Hey, it’s Marc.

Ant Group (the $200B Alibaba fintech giant behind Alipay’s 1.4 billion users and $21.3 trillion in annual transactions) launched Jovay Network, a high-performance Ethereum Layer 2 solution. [NEWS]

The goal? to reposition the company as a global, regulation-aligned fintech and blockchain infrastructure provider.

Backdrop: Ant’s IPO was derailed by China’s crackdown on fintech risk and Jack Ma’s criticism of regulators. It was forced to restructure into a financial holding company from a high-margin consumer lending model.

Let’s unpack.

PRO: Download the PDF

What Happened

Jovay emerges as a pivotal infrastructure connecting regulated, high-volume Web2 finance to Ethereum’s secure, liquid public ecosystem. By adopting Ethereum over its proprietary AntChain, Ant Group signals that L2 scaling is now the enterprise-grade foundation for international finance.

Technological edge: Hybrid ZK + TEE architecture ensures cryptographic verifiability and compliance-grade data privacy

Massive scale: Designed for 100,000 TPS, Jovay can handle Alipay’s 1.4B users

Geopolitical alignment: Serves as a compliant offshore gateway, leveraging jurisdictions like Hong Kong

Functional innovation: Intelligent Agent Contracts (IACs) combine AI and blockchain to create autonomous, dynamic financial instruments

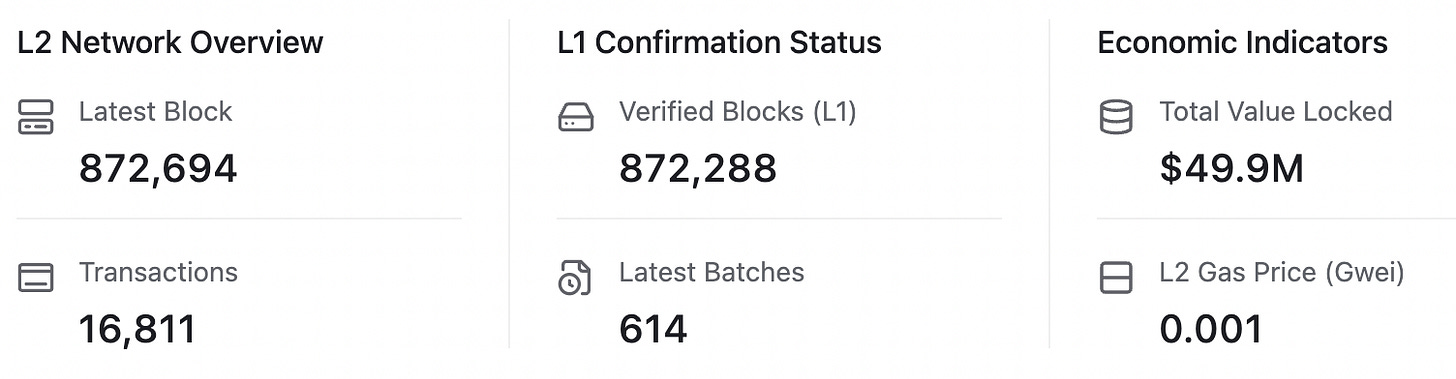

By the data: The network currently hosts $49.9M AUM and has processed 16.8K transactions. Alipay claims 1.4B monthly active users (MAU), while it recorded $21.3T transaction volume in 2025. It is just a start.

The goal is to deliver financial services at a global scale; the blockchain must perform well beyond today’s public crypto networks.

Stepping back: A month back, Ant Digital announced its plans of $8B renewable energy tokenisation, targeting DeFi liquidity with Hong Kong compliance.

Zooming in: Ant Group is positioning Jovay as the base layer for autonomous finance through Intelligent Agent Contracts (IACs), AI-driven smart contracts that sense, decide, and act in real time. Unlike static code, IACs adapt to market, supply chain, or geopolitical shifts, adjusting financial terms autonomously. Powered by Jovay’s secure TEE/ZK stack, they enable compliant, high-speed execution for complex transactions.

Zooming out: Jovay’s 100,000 TPS target sets a new benchmark for institutional-grade Layer 2s, addressing the speed and confidentiality gaps that limit current rollups like Arbitrum and Optimism.