Google Integrates Polymarket Data for Billions of Users

[Our daily CEO briefing for PRO readers; PDF at the bottom]

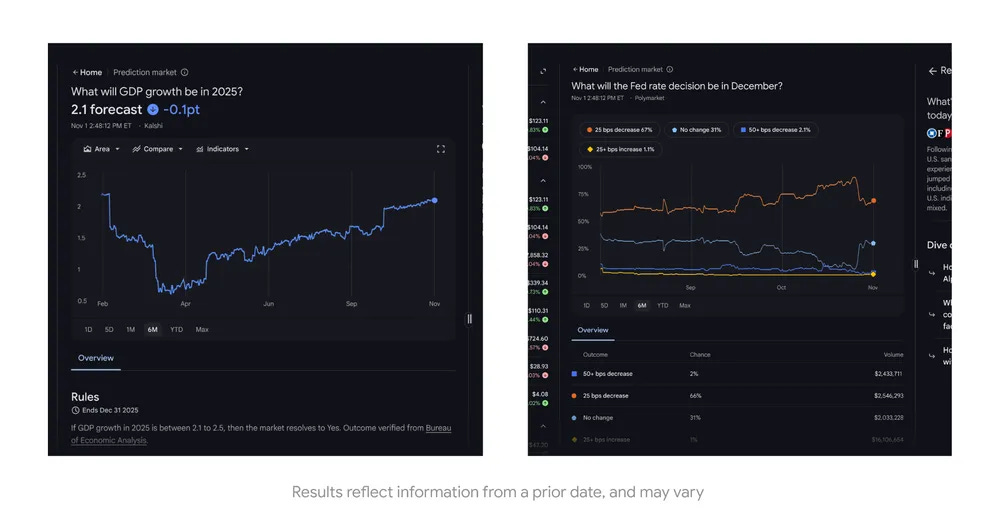

Google integrated Polymarket and Kalshi into Search and Finance. [RELEASE]

Prediction market data from Kalshi and Polymarket now allows users to see how traders are pricing real-world events, such as GDP growth or the Fed’s next move, turning crowd sentiment into a research signal. This marks a structural validation of crypto and nascent asset class: information itself.

Let’s unpack.

What happened

Google is turning Finance into an AI-powered research hub. The latest update adds “Deep Search,” prediction market data, and live earnings coverage.

Polymarket, the on-chain prediction market, is now showing up 𝗻𝗲𝘅𝘁 𝘁𝗼 𝘀𝘁𝗼𝗰𝗸 𝗽𝗿𝗶𝗰𝗲𝘀 and economic data for billions of users on Google. Users can see market-based probabilities for elections, inflation, policy moves, and more. For the first time, crypto’s pricing infrastructure just merged with the internet’s home screen.

In the last 4 years, Polymarket built crypto’s Bloomberg Terminal for sentiment:

Lets anyone create or bet on future events

Shows crowd-sourced odds on political and financial outcomes

Became a go-to source for retail and institutional market sentiment

The numbers tell the story:

Polymarket grew 100x to $9B in volume 2024 and 300k+ active traders.

This is why four weeks ago, the NYSE’s parent company (ICE) invested up to $2B on Polymarket at a $9B valuation.

Zooming in: This marks a rare convergence of three worlds: Big Tech’s scale (Google), TradFi’s credibility (ICE), and DeFi’s transparency (Polymarket). Polymarket built the rails on-chain, earned legitimacy through ICE, and now gains global distribution through Google, completing the loop from crypto niche to mainstream finance.

Be smart: The real breakthrough here is regulatory. Polymarket’s $112M acquisition of QCEX, a CFTC-licensed exchange and clearinghouse, offers a playbook for DeFi firms seeking U.S. legitimacy: buy compliance instead of battling for it. It’s a costly move, but one that turns regulation from a roadblock into a moat.

By the data: Polymarket grew 100x to $9B in volume 2024 and 300k+ active traders.

Thesis: The market economy is transitioning from primarily pricing assets and commodities to algorithmically pricing future uncertainty. In plain English, this means: For decades, markets priced assets. Now, they’ll price information. Financial firms will soon trade and price risk based on probability markets. Citadel’s is the first big hedge fund that explores prediction markets. And, it is just the start. And prediction markets, powered by blockchain, are the infrastructure for that future. We’re going to have a market for EVERYTHING.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.