Hey, it’s Marc & 51 team,

Jamie Dimon interrupted Brian Armstrong’s coffee with Tony Blair at Davos. The JPMorgan CEO got in Armstrong’s face and told him he was “full of sh*t” for claiming banks were sabotaging crypto legislation.

While CEOs traded insults in Switzerland, SEC Chair Atkins is building the regulatory framework: the GENIUS Act is live. Project Crypto just formalized SEC-CFTC coordination. DTCC launched its tokenisation pilot. OCC greenlit five crypto-focused national trust banks.

Everything is moving except one thing: Congress can’t agree on where to draw the line between securities and commodities. And that stall is costing the industry billions in legal ambiguity. [CLARITY Act]

Here’s the full map of what’s moving, what’s stuck, and what actually matters for builders, banks, and allocators right now.

👉PRO: Download the PDF at the bottom

🚨 Want more intelligence? Work with the 51 Intel team to embed continuous, high-signal market intelligence into your organization.

What happened

The US regulatory machine is undergoing a three-part transformation of how cryptocurrency is regulated.

Pillar 1: Monetary - The GENIUS Act (Done)

The GENIUS Act was signed into law July 18, 2025. It created the first federal framework for stablecoins, bifurcating jurisdiction between federal banking regulators and state authorities under a unified federal floor. The structure: three pathways to become a stablecoin issuer.

Federal Qualified Nonbank Issuers (OCC oversight): On December 12, 2025, the OCC granted conditional approval to five major entities, including Ripple, BitGo, Paxos, Circle, and First National Digital Currency Bank, allowing them to establish national trust banks. This is federal preemption: these firms now operate across all 50 states without state-by-state money transmitter licenses. [RELEASE]

IDI Subsidiary Issuers (Bank subsidiaries): On December 16, 2025, the FDIC board approved a Notice of Proposed Rulemaking (NPRM) to establish application procedures for state-chartered banks seeking to issue stablecoins through subsidiaries. The deadline for public comments is February 17, 2026. [RELEASE]

State-Qualified Issuers (State supervision with federal floor): Entities under $10 billion in issuance operate primarily under state supervision; above that, the Feds take over. [MORE]

Stablecoin issuers will be able to submit applications to the relevant state or federal regulator starting one year after passage of the GENIUS Act (approximately July 2026), with full implementation by January 2027.

Further reading:

Pillar 2: Market Structure - The CLARITY Act (Stalled)

The CLARITY Act passed the House of Representatives in July 2025 with bipartisan support. However, it hit a wall in the Senate due to diverging philosophies between the Senate Banking Committee (favoring SEC oversight and strict investor protections) and the Senate Agriculture Committee (favoring CFTC oversight and spot market flexibility).

On January 29, 2026, Senate Agriculture Committee advanced the first-ever crypto market structure bill, voting to give the CFTC authority over digital asset spot markets, but a full Senate vote is still pending. [RELEASE]

“Advancing this bill brings us closer to a U.S. regulatory framework that protects consumers while allowing American innovation and businesses to thrive.”

— John Boozman, U.S. Senate Committee on Agriculture, Nutrition, and Forestry Chairman

Two competing drafts are now in play:

Senate Banking Draft (Chair Tim Scott, released Jan 2026): Emphasizes SEC jurisdiction, strict investor protections, and restricts tokenized equities to traditional exchanges. [Read draft]

Senate Agriculture Draft (Chair John Boozman, released Nov 2025): Emphasizes CFTC jurisdiction, permits more decentralization, treats tokens as commodities once networks are functional. [Read draft]

The sticking points:

Yield on stablecoins. On January 12, 2026, the Senate Banking Committee released a new 278-page draft, which prohibits digital asset service providers from offering interest or yield to users for simply holding stablecoin balances, but allows for stablecoin rewards or activity-linked incentives. Coinbase’s $1.3B annual revenue stream from stablecoin yield rewards is directly threatened. The banking lobby argues this closes a loophole; crypto argues this stifles consumer choice.

DeFi regulation. The Banking draft requires “front-end” websites for DeFi protocols to register as broker-dealers and perform KYC. Crypto developers call this a “ban on software development.”

Where tokenized equities trade. Banking wants them only on traditional exchanges (NYSE/ NASDAQ). Agriculture is more permissive.

White House crypto adviser David Sacks has said that the Senate is expected to hold hearings about the market structure bill in January, and markup is coming in January. But negotiations are ongoing. The markup was forced to cancel as Coinbase withdrew support for the Senate version of the CLARITY Act. The bill stalled in late 2025 and remains stalled as of early February 2026.

Further reading:

Pillar 3: Infrastructure - Project Crypto & DTCC Tokenization (Moving Fast)

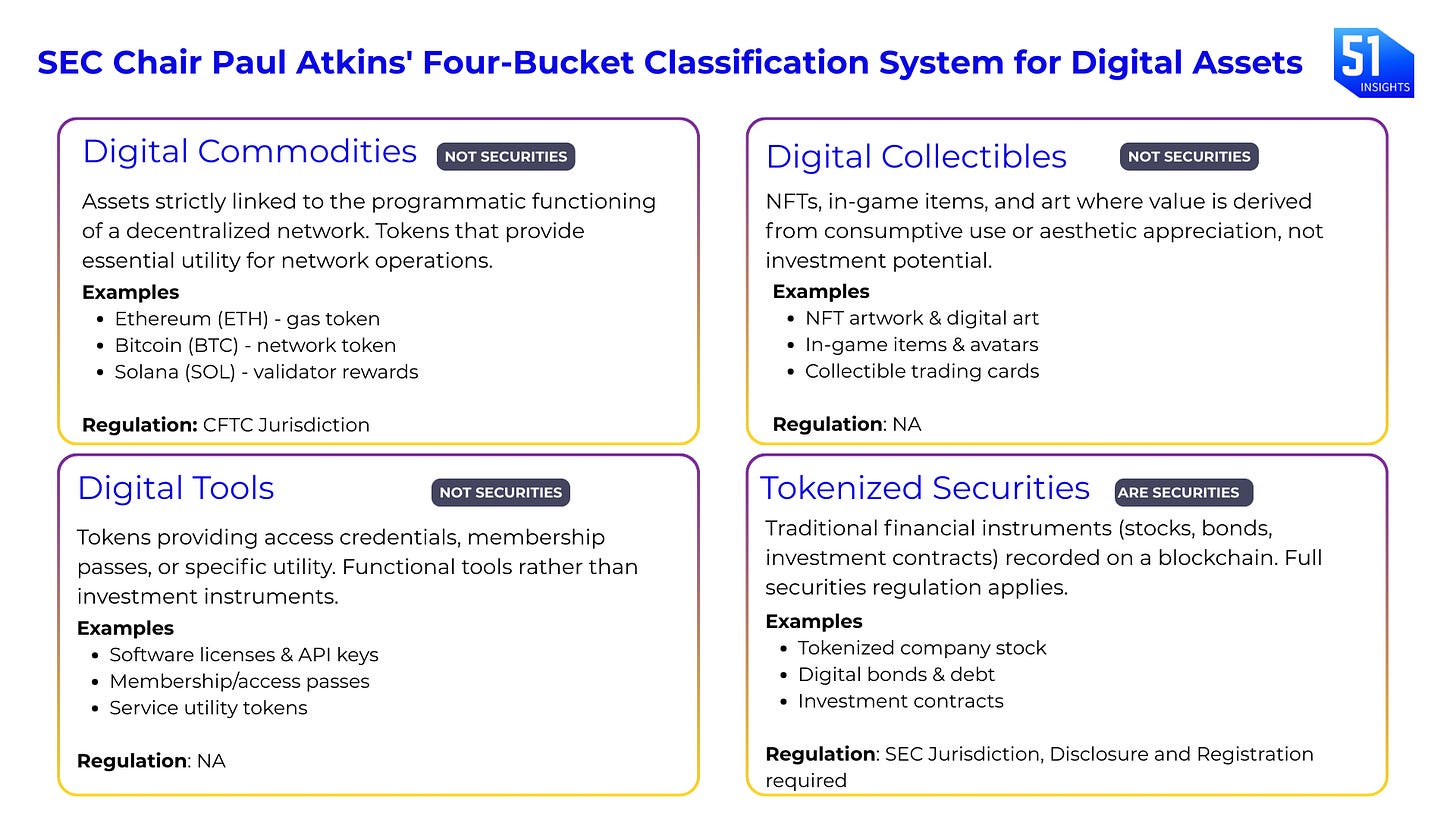

On January 27, 2026, SEC Chair Paul Atkins and CFTC Chair Michael Selig held a joint summit to announce Project Crypto, a historic joint initiative to harmonize U.S. cryptocurrency regulation. [Opening remarks]

On Jan 28, SEC released a statement saying stocks and other securities don’t avoid U.S. securities laws just because they’re issued or wrapped as tokens. It also drew a clear line between issuer-issued tokens and third-party “synthetic” versions, signaling tighter scrutiny of tokenized markets. [RELEASE]

Key components: