Stripe's Endgame

How Stripe is building the world's first unified fiat-crypto payment stack at scale.

Since 2016, every "crypto goes mainstream" story felt forced.

But lately, this changed.

Stablecoins and payments have emerged as the killer use case. And over the last months, Stripe went all-in on this:

Acquisition of Bridge, a stablecoin infra company, for $1.1B in February 2025

Launch of stablecoin accounts in 101 countries in May 2025

Acquisition of Privy, a crypto wallet provider with 75M users in June 2025

Stablecoin integration with Shopify & Coinbase in June 2025.

Today, we unpack how Stripe is assembling the world's first end-to-end crypto infrastructure monopoly.

The problem

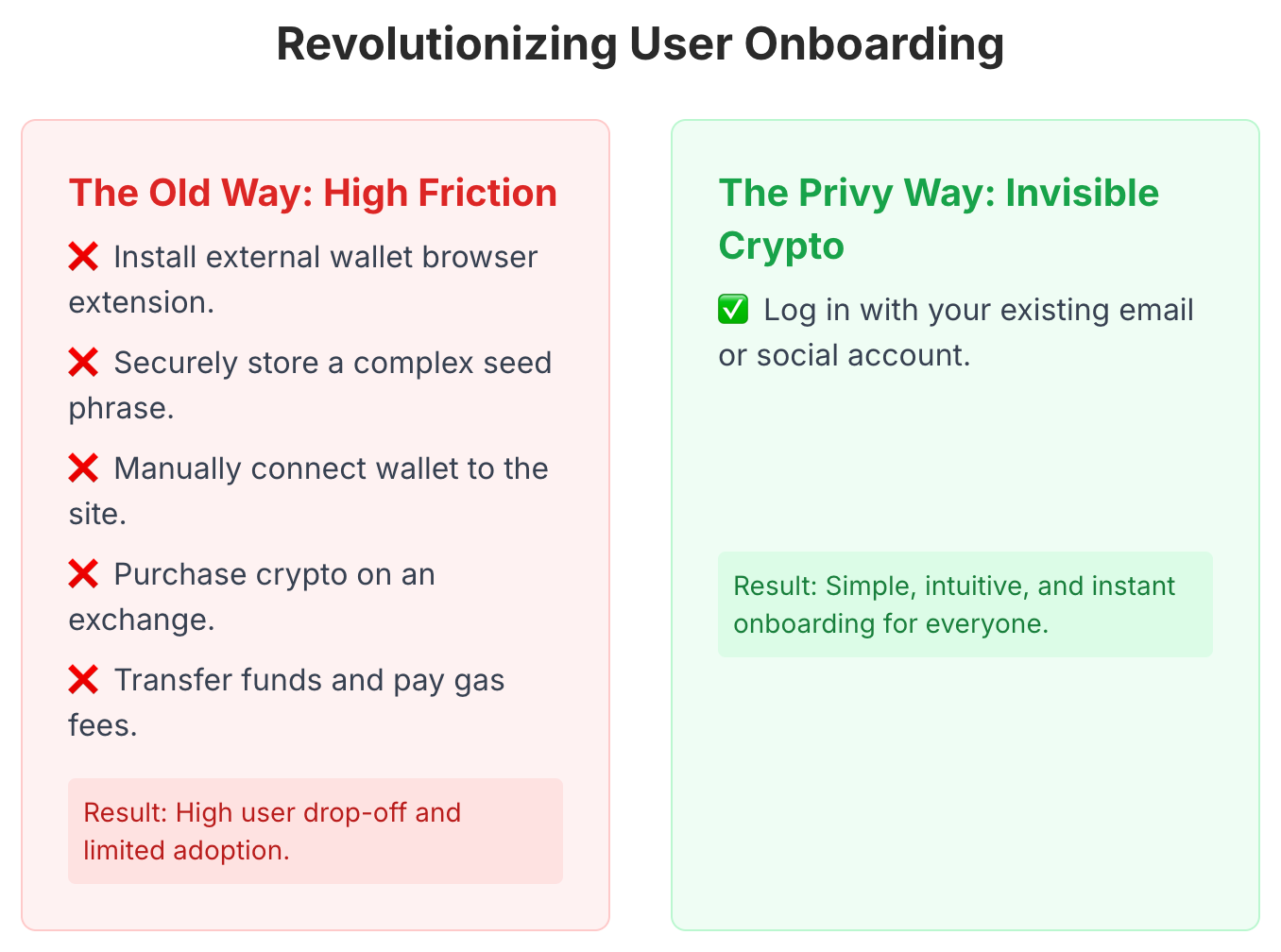

Crypto has (or had?) a problem: it’s impossibly hard to use.

Want to buy something with Bitcoin? First, download MetaMask. Write down 12 random words on paper. Figure out gas fees. Navigate five different blockchain networks. Oh, and pray you don't lose that piece of paper, because if you do, your money vanishes forever. On top of that, where do you convert back to fiat? (try MoonPay, one of our partners)

Result? 95% of people who try crypto give up immediately.

This has held back mass adoption for 15 years. Every crypto company accepted this complexity as the price of decentralisation. Everyone except Stripe.

We help teams like Avalanche, Near, and MoonPay drive awareness, institutional credibility, and deal flow. We’re not a marketing agency. We are native industry veterans and operators with 10+ years in the space.

The opportunity

Stripe isn't just improving payments—they're targeting three massive markets simultaneously:

Cross-border payments: $212B annual market dominated by expensive, slow traditional rails

Embedded finance: $7.2T market by 2030, where every app becomes a bank

Crypto infrastructure: $50B+ in transaction processing as digital assets go mainstream

The convergence of these markets creates a "once-in-a-decade" infrastructure opportunity. Stripe positioned to capture it by building what no competitor can quickly replicate.

The chess game

In February 2024, Stripe made an unusual declaration in their annual letter: "Stripe's platform will be the best way to build with stablecoins."

Most dismissed this as corporate fluff. Stablecoins, cryptocurrencies pegged to the dollar, seemed like a niche product for crypto traders. But Stripe saw something different: digital money that moved instantly, cost almost nothing, and worked everywhere.

The problem? Two massive gaps in the market:

Backend infrastructure: Who creates and manages stablecoins at enterprise scale?

Frontend experience: How do normal people actually use crypto without losing their minds?

So, Stripe went shopping.

Move One: Buy the Pipes

Bridge wasn't just any crypto company. They built the invisible infrastructure that powers stablecoins, the digital equivalent of Federal Reserve operations.

When Stripe paid $1.1B for Bridge in February, they bought:

Stablecoin creation and management for enterprises

Compliance systems covering 100+ countries

The ability to move money across borders instantly, 24/7

Think of Bridge as Stripe's new central bank. Instead of printing dollars, they mint digital dollars that live on the internet.

Move Two: Buy the Experience

But having digital money means nothing if people can't use it.

Enter Privy, Stripe's second acquisition announced in June 2025. While Bridge handles the plumbing, Privy solved the user experience problem entirely.

Instead of forcing people through crypto's nightmare onboarding, Privy lets them create wallets with just an email address. No seed phrases. No blockchain education. No technical knowledge required.

The numbers tell the story:

75M active wallets

Used by over 1,000 developer teams

Powers major platforms like OpenSea and Farcaster

More importantly, Privy made crypto invisible. Users interact with apps normally while cryptocurrency flows underneath, hidden from view.

Map both acquisitions together and Stripe's strategy crystallizes:

Bridge (The Backend)

Creates digital dollars

Handles compliance and regulations

Manages enterprise-scale operations

Privy (The Frontend)

Makes crypto wallets as easy as email accounts

Handles user onboarding and transactions

Abstracts away all technical complexity

Combined, Stripe now controls the complete stack from digital money creation to consumer spending. No other company, not PayPal, not Coinbase, not traditional banks, can match this end-to-end capability.

👉 Get your brand in front of 35,000+ digital asset decision-makers — book your ad spot now.

There’s More

Traditional cross-border payments are broken by design. Sending $1,000 from New York to Mumbai involves:

3-5 day processing time

3-7% in fees

Correspondent banks in multiple countries

Business hours restrictions

Regulatory friction at every step

Stripe's new stack flips this entirely:

Instant settlement, 24/7

0.1% transaction costs

Direct peer-to-peer transfers

Global compliance built-in

Works through simple APIs

The business impact is staggering. Stripe processes $1.4T annually through traditional rails. Even capturing 1% of that volume through crypto infrastructure generates billions in new revenue at higher margins.

The endgame

This isn't just about better payments, it's about market control.

Who gets disrupted:

Visa and Mastercard: Face their first real threat in decades. Why pay 3% fees when stablecoins cost 0.1%?

Traditional banks: Cross-border correspondent banking becomes obsolete when money moves instantly across the internet.

Crypto wallets: MetaMask and Coinbase Wallet lose their reason to exist when every app can embed wallets directly.

Who's scrambling to respond:

PayPal and Block are racing to build similar capabilities but lack Stripe's developer ecosystem

Traditional banks suddenly find their JPM Coin initiatives looking primitive

Big Tech needs crypto strategies or risks irrelevance in digital commerce

Here's what most miss about Stripe's strategy: they're not just building better crypto tools, they're creating the AWS of money.

Just as Amazon Web Services became the invisible infrastructure powering the internet, Stripe aims to become the invisible infrastructure powering all digital commerce. Every transaction, every wallet, every digital dollar could flow through their systems.

The competitive moat builds itself. Once developers integrate Stripe's crypto APIs, switching becomes prohibitively expensive. The more successful apps built on Stripe's infrastructure, the stronger their network effects become.

The strategic question every company now faces: In a world where sending money becomes as easy as sending a text, who controls the pipes?

Stripe's answer is clear: they do.

That’s all for now.

Thanks,

Marc & Team

Stripe's focus and determination in laying the foundation is truly applaudable. However, I can't help but getting a somewhat "

eerie feeling who's truly "pulling the strings" here? I know this touches the area of conspiracy theories, BUT what they're building could be used for highly questionable activities if the wrong puppetmasters decides to enter/show up on the scene.