📝 Web3 Field Notes #31 - A Milestone For Crypto

Ripple case: a milestone for crypto. BlackRock is bullish. 7-Eleven enters Web3. Wimbledon, Andy Murray, and NFTs. Venture funding is down. Elon Musk launches his AI company. Top charts & more.

Hey, it’s Marc. I write about Bitcoin, Web3, and brands. ✌️ Welcome to another issue of my obsessively curated field notes to help you filter out the noise.

⏱️ Reading time: 5 min

Dematerialzd is brought to you by NEAR.

NEAR isn't just a Layer 1 blockchain - it's the Blockchain Operating System for an open web. Unlike other next generation blockchains, NEAR was built from the ground up to be easy to build on for developers and accessible and simple to onboard for their users. Create and discover decentralized apps, and help build the future of the web, today.

“We do believe that if we can create more tokenization of assets and securities – that’s what bitcoin is – it could revolutionize finance.” – Larry Fink, CEO BlackRock

📚 Key Reads

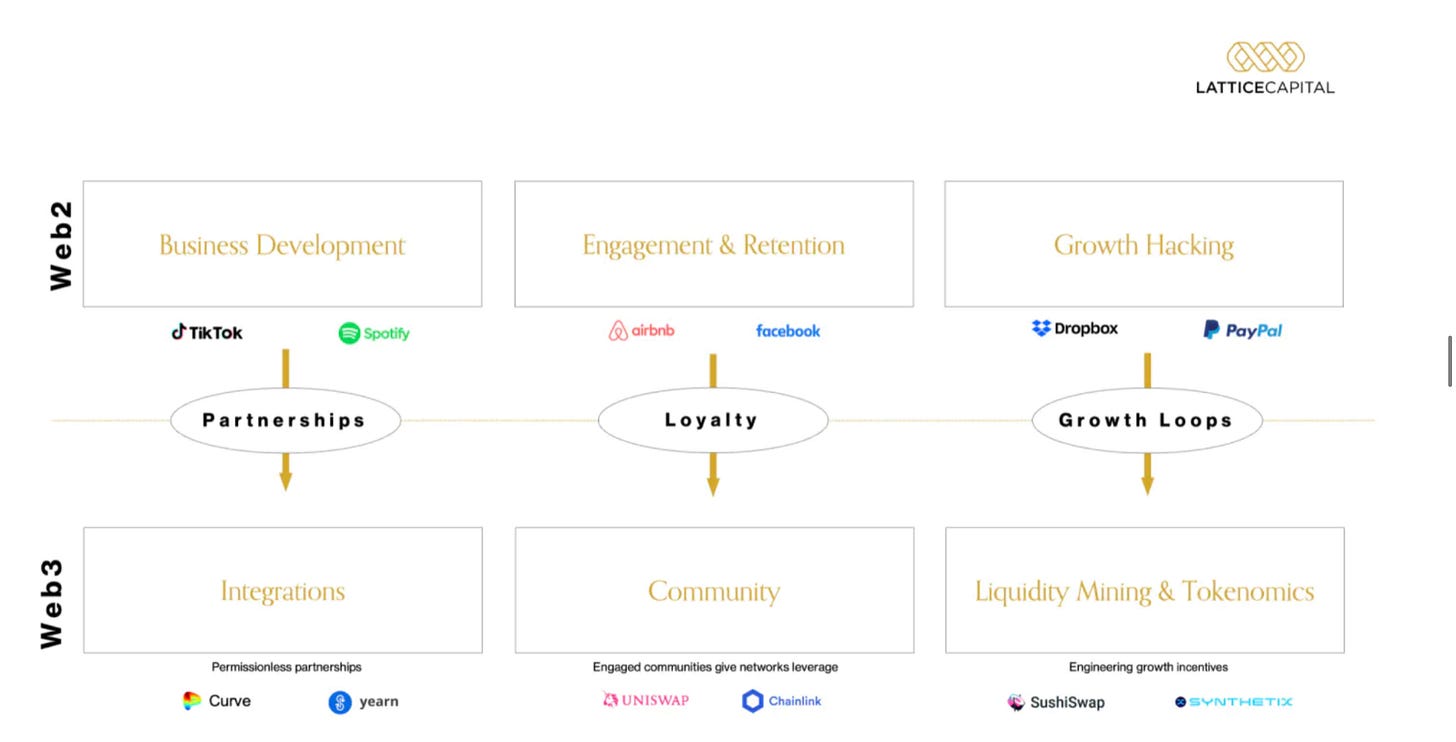

Growth Frameworks from Web2 to Web3. Link

Why culture and ownership are critical to the metaverse. By Yat Siu, Founder Animoca Brands. Link

Larry Fink, BlackRock and institutional adaption. By Galaxy. Link

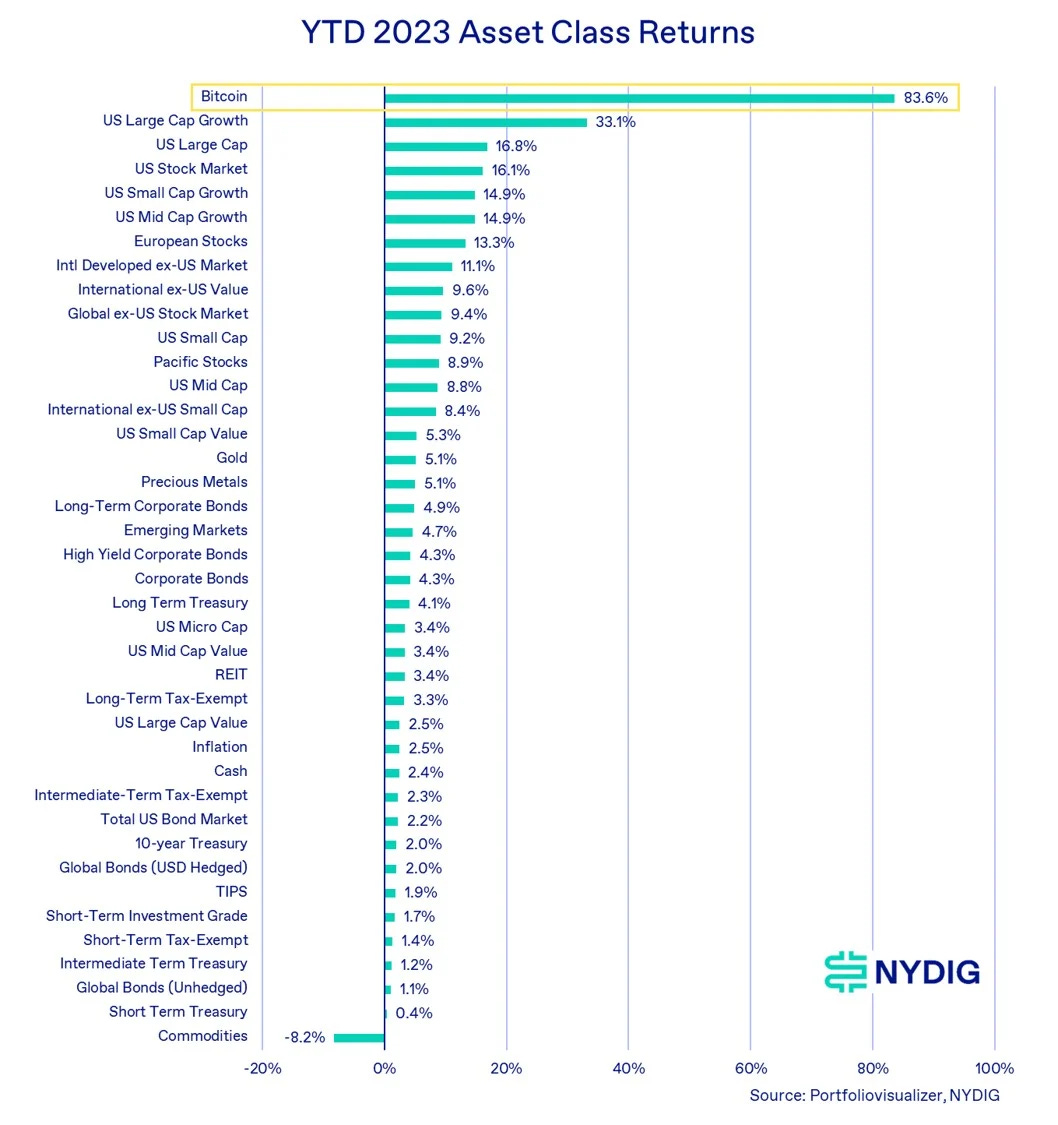

Crypto H1 2023 performance review. By NYDIG. Link

🚨 What caught my eyes

✨ Web3 + NFTs

Polygon, a leading blockchain for NFTs, has announced that its CEO Ryan Wyatt is stepping down from his role. His departure is significant as he was instrumental in bringing Polygon – and Web3 in general – on the radar of big brands. Polygon recently was dealt a significant blow when its native token MATIC was designated by the SEC as an unregistered security. Link

Wimbledon and Andy Murray enter the NFT space with artwork by Refik Anadol. The NFTs celebrate Murray's historic achievements at Wimbledon and showcase Anadol's innovative use of data and AI. After Australian Open’s ArtBalls, Wimbledon is the second Grand Slam that uses NFTs for fan engagement. Link

Sound.xyz raised $20M: a16z leads the round that includes investors Snoop Dogg, OneRepublic’s Ryan Tedder, and several others. Sound.xyz is one of the leading Web3-based platforms enabling direct relationships between fans and artists. Link

7-eleven entered Web3 with an NFT-based activation to celebrate its 96th birthday. Besides picking up Slurpee drinks in stores, customers can also mix and mint virtual drinks to their wallet. They then enter a draw to win jewellery. This isn’t groundbreaking – but hey: We need experiments! Link

🌎 Crypto & Macro

A federal judge ruled that the Ripple Labs Inc. token is a security when sold to institutional investors but not the general public. The Ripple case has been a key legal case of the last few years and could set a precedent for future crypto regulation. It undermines the SEC’s implicit notion that most cryptocurrencies except Bitcoin are securities. And it decimates the SEC’s case against Coinbase. The markets reacted immediately. This is monumental.

Larry Fink, the CEO of BlackRock, the world's largest asset manager, expressed astonishingly positive views on crypto in a recent interview with FOX Business. He said that crypto could "revolutionize finance" and that Bitcoin was "digitalising gold in many ways". This is significant as he represents the traditional finance industry and has a lot of influence over investors and regulators. Together with its latest Bitcoin spot ETF filing, it heralds the realization of one of crypto’s longest running mantras: “the institutions are coming.” Link

VC funding for crypto startups fell again in Q2, down 71% from the same period in 2022 and reaching its lowest level since the Q4 2020. Crypto funding is losing steam more quickly than the rest of the venture industry. Some of the investors are also pivoting to AI. Link

In Bank of America’s most recent “Primer on Tokenization”, the bank writes: “We are on the verge of an infrastructure evolution that may reshape how value is transferred, settled and stored across every industry. Tokenization is just one DLT/BCT application, but this one application may transform financial and non-financial infrastructure and public and private financial markets over the next 5-15 years.* Disruptive innovations like the radio, television and email took 30 years to reach mainstream adoption. We expect a far shorter road for digital assets.” This is the second comprehensive research report of the bank after releasing “A Primer on Digital Assets” last year.

Bitcoin mining revenue1 hit $184 million in Q2 amid Ordinals2 boom, reaching levels previously seen in May 2022. Ordinal inscriptions are still rising, but ordinal fees are going down. Apparently, most inscriptions are text based, which cost less than image based inscriptions.

🧠 AI

Elon Musk launches his AI company, xAI, with the goal to “understand the true nature of the universe”. What can you do with 400m Twitter accounts, a Starlink satellite network, which can bring internet to all corners of the planet, and world-class AI researchers of xAI? A lot. And Elon knows. Link

Anthropic releases AI chatbot Claude 2, available in the US and the UK via claude.ai and an API for businesses; Anthropic has raised $1B+, $450M in May 2023. Link

If you’re new here, we welcome you to join 4’395 bright + avid readers by subscribing here:

💡Word on the street:

It is encouraging to see more and more established, reputable institutions opening up towards crypto. The landmark result in the Ripple case will add to the positive momentum. This decision affirms so much of what this industry is fighting for.

But if we want this technology to reach its full potential, it's important that the its original, fundamental values of decentralization, freedom to transact, and right to self-custody are preserved and understood – without resorting to fundamentalism or ideology.

That’s all for now, folks.

Thank you for being part of the journey.

Back to building! 🚀

– Marc

🐦 Tweets of the week

📈 Top charts to share with friend

🎨 Artwork: “INFINITE | 無限”, by Ivona Tau

Mining revenues for Bitcoin are composed of two parts: block rewards and transaction fees. Block rewards are new bitcoins that are created and awarded to miners for validating blocks of transactions. Transaction fees are small amounts that users pay to miners for including their transactions in a block. Both sources of revenue are important for securing the Bitcoin network and incentivizing miners to invest in hardware and electricity.

Still, probably the best aggregator in the space IMHO.