Winning the Next Era of Payments

How your business can leverage onramps to convert more users, lower costs, and expand worldwide.

Hey, it’s Marc.

The demand for crypto onboarding is exploding.

Today’s consumers want smarter, faster ways to manage their money. Digital assets promise instant cross-border transactions, lower fees, and accessibility that traditional finance can’t match.

But the infrastructure for crypto onboarding is fragmented, clunky, and full of hidden fees.

Most crypto platforms still treat payments like an afterthought. High fees, failed deposits, and limited local payment options are killing conversion rates. And in a global market where UPI, Pix, and mobile money wallets are replacing banks, businesses that don’t localize lose users before they even start.

The solution? Onramp aggregators.

Onramp aggregators unify fragmented payment systems into a seamless, high-converting solution. Crypto is supposed to be easier, faster, and global. It’s time to deliver on that promise.

Today, we’ll explore how businesses can take crypto payments to the next level:

Why crypto payments are stuck in complexity

How aggregator solutions unlock massive growth for businesses

Onramper’s smart onramping innovations and real-world impact

Case studies of crypto platforms winning with better payment flows

Let’s dive in. 🦈

Millions of People Want to Onboard to Crypto

People are looking for financial tools that work for their daily lives. Crypto offers:

Speed: Instant transactions without borders.

Savings: Lower fees compared to old-school systems.

Accessibility: Services that were once out of reach are now available to everyone.

One of the most powerful examples of this shift is stablecoins, which are quickly becoming the backbone of digital payments. Offering instant settlement, low fees, and global accessibility—without the volatility of Bitcoin or Ethereum—stablecoins are bridging traditional finance and the crypto economy.

In 2024 alone, stablecoins settled $27.1T in transactions with a $190B market cap—outpacing some of the largest payment networks in the world. For businesses, stablecoins offer a massive efficiency advantage:

Remittances via stablecoins cost between 0.25% and 2.00%, compared to the 6.65% charged by traditional banks.

USDC and USDT dominate the space, holding 90% of the stablecoin market share.

For users in emerging markets, stablecoins aren’t just convenient—they’re a necessity for preserving wealth, avoiding inflation, and accessing global commerce.

Take Africa, where only 34% of adults have a bank account but mobile money adoption is soaring. Companies like Yellow Card are leading the way by integrating stablecoins into platforms that people already use. Through partnerships with M-Pesa, Coinbase, Onramper, and Lightspark, they enable:

Instant stablecoin transactions via mobile money—allowing unbanked populations to send, receive, and save in digital dollars.

Seamless fiat-to-crypto conversions, making stablecoins more accessible than traditional banking services.

Explosive growth in crypto transactions, with volumes skyrocketing from $1.7B to $3B in just one year.

Stablecoins aren’t just an alternative payment method—they’re becoming the default financial system for entire regions where traditional banking has failed.

Millions of people will need to “onramp” to crypto. For businesses, this presents a massive opportunity. And they need to be ready.

Buying Crypto is a Mess—Here’s How Aggregators Are Fixing It

Crypto platforms promise global access—but getting users on-chain is still a massive hurdle. Traditional banking rails don’t seamlessly connect with digital assets, leaving users stuck with slow bank transfers, high fees, or outright rejection by financial institutions. Even when demand for crypto is high, the onboarding process is clunky, fragmented, and full of friction. Crypto is global, but payments are deeply local.

This is where onramp aggregators come in. Instead of forcing exchanges, wallets, and DeFi platforms to manage dozens of local ramp integrations, these aggregators unify all major ramps into a single solution. The result? Crypto platforms can easily offer any local payment method, with users getting a streamlined, optimized experience that removes the barriers between fiat and crypto.

Example: Let’s say CryptoX, a fast-growing exchange, wants to expand globally. It already has thousands of customers in the US and Europe and is seeing strong demand from India, Brazil, and Nigeria. But there’s one massive bottleneck: making it easy for users to deposit funds.

Here’s the problem:

In India, users prefer UPI for instant payments, but CryptoX only supports bank transfers, which take days.

In Brazil, Pix is the dominant payment method, yet CryptoX relies on expensive credit card deposits.

In Nigeria, many users don’t have traditional bank accounts, making it hard to buy crypto. Mobile money or stablecoins are their go-to options.

Every extra step in the funding process means lost users. If people can’t deposit quickly, they abandon the platform.

The future of crypto payments isn’t just about crypto—it’s about seamlessly connecting fiat and digital assets. That’s what payment aggregators are doing, and businesses that integrate now will lead the next wave of global commerce.

But it doesn’t end here. Even if a platform supports multiple payment methods, the real challenge lies in ensuring transactions actually go through. Aggregators bring together alternative payment methods from around the world—tailored and localized for each market—into one single solution, but it still doesn’t make life easier for exchanges, wallets, and DeFi platforms, forcing them to manage dozens of local integrations.

It’s not just about offering more payment options. Here are some key hurdles:

Credit card challenges: Auth rates can be as low as 50-80% due to issues like quasi-cash merchant codes (MCC).

Bank rejections: Transactions may be denied by the user’s bank, issuing bank, or acquiring bank.

Localization & compliance: KYC processes and payment methods aren’t always tailored to local markets, leading to unnecessary denials.

Each failed transaction means a lost user—and lost revenue. Every extra step or misconfigured integration adds friction, causing potential customers to abandon the process entirely.

Onramper: Smart Routing for Higher Transaction Success

For crypto platforms, getting users on-chain is the biggest friction point. Whether it’s an exchange, a DeFi protocol, or a wallet, onboarding users still depends on fiat onramps—the bridges between traditional finance and crypto.

This is where Onramper comes in, the #1 fiat-to-crypto onramp aggregator trusted by crypto industry leaders like Coinbase, Telegram, Bitcoin.com, and Exodus.

Onramper is a fiat-to-crypto aggregator that connects businesses to multiple onramp providers (like MoonPay, Banxa, Revolut, and Stripe) through a single integration. Instead of managing multiple partnerships, APIs, and compliance hurdles, businesses can plug into Onramper once and instantly offer their users the best fiat-to-crypto conversion experience available.

Why it’s important: Most fiat-to-crypto aggregators simply bundle onramps together and leave businesses to figure out which one works best. But Onramper isn’t just an aggregator—it’s an optimization engine. It doesn’t just show users different onramp options, it actively routes transactions to the most effective provider based on real-time data and significantly increases completion rates.

Intelligent Orchestration: Powering Unmatched Transaction Success

Traditional aggregators leave businesses guessing which onramp will convert best in a given region. Onramper eliminates the guesswork with a smart recommendation engine that automatically routes transactions based on:

Onramp success rates: Selecting providers with the highest transaction success rates in real-time.

User location: Matching transactions with the most effective local payment providers.

Payment preferences: Prioritizing frictionless methods like UPI in India, Pix in Brazil, and credit cards in the US.

By understanding what works where and when, Onramper dynamically directs each transaction to the most reliable onramp. This smart routing optimizes local payment methods and bank requirements, boosting your conversion rates and ensuring a smoother, more successful onboarding experience.

Onramper’s data-driven orchestration ensures fewer failed transactions, lower friction, and higher conversion rates—giving crypto platforms a major advantage over legacy aggregators.

The #1 Metric That Matters: Conversion Rates

In fiat-to-crypto onboarding, conversion rates are king. Failed transactions and user frustration kill growth.

Yet many global onramps suffer from low conversion rates. The biggest culprit? Transaction failures at multiple levels:

Credit card declines: Many banks flag crypto purchases under quasi-cash merchant codes (MCCs), leading to 50–80% authorization failure rates.

Bank rejections: The user’s bank, the issuing bank, or the acquiring bank may block transactions outright.

Non-localized KYC: Mismatched identity verification processes create unnecessary friction, causing users to drop off.

Limited payment methods: Without tailored payment options, users are forced into inefficient, high-failure pathways.

How Onramper fixes this: Onramper’s intelligent, real-time routing engine solves these issues by optimizing every transaction for success.

Real-time data routing: Analyzes every transaction instantly to route users to the payment method with the highest success rate.

Frictionless onboarding: Avoids unnecessary KYC roadblocks by aligning with the right local payment method, reducing failures from credit card declines and bank denials.

Speed optimization: Ensures users receive their crypto instantly—without delays or hidden fees.

"If teams fully grasped the cost and complexity of building ramp infrastructure from scratch, they’d steer clear. The best companies double down on their core product and integrate solutions that just work. Onramper not just streamlines this process, but boosts volumes by ensuring the right solution is used for each individual user."

— Thijs Maas, co-founder & CEO, Onramper

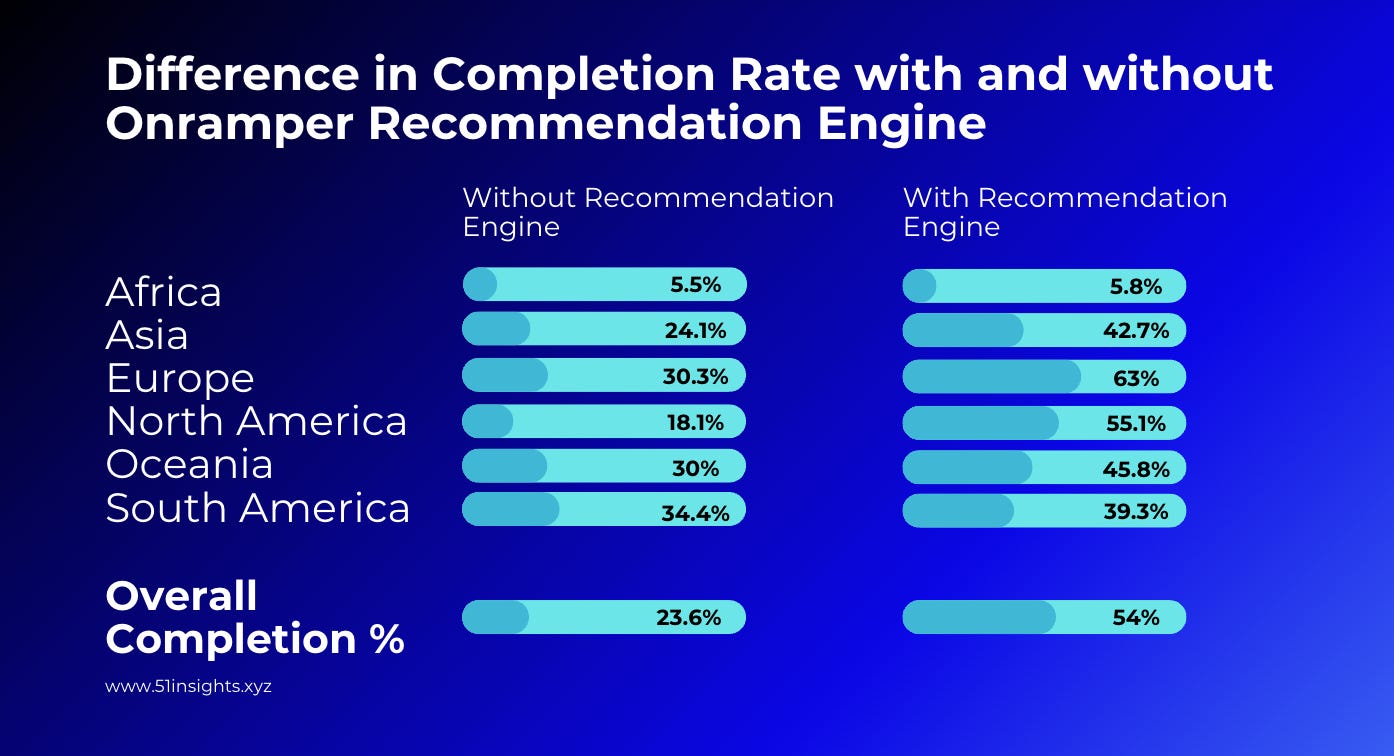

The data speaks for itself. Onramper’s algorithm significantly improves transaction success rates across all regions. Globally, completion rates more than doubled to 54.03%, underscoring the engine’s ability to optimize user flows at scale:

Asia: Completion rates rise from 24.07% to 42.7%, showcasing the engine’s capability to navigate diverse payment systems like UPI and Alipay.

Europe: The largest improvement, with rates jumping from 30.26% to 62.96%, highlights its effectiveness in optimizing card-dominated transactions.

The result? Unlock the potential to onboard up to 70% more customers, every single day.

Localized Optimization = Higher Conversions

Crypto adoption thrives on localized payments, but integrating region-specific solutions is a logistical nightmare. Onramper solves this by automatically routing users to the most effective local payment rails, ensuring seamless transactions worldwide:

India: UPI (15B+ transactions per month)

Brazil: Pix (79% of digital transactions)

Africa: Mobile money services, essential in cash-first economies

US/Europe: Credit cards & instant bank transfers

So what? For crypto platforms, this means onboarding more users, reducing drop-offs, and scaling faster—without the complexity of fragmented payment systems.

Case Study: How Solflare Boosted Volumes by 280% with Onramper

Solflare, a leading Solana wallet, serves millions of users on its browser and mobile platforms. Despite its popularity, its fiat-to-crypto onramp was falling short, offering limited payment options and a high rate of failed transactions.

The Challenge: Solflare was aware of the fact that building and maintaining a custom onramping solution would be time-consuming and resource-heavy. Most wallets eventually face a “build or buy” dilemma (build an onramp solution from scratch or buy an existing solution) but Solflare was one of the few that understood the pitfalls of going the “build” route: maintenance nightmares, constant firefighting, and runaway costs.

The team needed a simpler way to improve their onboarding experience without slowing down other priorities.

The Solution: Solflare teamed up with Onramper to upgrade its onramp. With just a few lines of code, Solflare integrated Onramper’s widget into its app and browser extension. Onramper handled contracts, updates, and maintenance, making the process quick and easy.

In just weeks, Solflare unlocked:

130+ payment methods (up from 7)

Support in 180+ countries (up from 160)

18 onramp providers (up from 1)

The Results: Onramper delivered a smoother, more reliable onramping experience, leading to:

280% growth in transaction volume in the first month

64% transaction completion rate (up from 22%)

37.5% usage of local payment methods (up from 5%)

85% authorization rate (up from 54.67%)

"We serve users worldwide, and offering suitable onramp options is challenging. User preferences for payment methods can vary significantly across different markets. Onramper simplifies this process for us by connecting us to over 18 onramp providers, each specializing in their respective markets. This ensures we understand and meet our users’ genuine wants and needs.”

— Filip Dragoslavic, Co-founder, Solflare

As crypto evolves, wallets are becoming the key gateway for mainstream adoption. Onramper is helping enhance these wallets to support adoption, offering faster transactions, broader payment options, and higher success rates—all while delivering a seamless user experience.

Aggregators like Onramper transform the complexity of payments into seamless, scalable opportunities. Whether you're a wallet provider, exchange, or dApp, Onramper is the plug-and-play solution for global growth.

Takeaways for Business Leaders

For businesses and crypto platforms, payments aren’t just a feature—they’re a competitive advantage. The companies that remove friction, localize payments, and make fiat-to-crypto conversions seamless will dominate global markets. Where to start:

1. Stop Treating Crypto as an Experiment—It’s A Massive Opportunity

Crypto payments aren’t a niche play. Look at stablecoins—they processed $27T in transactions in 2024, outpacing Visa and Mastercard’s combined annual volume. And that’s just one piece of the puzzle. Innovations in DeFi, cross-border remittances, and treasury management are opening up entirely new avenues for growth and efficiency.

For Web3 businesses: Frictionless fiat-to-crypto onboarding means higher conversion rates, more deposits, and lower churn.

For corporates: By leveraging crypto, brands can slash remittance costs and accelerate international transactions, thriving in today’s interconnected market.

Cryptocurrencies like stablecoins cut cross-border costs from 6.65% to under 2%—instant global expansion without banking headaches.

Bitcoin is emerging as a key asset reserve, offering a secure store of value and diversification for corporate treasuries.

Actionable step: Start by integrating a fiat-to-crypto aggregator to enable global customers to purchase crypto assets instantly.

2. Don’t Build Payment Infrastructure—Leverage Aggregators

Managing multiple payment rails, banking partners, and compliance across 200+ regions is an operational nightmare. The fastest-growing crypto businesses are skipping the complexity and integrating aggregators instead.

(Hint: Onramper combines 190+ payment methods into a single API, letting businesses accept credit cards, bank transfers, and local methods without dozens of integrations)

3. Optimize for Conversion Rates, Not Just Cost Savings

Cheap transactions are useless if users can’t complete them. Every failed deposit means a lost customer. Conversion rates—not just fees—should be your north star.

4. Make Payments Feel Like Web2 or Lose Users

Your customers expect instant, seamless payments. If your deposit flow feels slower than PayPal, you’re losing business. Onramps should work like tap-to-pay—fast, intuitive, and effortless. The more friction (extra KYC, delays, hidden fees), the more users abandon the process.

Actionable step: Audit your onramp experience. If it takes more than two minutes for a user to buy crypto, your competitors are winning your customers.

6. Expansion Is No Longer a Banking Problem—It’s a Payment Problem

Global payments used to mean opening bank accounts, dealing with currency restrictions, and navigating slow, expensive remittance networks. Now, it’s just about integrating the right onramp.

Crypto businesses can scale internationally overnight with onramps that handle local payment preferences, compliance, and KYC.

Instead of dealing with dozens of banking relationships, companies can accept stablecoin payments from anywhere with one integration.

Crypto onramping is no longer optional—it’s a strategic necessity for mainstream adoption.

That’s it for now.

Talk soon,

Marc & 51 Insights

PS: If you’re interested in working with Onramper, reach out here.

—

This report is published in collaboration with Onramper. As the author, I maintain full editorial integrity and the views and insights expressed are my own, ensuring the content remains unbiased and authentic.

I’ll keep it short: 51 can help your Web3 & AI scale-ups to become the go-to name for enterprises & brands. We’ve built the highest-quality growth engine in Web3:

70K+ B2B business leaders & direct corporate access to get in front of decision-makers.

Institutional-grade research & BD execution to deliver high-intent corporate prospects & higher conversion rates

Sales enablement & GTM strategy to close enterprise deals faster.

Clients include: Avalanche, MoonPay, Near Foundation, and others.

Let’s talk.