Hey, it’s Marc.

“There is room for both gold and Bitcoin to coexist on central bank balance sheets by 2030.” — Deutsche Bank, in a new report released this week.

Did you know that Norwegian and Swiss National Bank already have $700M+ of Bitcoin exposure by owning Strategy stocks?

PS: Upgrade to Pro for our daily CEO Notes & market signals.

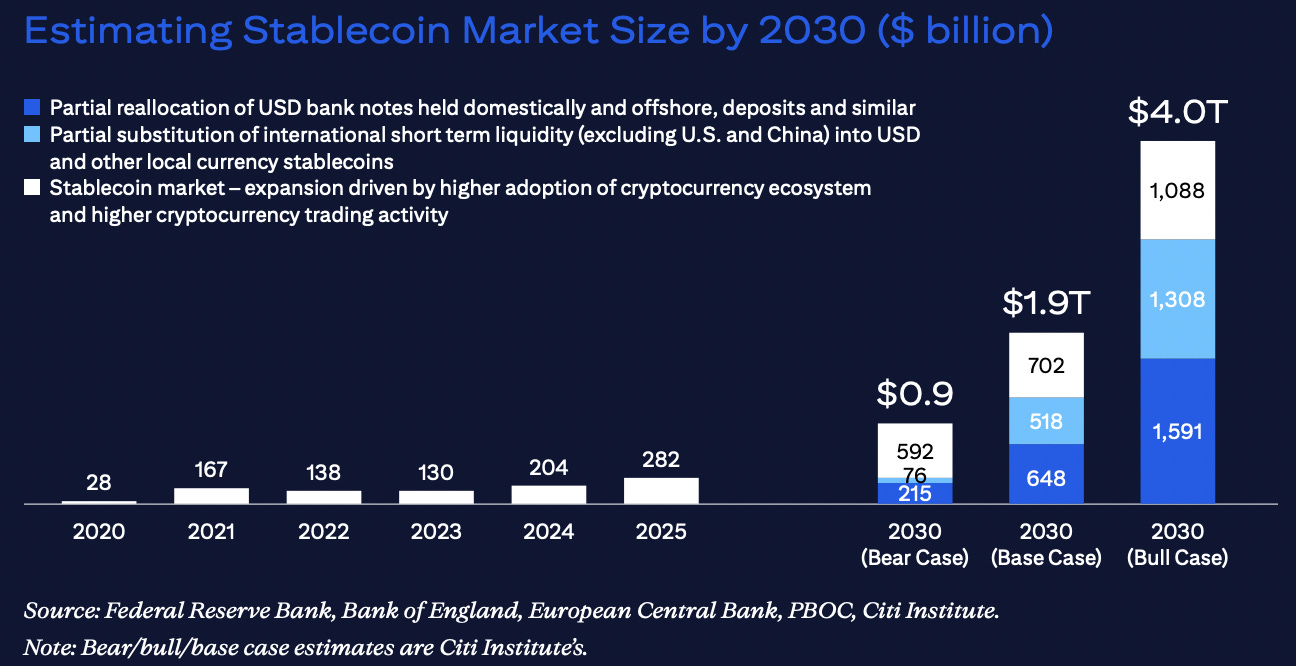

Then: Citi came out with a new report and estimated the stablecoin market size to grow up to $4T by 2030. [Full report]

🚨 We just opened new sponsorship slots for our newsletters & podcast. Want to reach 35k+ digital asset leaders? Contact us here.

Then: Hyperliquid just minted its own dollar. USDH went live this week with ~$2.2M in first-day trading, giving the exchange a native currency to power its markets. The timing is sharp: only a week earlier, Circle launched USDC on Hyperliquid with new cross-chain rails spanning 14+ blockchains. The stage is set for a showdown between “platform-native” and “network-native” money. [Read more]

Whereas, Tether seeks $20B raise at $500B valuation, rivaling OpenAI, among world’s most valuable private companies.

Also this week:

House GOP pushes 401(k) access to crypto

Vanguard, the $10T asset manager, to launch crypto ETFs

CFTC moves to allow tokenised collateral in derivatives

HSBC expands tokenised deposits to cross-border corporate settlements

Morgan Stanley nears launch of crypto trading via E-Trade. Link

We’ll unpack all of these highlights below.

👉 We launched a new newsletter on digital asset treasuries. Subscribe below!

Top Boardroom Reads

👉Subscribe to our Crypto Treasury Alpha newsletter here.

A conversation with VP of Technology at Solana Foundation (51)

$20B DAT Surge (51)

Bitcoin vs. Gold: The Future of Central Bank Reserves by 2030 (Deutsche Bank)

How Bitcoin can Shape the Future of Wealth Management (Bitcoin Suisse)

Central bank money as a catalyst for fungibility: the case of stablecoins (ECB)

Vitalik on L2s (Vitalik Buterin)

Stablecoin for treasuries (BVNK)

HYPE’s Damocles Sword (Maelstrom)

Nasdaq TradeTalks: New Tech Is Driving Market Structure Evolution (DTCC)

🙌 Work with us: We create pioneering thought leadership that helps digital asset and technology companies lead the conversation, earn trust and win business.

Top Signals This Week

Vanguard goes crypto

Vanguard, the $10T asset manager, is about to roll out crypto ETF access across its platform, reaching 1 in 6 U.S. households. For years, Vanguard swore off Bitcoin ETFs, calling them “too volatile.”. In 2024, Vanguard’s head of ETFs, Janel Jackson, called Bitcoin “immature” and “without inherent value”. [NEWS]

Why it matters: Even a 1% allocation from its client base = $100B in flows, bigger than entire crypto ETF categories today. Once access goes live, crypto ETFs move from the edges of retail investing into retirement accounts, long-term portfolios, and passive allocations.

Our take: Vanguard’s CEO Salim Ramji literally built BlackRock’s Bitcoin ETF before joining Vanguard. BlackRock’s Bitcoin ETF IBIT is the most successful ETF in the company’s history: $80B in assets since its launch in Jan 05, 2024. He knows exactly what he’s walking away from. The timing isn’t coincidence: The SEC just introduced generic listing standards. Expect 100s of ETFs over the coming 8-12 months and an institutional inflow we’ve never seen before.

401(k)s open to crypto

On Sept 22, House Republicans pressed SEC Chair Paul Atkins to fast-track rules letting 401(k)s invest in Bitcoin, Ethereum, private equity, and VC. This builds on Trump’s Aug 7 executive order directing regulators to clear the path. [NEWS]

Our take: $9T sits in U.S. 401(k)s. Even a 1% allocation to crypto = ~$90B of new demand. For context, all U.S. spot BTC ETFs combined have ~$140B AUM today. This isn’t about retail traders, it’s about creating the largest long-term, dollar-cost-averaging inflow Bitcoin has ever seen.

CFTC greenlights Stablecoins for derivatives

The Commodity Futures Trading Commission (CFTC) has launched a formal initiative to allow tokenised collateral, including stablecoins, into U.S. derivatives markets. The plan: let traders use tokenised assets like stablecoins and money market funds (MMFs) as margin in derivatives markets. [RELEASE]

Our take: This is the strongest signal yet that U.S. regulators will allow tokenised Money Market Funds (MMFs) and stablecoins as eligible collateral in the $600T global derivatives market (notional value). Collateral = the foundation of derivatives. Shifting from cash and Treasuries to tokenised instruments unlocks 24/7 liquidity, faster settlement, and lower capital costs.

Hyperliquid’s stablecoin

Hyperliquid just launched its own stablecoin, USDH, with ~$2.2M in early trading volume against USDC. Native Markets, which beat Paxos, Frax, and Agora in a validator vote, is rolling out USDH as a fiat-backed token issued on HyperEVM and bridged across the Hyperliquid stack. Reserves sit in cash and short-dated Treasuries, with transparency via oracles and a feedback loop funneling earnings into HYPE buybacks. [NEWS]

Our take: Stablecoin competition is no longer just Circle vs. Tether. Exchanges, L2s, and now trading platforms like Hyperliquid are pushing “house dollars” to own their settlement rails. USDH is an attempt to localise stablecoin utility, yield, and governance within the Hyperliquid ecosystem instead of letting profits flow out to external issuers like Circle (USDC).

HSBC pushed the tokenised deposit service (TDS) in Asia

HSBC just expanded its tokenised deposit service (TDS) to cross-border corridors (Hong Kong ⇄ Singapore) and is eyeing scale into the UK/EU. It has completed its first live USD transfer between Hong Kong and Singapore for Ant International and is pitching 24/7 instant settlement as a new baseline for corporate treasury operations.

So what? Stablecoins may have led the early race with speed and reach, but banks are striking back with their strongest asset: regulated deposits. By tokenising them, traditional financial institutions are creating digital money that delivers blockchain’s instant, programmable features with the safety, trust, and regulatory clarity only banks can offer. [ANNOUNCEMENT]

$100B Bet on 10GW AI Infrastructure

OpenAI and Nvidia signed a letter of intent: Nvidia may invest up to $100B in OpenAI to fund AI data centres using millions of Nvidia chips. [RELEASE] [See full story]

So what: It is Nvidia pre-paying one of its largest customers to ensure demand. It validates that compute scarcity = strategy, as Nvidia is investing $100B just to guarantee demand and erecting a formidable moat against rivals like AMD, Intel, and Google’s in-house silicon.

News Flash

Strive acquires Smeler Scientific. Link

Circle is exploring mechanisms to make USDC transactions reversible. Link

Anthony Scaramucci backs AVAX treasury aiming to raise $550M. Link

Morgan Stanley nears launch of crypto trading via E-Trade. Link

Swarm to offer nine tokenised stocks on the Plasma blockchain mainnet. Link

Forward Industries to tokenise stock, expanding Solana treasury and DeFi use. Link

World Liberty Financial to launch debit card and trading app soon. Link

Kraken and Legion launch the Yield Basis BTC protocol with merit-based sale. Link

Plasma launched a neobank, Plasma One. Link

Bank of Canada urges federal stablecoin rules to modernise payments, remittances. Link

UAE signs global crypto tax deal, launches consultation to shape rules. Link

China and South Korea launch CN and KRW stablecoins globally. Link

PayPal invests in Stable blockchain to expand PYUSD usage globally. Link

GSR proposes Digital Asset Treasury ETF. Link

Grayscale crypto index fund approved for ETF. Link

That’s all for now, folks.

Take care

– Marc & Team

PS: Upgrade to Pro for our daily CEO Notes & market signals.

Check out our AI newsletter, AI Operator, here.

Check out our Crypto Treasury Alpha newsletter here.