Yesterday, the New York Stock Exchange (NYSE) dismantled Wall Street’s most long-boundary: market hours.

For 232 years, equity markets have operated under a simple constraint. Trading happens between 9:30am and 4:00pm ET, Monday through Friday. That created an entire ecosystem: futures markets for after-hours risk, “gap” strategies betting on weekend news accumulation, and a global pecking order forcing Asia to wake up at 2am to trade U.S. stocks.

But on January 19, 2026, Intercontinental Exchange (ICE) announced plans to launch a 24/7 on-chain tokenized exchange for the $68T U.S. equity market. Instant settlement. Dollar-denominated orders. Stablecoin funding. [PRESS RELEASE]

This is likely one of the most important events in the history of modern capital market infrastructure. Let’s unpack.

👉PRO: Download the PDF at the bottom

🚨 Want more intelligence? Work with the 51 Intel team to embed continuous, high-signal market intelligence into your organization.

What Happened

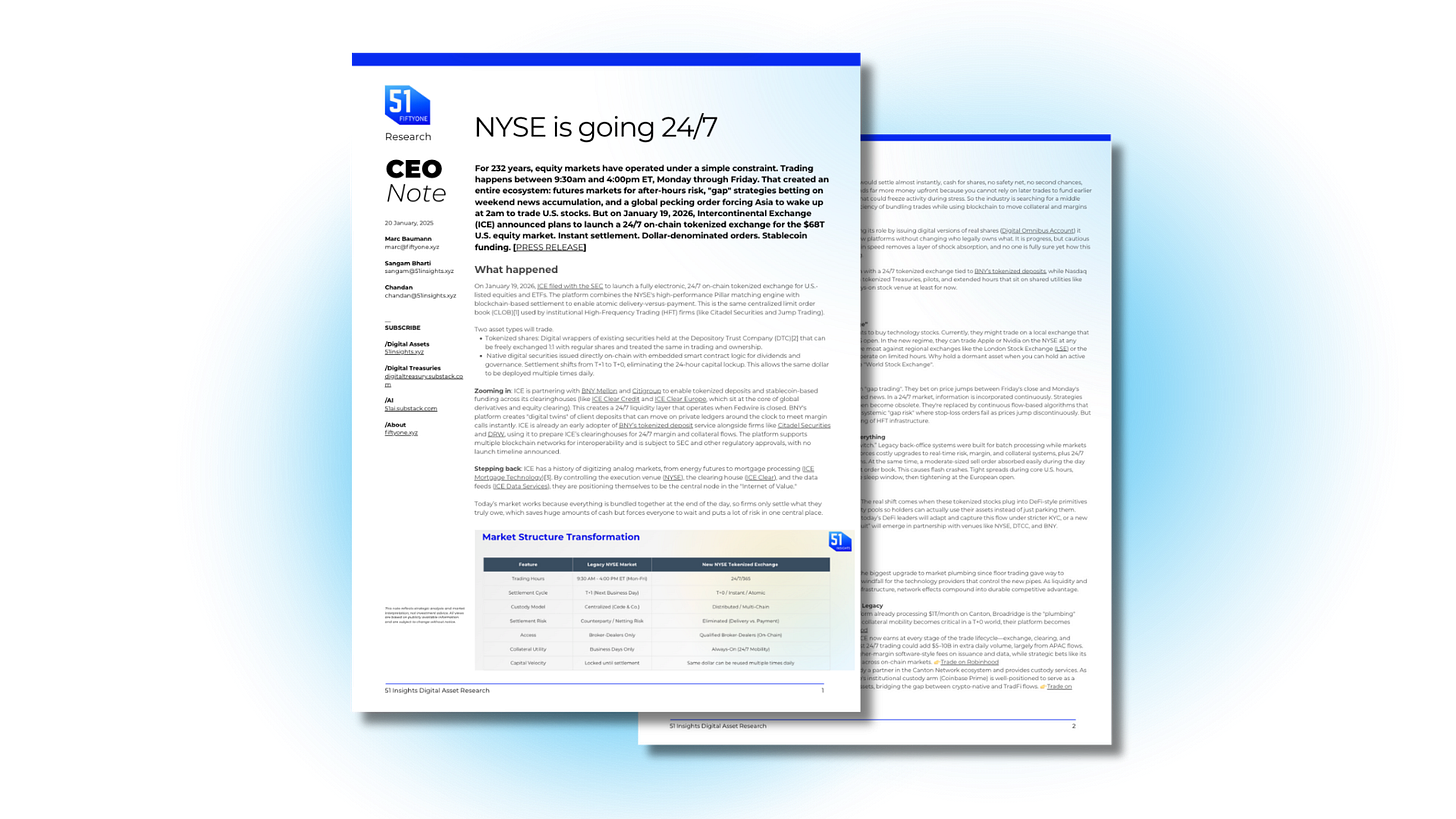

On January 19, 2026, ICE filed with the SEC to launch a fully electronic, 24/7 on-chain tokenized exchange for U.S.-listed equities and ETFs. The platform combines the NYSE’s high-performance Pillar matching engine with blockchain-based settlement to enable atomic delivery-versus-payment. This is the same centralized limit order book (CLOB)1 used by institutional High-Frequency Trading (HFT) firms (like Citadel Securities and Jump Trading).

Two asset types will trade.

Tokenized shares: Digital wrappers of existing securities held at the Depository Trust Company (DTC)2that can be freely exchanged 1:1 with regular shares and treated the same in trading and ownership.

Native digital securities issued directly on-chain with embedded smart contract logic for dividends and governance. Settlement shifts from T+1 to T+0, eliminating the 24-hour capital lockup. This allows the same dollar to be deployed multiple times daily.

Zooming in: ICE is partnering with BNY Mellon and Citigroup to enable tokenized deposits and stablecoin-based funding across its clearinghouses (like ICE Clear Credit and ICE Clear Europe, which sit at the core of global derivatives and equity clearing). This creates a 24/7 liquidity layer that operates when Fedwire is closed.

How it works: BNY’s platform creates “digital twins” of client deposits that can move on private ledgers around the clock to meet margin calls instantly. ICE is already an early adopter of BNY’s tokenized deposit service alongside firms like Citadel Securities and DRW, using it to prepare ICE’s clearinghouses for 24/7 margin and collateral flows. The platform supports multiple blockchain networks for interoperability and is subject to SEC and other regulatory approvals, with no launch timeline announced.

Go deeper:

Stepping back: ICE has a history of digitizing analog markets, from energy futures to mortgage processing (ICE Mortgage Technology). By controlling the execution venue (NYSE), the clearing house (ICE Clear), and the data feeds (ICE Data Services), they are positioning themselves to be the central node in the “Internet of Value.”

Today’s market works because everything is bundled together at the end of the day, so firms only settle what they truly owe, which saves huge amounts of cash but forces everyone to wait and puts a lot of risk in one central place.

The new model flips this: