Hey, it’s Marc.

This week felt like a turning point. Nasdaq tokenizing stocks, Tether entering the US, Fidelity moving Treasuries onchain, Franklin Templeton plugging into Binance, and then, this:

“Crypto’s time has come. Most crypto tokens are not securities, and we will draw the lines clearly. We must ensure that entrepreneurs can raise capital on-chain without endless legal uncertainty.” — SEC chair Paul Atkins

Wow. On top of that, we’ve all been glued to the Hyperliquid showdown and why Circle is about to lose 10% of its yearly revenue.

We’ll unpack all of these highlights below.

👉 Crypto Treasury Alpha: Subscribe to our newsletter on digital asset treasury vehicles as long as it’s free 👇

Top Boardroom Reads

Stablecoin and the Future of Finance (IMF). How stablecoins reshape payments and challenge monetary control.

The New Entertainment Economy (51). How blockchain is rewriting music & media economics.

Blockchains as emerging economies (Fidelity). A framework to value chains as digital nations.

The stablecoin moment (State Street). GENIUS Act and its global market fallout.

1 Million Bitcoin (Fiftyone). A snapshot digital asset treasuries.

Tempo, Libra, and the Illusion of Neutrality (Maja Vujinovic). Why both corporate and open chains will win.

🙌 Work with us: We create pioneering thought leadership that helps digital asset and technology companies lead the conversation, earn trust and win business.

Top Signals This Week

Tether goes U.S.

What happened: Tether is launching USAT, its first U.S.-compliant stablecoin in December. Anchorage Digital will issue, Cantor Fitzgerald will custody, and Bo Hines (ex-White House digital asset advisor) will run Tether U.S.

Why it matters:

Direct shot at Circle: Tether already prints $13B in yearly profits vs. Circle’s $156M. With USAT, Tether now invades Circle’s regulatory home turf.

Boost for ETH & Tron: 78% of USDT supply lives on these chains — expect more flow as USAT scales.

Dollar dominance: Treasury Secretary Scott Bessent said it best: “We’re going to keep the U.S. the dominant reserve currency in the world — and we’re going to use stablecoins to do that.”

So what? This is about who controls the rails of the dollar in the digital era. USDT has a $180B market cap today. I expect 100s of billions to be flowing into USAT over the next years. And Tether just went from offshore giant to U.S. player with Washington ties, Wall Street custody, and a clear regulatory framework.

NASDAQ tokenizes stocks starting 2026

Nasdaq has filed with the SEC to tokenize every stock on its exchange starting 2026.

If approved, every listed share will trade in two forms:

traditional digital (today’s rails)

tokenized blockchain version (new rails)

Same order book. Same rights. Same execution priority.

Dive deeper: Nasdaq won’t run its own chain. Instead, it’s tapping DTCC’s AppChain, built on Hyperledger Besu (Ethereum-compatible), with a working group that includes Citi, Mastercard, Visa, Santander, Consensys, and Accenture.

Why it matters: Tokenized assets are $28B today. Ripple + BCG project $18.9T by 2033. Until now, “tokenized stocks” were mostly wrappers and derivatives with no shareholder rights (Robinhood, Kraken). This would be different: issuer-recognized, regulator-approved, real equities onchain. And once stocks settle on blockchain, the rest of Wall Street will follow. This could be a once-in-a-generation overhaul of capital markets.

Circle about to lose 10% of its yearly revenue

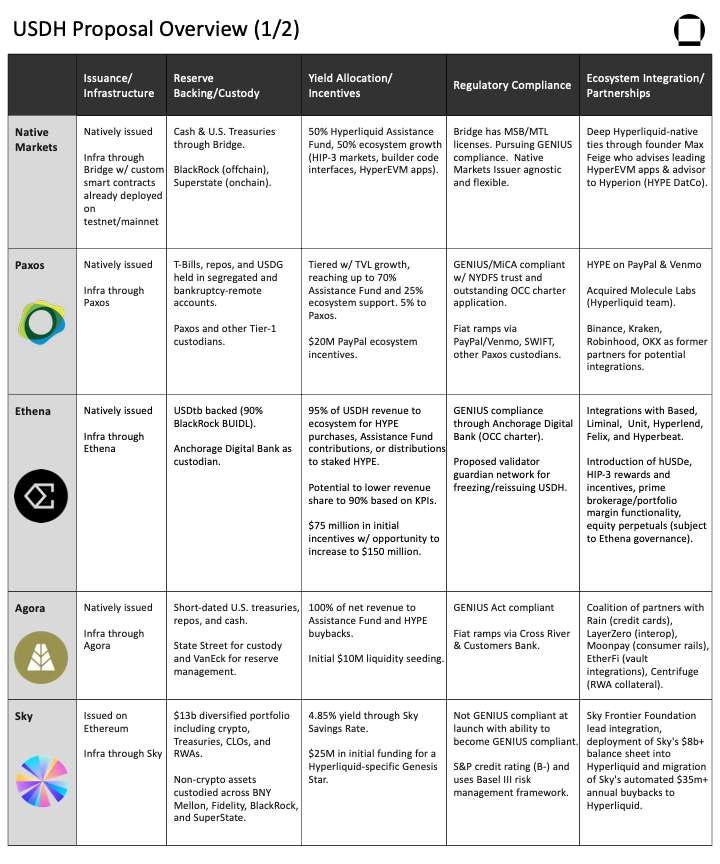

What happened: Hyperliquid, a DEX with $700M TVL and more daily protocol revenue than Ethereum and Solana, wants its own native stablecoin: USDH. We’re witnessing one of the biggest showdowns in crypto right now. [NEWS]

Why it matters: Hyperliquid has $5.5B in stablecoins sitting on it today. Most of that is USDC, on which Circle quietly collects the interest. At current rates that’s ~$200M a year (almost 10% of its revenue). Zero flows back to Hyperliquid. With a native USDH, that value could be captured by the Hyperliquid ecosystem instead. [ANALYSIS]

Now Paxos, Ethena, Agora, Sky (MakerDAO), Frax, Native Markets and others are all competing with proposals ranging from BlackRock-backed reserves to PayPal integrations to fully decentralized issuance. The final vote will happen on September 14.

The twist: Whoever issues USDH must share the yield back to the ecosystem, pay validators, fund the assistance pool, and buy back HYPE. That revenue could grow to $1B+ a year as stablecoin balances scale.

Bottom line: Winning USDH doesn’t guarantee revenue, but it grants brand legitimacy, the seal of being Hyperliquid’s “native” stablecoin. Even if no proposal hits escape velocity, the network wins.

Fidelity joins tokenization race

What happened: Fidelity just launched its $204M Fidelity Digital Interest Token (FDIT) ($16.4T AUA) on Ethereum, a tokenized Treasury MMF, making it the second mega-asset manager (after BlackRock’s $2.2B BUIDL fund) to move assets onchain. Ondo Finance is the anchor investor, with 99% of FDIT’s assets tied to its OUSG fund. [ANNOUNCEMENT]

So what? This instantly makes Fidelity one of the largest players in the $7B tokenized Treasuries market and a direct challenger to BlackRock’s BUIDL. With $12T AUM, the potential pipeline is enormous.

Devil’s advocate: FDIT already has 99% exposure to Ondo’s OUSG. If Ondo’s inflows stall or reverse, Fidelity’s on-chain MMF looks illiquid.

Dive deeper: FDIT is ERC20-native, recording ownership, transfers, and settlement directly onchain. JPMorgan, Fidelity, and BlackRock are already using tokenized MMFs as collateral, proving real efficiency gains in settlement, margining, and capital flows.

Big picture: Tokenisation is moving from pilots into production. BlackRock, Kraken, R3, Solana are pushing tokenised stocks, MMFs, bonds, real estate, and more.

Bonus: Fidelity released a report where it compared tokenization to American Depositary Receipts (ADRs), concluding it as the blockchain equivalent of moving an offshore asset to be recognized for investment and trading in a local market.

Franklin Templeton partners with Binance

Franklin Templeton ($1.6T AUM) partners with Binance (300M users) to build "tokenized financial products" that merge: [ANNOUNCEMENT]

Franklin’s compliant tokenization (BENJI platform + tokenized funds)

Binance’s global trading infrastructure + investor reach

This dwarfs any pervious partnerships.

BlackRock x Coinbase? US only.

JPMorganChase x Coinbase? 80M users, US only.

Franklin x Binance? 300M users + global markets + retail & institutions.

Tokenized funds won’t sit in a silo; they’ll trade at scale. And 300M Binance users = instant distribution.

Stepping back: Franklin Templeton was the first incumbent to launch tokenised money market funds in 2021 with FOBXX, now live on eight blockchains, and this year launched the first fully tokenised UCITS SICAV fund in Luxembourg.

So what? The line between TradFi and DeFi is blurring faster than most investors realize.

News Flash

BBVA brings crypto custody on-chain with Ripple. Link

SEC’s plan to let companies raise capital directly on-chain under clear rules. Link

SEC delays BlackRock’s Ethereum staking ETF, plus XRP and Solana funds. Link

DTCC released institutional-grade upgrades on its collateral appchain. Link

Ant Digital tokenises $8.4B in China’s renewable energy assets. Link

Solowin Holdings (NASDAQ: SWIN 0.00%↑) acquires AlloyX, a stablecoin infrastructure provider, for $350M. Link

Kraken acquires Breakout, an evaluation-based proprietary trading firm. Link

Tetra Digital Group to launch Canada’s first regulated stablecoin in 2026. Link

R3 hits $17B in tokenised assets, launches Labs on Solana. Link

Trump Media plans five America First ETFs, pending SEC approval. Link

Grayscale files for BCH, LTC and HBAR ETFs. Link

Hong Kong to launch wholesale CBDC and tokenised interbank deposits. Link

Oracle jumped 40%+ and added nearly $250B of market value (currently $922B) in a single session. Read the full AI story

That’s all for now, folks.

Take care

– Marc & Team

🚀 Work with us: We create pioneering thought leadership that helps digital asset and technology companies lead the conversation, earn trust and win business.

Check out our AI newsletter, AI Operator, here.

Check out our Crypto Treasury Alpha newsletter here.