What's Next: Web3 for Consumer Brands in 2024

Key verticals, key trends, key players: Here is all you need to know on consumer Web3 heading into 2024.

Dear Readers,

Welcome to 2024. The dust has settled, infrastructure has matured, and we’re witnessing the convergence of several exciting consumer technologies. This is why, today, we’ll look at what’s next for consumer brands in Web3.

We’ll cover:

The ongoing Web3 transformation

What’s next for key verticals:

Tokenization & phygitals

Loyalty

Community & commerce

Data & insights

Infrastructure

The big picture

We’ve got a big year ahead. This will help you meeting 2024 well prepared.

Ready? Let’s jump in.

⏱️ Reading time: 10min

The Ongoing Web3 Transformation

Before we dive into specific trends, let’s zoom out for the bigger picture.

This isn’t about quick bucks, crypto-degenerative gambling or a bunch of overpriced JPEGs.

Web3 is more – much more – than that.

It’s a commerce protocol for the internet, a new era for customer engagement, and a new data layer.

Justin Banon from Boson even describes it as the groundwork for a "computable economy, as all products and services are moving on-chain.

In short: Web3 is a programmable transaction layer for digital and physical goods.

Here’s another way to think about it:

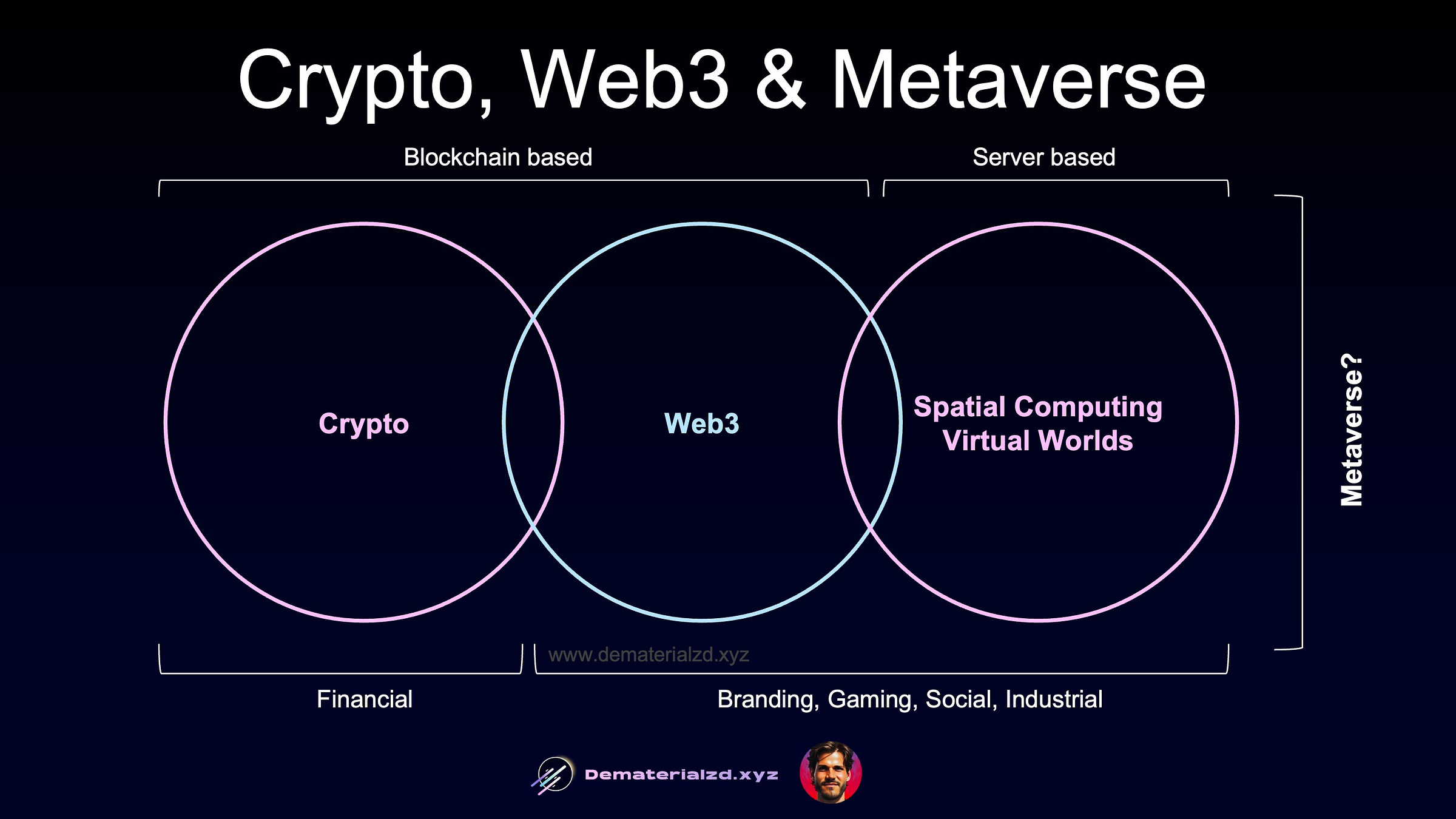

Over the last three years, three distinctive consumer tech verticals have emerged: crypto, Web3, and virtual, immersive words.

Crypto enables programmable, decentralized transaction of value. Web3 does the same, but with goods.

Being blockchain-based, they both hinge on two core principles:

1) Digital ownership, scarcity, and transferability of assets and

2) a wallet centric interaction model: The wallet becomes the user's main point of interaction.

The third category includes virtual, immersive applications, spurred by new hardware (AR/VR headsets, faster chips), social gaming platforms (Roblox, Fortnite, The Sandbox, etc.) and generative AI. Apple now calls AR “spatial computing”.

These three verticals are converging and enabling new financial, marketing, gaming, social, and industrial applications for businesses.

In short: They transform how consumers and businesses interact and relate, opening new paths for collaboration and communication, blending multiple open and interoperable technology layers.

Partner with us

⚡️ Get in front of 8,000+ of Web3 leaders 👀

Partner with Dematerialzd to get your brand in front of thousands of Web3 industry leaders. Get in touch today or reply to this email.

What’s next: Web3 for consumer brands in 2024

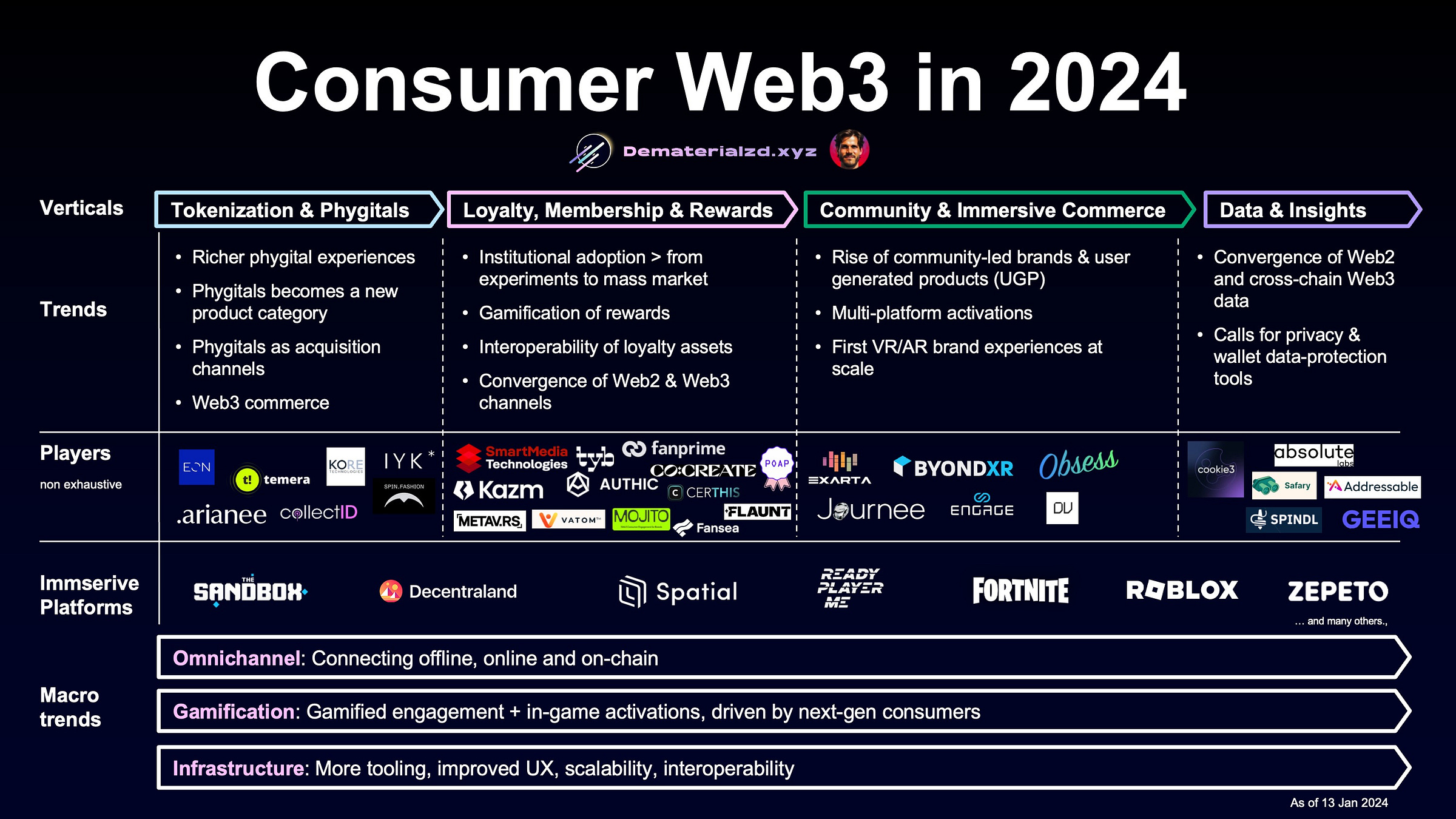

Throughout the last cycle, we’ve seen four (or five) emerging Web3 consumer verticals:

Data & Insights

(Infrastructure)

We’ve also seen case studies from brands that combined multiple verticals with one activation.

Let’s quickly dive into each vertical.

Tokenization & Phygitals

In 2023, brands like Dior, Nike, Louis Vuitton, Lamborghini, Adidas, Puma, and others launched phygitals. They enable brands to:

launch blockchain-secured limited editions,

authenticate of products,

engage in post-purchase marketing,

establish direct customer relationships,

and gather more first-party data.

And I think in 2023 we were just scratching the surface.

For 2024, I see four big trends:

Major consumer brands will launch standalone virtual collections and more phygitals, making them a new product category for consumer brands.

Richer, more engaging, phygital experiences, driven by a new wave of Web3 ready, digitally native consumers. Phygitals will turn from top-of-the-funnel collectibles to powerful experiences within a brand’s ecosystem.

Phygitals as acquisition channels: Phygitals help brands to win pack direct consumer relationships previously lost to retailers. Suddenly, physical products turn into acquisition and engagement channels. This is massive.

Trust-minimized, tokenized commerce: This will unlock buying and selling of phygitals without relying on intermediaries – DeFi style, with complete freedom to transact (Boson, a partner of Dematerialzd, is the go to protocol enabling that).

Further, I believe we’ll see further distinction of three categories of providers:

Infrastructure: EON, Arianee, or KORE Technologies who are focused on equipping big brands with the blockchain tech needed for the Digital Product Passport and Temera, providing the hardware.

Marketing: Swiss-based CollectID, Vivents, or New York-based Solaire and IYK, or fashion-focused platforms like SPIN (and many more!), focusing on the end-user experience of phygitals.

Digitization: Virtual-only fashion platform The Fabricant, Avolve, and Republique, marketplaces such as DressX, players who turn physical into digital such as NAK3D or digital into physical such as PhygitalTwin or start-ups like SOL3MATES or Endstate, facilitating phygital drops.1

The third group will be particularly important as brands will have to meet next-gen consumers where they spend time, socialize and express themselves: online.

To give you an idea:

70% of Fortnite players said they’d bought special outfits and characters – for no in-game benefit other than looking cool.

In the latest Roblox study, 56% of Gen Z users now say styling their avatar is more important to them than styling themselves in the physical world. 50% “very” or “extremely likely” to consider a brand in the physical world after wearing or trying a brand’s item virtually.

Owning virtual products might become a top-of-the-funnel gateway drug, enticing consumers to explore and invest in the brand's physical products and experiences. Brands will have no choice than to go virtual.

Loyalty & Rewards

Loyalty is the talk of the town. Just recently, Visa announced their Web3 loyalty solution, powered by SmartMedia Technologies (partner of Dematerialzd).

In 2023, brands Starbucks, Fiat, 7-Eleven, Alo Yoga and many more started Web3 loyalty activations.

The reason? Web3 makes loyalty assets:

transferable (own & cash out)

programmable (adapt to consumer behavior)

authentic (can’t be forged)

more personalized (through first-party data)

At the moment, I see two types of players with two competing narratives:

“Web3 for everything”- loyalty

Meaning: Web3-native providers (e.g. Co:Create, POAP, Certhis, Authic, etc.)

“Web3 as an additional channel” — feeding into a unified CRM

The power of “Web3 as a channel” is that it makes it easy for brands to reward everywhere (e.g. enabled by providers like SmartMedia Technologies, Kazm*, etc. ). *partner of Dematerialzd

The vision? An open, blockchain-based loyalty system across a brand’s ecosystem – or ecosystem of brands.

In 2023, big brands launched isolated Web3 loyalty experiments (e.g. Nike, Starbucks, Lufthansa, Alo Yoga, etc.). In 2024, I expect the first brands to roll out Web3 loyalty programs to their entire customer base.

Specifically, I see four trends for 2024:

Institutional adoption and first mass market apps

Gamification of reward experiences

Interoperability between brands and Web3 communities

Omnichannel experiences, connecting Web3 loyalty across digital and physical and different platforms (e.g. PepsiCo’s Roblox activation)

Many of these trends, including the convergence of Web3, gaming and brands, “multiplayer Web3: offline, online and on-chain” and interoperable loyalty (aka. “collaborative gating”) have been perfectly articulated in “It’s all a game” by Colleen Sullivan.

And Visa’s Web3’s loyalty solution is the perfect example of how all that will play together.

Community & Immersive Commerce

Here, I expect two big trends:

Community-led brands and user-generated products (UCP)

Multi-platform activations

Community-led brands

Token-based memberships, and social, gamified immersive worlds give rise to “community-led brands”.

These are brands with built-in ownership, fostering collaboration and shared value creation within a brand’s broader cultural narrative. These brands move from user-generated content (UGC) to user-generated products (UCP).2 3

Case in point 1: Nike.

In November 2022, Nike launched .SWOOSH platform.

.SWOOSH is set to be the hub of Nike’s Web3 activities and the primary interface for user interaction.

The platform’s first collection, "OurForce 1", inspired by the classic Air Force 1, was part of a co-creation contest, inviting users to design future virtual footwear that they later owned as NFTs.

Case in point 2: Pudgy Penguins.

In June last year, Pudgy announced its licensing platform Overpass, aiming to streamline license payments by using blockchain.

In 2024, Pudgy will start licensing Penguins from their community by featuring community-owned Penguins in products, animations, branded experiences.

Pudgy toys are the first mass-market NFT IP product licensed directly from the community.

This gives a glimpse of how digital assets will revamp traditional models of co-creation, co-participation and co-ownership.

I expect a lot more “community-collabs”, i.e. partnering and tapping into communities of other brands. Here’s a great table by Colleen Sullivan:

Multi-platform activations

Similar to loyalty, community and gamified, immersive commerce took place largely on isolated platforms.

For example: Gucci Town or Lamborghini’s Lanzador Lab in Roblox weren’t connected to other Web3 activations of the brand. Starbuck’s Odyssey community lives largely on a platform on its own.

In 2024, I expect brands to merge different formats (NFT collections, games, etc.) and platforms (Discord, social, Sandbox, Roblox, or owned worlds like Journee) to merge into a coherent, interoperable activations.

This means, that, for example, a winner in Lamborghini’s Lanzador Lab race in Roblox would be eligible for an NFT which can be redeemed at other places within the brand’s ecosystem.

Data & Insights

All activities on the blockchain generate a first-party data layer, saved in digital wallets — the primary user interface in Web3.

These wallets, while pseudonymous, can be linked to real-world identities by correlating wallet addresses with social media profiles.

Brands can deepen these user profiles by integrating email addresses collected from landing pages or marketing campaigns.

This allows brands to create targeted audiences. Preferences, interactions with decentralized apps (dApps), asset ownership, and community involvement are key factors in this segmentation.

Data is collected and connected when users connect their wallet to platforms or dAppos like Discord, The Sandbox, Decentraland, OpenSea, etc.

The principle is straightforward: the more popular the wallets, the more data brands can access. At least for now.

Two predictions for 2024:

The rise of omnichannel data integrators: As multichannel campaigns (offline, online, on-chain) become more popular, tools will pop up that help brands combining all that in a single interface (e.g. start-ups like Absolute Labs, Addressable, Cookie3, Safary or GEEIQ).

The call of data privacy: As cookies are fading out, we’re at an inflection point where Web3 user data is freely and openly accessible on-chain. It's likely we'll see either regulatory measures or technological solutions emerge to protect user data and foster opt-in experiences.

The Eagle Has Landed

In 2024, crypto, Web3 and virtual worlds will continue to converge.

Likewise, activations combining the four emerging Web3 consumer verticals will become richer, and more fun for consumers.

Brands will increasingly ask for all-in-one providers, offering services across the whole range of verticals. With collabs like Future+, combining forces of Insomnia Labs, Co:Create, Cookie3, Crossmint, and Smart Layer, we’ve already got a taste of how this might look like.

Across all verticals, I see three macro trends:

Infrastructure

From single to gamified omnichannel

Nex-gen consumers requiring new types of engagement.

Infrastructure

Here, I expect four trends:

Better tooling: Brands have now an immense range of solution providers to choose from covering the whole value chain, ranging from wallet onboarding (Magic*, Dynamic, Privy, Tweed, Web3Auth, etc.) to all-in-one user management or ready-made, individual building blocks (e.g. ThirdWeb, Venly, etc.). The quality and breadth of choice will only increase. *partner of Dematerialzd

Improved UX: Embedded wallets, MPC (multi-party computation), Account abstraction will simplify wallet UX massively. Learn more here.

Scalability: The number L2s for Ethereum is going to increase further. “Proto-Danksharding” (just ignore the name), will significantly reduce transaction fees for certain L2s. Meanwhile, highly-scalable L1 chains such as Solana, Sui, Aptos, or Near will likely emerge as Ethereum alternatives for brands.

Interoperability: Cross-chain wallets and better bridges will further reduce frictions of switching between protocols and applications.

From Single to Gamified Omnichannel

For example, standalone activations we’ve seen in 2022/2023 were:

Attach a digital product passport to a physical product (e.g. Dior B33 sneakers)4

Drop digital product to redeem for a physical one (e.g. Gucci Material NFTs)

Issuing membership NFTs for access to a brand-community (e.g. Porsche, Lacoste UNDW3, GQ, Casio G-Shock Community, etc.)

Creating virtual branded worlds (Gucci Town in Roblox, the Lamborghini Lanzador Lab on Roblox, Macy’s Mstylelab, etc.)

Issuing loyalty rewards (e.g. Lufthansa Uptrip)

or simply releasing digital collections (e.g. Adidas X Moncler “Explorer”, Coca-Cola “Masterpiece”, Karl Lagerfeld “Tribute Collection”, Mercedes-Benz NXT Icons, Maison Margiela’s NFT drop5, etc)

… will turn into cross-channel, cross-platform, gamified, and community-driven product and loyalty experiences.

Nike (.SWOOSH), Starbucks (Odyssey) or Fiat (Fiat Pass) have already hinted at how such unified engagement journeys could look like.

Next-Gen Consumers

Thanks to a new Web3 data layer, activations will become more personal and meaningful, aligning perfectly with the expectations of next-gen consumers.

First, they’ve grown up socializing and co-creating on social, gamified platforms and worlds like Roblox or Fortnite. In the U.S, 38% of Gen Z spend over four hours a day on social media. Roblox has 100m Gen Z users, spending 2.6 hours on Roblox – every day!

They’ve witnessed the rise of social brands, grown big through on social media through shared value creation within their broader cultural narratives.

They’ve been part of the creator economy, fuelled by new tools, enabling anyone to create, own and monetize anything online.

And hey've seen the internet become a place where a few big platforms use their data for profit. They know what it means to have, or not have, control over their data.

Next-gen consumers value ownership, participation, and agency in the things they do.

And they seek out an active and fair value exchange with the brands they interact and identify with.

Web3 facilitates this.

This is why I expect 2024 to be a massive year for crypto and for consumer Web3.

The eagle has landed: Infrastructure is ready, the tooling is in place, and the mindset of brands is shifting.

It's a cultural paradigm shift, or “the foundation of a new supercycle that is user-powered and community-centric,” in the words of Joe Lubin, Co-Founder of Ethereum.

Let’s buckle up for a transformative year.

Onwards.

– Marc

PS: If this was helpful, please share it with your friends to support Dematerialzd.🙏 And stay tuned for some exciting updates.

Follow me on LinkedIn for shorter insights on Web3.

👉 I would love to hear from you! Reply to this email with feedback.

Sol3mates is part of Chalhoub Group, one of the leading luxury retailers in the middle east.

Shoutout to Aleksija Vujicic who articulated this perfectly in her essay “From UGC to UGP: Consumer Brands & Co-Creation”.

Deep dive 1: Community, Culture & Brands

Deep dive 2: A Web3 Community Formula for Brands

Luxury brands such as Hublot, Bulgari, Dior, LVMH or Prada are working with the Aura Blockchain Consortium to bring digital twins of their products on-chain to ensure product traceability and authenticity. Upcoming EU regulation mandate a Digital Product Passport (DPP) for product traceability and life cycle information. Consumers wouldn’t need to rely on the brand's word and could easily verify the authenticity of a product.

Interesting about this drop is the gamified minting experience.

Marc, do you have a PhD?

The best content for how to ease explain about what web3 is

This is why I love your newsletter - You nailed this one with your deep dive into the transition happening. We just started with announcing our recent ENS's, with our first attempts at Digital Art in the works - Many of the brands you mentioned are some of our existing partners for many years so it makes total sense for us to work with them in the digital world in addition to the traditional methods that our organization has done for many years.