China Pays Yield. America Bans It.

We’re 72 hours from a Senate vote that could reshape crypto.

Remember when your bank paid 0.1% on checking? Then Coinbase started paying 4.5% on your USDC. Not interest: “rewards.”

That loophole might be dying this Thursday.

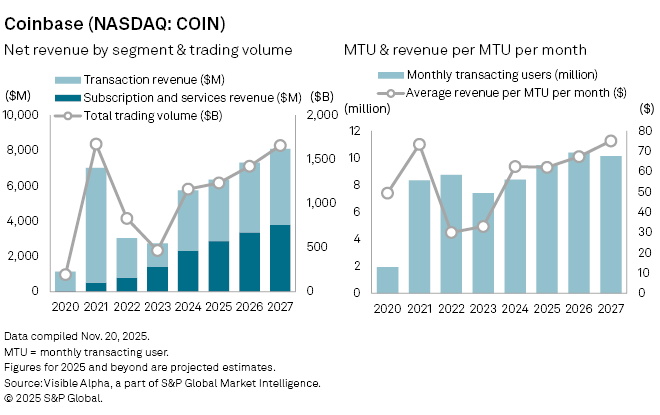

On January 12, Senate staff told crypto leaders they would “need prayers“ for the January 15 markup on the Clarity Act1, signalling that banks had successfully lobbied to close the stablecoin “loophole” that allows platforms like Coinbase to share Treasury returns with users. The $1.3B Coinbase revenue stream from stablecoin yield? Gone.

China started paying interest on the digital yuan on January 1st. America is banning it. What’s going on?

This vote is not just about your 4.5%. It’s about whether America gets regulatory clarity at all.

Let’s unpack.

👉PRO: Download the PDF at the bottom

🚨 Want more intelligence? Work with the 51 Intel team to embed continuous, high-signal market intelligence into your organization.

What happened:

The Senate Banking Committee will vote on January 15 on the death of stablecoin yield.

While the 2025 GENIUS Act banned issuers (like Circle) from paying interest, it left a loophole for intermediaries (like Coinbase) to pass 4.5% treasury yield to users as “rewards.” Legal arbitrage. The banking lobby just closed it.

Just-in: The latest draft (page 189) says companies cannot pay interest just for holding balances. They can earn rewards, but only if they’re tied to opening an account or activity like making transactions, staking, providing liquidity, putting up collateral, or participating in network governance.

Zooming in: Your local bank lobbied (led by the American Bankers Association (ABA)2 and Banking Policy Institute (BPI)3) against your ability to earn yield. They sent Congress a letter: $6.6T in deposits are “at risk.” At risk of what? Paying you market rates.

What they’re saying:

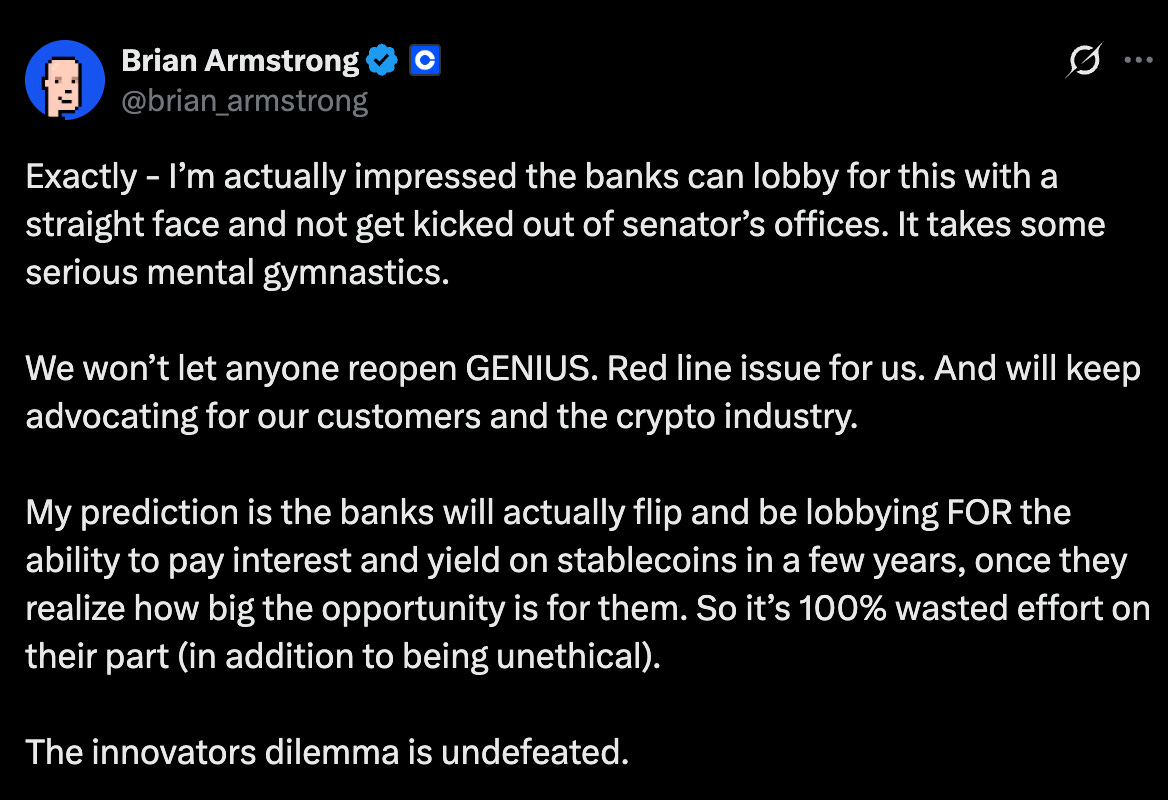

Coinbase is telling the crypto industry to stand down on opposing the stablecoin yield language for now.

Senator Angela Alsobrooks (D-MD) has proposed a last-minute compromise: limiting yield strictly to “transaction-based” activity while banning passive yield on deposits.

“We want to make sure that we are not doing anything that mimics a bank-like product without bank-like protections. Pay rewards on transactions made with dollar-pegged stablecoins, but bar programs that pay rewards on tokens sitting in a digital wallet.”

The American Bankers Association’s case: Interest-bearing stablecoins pull deposits from community banks. Fewer deposits mean fewer loans to small businesses, farmers, and students. Circle and Coinbase exploit a “loophole” by paying yield through affiliates. Stablecoins lack FDIC insurance. Ban it all.

Banking Policy Institute argued stablecoins are “shadow banks” that bypass regulation while offering superior products. They want stablecoins to function strictly as payments (M0) not savings (M1/M2).

Here’s how the arbitrage worked

The GENIUS Act (passed July 2025) banned stablecoin issuers like Circle from paying interest to holders. Clean and simple.

But Circle doesn’t pay interest. Circle earns it. Circle generated $711M in Q3 2025 from interest on the $60B+ in Treasuries backing USDC. That’s 96% of their revenue. They can’t share it with users—but they can share it with Coinbase.

The revenue-sharing deal: Coinbase gets 100% of interest on USDC held on Coinbase’s platform, 50% on USDC held elsewhere. Circle paid Coinbase $900M in 2024—54% of Circle’s total revenue—as “distribution costs.”

Coinbase then offers that money to users as “rewards.” Not interest. Rewards. Legal.

The banking lobby just closed it.

Coinbase generated $1.3B from this model in 2025. Mike Novogratz didn’t hold back: “Sad state that Congress cares more about banks’ margins than they do consumers! Both [Democrats] and [Republicans] need to ask who are they serving?“

In short: The proposed amendments can extend the GENIUS Act’s yield prohibition beyond stablecoin issuers to all third-party intermediaries, including Coinbase, Kraken, and other digital asset service providers. This kills how Coinbase makes money. This reverses the current operating model, where Eexchanges legally share a portion of reserve interest (currently ~4.5%) with users as “rewards” rather than “interest.”

Plot twist: Coinbase may withdraw support for the entire CLARITY Act if yield restrictions pass, per Bloomberg sources. When your biggest industry supporter threatens to walk, you’ve miscalculated.

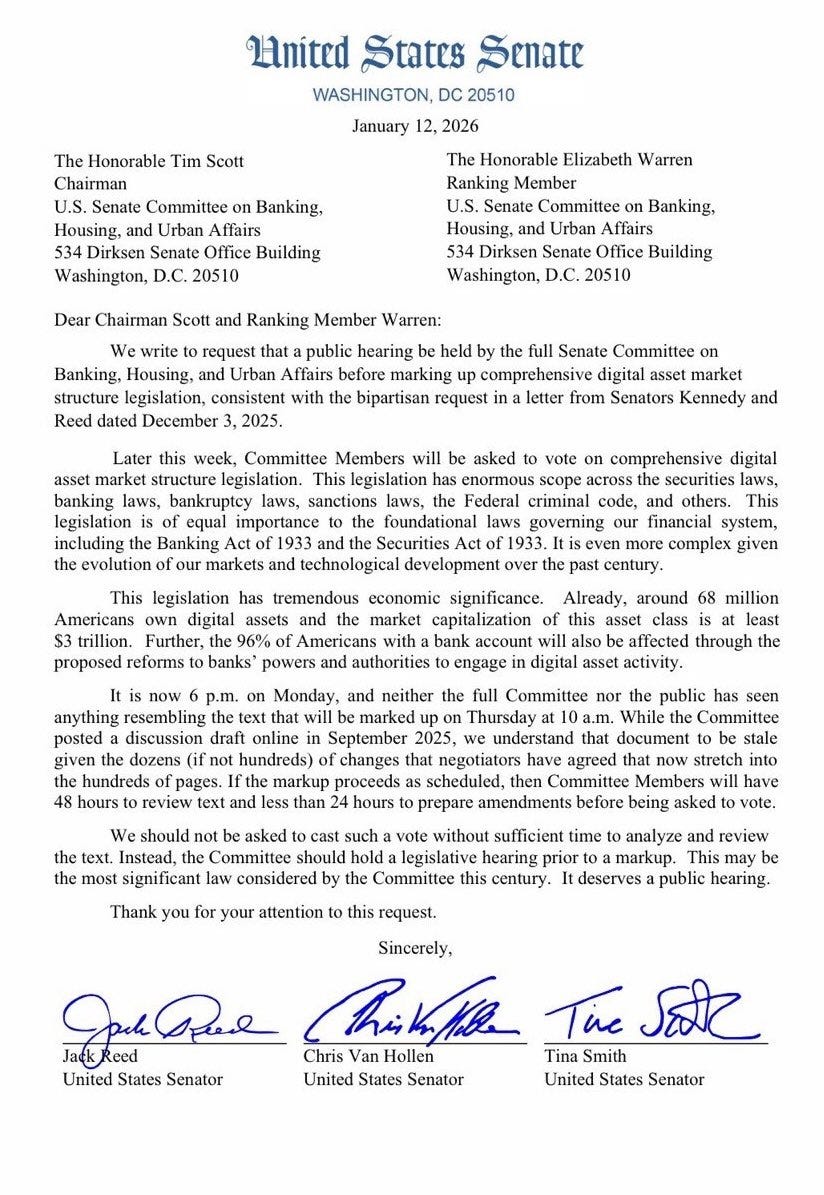

Must know: The Jan 15 markup isn’t the real decision point, it’s just one committee moving its piece forward. This is a bipartisan bill4 that only matters once both committees (Senate Agriculture Committee and House Committee on Financial Services) agree and enough Senators are lined up to actually pass it.

Banks want to ensure that payment stablecoins function strictly as a medium of exchange (like cash) rather than an investment product (like a savings account or money market fund).

Why you need to pay attention

PRO subscribers get the non-obvious alpha below:

The China angle nobody is pricing in

The winners / losers of Thursday’s vote

Our watchlist

The full board-ready PDF

Read on or subscribe to PRO👇