📝#93: $16 Trillion By 2030

BlackRock is quietly backing a new stablecoin. CZ released from prison. SG Forge plans Euro stablecoin with Solana. Meta's new XR glasses. OpenAI CTO departs.

Hey, it’s Marc ✌️

This was a big week for stablecoins. Expect an explosion of activity in the coming months. And: crypto has its hero back: CZ is free.

Let’s dive in 🦈

⏱️ Read time: 3min | Focus: Crypto, Macro & AI

👉 Want to get in front of 50k+ business leaders or accelerate your growth? Work with us here.

📚 Our Top Reads

Crypto

Making sense of stablecoins. By Visa. Link

Crypto’s third super category. By Redphonecrypto. Link

Volatility Supercycle. By Arthur Hayes. Link

A personal update from CZ. Link

MoonPay x PayPal: Unlocking Crypto for Half a Billion People. Link

AI

AI x Blockchain: Reinventing Data for Corporates. Link

Orion: A New Lens on Reality [Paid]. By 51 Insights. Link

An Interview with Meta CTO. Stratechery. Link

OpenAI, Google DeepMind, Meta, Tencent, Stability AI, announcements.

Reality Hits AI Very Hard Again [Paid]. By Ignacio de Gregorio. Link

Apple Is No Longer in Talks to Join OpenAI Investment Round. WSJ. Link

🌎 Crypto & Macro

All Bets on Stablecoins

BlackRock is quietly backing a new USD rival that could shake up the $170B stablecoin market:

Ethena Labs’ new stablecoin, UStb, is a fund that invests in US Treasury securities, with BlackRock’s BUIDL fund as a key backer.

The launch was facilitated by Securitize.

UStb joins Ethena’s synthetic stablecoin USDe, which uses collateralized debt and arbitrage to maintain its 1:1 dollar peg.

Ethena Labs intends to integrate UStb into various centralized exchanges.

Why it matters: The stablecoin market is led by Tether’s USDT (75% market share; 120B market cap). BlackRock’s entry could increase competition and drive greater institutional adoption of stablecoins, shaking up the current landscape.

Another stablecoin? Yes.

Recently, Robinhood, Revolut, Anzens, SG Forge, PayPal and Ripple have entered the stablecoin race, tapping into $170B stablecoin market.

By the numbers: 90% of stablecoin transactions are executed by proprietary traders, hedge funds, and market makers—mainly to balance liquidity across platforms.

Regulation: The U.S. is developing a regulatory framework for stablecoins, while Europe has already implemented stringent regulations under the MiCA legislation.

Devil’s advocate: Even with BlackRock’s muscle, stablecoin projects aren’t immune to hurdles. JPMorgan Chase, Meta, and Binance have faced regulatory scrutiny and operational challenges in launching their stablecoins.

Punchline: BlackRock's entry into the stablecoin market is a significant step towards the broader vision of tokenizing traditional assets, potentially unlocking a $16t market.

CZ Returns

Changpeng Zhao (CZ), founder and former CEO of Binance, was released from prison.

What you should know:

Imprisonment Reason: CZ pleaded guilty to failing to implement adequate anti-money laundering (AML) controls at Binance, facilitating illicit activities on the platform.

Sentence and Fine: He completed a four-month sentence at a California low-security correctional facility and paid a $50M fine.

Stepping Down: As part of his plea deal, CZ stepped down as CEO of Binance.

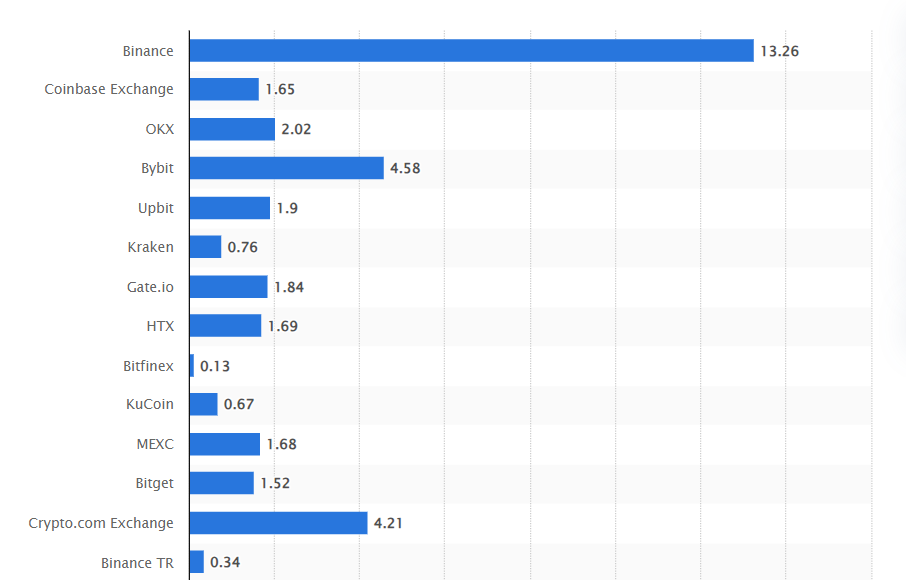

By the numbers: Binance is the largest cryptocurrency exchange in the world with a daily trading volume of $13.26B, $16.8B revenue and 170M users.

Market impact: Binance lost its place among the top 5 cryptocurrency exchanges in the United States. Binance.US's market share among US crypto exchanges fell from around 20% pre-lawsuit to less than 1% by August 2023, with a drop of 80% in website traffic.

Zooming in: CZ’s conviction in 2024 resulted in hundreds of millions in fines and strict conditions on his future involvement in the crypto sector.

Post-Release Limitations: He is barred from holding any executive position at Binance or engaging in activities related to crypto exchanges for a designated period.

Punchline: Despite stepping down as CEO, CZ remains a major shareholder in Binance. With a net worth of $57.3B, his future actions and pronouncements could indirectly influence Binance's trajectory and strategy.

🔵 No PRO yet? Get a PRO subscription and profit from data-driven long takes, our data room, full archive & more exclusive content. Starting at $7/month.

More Crypto Highlights:

SG Forge is launching its MiCA-compliant euro stablecoin, EUR CoinVertible (EURCV), on Solana to leverage the blockchain’s speed and efficiency. This follows limited adoption on Ethereum and builds on Solana's growing appeal after PayPal’s PYUSD success. Link

SEC Chair Gary Gensler emphasized this week that Bitcoin is not a security, reinforcing the SEC’s stance. Link

Folks Finance launched xLending, a cross-chain lending market on Ethereum, Avalanche, and Base solving liquidity fragmentation. Link

🪙 Regulation Highlights

Japan's review of crypto regulations could lead to the introduction of crypto ETFs. Link

🧠Artificial Intelligence

Orion: A New Lens on Reality👓

Meta just made a bold move at Meta Connect 2024, unveiling Orion, its most advanced AR glasses to date (formerly known as Project Nazare).

This isn’t just another tech gadget—it’s Meta’s play to bring Augmented Reality (AR) into the mainstream, making it as essential as your smartphone

Meta’s goal? To embed AR into everyday life—from how we work and shop to how we engage with brands and each other.

But there’s a catch.

Read the complete story:

More AI Highlights:

Mira Murati, former CTO of OpenAI, announced her departure after six and a half years. Her exit follows a series of high-profile departures. Link

Meta Platforms has decided not to join the European Union's voluntary AI Pact as it focuses on compliance with the forthcoming AI Act, which mandates companies to disclose data used for training AI models. The AI Act, set to take effect in 2026, is part of a broader EU regulatory framework alongside other significant legislation. Link

💰 Money Moves

Funding Rounds:

Celestia: Liechtenstein-based non-profit organization raised $100M co-led by Bain Capital and Polychain Capital. Link

Initia: The blockchain project raised $14M in a Series A funding round. Link

Mawari: Solana DePIN raised $10.8M in strategic funding from Borderless Capital, 1kx and others. Link

Mind Network: FHE (Fully Homomorphic Encryption) layer raised $10M in a Pre-A funding round. Link

That’s all for now, folks.

The next edition on Web3 Consumer & Gaming will follow on Friday.

Talk soon,

– Marc & Team

PS: Follow us on LinkedIn and X for shorter insights.

⚡️ Amplify Your Growth

👉 Want to get in front of 50k+ business leaders or accelerate your growth? 51 Insights is your unfair advantage. We combine what and who we know to help you win:

Capturing market & mind share with our 50k+ b2b audience

Shape your narrative & create qualified opportunities

Developing a go-to-market and growth strategy

Increase your b2b outbound conversion rates

Hey Marc,

love your content,

which stablecoin is most promising?

my answer:

Tbil - https://openeden.com/