US regulated stablecoin, USAT in January 2026. [ANALYSIS]

Also in January 2026, BNY went live with tokenized deposits with Citadel as a client. [ANALYSIS]

Why it matters

Citadel buying the token is the signal. Citadel Securities handles about one-third of all U.S. retail stock trades. Citadel has backed crypto infrastructure through equity before (Kraken, Ripple). Purchasing ZRO suggests they see the token as essential plumbing — not a speculative bet.Their bet is simple: if Zero’s networking technology can reduce delays and eliminate unpredictable lag, it could deliver the consistent, split-second timing that high-frequency trading firms depend on.