Mastercard’s $2B play to own digital money’s backend

[Our daily CEO briefing for PRO readers; PDF below]

Mastercard is reportedly in late-stage talks to acquire Zerohash for between $1.5B and $2B, a company that raised $104M from Interactive Brokers, Morgan Stanley, and Apollo at a $1B in September and just became one of the first firms authorised under Europe’s new MiCAR framework. [NEWS]

This is one of Mastercard’s largest investments ever in the crypto space.

The seven-year-old startup not only powers 5M+ users across 190 countries but also serves blue-chip clients like Stripe, Franklin Templeton, Morgan Stanley’s E-Trade and BlackRock’s BUIDL fund. Let’s unpack.

👉Download the PDF

What’s happening?

Mastercard is making its biggest move in crypto by acquiring Zerohash, a turnkey, regulated infrastructure stack that lets banks, brokers, and fintechs plug into digital assets without touching the backend.

Zooming in: Mastercard has long talked about “crypto-ready” payments, but most of its progress has been through partnerships and pilots. Owning infrastructure like Zerohash would give Mastercard direct control over the APIs that convert dollars into stablecoins, settle transactions on-chain, and manage custody. Zerohash key technological services include: custody and settlement, on/off ramps, tokenisation APIs, and compliance layer.

Zerohash isn’t a “payments” company. It’s basically a crypto’s back office. They enable

fiat-to-crypto conversions for major banks,

stablecoin trading infrastructure for platforms,

API-level crypto integration for financial institutions, and tokenization infrastructure.

This means: Mastercard is not bidding for its revenue, but for a plug-and-play infrastructure that buys time and regulatory access. It will an add-on to Mastercard’s existing Multi-Token Network (MTN)™.

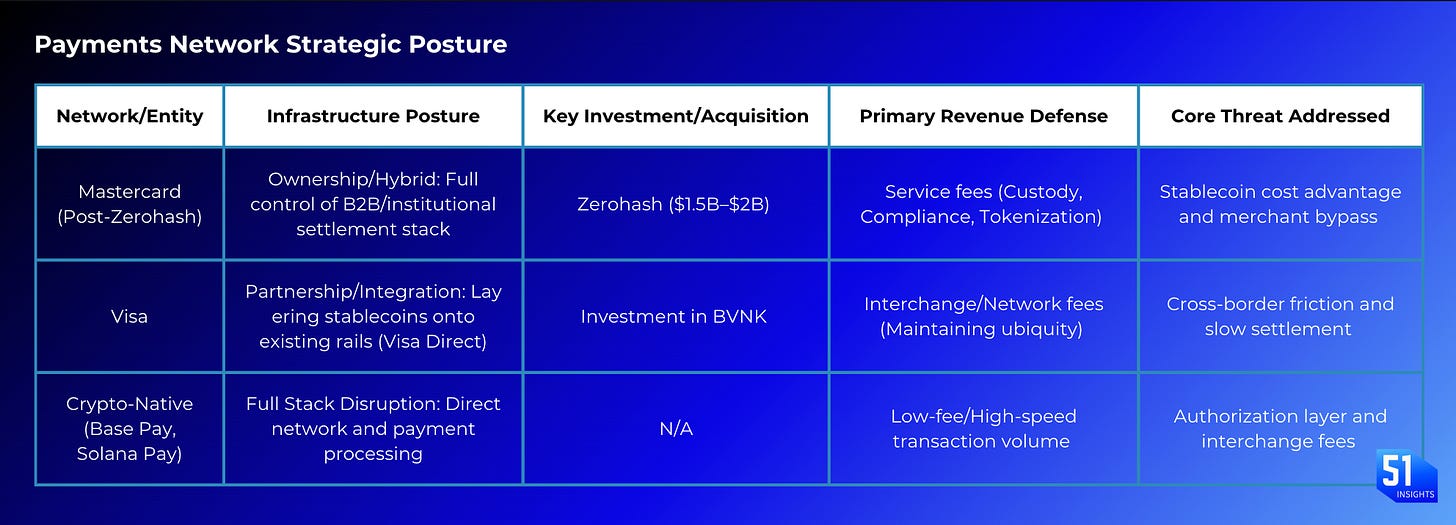

Zooming out: As fees from traditional card payments shrink, Mastercard is betting its future on selling the compliant “pipes” and custody services that make stablecoin and tokenized money flow safely through the global system.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.