Hey, it’s Marc.

“Ethereum is the Wall Street token.” That’s not crypto Twitter talking. It’s Jan van Eck, CEO of VanEck. His point is simple: every bank will need rails for stablecoins, and they’ll ask where to build them. His answer: Ethereum.

That’s the backdrop this week as Google is building its own blockchain, Mastercard embeds stablecoins, and Rain made stablecoins swipeable at 150M Visa merchants.

👉 Crypto Treasury Alpha: We launched another newsletter covering institutional moves and digital asset treasury vehicles. Subscribe below 👇

Also, our highlights this week:

Google is building its own blockchain, CME already testing it

Mastercard goes stablecoin-native, settlement live across EEMEA

U.S. puts macro data onchain

Rain raises $58M, makes stablecoins spendable at 150M+ merchants

Solana gets $1B Wall Street treasury vehicle, Galaxy, Jump, Multicoin leading

And much more.

🚨Save your spot for our upcoming webinar!

We’ll unpack how artists, music labels and filmmakers can strategically leverage blockchain to unlock direct-to-fan monetisation, onchain royalties, fan engagement and film financing. Spots are limited!

Subscribe here to get notified of our upcoming events.

Top Boardroom Reads

Ethereum meet Wall Street (Joseph Lubin). His take on SharpLink, Fundstrat and the future of Ethereum.

The productive treasury: A corporate guide to integrating Ethereum and digital

asset staking (Eigenlayer).

Google’s new Layer 1 blockchain (Rich Widmann).

Money’s new operating system (51). An fintech-focused stablecoin report.

Bitcoin Long-Term Capital Market Assumptions (Bitwise). The report details the macroeconomic factors influencing Bitcoin's outlook, such as rising U.S. debt, fiat debasement risks, friendlier regulation, and institutional adoption.

The State of Crypto Venture Capital in 2025 (Pantera Capital). Paul talked about how 2025 marks crypto’s most mature cycle yet, defined by record M&A and IPO activity, regulatory clarity, and convergence with AI, payments, and global finance.

Building the Stripe of Crypto Payments (51). A podcast with Iron CEO on how stablecoins are becoming the new rails for global finance.

The future of money is onchain (51). A discussion with the CEOs of OpenTrade and Ubyx on stablecoin use cases, infrastructure and programmatic yield.

The Relative Benefits and Risks of Stablecoins as a Means of Payment (BCA Research). The paper discusses the utility of stablecoins for retail payments through an objective, evidence-based approach that compares stablecoins with traditional retail payment methods.

🙌 Work with us: We create pioneering thought leadership that helps digital asset and technology companies lead the conversation, earn trust and win business.

Top Signals This Week

Google launches its own blockchain

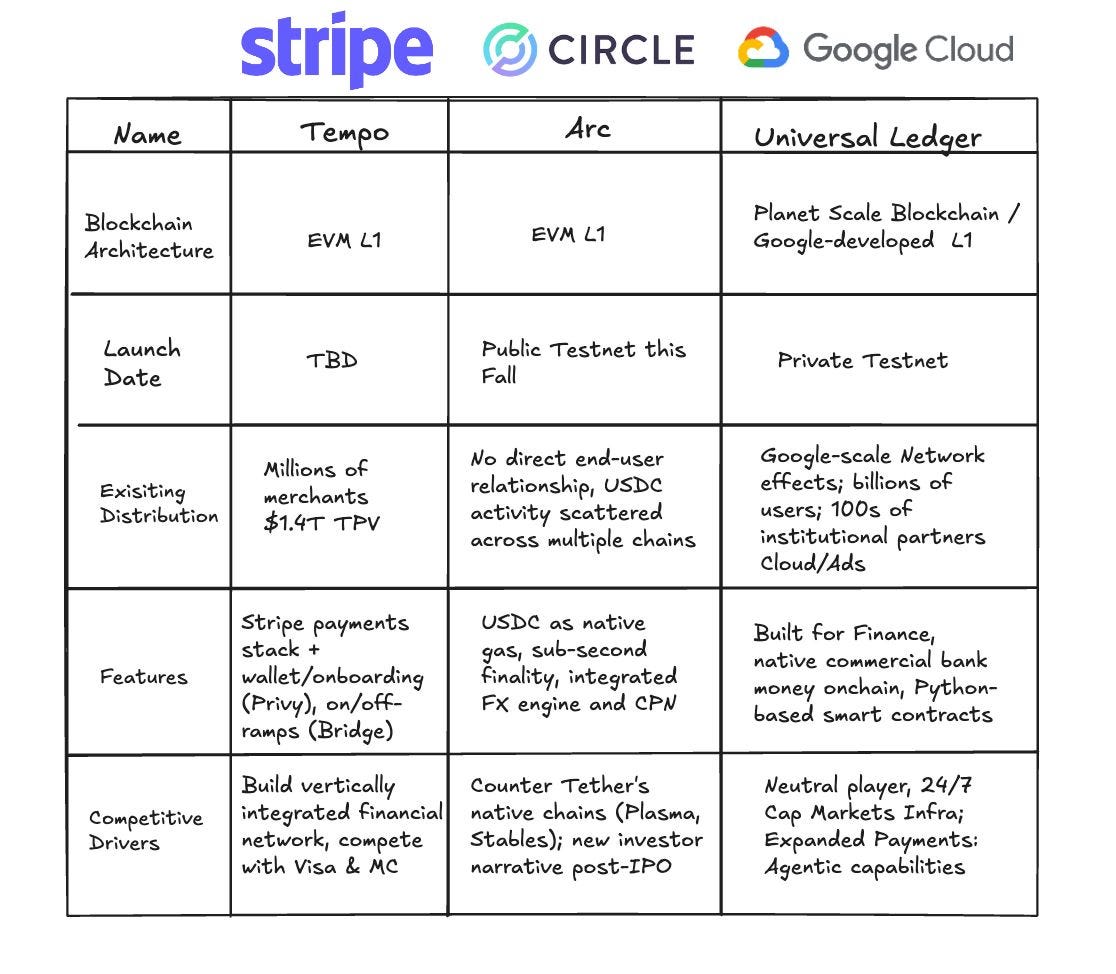

Google announced the Google Cloud Universal Ledger (GCUL), its own layer-1 blockchain earlier this year. It’s EVM-compatible, Python-programmable, and already being tested with CME Group for payments and tokenisation. Now, the announcement has gained new traction from a LinkedIn post of Google’s Web3 lead. [NEWS]

Why it matters: GCUL isn’t just another chain. It’s Google applying the same playbook Stripe and Circle are running: own the rails, own the money. But here’s the catch: history is littered with failed corporate chains (IBM’s Hyperledger, Meta’s Libra). Why? Because centralized blockchains can’t solve the trust problem. Institutions like BlackRock or governments issuing digital currencies need credibly neutral, public infrastructure, not rails owned by one company. Don’t confuse distribution with trust. [OUR TAKE]

Mastercard goes stablecoin-native

What happened: Mastercard and Circle are rolling out stablecoin settlement (USDC + EURC) across Eastern Europe, the Middle East, and Africa. For the first time, acquirers on Mastercard’s network can settle merchant payments in stablecoins instead of waiting days for fiat bank wires [RELEASE].

Why it matters: Merchants don’t get paid directly, acquirers do. Embedding stablecoins into the acquiring stack means:

Faster payouts → no waiting days for cross-border payouts

Lower costs → stablecoin rails vs legacy correspondent banking

This is Mastercard putting stablecoins at the core of commerce rails, sidestepping banks and owning the flow of settlement [OUR TAKE].

U.S. Government puts macroeconomic data onchain

The U.S. Department of Commerce (via the BEA) and Chainlink are publishing official GDP, inflation (PCE), and consumer demand metrics onchain across 10 blockchains (Ethereum, Arbitrum, Avalanche, etc.). These feeds are secure, audited, and enterprise-grade. [Announcement]

Why it matters: Onchain GDP and inflation data embed macro directly into enterprise workflows:

Payments: stablecoin treasuries auto-adjust yields to inflation

Lending: DeFi loans auto-adjust rates if PCE spikes

Risk: automated hedges trigger on macro releases

This bridged the gap between Wall Street workflows and onchain finance. Instead of reconciling off-chain feeds, institutions get real-time, tamper-proof data where they already operate, making blockchains not just transaction rails, but macro-aware financial infrastructure.

Stablecoins you can swipe

Stablecoin platform Rain raised $58M (Series B led by Sapphire Ventures), bringing total funding to $88.5M just 5 months after its $30M Series A. The company reports 10x transaction growth YTD and says its rails now reach 1.5B+ people across 150 countries via Visa, wallets, and on/off-ramps. [RELEASE] [OUR TAKE]

Why it matters: Stablecoins have $283B in circulation — but most are stuck on balance sheets, not in daily commerce. Rain fixes that by making stablecoins:

Spendable: direct settlement at 150M+ Visa merchants

Scalable: one API for money-in, storage, and payouts

Enterprise-ready: PCI, SOC 2, and audited contracts

This shifts stablecoins from “treasury assets” to operating capital that businesses can actually use for payroll, merchant payouts, and cross-border spend.

🚨Download our latest stablecoin for a deep dive on Rain

Solana gets a $1B Wall Street vehicle

What happened: Galaxy, Jump Crypto, and Multicoin Capital are raising $1B (with Cantor Fitzgerald as banker) to launch the largest Solana treasury company. Think of it as Solana’s de-facto ETF alternative: investors buy shares in a public vehicle that holds SOL, earns staking yield, and offers leveraged exposure.

Why it matters: Bitcoin and Ethereum already have ETFs (11 BTC, 8 ETH) and multiple treasury companies (MicroStrategy, Metaplanet, SharpLink, FG Nexus, Bitmine). Solana has neither.

This treasury vehicle:

Becomes the default institutional on-ramp to Solana

Offers 3–5% yield from staking + DeFi (vs. zero from ETFs)

Bridges SOL into capital markets, not just crypto exchanges

Our take: Forget waiting on a Solana ETF. Wall Street just built one with yield.

News Flash

Tron cuts fees 60% to protect $81B USDT dominance. [Link]

US banks lobbying to amend GENIUS [Link]

Citi’s tokenisation plan with Citi Integrated Digital Asset Platform (CIDAP). [Link]

B5G6G pushes barter trade stablecoin at Africa–Singapore Forum. [Link]

Bitwise files for LINK ETF [Link]

B Strategy plans $1b BNB DAT [Link]

Metaplanet buys $11.7m BTC, joins FTSE Japan [Link]

That’s all for now, folks.

Take care

– Marc & Team

🚀 Work with us: We create pioneering thought leadership that helps digital asset and technology companies lead the conversation, earn trust and win business.

Check out our AI newsletter, AI Operator, here.

Check out our Crypto Treasury Alpha newsletter here.

Got suggestions? Reply to this email.