Hey, it’s Marc.

When gold outperforms Bitcoin, BlackRock starts building on-chain infrastructure, and JP Morgan invests $1.5T in U.S. infrastructure, something is cooking (we’ll unpack all of this below and in our CEO Notes).

“We need to be tokenising all assets, especially assets that have multiple levels of intermediaries.” — Larry Fink, BlackRock CEO

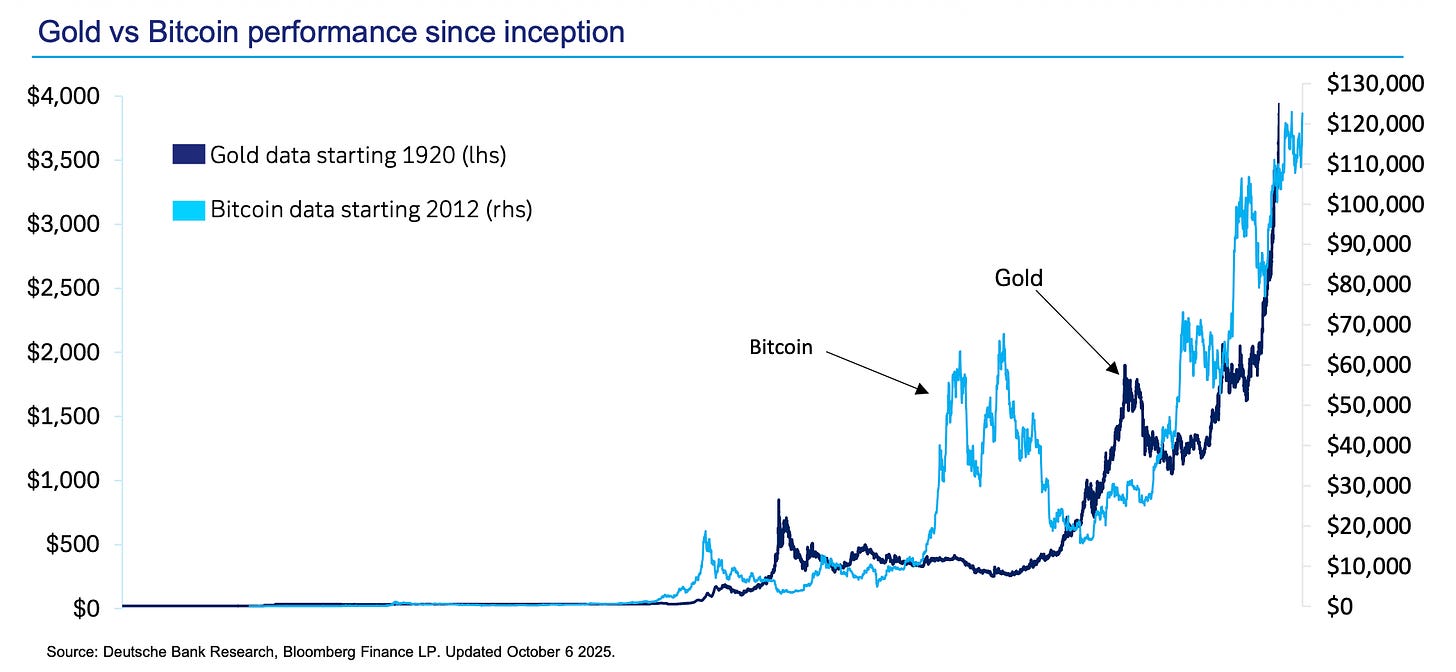

“Bitcoin is likely to become a reserve asset for central banks. Alongside gold, by around 2030.” – Deutsche Bank

The signal is clear: Smart money is moving from fiat dependence to real and digital (hard) assets. I highly recommend Maja Vujinovic ‘s read on this: Powell, JPMorgan, and the Quiet Pivot.

Oh, and before I forget: This week, crypto markets also experienced their largest-ever liquidation event, with over $19–20B in leveraged positions wiped out. And, DeFi held firm while centralised exchanges stumbled. [Read full story]

Also this week:

We’ll unpack all of these highlights below.

🚨 We just opened new sponsorship slots for our newsletters & podcast. Want to reach 35k+ digital asset leaders? Contact us here.

Top Boardroom Reads

Stablecoins beyond payments (Visa)

Powell, JPMorgan, and the Quiet Pivot (Maja Vujinovic)

Ethereum’s Endgame: Why Credible Neutrality Beats Speed, with William Mougayar (51)

The Compelling Case for Crypto (Franklin Templeton)

Stablecoins (KPMG)

🙌 Work with us: We create pioneering thought leadership that helps digital asset and technology companies lead the conversation, earn trust and win business.

Top Signals This Week

Crypto's biggest liquidation ever

$19-20B in total liquidations occurred within 24 hours, affecting over 1.6M traders, triggered by President Donald Trump’s announcement of escalated tariffs against China. Here’s the breakdown.

Long positions liquidated: $16.7-16.8B

Traders affected: 1.6M+

Single-hour liquidations: $7B (within one hour of Trump’s announcement)

Open interest destroyed: $65B wiped out

Let’s do the math: Open interest in perpetual DEXs fell 50% ($25.7B → $13.7B) but recovered to $17B within days, with Hyperliquid leading the rebound.

So what? The event exposed how geopolitical shocks can trigger systemic fragility in 24/7 crypto markets, but it also showed how far DeFi has come. While Binance froze trading and mispriced stablecoins, decentralized protocols like Hyperliquid, Aave, Ethena, and Solana handled record liquidations, redemptions, and transactions without breaking.

That’s the real headline: in crypto’s biggest stress test to date, permissionless infrastructure outperformed the world’s largest regulated exchanges.

👉Subscribe to our Crypto Treasury Alpha newsletter here.

BlackRock will tokenise everything

On Tuesday, the CEO of the world’s largest asset manager—$13.46 trillion in AUM—told Wall Street that BlackRock is building proprietary tokenisation technology to rebuild capital markets on-chain. [NEWS]

The goal? To onboard the next generation of investors.

“If we can tokenize an ETF, we can bring investors who start with crypto into traditional long-term products. Over the next decade, we’ll move away from traditional assets by repotting them in a digital form and keeping investors inside that ecosystem.” – Larry Fink

So what? BlackRock initially relied on specialised partners like Securitize for BUIDL’s issuance. Now it’s internalising the stack. The move signals BlackRock intends to weave tokenisation, issuance, and compliance directly into Aladdin, its flagship risk management and trading platform serving $13.4T in AUM. The shift from “owning assets” to owning the infrastructure of ownership has begun.

Ant Group builds on Ethereum

Ant Group, the owner of Alipay (1.4B users, $20T annual volume), launched Jovay Network, a high-performance Ethereum Layer 2 solution. [NEWS]

The goal? To turn the world’s largest fintech app into a global blockchain infrastructure provider.

What’s happening: Jovay is a high-performance Ethereum L2 targeting 100,000 TPS using a hybrid ZK + TEE design. It connects directly to AntChain, Ant’s private blockchain, which already manages $8.4B in tokenised energy assets — 15 million power devices including wind turbines and solar panels.

So what? Ant Group processes 1.5× Visa’s global volume and 15× PayPal’s. If even 1% of Alipay’s flows touch Jovay, it instantly becomes the largest on-chain payments network in history.

JP Morgan’s $1.5T bet

JPMorgan Chase just launched one of the largest private initiatives in U.S. history, a $1.5T, 10-year Security and Resiliency Initiative (SRI) to strengthen America’s economic backbone across defence, energy, and frontier technologies. [RELEASE]

So what? Most of the $1.5T plan fuels lending, underwriting, and advisory work for clients across critical sectors. But the real strategic edge lies in the $10B the bank will invest directly, buying stakes in cutting-edge manufacturing and frontier technologies. By tying its core business to national security priorities, JPMorgan isn’t just chasing profit; it’s locking in long-term relevance, influence, and political leverage in the next phase of U.S. industrial policy.

🚨Upgrade to Pro for our daily CEO Notes & market signals.

Citi’s crypto custody

Citi just confirmed it’s launching crypto custody in 2026. They’ve been quietly building it for 2–3 years, writing code, lining up partners, getting regulatory clearance. They also invested in a stablecoin payment company, BVNK. [NEWS]

So what? Wall Street banks (State Street, JP Morgan, BNY Mellon and now Blackrock) are not just adopting stablecoins but have started building/ owning the infrastructure. The move comes after the SEC scrapped the SAB 121 rule in January, which previously forced banks to treat customer crypto as a liability, making custody economically unfeasible. Simply put, traditional banks are positioning themselves to fully capitalise on one of the biggest transformations in finance since electronic trading.

News Flash

Stripe adds stablecoin payments for recurring subscriptions using USDC. Link

New York launches city office for digital assets. Link

Bhutan moves its national ID system from Polygon to Ethereum. Link

CME launches CFTC-approved options trading for Solana and XRP. Link

Morgan Stanley opens crypto fund access to all wealth clients. Link

Cantor Fitzgerald considers acquiring Securitize in a SPAC deal. Link

S&P Ratings brings real-time stablecoin risk data on-chain via Chainlink. Link

US lawmaker moves to make Trump’s crypto 401(k) order law. Link

French ODDO BHF launches Euro-backed stablecoin EUROD. Link

That’s all for now, folks.

Take care

– Marc & Team

PS: Upgrade to Pro for our daily CEO Notes & market signals.

Check out our AI newsletter, AI Operator, here.

Check out our Crypto Treasury Alpha newsletter here.