3.5 million pages of DOJ documents confirm what no compliance officer flagged in 2014: a convicted sex offender was funding Bitcoin’s development pipeline.

The 2026 Tranche of Epstein files suggests that the roadmap of Bitcoin was a commercial strategy financed by Jeffrey Epstein. But the story is different and a mix of fact, rumors, interpretations and opinions.

Let’s unpack.

👉PRO: PDF at the bottom

The Consensus Miami 2026 Global Digital Asset Adoption Index Report by CoinDesk Data just dropped, which our 51 team dissected line-by-line and stress-tested against our own institutional data.

✅ Download the full report here (free, yours, right now, $30K+ McKinsey-equivalent value).

👉 Register for Consensus Miami May 5-7, 2026, and get in the room where the people moving that money actually meet. Use this for up to $900 off:

🎟️ 20% Discount Code: MARC

🔗 Auto-applied discount link: https://go.coindesk.com/3NLCAAd

We’ll be there too!

What happened

On January 30, 2026, the U.S. Department of Justice released a massive new tranche of documents, videos, and images related to the late sex offender Jeffrey Epstein, complying with the Epstein Files Transparency Act (signed by President Trump in Nov 2025). This release, often described as the largest yet, consists of over 3M pages of documents, 2,000 videos, and 180,000 images, shedding further light on his network. [Full Letter] [Epstein Library]

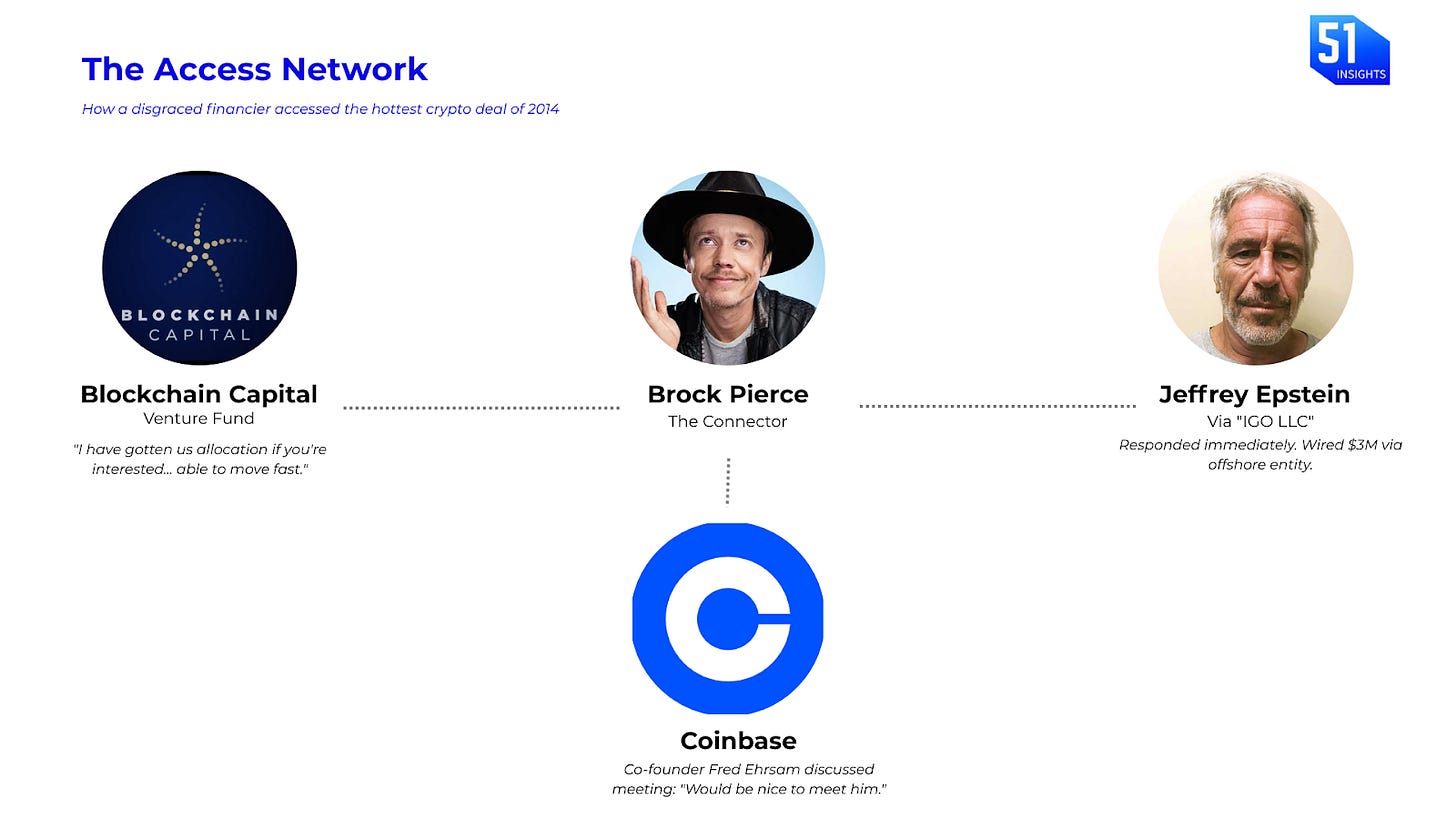

The 2026 release of Epstein documents indicates he was an early investor and networker in the cryptocurrency industry, particularly during its early years, with direct investments in Coinbase and Blockstream (Co-founded by Adam Back) and donations to the MIT Media Lab’s Digital Currency Initiative.

Here are the verified facts:

Epstein invested $3M in Coinbase (2014, via IGO LLC, a Virgin Islands-based entity controlled by Epstein).

Brock Pierce (Co-founder of Tether), had a nearly decade-long professional and personal relationship with Jeffrey Epstein. He reportedly advised Epstein on crypto investments as early as the early 2010s. In 2018, Pierce’s firm, Blockchain Capital, reportedly bought half of Epstein’s Coinbase stake for $15M (~900% gain in 4 years).

He invested ~$500K in Blockstream {2014, via Joi Ito‘s (Director of the MIT Media Lab) fund Kyara Investments III}.

He donated ~$850K to MIT DCI between 2002-2017.

MIT DCI did pay Bitcoin Core developers’ salaries. These developers were:

Wladimir van der Laan: The Lead Maintainer of Bitcoin Core, who held the ultimate authority to merge code changes.

Cory Fields: A key developer focused on the build system and peer-to-peer logic.

Gavin Andresen: The former Lead Maintainer and the successor chosen by Satoshi Nakamoto.

Joi Ito (and MIT staff) called Epstein “Voldemort“ to hide funding in internal emails.

Epstein contacted Gavin Andresen in 2011, but Andresen declined the meeting.

Zooming in: While the files detail connections to crypto figures and projects, they contain no evidence linking him to Bitcoin’s creation or code, and viral theories claiming he was Satoshi Nakamoto are based on fabricated screenshots not found in the official documents.

May 2016 marked a power shift: Gavin Andresen’s GitHub access was revoked after he backed on-chain scaling, officially framed as a security concern but, per later records, executed as a political removal. As a result, the control of Bitcoin’s codebase consolidated under the Core/Blockstream group, ending the scaling debate, ironically while some decision-makers were funded by ethically compromised capital.

Crypto industry response: It has been muted, with most leaders arguing Epstein’s capital had no influence due to bitcoin’s decentralization and the relatively small size of his investments. Some people are also arguing that Epstein wasn’t Satoshi, he was just a conduit to some power to support Bitcoin development.

One notable disagreement: early bitcoin contributor Luke Dashjr called for Blockstream CEO Adam Back to resign over the ties.

Consensus view among industry insiders: no meaningful impact on crypto adoption, regulation, or Coinbase’s position; retail behavior unlikely to change.

The conspiracy narrative is wrong, but the compliance failure is real

Bitcoin didn’t become Epstein’s puppet. The open-source protocol survived because it’s designed to resist single points of influence. Bitcoin’s governance is decentralized, designed to resist influence from any single funding source, and the three developers who joined MIT reportedly had no knowledge of the source of the funds DL News. In 2025 alone, 135 developers contributed code for Bitcoin Core with hundreds of thousands of lines changed, showing ongoing community work independent of historical donors.

But here’s what should terrify institutional allocators: tainted capital hiding in plain sight.

Epstein has been a registered sex offender since 2008. Standard AML/CDD protocols should have flagged a $3M investment from a high-risk individual instantly. Instead:

KYC failed at the entity level. Shell companies (IGO LLC, Kyara Investments III) bypassed negative media screening. No one dug into ultimate beneficial ownership.

Syndicate due diligence collapsed. When DFJ and a16z lead a round, they don’t typically ask about all LPs (Limited Partners1). They trust the sponsoring investor (Blockchain Capital). But systemic trust isn’t due diligence.

MIT’s opacity enabled hidden funding. Joi Ito kept Epstein close and sometimes used his money indirectly; one email showed Ito wrote to Epstein, “FYI, used gift funds to underwrite this which allowed us to move quickly and win this round. Thanks” Futurism. Developers didn’t know the source.

Market incentives broke governance. Epstein’s allocation was bumped 10x by Reid Hoffman (Co-founder of LinkedIn) after the round was oversubscribed. In 2014–2015, exercising basic discipline would have meant asking where the money came from, and saying no if it raised concerns. That check existed in theory, but it was never enforced.

Be smart: Private equity in crypto is still opaque. Fund-of-fund structures still hide beneficial owners. Nominee vehicles still mask the original source of capital.

Must know: The MIT Digital Currency Initiative (DCI) played a central role in researching a US Central Bank Digital Currency (CBDC) through “Project Hamilton,” a multi-year collaboration with the Federal Reserve Bank of Boston along with its contribution to the Bitcoin Core ecosystem. They developed and tested “OpenCBDC,” an open-source, non-blockchain research platform focused on technical feasibility, performance, and security.

🔺Subscribe to PRO: Last month, PRO subscribers received 16 daily CEO notes from our research team and were first to know about Blackrock x Uniswap in depth. We’re tracking every institutional move in real-time & deliver decision-ready intelligence & frameworks for executives and investors.