📝#100: Paxos, Galaxy, Kraken, Robinhood Launch Stablecoin

Executive briefing: Trump becomes crypto president. Tokenized assets on Swift. Tether launches stablecoin for Middle East. Paxos, Galaxy, Kraken, Robinhood launch stablecoin.

Hey, it’s Marc ✌️

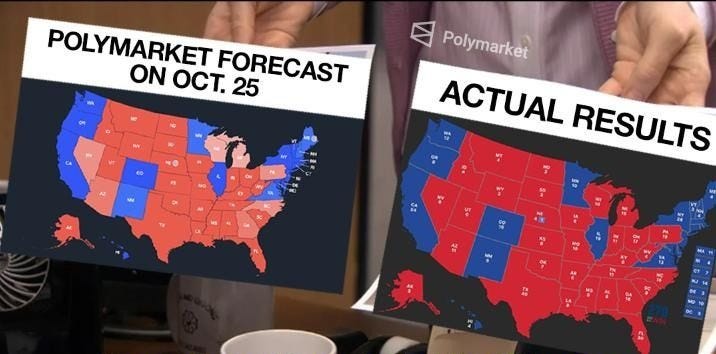

Everyone is talking about Trump’s “crypto presidency”. Did you know that Polymarket, the prediction market that grew by 100x this year, predicted US election results with 100% accuracy 2 weeks ahead? Survivor bias – maybe.

Nevertheless, the numbers are impressive: $3.5 billion — that’s how much people have bet on the big question: Who will win the 2024 presidential election?

Here’s the big news that slipped under the radar: Paxos, Galaxy, Bullish, Anchorage, Kraken, Robinhood, and Nuvei launched the Global Dollar Network (GDN) — along with its own stablecoin, USDG [press release].

This is one of the most ambitious industry-wide stablecoin initiative to date, challenging USDT and USDC with almost 90% combined market share.

Just for context: Nuvei alone processes over $200B in global volume.

What makes GDN different?

Instead of holding all reserve benefits centrally, the Global Dollar Network shares rewards directly with participants, shaking up the traditional stablecoin model.

Plus: Keep up with our signals for Web3 execs on our Telegram channel.

Let’s dive in🦈

📚 What we’re reading (& writing)

Crypto's Role In The AI Revolution. Pantera. Link

Bitcoin, BRICS, and the ETF Revolution. Maja (Maya) Vujinovic . Link

AI for Startups. Satya Nadella, Marc Andreessen, Ben Horowitz. Link

Value of Premium Content for Scaling AI models. Michael Parekh . Link

Enterprises ramping up AI use cases. Michael Parekh . Link

The Luxury Tech Playbook: Digital Transformation & Blockchain. 51 Insights. Link

How Brands Can Win on Roblox [Live event]. 51 Insights. Link

UBS Doubling Down on Tokenization

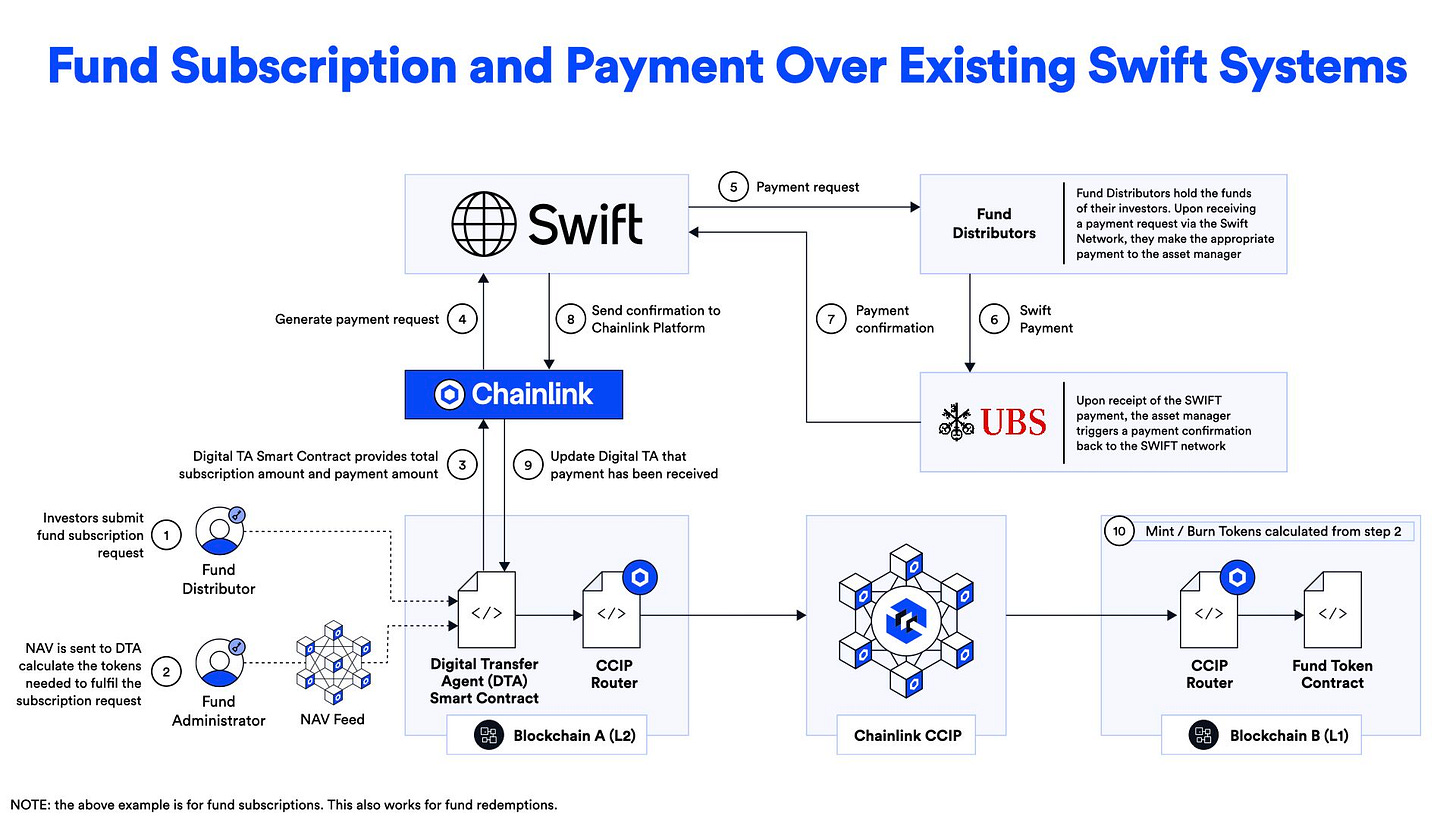

Swift, UBS Asset Management, and Chainlink have completed a pilot that connects tokenized assets with existing payment systems [press release].

The problem: It's been tricky to use traditional payment systems for buying and selling tokenized assets.

The solution: They created a "bridge" that lets you use regular money to buy tokenized assets and vice versa, all within the existing, secure Swift network.

The result: Increased efficiency, lower costs, and faster settlements.

Why it matters: The model shows how tokenised assets can coexist with fiat systems. Integrating tokenised fund operations with fiat-based payments could unlock access to over 11,500 financial institutions across 200+ countries.

Swift’s global network and Chainlink’s blockchain technology bring potential efficiency and transparency to the $63T mutual fund market.

Zooming in: The pilot was launched as part of the Monetary Authority of Singapore’s (MAS) Project Guardian (aims to enhance financial markets through assets tokenization).

The big picture: UBS utilizing Swift and Chainlink infrastructure is a crucial step towards the mainstream integration of tokenized assets into global financial systems.

Also: On Nov 1, 2024, UBS launched its first tokenized investment fund, the "UBS USD Money Market Investment Fund Token" (uMINT).

🍏Today’s Top PRO Bite:

Tether Expands to Middle East

Tether is set to launch a dirham-backed stablecoin on The Open Network (TON) blockchain in collaboration with Phoenix Group and Green Acorn Investments,

The stablecoin will be fully backed by liquid reserves in the UAE.

Why it matters: With a 75% share of the stablecoin market, Tether’s partnership with TON is a play to reinforce its lead as stablecoins go mainstream.

By the number:

TON has become the fastest blockchain to hit 1B USDT in transactions, with a 670% increase in 6 months.

TON's growing popularity and Telegram integration give Tether access to over a billion users.

Zooming out: More than 100 platforms now support USDT on TON, including Fireblocks, simplifying access for businesses. With the AED stablecoin launch, Tether is positioning itself—and TON—as a leading force in the Middle East’s digital finance landscape.

🚨 Other Highlights You Can’t Miss

Bitcoin hits a new all-time high after Trump win. Link

Polymarket predicted US election results with 100% accuracy 2 weeks ahead. Survivor bias? Maybe. Link

Paxos, Galaxy, Bullish, Anchorage, Kraken, Robinhood, and Nuvei launch a stablecoin network. Link

Perplexity launched its Election Information Hub. Link

💰 Money Moves

Atlas: Ellipsis Labs raised $21M led by Haun Ventures to build Atlas. Link

Vlayer: Infrastructure company raised $10M in the pre-seed funding round. Link

That’s all for now, folks.

Talk soon,

– Marc & Team

PS: Before you go, here’s how our industry OGs, vast network, research team & 50k+ B2B audience help you:

Co-publish enterprise-grade reports with us, driving traffic and boosting B2B outbound conversion rates.

Execute a multi-channel growth campaign that delivers better results than anything else in Web3's consumer space.

More feedback? Reply to this email.