Where regulation meets reality

Hey, it’s Marc

Your competitive intelligence just got uncomfortable.

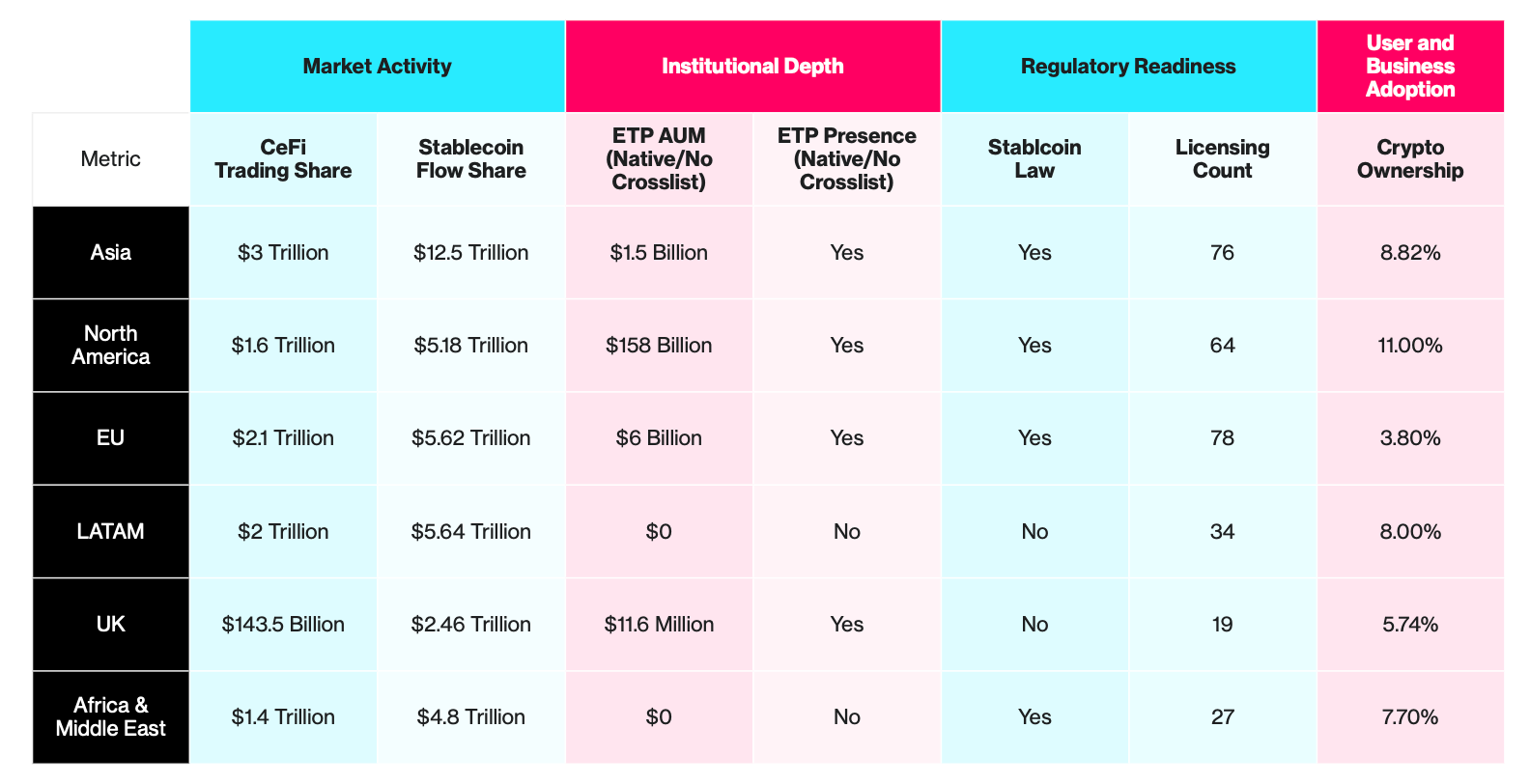

While Asia processed $12.5 trillion in stablecoin flows in 2025, the US quietly built the institutional infrastructure to trigger adoption on a scale few have dared to imagine.

This is according to Consensus Miami 2026 Global Digital Asset Adoption Index Report by CoinDesk Data that dropped today, which our 51 team dissected line-by-line and stress-tested against our own institutional data. Trust me: You should pay attention.

✅ Download the full report here (free, yours, right now, $30K+ McKinsey-equivalent value).

👉 Register for Consensus Miami May 5-7 (20% off or up to $900 with code MARC, auto-applied).

Read this first. Then decide if you want to be in the room with the people moving this capital.

First off: Everyone’s watching the US - Trump’s executive orders, the GENIUS Act, Circle’s $1B IPO.

But CoinDesk’s 2026 Global Digital Asset Adoption Index reveals something more strategic: Asia dominates current transaction volume. But the US is setting the pace for institutional acceleration.

The U.S. has built the world’s most sophisticated compliance shell, and Asia has built the engine.

Asia now ranks #1 globally, driven by a 67% YoY growth in stablecoin velocity and a massive $3 trillion in centralised exchange volume.

Meanwhile, North America sits at #2, but here’s what matters: The US controls $158 billion in crypto ETP assets (100× Asia’s total), 49 active exchange licenses (now the global licensing leader), and has converted crypto from regulatory risk to institutional asset class through the GENIUS + CLARITY Acts.

Why It Matters: The Narrative vs. The Reality

The global digital asset landscape is no longer a single race; it is a multipolar system where different regions have optimised for specific layers of the stack.

1. The American advantage: Institutional lock-in at scale

North America controls the “compliance chokepoints.” With the passage of the GENIUS and CLARITY Acts, the U.S. has transformed from a regulatory laggard into the world’s most predictable environment for big capital. The reopening of the U.S. crypto IPO window in 2025 (Circle's $1B+ raise, Bullish's NYSE listing) was the clearest signal of institutional depth.

The U.S compliance & capital layer:

$158B in listed crypto ETP AUM: ~100× Asia

49 active exchange licenses, now the global licensing leader

GENIUS + CLARITY Acts converted crypto from a regulatory risk to an institutional asset class

Stablecoin issuers structurally tied to U.S. Treasury demand [Read more]

When regulatory clarity hardens post-GENIUS/CLARITY and TradFi institutions flip the switch on infrastructure they've already built, Asia might have the flows, but the US will have the infrastructure to 10× them.

2. Asia is the world’s settlement layer

While the U.S. buys and holds, Asia moves. The region’s $12.5 trillion in stablecoin flows represents a scale of “multi-purpose financial infrastructure” that handles everything from speculative trading in Korea to enterprise treasury in Singapore. Asia is where digital assets are being embedded into the actual “plumbing” of commerce.

Asia’s settlement layer:

$3T in centralized exchange volume

8.8% population crypto ownership

Stablecoins used for trade settlement, FX hedging, treasury ops, remittances

Enterprise rails in HK + SG, retail velocity in Korea + SEA

Highest concentration of AA-rated exchanges globally (Crypto.com Singapore, OKX Hong Kong)

Cultural adoption: East Asia (Japan, South Korea)

In short: While Asia dominates transaction volume, North America controls the compliance chokepoints that institutional capital requires.

But debating whether “the US or Asia will win crypto?” is the wrong question.

The actual market structure is more complex:

Asia = highest-velocity transactional layer

US = deepest institutional capital formation + compliance architecture

LATAM = utility-driven mass adoption (inflation hedge, remittances, commercial settlement)

Europe = regulation without market momentum (Europe’s stablecoin flows, but only 16 MiCA licenses issued so far and EU exchange registrations down 33% since April 2025).

Middle East = concentrated institutional infrastructure, top-down policy-led

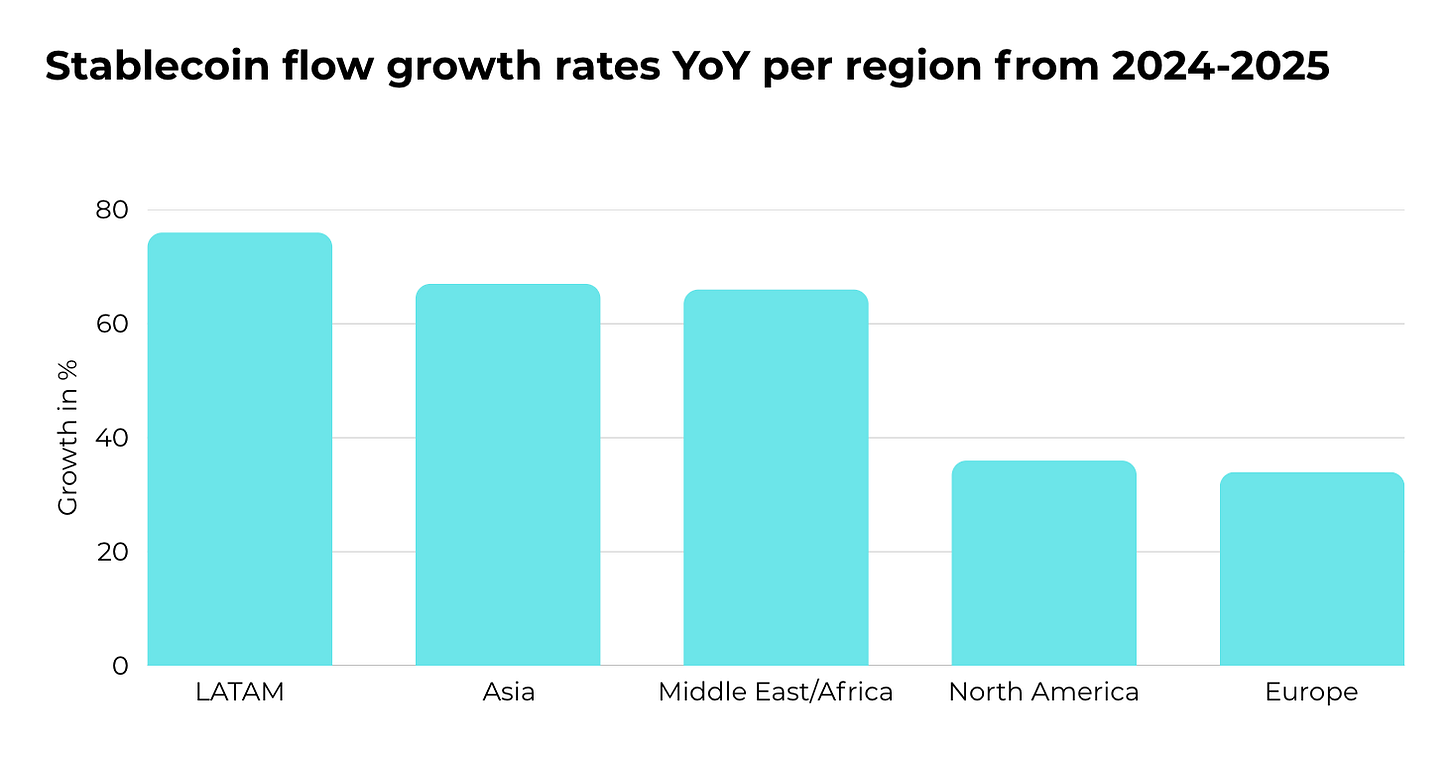

Meanwhile, stablecoin adoption is unequally distributed. While the US captured stablecoin mindshare pioneering regulation and tying stablecoin issuers structurally to U.S. Treasury demand, stablecoin flow growth rates tell another story:

LATAM: +76% YoY ($3.2T → $5.6T)

Asia: +67% YoY ($7.5T → $12.5T)

Middle East/Africa: +66% YoY ($2.9T → $4.8T)

North America: +36% YoY ($3.8T → $5.1T)

Europe: +34% YoY ($4.2T → $5.6T)

The regions with unreliable fiat currencies are growing stablecoin usage at 2x the rate of developed markets. In LATAM, for example, people are using USDT to buy BYD automobiles to bypass FX controls.

The Consensus Miami Offer: Your Competitive Intelligence Upgrade

Most executives will read the 2026 Global Digital Asset Adoption Index, screenshot a few charts, and file it in a folder they’ll never open again.

You’re not most executives.

Here’s what smart allocators and operators are doing right now:

✅ Download the full report → https://go.coindesk.com/4kf8b9h ($30,000 in value if you hired McKinsey to do this; it’s free, yours, right now).

✅ Register for Consensus Miami, May 5-7, 2026, and get in the room where the people moving that money actually meet.

Then they’re using this:

🎟️ 20% Discount Code: MARC

🔗 Auto-applied discount link: https://go.coindesk.com/3NLCAAd

(get up to $900 off)

I’ll be there too, and I want those people at Consensus.

If you’re reading this, you’re probably one of them.

Here’s what you actually get:

Stablecoin Summit → PayPal’s May Zabaneh, SEC Chairman Paul Atkins, Circle execs breaking down GENIUS Act implementation + MiCA playbooks + yield-bearing stablecoin mechanics

TradFi-DeFi Convergence programming → Citi’s Ryan Rugg (Global Head of Digital Assets, $4T AUM), BlackRock, Galaxy’s Novogratz on ETFs, tokenization, custody innovation

Bitcoin Treasury Summit → CFOs and corporates learning balance sheet BTC strategies (the Saylor playbook, scaled)

Cross-border payments & RWA tokenization → Ripple’s Brad Garlinghouse on stablecoin settlement rails outpacing Visa

6 stages. 6 summits. 200+ sessions. 500+ speakers.

If you’re building infrastructure and you meet one institutional counterparty who routes $100M through your rails…

You just captured more enterprise value than you’ll generate in 6 months of cold outreach.

If you’re an allocator and you meet one liquidity partner who shaves 10bps off your crypto execution costs on $1B in flow…

That’s $1M saved. Your ticket paid for itself 100X over.

The only question is:

Do you want to read about the $1T stablecoin economy 12 months from now…

… or do you want to be in the room with the people building the settlement rails for it?

✅Download the report: https://go.coindesk.com/4kf8b9h

✅Register for Miami (20% off, auto-applied): https://go.coindesk.com/3NLCAAd

🎟️ Code (if needed manually): MARC

Your move.

See you in Miami.

Marc

P.S. The 20% discount (code: MARC) isn’t public. If someone asks you how you got in cheaper, tell them to read 51.

P.S.S. I’m personally attending, can’t miss this on my home turf. If you see me, say hi.

P.S.S.S. CoinDesk is a proud partner of 51, because it pays off. Want to become a partner too? Reach out. Here's the part where I tell you we're "selective" about advertisers. When you show up in 51, you’re saying:

“I build products for institutions, not memes for retail.”