Hey, it’s Marc,

Crypto custody has come a long way from scribbled seed phrases and anonymous exchanges. Today, it’s a multi‑billion‑dollar institutional industry led by players like BitGo, which now safeguards over $100 billion in digital assets.

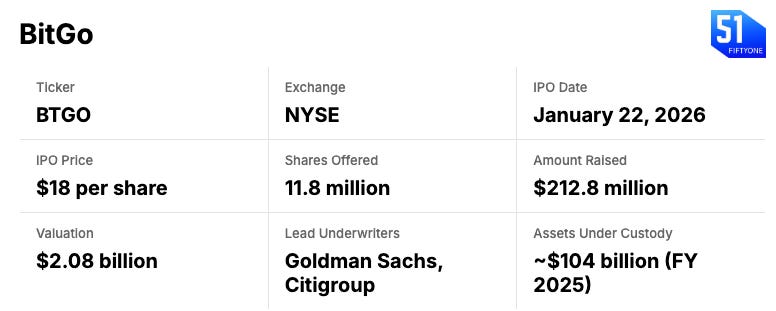

BitGo just accomplished what few thought possible on Wall Street: becoming a $2.1 billion federally chartered custody bank and now, with its $212.8 million IPO last week, it’s taking crypto infrastructure into the institutional era. This isn’t just a crypto company anymore; it’s a custody powerhouse built for Wall Street. [PRESS RELEASE]

When Goldman Sachs and Citigroup lead your underwriting, the only question left is: which infrastructure play captures the $10T tokenization wave? Let’s unpack.

👉PRO: Download the PDF

🚨 Want more intelligence? Work with the 51 Intel team to embed continuous, high-signal market intelligence into your organization.

What happened

On Jan 22, BitGo Holdings (NYSE: BTGO) successfully priced its initial public offering of 11.8M Class A shares at $18.00 per share, beating the marketed range of $15-$17 according to reports and closed its first day of trading at $18.68 per share, just above its IPO price.

The offering raised approximately $212.8M , with only 6.7% of the IPO’s shares being sold by existing stockholders. Goldman Sachs and Citigroup as lead underwriters.

Zooming in: This pure-play custody debut values BitGo at $2.6B on close, with 94.9M shares out, 46.8M float. Custody and staking now make up roughly 60–80% of BitGo’s real economic revenue, and most of that is steady, fee-based income on assets under custody.

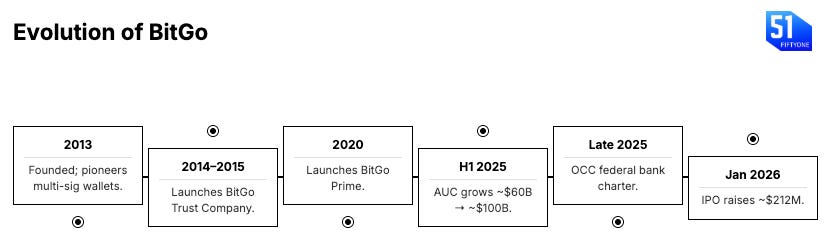

Stepping back: Over the past decade, BitGo has evolved from a 2013 multi‑sig wallet startup into a full‑stack institutional platform, adding trust‑company status, prime services, and ultimately transforming into a federally chartered, publicly listed digital asset bank that safeguards over $102B in crypto assets for institutions.

BitGo advantage: BitGo combines a decade‑long track record, support for 1,500+ assets, and its Go Network settlement rails which keep assets in qualified cold custody while enabling 24/7, off‑exchange, delivery‑versus‑payment settlement across USD and digital assets making it uniquely suited for complex altcoin and DeFi strategies for institutions.

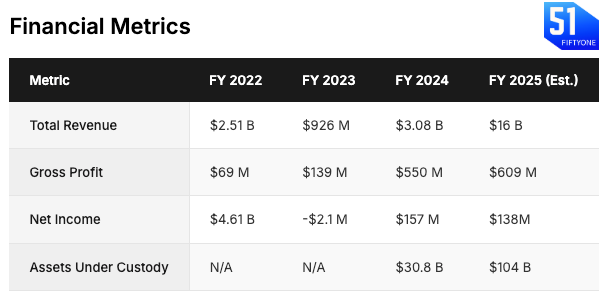

By the numbers: BitGo’s $16B revenue figure represents the gross transaction volume of its agency trades as mandated by GAAP ASC 6061, whereas its actual core economic revenue from high-margin services like custody, staking, and subscriptions is estimated at ~$170M. The net margin has compressed from 2.76% in early 2024 to 0.30% in the first half of 2025 because of aggressive scaling that is reflected in Assets Under Custody (AUC) and when measured against its core economic revenue of ~$170 million, the normalized EBITDA margin is approximately 7.4%.

First mover in 2026: BitGo is the first crypto IPO of the year, serving as a litmus test for a pipeline that includes Kraken (targeting Q1 2026 at a $20B valuation), Grayscale, and potentially Ripple.