Where Physical Meets Digital: How tokenization unlocks new value for brands and consumers

Hey, it’s Marc. ✌️

Modern brands are digital and physical.

Until recently, “digital” meant nothing more than an account.

“Digital” products were just that – ”digital”. Until recently.

Now, blockchain technology allows brands to connect physical products to unique, digital counterparts – “onchain”.

Once a product has a unique ID and is on-chain, it’s traceable, intelligent, and more valuable. The potential is limitless.

So are the obstacles. Use cases that truly entice consumers are still rare.

Here’s why brands should pay attention.

👉 Want to get in front of 50k+ business leaders or accelerate your growth? Work with us here.

This article is published in collaboration with Boson Protocol.1

Tokenization

In 2023, The narrative around “digi-physical products”, “phygitals”, or the tokenization of “real world assets” (RWAs), emerged with new momentum.

By the numbers:

Around 35% of high-net-worth individuals are considering investing in digital assets tied to real-world assets like real estate, art, etc. in 2023.

AB Bernstein projects $5 trillion in assets could be tokenized over the next five years.

Boston Consulting Group (BCG) estimated tokenized assets could reach $16 trillion by 2030.

The global digital twin market size was valued at $6.9 billion in 2022 and is expected to reach $125.4 billion by 2030, growing at a CAGR of 45.4%.

Digital twin use cases span sectors like manufacturing (34%), smart cities (18%), healthcare (16%), and retail/ecommerce (13%).

A subcategory of tokenized real world assets are consumer goods.

Zoom in: Tokenized products from consumer brands enabling experiences that connect digital and physical elements.

These products are called “phygitals” (sorry about that word!).

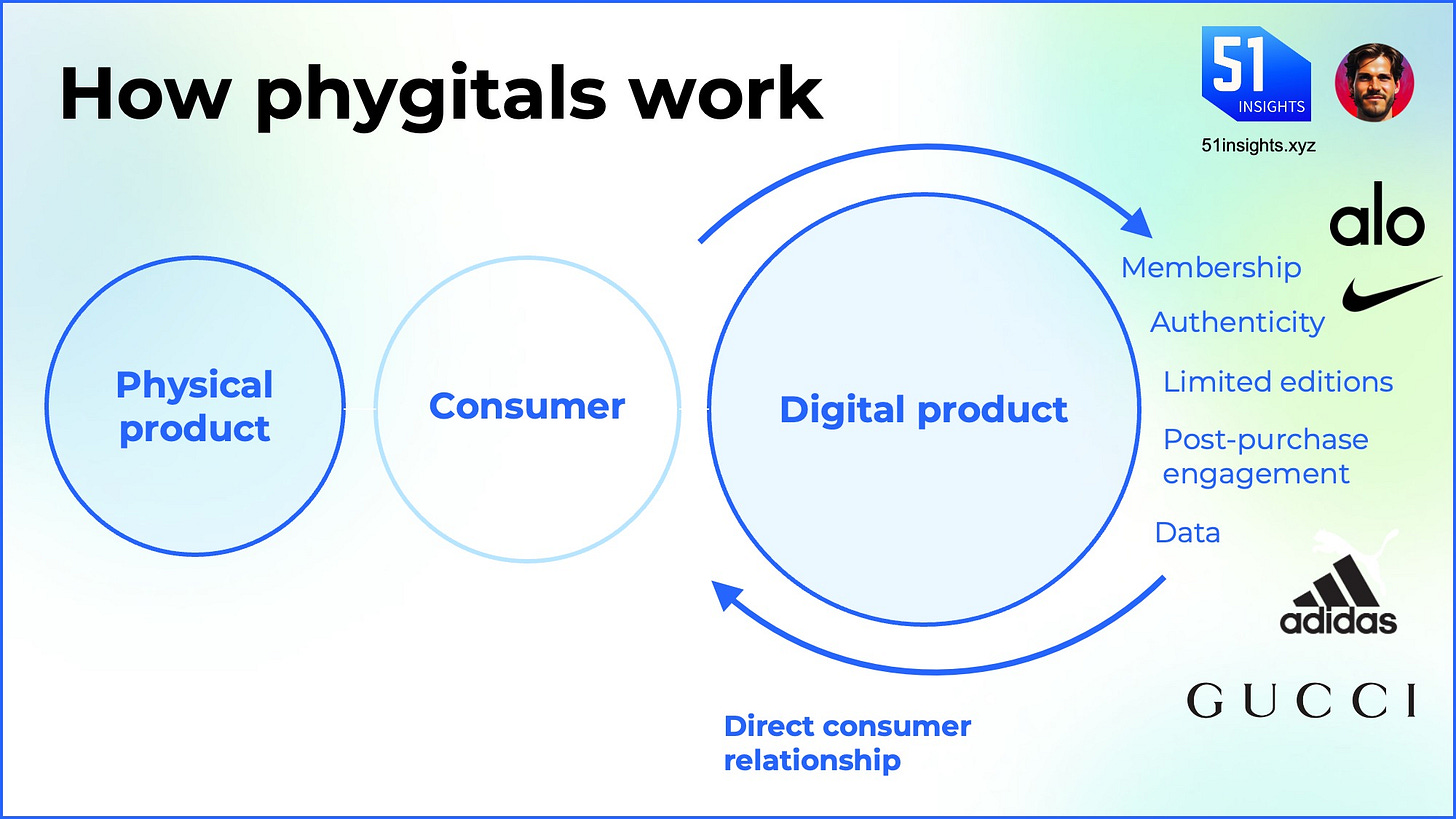

How it works: They have a unique digital counterpart (or “digital twin”) on a blockchain in the form of a non-fungible token (NFT), i.e. owning a physical product unlocks a corresponding digital ID or collectible, or vice-versa.

Users connect their “wallet” to the physical product via NFC chips, QR codes or AI image fingerprinting.

Phygitals can also be tokenized and exchanged on trust-minimizing protocols such as Boson, which don’t require hardware. More on that later.

Boson Protocol – Real Web3 Commerce, with Web2 UX

As the next bull market emerges, so does a new crypto-rich, Web3-savvy demographic, who are demanding authentic Web3 commerce experiences. Uniquely, with Boson, you can sell physical things as NFTs, with a slick Web2 experience while running on a fully decentralized Web3 backend. No more Web3 washing required!

What’s Happening

Consumers are changing.

Next-gen consumers, particularly the younger generations, are always shopping, blending and experiencing multiple channels at once: social media, online platforms, in real life, on phones, laptops, and beyond.

In fact, 75% of consumers expect retailers to offer a seamless blend of physical and digital shopping experiences.

And the concept of digi-physical experiences is gaining traction in retail.

Last year, major brands started connecting physical goods to virtual counterparts.

Brands like Remy Martin (alcohol), LVMH (fashion), and De Beers (diamonds) have invested in platforms enabling tokenization of physical assets and goods.

Other brands like Gucci, Breitling, and Alo Yoga are also blending digital and physical realms:

Gucci offered 2,896 holders of its Gucci Material NFTs the chance to swap their tokens for limited-edition physical items (either a wallet or a bag) at no cost.

Breitling pairs some watches with a digital passport (an NFT) that unlocks special services and ensures secure trading and traceability.

Alo Yoga provides NFT certificates for each piece of its Aspen Collection to verify rarity, authenticity and ownership. The NFT also unlocks VIP experiences, e.g. a personalized private client manager, admission to one Alo House, or a personal training session at one of the Alo Wellness Clubs.

In December 2022, Nike launched the Cryptokicks collection, offering 20,000 customizable sneaker NFTs to MNLTH holders (MNLTH is an NFT that Nike distributed to holders of its CloneX NFT collection, Nike’s first major NFT collection). Owners could later exchange their NFTs for actual sneakers through Cryptokicks iRL.

Why Care Or Not to Care about Phygitals

Why did brands do this?

First, they jumped on the hype.

Second, they wanted to experiment.

And third, they might have realized the potential down the road.

Tokenization allows brands (and literally anyone):

to sell physical things as NFTs online, in virtual worlds and on NFT marketplaces.

whereas buyers are guaranteed to either get the (verified) product or their money back.

And once a product has a unique ID and is on-chain, it’s traceable, intelligent, and more valuable. The potential is limitless.

Here are the key advantage for brands for tokenizing products:

Data on ownership and secondary sales: Brands who sell products through retailers can win back direct consumer relationships previously lost to retailers by letting customers connect their products to a digital counterpart, opening up a direct communication channel and tracking for resales.

Royalty revenues on resales: Digital twins can be programmed to generate a fee for every resale of the product; this is particularly interesting for luxury. The global luxury resale market was estimated to be worth $25-30B in 2020.

Genuine limited editions: Digital twins can transparently limit collections on-chain, removing the need to rely on the brand's word.

Authenticity & protection against counterfeits: To ensure product traceability and authenticity in the context of the upcoming European Digital Product Passport (DPP).

Programmable, post-purchase marketing activations: Owning an NFT and a physical piece connected to it unlocks unique post purchase experiences (e.g. token-gating), and generates a wealth of data through a direct-to-consumer channel for brands.

This sounds all great on paper. And brands have run interesting experiments:

Adidas' Into the Metaverse NFT drop required users to hold special tokens to access exclusive merchandise and experiences, driving demand and engagement.

Louis Vuitton's "Louis The Game" NFT game rewards players with exclusive NFTs that can be redeemed for physical merchandise or special perks.

In reality, most of the activations up to now were very isolated and hardly created any measurable results for these brands – yet. Why?

Digi-physical activations are complex:

Often, physical products need to be chipped, which requires a change in the production process of goods. This can be costly, depending on the per unit price.

Once chipped, brands need to have a platform to create, host and manage the digital twins and customer data attached to it.

Integrating that data with existing data pools and actually making sense of it.

Integrating experiences across web, mobile and third party platforms, like Roblox, in a seamless manner requires a plethora of partners.

…

The list goes on.

Above all, making these campaigns appealing, easy to use and valuable enough for mass consumers is even harder.

Players like Boson Protocol (partner of FiftyOne Insights) make this much easier by providing a blockchain application and the tooling required to create and manage phygitals.

Boson also built technology that doesn’t require brands to use any hardware to link physical to digital and allows brands to create decentralized phygital products easily, cheaply, and at scale.2

And they’ve recently launched their plug-and-play phygital platform.

Unlike other platforms, Boson doesn't rely on hardware like NFC chips to link physical products to NFTs. Instead, it employs a combination of:

Creating a binding commitment: The seller's deposit acts as a guarantee that they will deliver the correct product.

Providing economic incentives: The risk of losing the deposit incentivizes both parties to act honestly.

Enabling dispute resolution: A fair mechanism is in place to resolve any disagreements or issues that may arise.

You shouldn’t worry about that though, as it’s designed to just work.

🔵 Get a 50% welcome discount on your PRO subscription—available for a limited time only!

A PRO subscription gets you:

Weekly Field Notes

2x/month case studies & data-driven industry analysis

Private community with exclusive content, virtual events, AMA’s with special guests & access to Marc

Access to top cheatsheets, lists & full archive

Why Now

Earlier this year I wrote about the tokenization opportunities in 2024 for brands. For phygitals, expect:

Phygitals will turn from top-of-the-funnel collectibles to powerful experiences within a brand’s ecosystem.

I also expect that consumer brands will launch standalone virtual collections, making them a new product category for consumer brands.

I argued that the timing to start these initiatives is unique due to the convergence of three trends:

Web3 infrastructure is maturing

A new demographic of Web3 native consumers is entering the market

We’re at the beginning of another Web3 adoption cycle

You can dive much deeper here.

By the numbers:

At the same time, consumers are changing. 38% of Gen Z spend four hours a day on social media, and even more time consuming content or gaming – at least in the US.

In the latest Roblox study, 56% of Gen Z users now say styling their avatar is more important to them than styling themselves in the physical world.

50% “very” or “extremely likely” to consider a brand in the physical world after wearing or trying a brand’s item virtually.

Wherever you look at, next-gen consumers are begging for digital experiences.

It’s simple: more time people spend online, the more digital value they create and consume, including virtual products.

These products become tools for self-expression. For brands, they become tools for richer storytelling and brand experiences.

The big picture: In October 2021, I tweeted:

Web 3.0 will open a metaverse in which all digital objects will live on the blockchain and most physical objects will have a digital twin.

This is what’s playing out in front of our eyes – in slow motion.

Start experimenting now.

Talk soon,

Marc

PS: You can start creating phygitals with Boson here.

PSS: Want to learn more? Reach out to me by replying to this email.

Further reads:

Partner with us

⚡️ Amplify Your Growth and Reach 50k+ Web3 Leaders

Together with our global network of technology and execution partners, we accelerate start-ups and consumer brands to unlock next-gen consumer growth across Web3 and emerging technologies.

We’re also to offer our partners exposure to thousands of b2b Web3 industry leaders & access to the FiftyOne network to grow your business.

For advertisements & partnerships: Get in touch today or reply to this email.

As the author, I maintain full editorial integrity and the views and insights expressed are my own, ensuring the content remains unbiased and authentic.

Commitment Tokens and Escrow: When a seller lists a physical product, they create a commitment token (NFT) representing the promise to deliver that specific item. A deposit is locked in escrow within a smart contract, ensuring the seller's commitment.

Physicality and materiality is human and very tangible in its own reality. End of the day the experience we create is tangible with material reality!