What is going on with Grayscale Bitcoin Trust (GBTC), the world’s largest crypto fund?

Shares of the world's largest crypto fund ($10.5bn) are trading at 40% discount to the value of its holdings. What does this mean? Why does this matter? And should we be worried?

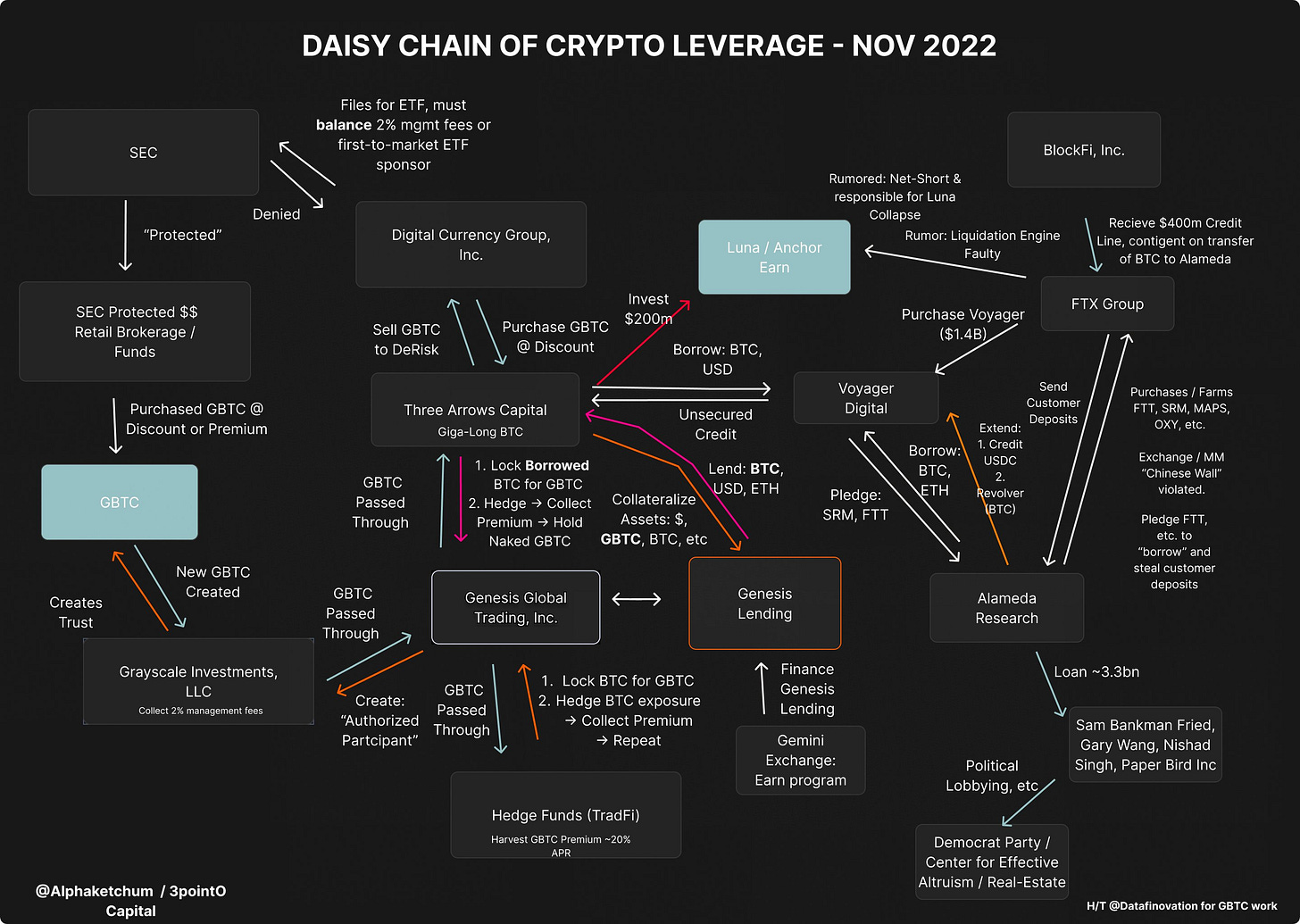

Another week, another story. There’s as lot of buzz about Grayscale Bitcoin Trust (GBTC), its connection to FTX, DCG (Digital Currency Group), Three Arrows Capital (3AC), and Genesis, its dangerously low discount rate and its risk of being liquidated. It’s pretty entangled. I dug into some of the details on how it all works:

GBTC is the world’s largest cryptocurrency fund, owning about 3.5% of the world’s Bitcoin (643’572 BTC). Since its inception in 2013, it has attracted a large amount of institutional investors.

Investors don’t receive bitcoin (BTC) but shares representing BTC. GBTC buys and stores the underlying BTC (apparently at Coinbase) and takes a 2%/year management fee. At the moment, GBTC holds 0.00091487 BTC per share. With Bitcoin at around $15’600 it should trade at roughly $14.27. Instead, it closed yesterday at $8.50, a 42% discount.

Why does GBTC trade at discount?

During the bull market, GBTC was trading at a premium. For institutional investors, it was one of the few ways to get exposure to Bitcoin. Increased options for BTC exposure, new Bitcoin spot ETFs (except in the US), a bull market turned bearish, and the recent short-term price pressure from the FTX contagion all decreased the demand in GBTC, as institutions sold their (semi-)liquid assets. Its premium decreased.

While GBTC was trading at a premium, folks were buying BTC on the market, sending it to the trust in exchange for shares, then selling the shares to capture the premium. Now, as it’s trading at a discount, you could gain exposure to $1 of Bitcoin with 60 cents of GBTC – So why isn't everyone doing it?

Because the opposite is NOT possible: Investors cannot redeem shares for BTC and sell it in the market to arbitrage the discount away (as publicly specified in the Trust agreement). GBTC does not allow redemption. Investors can only sell the shares at a loss against USD. This is why GBTC trades at a discount.

Why wouldn’t Grayscale allow redemptions? It's possible that they might be (a) buying time for that 2%/year fee and (b) buy back shares at a deep discount before allowing redemptions to spike the price. Who knows. SEC regulatory statements filed Q3 2022 indicate that Grayscale has made over $302m in YTD fee revenue from GBTC.

Why are investors worried?

Investors are worried. Why?

Unlike many other CEXs, Grayscale is not disclosing its “proof-of-reserves”, meaning the blockchain address on which the BTC are stored, unlike many others. Nevertheless, Coinbase custody backs Grayscale’s claim.

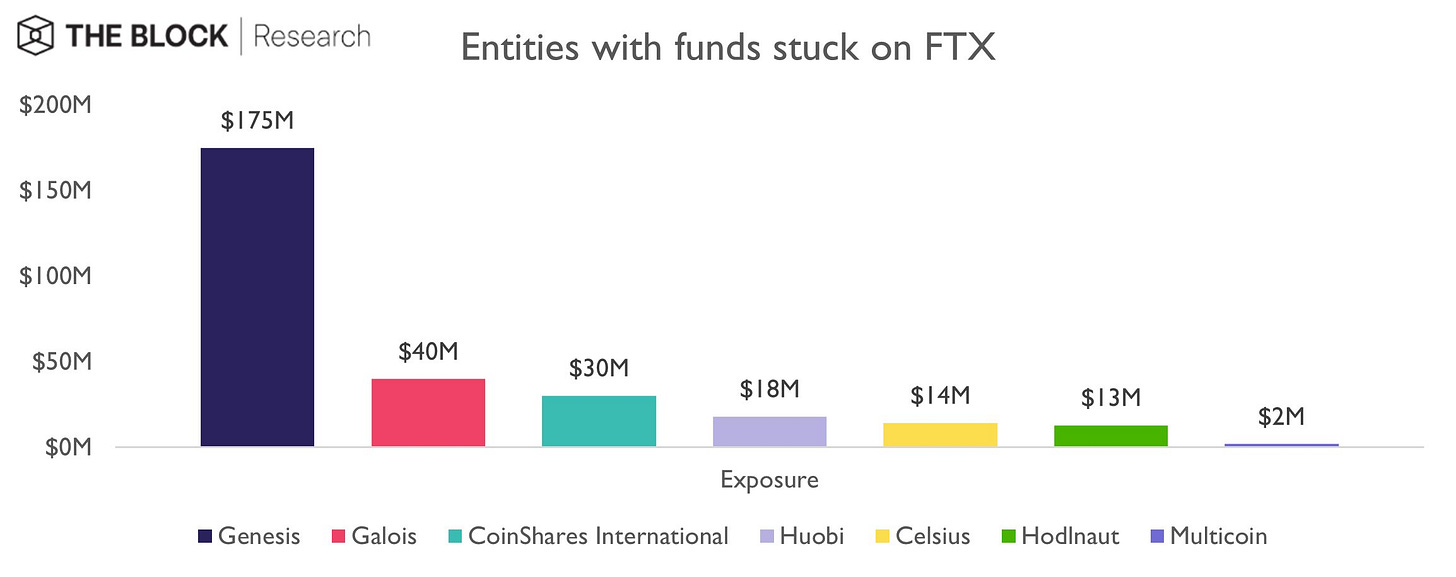

This comes in the wake of sister company Genesis, a BTC prime broker, halting withdrawals and new loan originations. GBTC and Genesis are both subsidiaries of DCG, a Stamford, Connecticut-based venture capital company. DCG is rumoured to have very little remaining liquidity after infusing $140m of fresh capital into Genesis last week, after Genesis had lost $175m of funds in the FTX collapse.1 Genesis’ lending business has already been hit by the failure of 3AC, the Singapore crypto hedge fund that filed for bankruptcy in July. Word on the street is that this poses an indirect risk to GBTC of being liquidated.

Many recent GBTC investors speculated that the SEC would approve a GBTC spot ETF in the near future. This would make GBTC freely tradable on an exchange, close the discount gap immediately and bring it on par with the net asset value (NAV) respectively.2 Investors would cash in the discount. However, given the current climate, and given that the SEC already denied a previous GBTC spot ETF application, it's expected that the SEC approve it in the near future. This locks investors into a position that might trade sideways for a long time, while Grayscale rakes 2%/year management in their own pockets (without really managing anything).

The only way go get out of this position is to sell GBTC shares to other investors at a loss. The only problem is that not enough buyers exists, driving the discount further down.

Why would someone by GBTC at a discount anyway?

For the following reasons:

Not so long ago, GBTC was one of the only ways for investors to get exposure to Bitcoin without actually buying the BTC. Institutional interest over the last three years increased massively.

GBTC’s ability to be held in certain tax advantaged accounts, like Roth IRA. Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and earnings can grow tax-free, and you can withdraw them tax- and penalty-free after age 59½ and once the account has been open for five years.

To speculate on a SEC approval of the GBTC spot ETF, cashing in the discount.

The connection of 3AC to GBTC

GBTC’s issuance of new shares is done through private placements. These private placements are done through a rule exception which only allows subscriptions for accredited investors (see GBTC disclaimer). These subscriptions come with a six-month lock-up period.

As a regulated product, GBTC allowed investors like 3AC to purchase shares directly by giving bitcoin to the trust. Holders could then sell the shares on over-the-counter markets for a premium (at that time, GBTC was still trading at a premium) – which netted a sizable profit for holders and became an attractive trade among investors.

As GBTC shares were locked for six months, falling prices led to holders taking on losses instead of profits. 3AC was one of the largest holders of GBTC.3

The story is unfolding

It’s been reported that Genesis is on the brink of bankruptcy if it doesn’t secure funding soon. Given that DCG not only owns Genesis, but GBTC, CoinDesk, Luno, TradeBlock and Foundry, this could be a tail risk for the whole industry.

At the moment, DCG is interested to keep GBTC alive, as they generate hefty fees with it ($302m YTD, $433m in 2021). Liquidating GBTC would also mean open-market selling bitcoin currently worth $10.5 billion at a 40% discount. This would be a shockwave for the market. Many troubled firms are also likely still holding (and buying) GBTC (e.g. ARK Invest). Once assets are liquidated, this could lead to even steeper discounts in GBTC, putting more firms at risk.

Let’s hope the best.

PS: Please let me know you’re thoughts and whether I missed something in the comments! We’re all learning. 🫡

Sources and further reading:

https://blockworks.co/news/the-grayscale-dilemma-a-record-discount-and-a-golden-goose

https://seekingalpha.com/article/4558910-gbtc-heres-why-discount-became-larger-still

https://seekingalpha.com/article/4429761-the-price-for-grayscale-bitcoin-trust-makes-sense

https://www.ft.com/content/29a2f96f-6d9b-4593-abdf-ffaadc502951

https://www.coindesk.com/business/2022/07/22/three-arrows-capital-founders-says-terra-gbtc-trades-led-to-fund-blowup-report/

https://www.bloomberg.com/news/articles/2022-11-14/-broken-crypto-fund-hits-record-42-discount-as-etfs-hum-along

This means buying GBTC, redeeming the Bitcoin, selling it, and repeating the cycle until GBTC and Bitcoin trade at "fair value" (NAV).

Bankless reports:

Genesis was a primary lender to 3AC. According to an analysis of publicly available SEC and investor filings by DataFinnovation performed back in July, Genesis was essentially lending at its single counterparty limit to 3AC.

The analysis speculates that in exchange for collateral, 3AC would borrow BTC from Genesis, return the BTC to Genesis to create GBTC (Genesis is the only Authorized Participant who can create shares of GBTC), and provide the GBTC back to Genesis to restart this circular process.

When GBTC was trading at a premium to BTC, 3AC was essentially creating free money and using the profits to increase exposure to GBTC and other crypto assets. Assuming that the premium held, 3AC could theoretically repeat this arbitrage process forever.

If GBTC were to be sold, would there be risk in holding its shares?

Selling all that bitcoin onto the market would tank the price of bitcoin, destroying value for all the shareholders, many of whom would probably be happy just to take possession of their share of the bitcoin.

It seems like, whoever owns GBTC has no interest in unwinding it, since they'd lose these hefty fees. It seems like what they'd probably prefer to do is just drag their feet on the SEC application while stocking on up their own shares prior to approval.

3AC got rekt by GBTC:

https://medium.com/@michelcryptdamus/3ac-and-blockfi-made-the-same-exact-dumb-trade-and-seem-headed-for-the-same-place-cd5a1dfd2eb