Hey, it’s Marc.

This week, I had the chance to speak with Raoul Pal on the big debasement trade, rising debt, Bitcoin vs Gold and the best macro play for the next 5 years.

Then, the signal of the week:

Mastercard: $2B for Zerohash. Coinbase: $2B for BVNK. Kraken: $1.5B for NinjaTrader. Ripple: Palisade. Securitize: $1.25B SPAC.

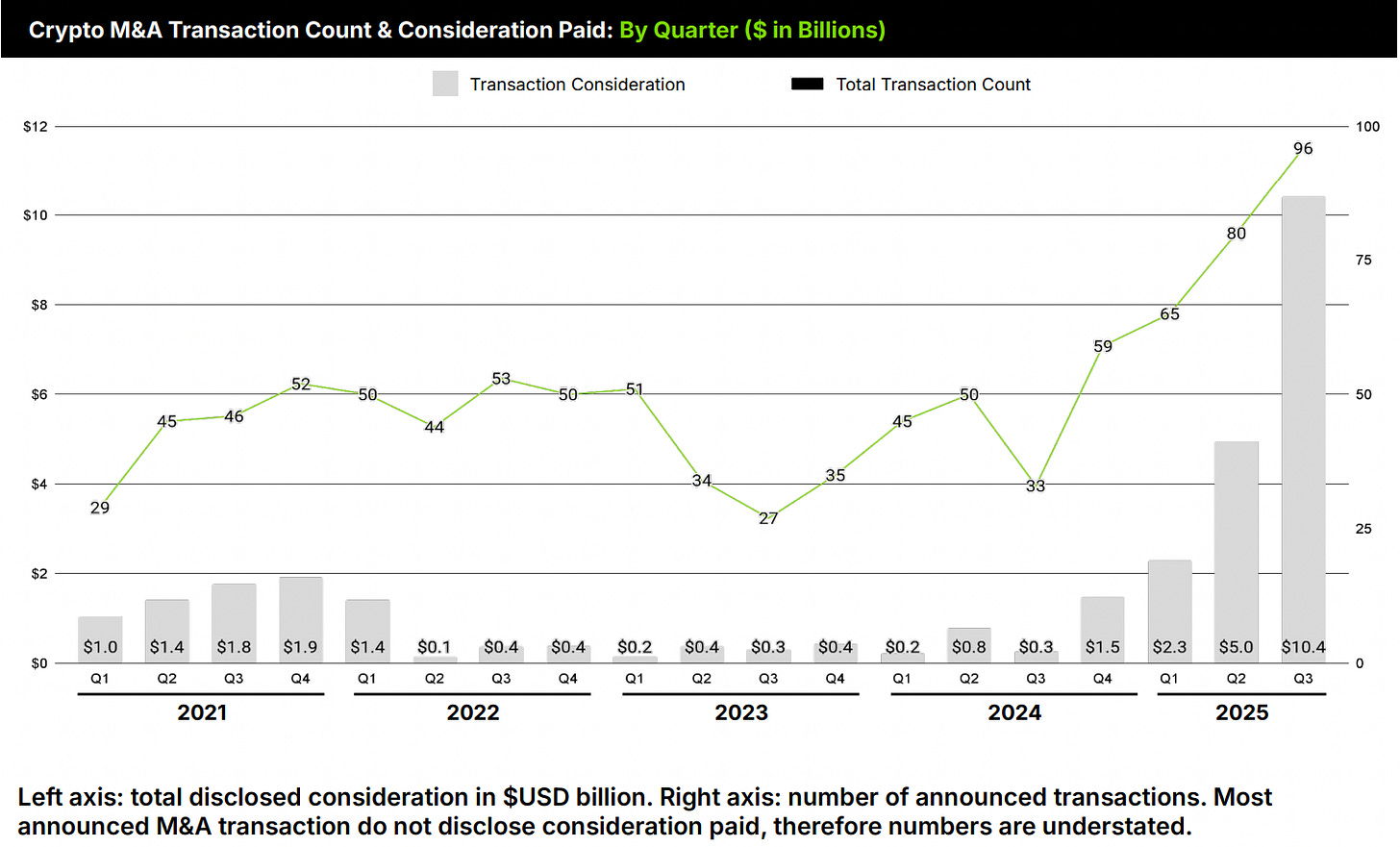

The pattern is unmistakable: crypto and payment giants are writing billion-dollar checks to own the infrastructure layer of digital money. The boring stuff: authorization layers, settlement rails, custody pipes. The backend that connects dollars to digital assets. In Q3 alone, 95 companies closed crypto M&A deals worth $10B+. This isn’t M&A. It’s a land grab for the pipes. And whoever controls the pipes, controls the flow. Who’s next?

This week’s highlights:

Google integrates Polymarket data into Search and Finance

Mastercard acquires Zerohash for $2B.

Coinbase to buy BVNK for $2B.

Securitize’s is going public with $1.25B SPAC

Visa adds support for 4 stablecoins

Franklin Templeton launches Hong Kong’s first tokenized money market fund

We’ll unpack all of these highlights below 👇

🚨 We just opened new sponsorship slots for our newsletters & podcast. Want to reach 35k+ digital asset leaders? Contact us here.

Top Boardroom Reads

Q3 2025 Crypto M&A and Financing Report (Architect & Partners)

Raoul Pal’s 2026 Playbook: Dollar, Debt, and Crypto’s Big Debasement Trade (51)

How Stablecoins Are Eating Payments, with Chris Harmse, Co-founder & CBO of BVNK (Fiftyone)

DeFi 101 (Standard Chartered)

DeFi - A Strategic Opportunity for the UK (UK Cryptoasset Business Council)

Stablecoin Payments from the Ground Up (Artemis)

Top Signals This Week

Mastercard’s $2B play to own digital money’s backend

Mastercard is reportedly in late-stage talks to acquire Zerohash for between $1.5B and $2B, a company that raised $104M from Interactive Brokers, Morgan Stanley, and Apollo at a $1B valuation in September and just became one of the first firms authorised under Europe’s new MiCAR framework. This would be one of Mastercard’s largest investments ever in the crypto space.[NEWS]

Our take: This is about owning the infrastructure layer between traditional money and digital money. Mastercard’s entire business model rests on controlling the “authorization” and “settlement” layers of global payments. In today’s system, those steps are intentionally separate: authorization happens instantly, but settlement drags on for days, allowing Mastercard to sit in the middle and monetize the flow. Stablecoins collapse that gap. The move would let Mastercard internalize the new on-chain settlement layer, preserving its role as the trusted, compliant intermediary.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

Coinbase to buy BVNK for $2B

Coinbase is reportedly in late-stage talks to acquire BVNK for around $2B. Backed by Visa, Citi and Tiger Global, BVNK has processed $20B+ in transactions and is valued at $750M, available across 180+ countries. [NEWS]

Why it matters: The distribution war just got real. Stablecoin economics are splitting into two games: issuers (Tether, Circle) capture yield on reserves, while distributors (Coinbase, Stripe) capture transaction flow. Coinbase already keeps the lion’s share of Circle’s USDC yield, now it’s buying the payment rails to control both ends. As BVNK’s Chris Harmse told us: “Issuance will end up like money market funds—low-margin wrappers. The value is in distribution.”

So what? Coinbase’s Q3 numbers make one thing clear: it is no longer a retail trading story. Institutional investors now drive 4x more volume than consumers ($236B vs. $59B). Revenue from these clients jumped 144% YoY to $135M, while stablecoins quietly became a profit engine, contributing $246M (20% of total revenue). With $747M coming from subscriptions and services, Coinbase is building a steadier, enterprise-grade business.

Visa’s new card: It’s called a stablecoin

Visa has just gone all-in on stablecoins, adding support for four tokens (USDC, PYUSD, USDG, EURC) across four different blockchains, all of which are convertible into 25 fiat currencies. [NEWS]

So what? Stablecoin card spend has quadrupled year-over-year, with Visa now facilitating more than $2.5B in annualised blockchain settlements. Visa users have purchased more than 100B of crypto and stablecoin assets and spent more than 35B of these assets using their Visa credentials. As money gets faster, smarter, and more software-driven, Visa is aiming to make sure every new transaction, whether it’s a tap, token, or transfer, still runs through its network.

Securitize’s is going public with $1.25B SPAC

BlackRock-backed fintech Securitize is going public via a $1.25 billion SPAC merger with a Cantor Fitzgerald–affiliated vehicle, making it the first major tokenisation infrastructure company to go public. The deal, unanimously approved by both boards, is expected to close in the first half of 2026, pending regulatory approvals. [NEWS]

The backdrop: Founded in 2017, Securitize operates the pipes of tokenisation: issuance, trading, and servicing of digital securities and is one of the few SEC-registered firms in the space (broker-dealer, transfer agent, and ATS). The company has already tokenised over $4B in assets, including BlackRock’s $3B BUIDL fund.

“We’ve been profitable for two years and forecast around $69 million in revenue and will be profitable in 2025. Our credibility increases immediately once we’re publicly traded.”

— Carlos Domingo, CEO at Securitize

So what? Traditional investment banks are repositioning to capture the tokenisation wave, with SPACs serving as fast-track vehicles for high-trust fintech plays. Securitise is betting on $10T tokenisation market, suggesting a coming capital rotation from yield-bearing stablecoins to on-chain treasury markets, where Securitize’s rails are already embedded.

👉 Upgrade to PRO to receive our deep dive on this

Hong Kong builds liquidity bridge for U.S. treasuries

Franklin Templeton just launched Hong Kong’s first tokenised money-market fund. The fund, backed by U.S. Treasuries, is the first live project under the Hong Kong Monetary Authority’s new “Fintech 2030” strategy. This is happening with regulatory support and in partnership with banking titans like HSBC. [NEWS]

By the numbers: Tokenized U.S. Treasuries grew 5x between January 2024 and April 2025, hitting $7.4 billion by mid-2025. That’s still tiny, just 0.03% of the $26 trillion Treasury market. But Standard Chartered forecasts $30 trillion by 2034. BlackRock’s BUIDL fund alone controls $2.8B and grew 4x in 2025. Franklin Templeton’s $844M BENJI platform is second. Six players control almost all of tokenized Treasuries. The infrastructure is concentrating fast.

So what? It signals Hong Kong’s bid to make U.S. dollar–backed digital assets a core part of its capital market infrastructure, effectively bridging Western assets with Asian liquidity under regulatory oversight.

News Flash

Ripple raised $500M with $40B valuation. Link

Tether made a profit of $10B in 2025. Link

Polygon & Anq are developing a sovereign-backed digital token in India, ARC. Link

Canada plans stablecoin laws requiring reserves and risk controls. Link

Gemini enters prediction markets. Link

Animoca Brands plans NASDAQ listing through reverse merger. Link

Visa adds tokenised digital wallet support to fleet cards. Link

Fireblocks acquired authentication startup Dynamic. Link

That’s all for now, folks.

Take care

– Marc & Team

Check out our AI newsletter, AI Operator, here.

Check out our Crypto Treasury Alpha newsletter here.