State of Play: Web3 & Gaming

The definitive state of play on gaming for consumer brands, including Web3 gaming, sector snapshot, actionable takeaways, and what's next.

Hey, it’s Marc ✌️

Gaming isn't just fun and games anymore — it's a marketing mega trend.

Over 80% of Interbrand’s Top 100 Global Brands are already tapping into its massive audience with immersive experiences in games like Roblox and Fortnite.

Meanwhile, the Web3 gaming market is booming, with over 3,100 blockchain-based games and a market cap of $23.5B.

In this deep dive, we'll explore why gaming has become a must-have strategy for consumer brands and how they can leverage this explosive trend to reach new audiences and boost engagement.

Today we’re going to out to look at:

State of play: Gaming is booming

Web3 games: Amplifying engagement

Web3 gaming ecosystem

Web2 studios going Web3

The opportunities for brands

Key take-aways

Let’s jump in. 🦈

1. State of Play: Gaming is Booming

The convergence of consumer brands and gaming is no longer a niche trend. With billions of active players worldwide, gaming offers an unparalleled opportunity to reach a vast and diverse audience that's deeply engaged with the content they consume and acquire first party data on consumers.

First, let’s frame the gaming market:

Overall gaming market: Expected to reach $189.3B (+2.9% YoY) market size in 2024 and $225B by 2029.

Gamer demographics: 4 out of 5 gamers are over 18, totaling 3.09B gamers worldwide, projected to increase to 3.32B by 2024.

Revenue projections: Video game revenue is set to rise from $262B in 2023 to $312B in 2027.

Regional leaders: Asia Pacific led the market with a 35.26% share in 2023, driven by China and India.

Mobile boom: Mobile gaming is a major driver, accounting for 45% of the global gaming revenue in 2022, with expectations to surpass $100B soon. The share of mobile gaming in worldwide gaming revenue has increased from 18% in 2012 to 59% in 2021.

The opportunity: Product placement in games seamlessly integrates brands into the virtual experience. Brands can achieve this through in-game advertising, branded items or characters, sponsored events, or entire branded virtual worlds. On top of that: co-creation and brand building with user-generated content.

By the numbers: Nearly half of gamers (47%) are more likely to buy from brands in their favorite games, and over 50% discover new brands while gaming. Additionally, about 54% of gamers engage with gaming through streaming platforms like Twitch and YouTube.

Brand enters gaming: 4 out of 5 of Interbrand’s Top 100 Global Brands are already in gaming / immersive commerce, creating engaging experiences and boosting visibility.

Notable examples include:

Nike's 2019 Fortnite collaboration, featuring Air Jordan skins, that kickstarted a trend of gaming brands partnering with luxury fashion.

Louis Vuitton's 2019 League of Legends partnership included creating in-game skins and a real-world fashion collection inspired by the game, blending high fashion with gaming.

KFC’s 2020 PUBG Mobile event and Travis Scott’s 2020 Fortnite concert also stood out, driving significant player engagement.

Other brands that successfully integrated gaming into their marketing strategies include Gucci x Tennis Clash, Balenciaga x Fortnite, Wendy’s x Fortnite, Burberry x Honor of Kings, Adidas x Fortnite, and McDonald’s x Pokémon GO.

Noteworthy:

Roblox: 3.2B virtual transactions, 70.2M daily active users, $1.1B in creator earnings (2021-2022).

Mobile Gaming: LiveOps (Live Operations refers to the ongoing management, updates, and content releases that occur after a game's initial launch) generated $18.6M in revenue from the top 10 games in 2023.

Counter-Strike 2: Players unboxed over 400M cases, spending $980M.

Dmarket: Over 46M transactions after the Mythical Games acquisition.

📊 Data Drop: Top Brands in Gaming / Immersive Commerce

We have curated a dataset of 150+ of immersive commerce / gaming activations of major consumer brands. Subscribe to PRO to get free access to all the data (at the bottom of the article) 👇

#1 Case Study: Adidas

Adidas launched the customizable Three Stripe Squad Bundle in Fortnite, featuring Adidas-inspired characters and accessories.

Zooming in: The Three Stripe Squad Bundle included five unique skins, each priced at 1,500 V-Bucks, along with other items. Watch how it works.

The bundle allows for extensive customization, including the selection of human and creature heads, color zones, and LEGO-style options.

It was available in the Fortnite Item Shop from July 23 to July 29, 2024.

Be smart: The take rate (aka the platform fee on sales) on Roblox is considerably higher than the estimated 30% on Fortnite.

Stepping back: Adidas launched its first digital clothing NFT collection, "Into the Metaverse," in December 2021. In July 2024, it released "Adidas Onchain: Summer of Sports," an NFT collection in collaboration with Ethereum L2 Base, followed by a partnership with Manchester United to launch its phygital collection on Roblox.

Why it matters: By introducing in-game skins and items, Adidas is tapping into a growing trend where virtual and real-world fashion intersect, appealing to a younger, tech-savvy audience. This multi-faceted approach, including NFT collections and collaborations with platforms like Fortnite and Roblox, positions Adidas at the forefront of Gen Z consumer engagement, driving brand awareness, loyalty – and hopefully revenue.

Nike launched the "Airphoria" initiative, introducing exclusive in-game outfits, including Air Jordan-themed skins on Fortnite before, but Adidas’s approach is more streamlines with multiple gaming marketing strategies.

👉Want to get into gaming and accelerate your growth? Work with us here.

#2 Case Study: OneFootball

OneFootball, Germany’s leading digital football platform, has launched the OneFootball Club (OFC) in partnership with Animoca Brands.

Why it’s important: Built on the L2 blockchain base, it’s the first digital football club designed to recognize and reward the most engaged football fans globally. They boost fan interaction and set the stage for engaging Gen Z, addressing the decline in sports viewership among younger generations.

Zooming in:

Founded in 2008, OneFootball has over 200M active users, backed by top football clubs worldwide, and partners with over 200 clubs, leagues, and broadcasters.

Since February, the alpha version engaged 300K+ users, with the next phase launching in July 2024.

Moca Network Partnership: Introducing the .football digital passport to track and reward fan engagement.

New Game: Launched "OneFootball: Striker" on the blockchain-powered gaming platform "Arc8".

They have ventured into web3 before but shut down their AERA NFT marketplace in 2023 due to low user engagement and financial struggles, including significant debt to football leagues.

The big picture: OneFootball is betting on loyalty. They aim to onboard 200M football fans to Web3 through gamification and digital collectibles, integrating Web3 into their Web2 ecosystem.

Their vision? To become the top football marketplace for content, services, and products.

📊 Data Drop: Top Brands on Roblox

We have curated a dataset of 100+ top brands on Roblox and their activation in immersive commerce. Subscribe to PRO to get free access to all the data (at the bottom of the article) 👇

2. Web3 Games: Amplifying Engagement

Web3 games, or blockchain games, use blockchain to give players true ownership of in-game assets and offer developers more creative options.

These games enhance user engagement and monetization through decentralized elements like NFTs and in-game currencies.

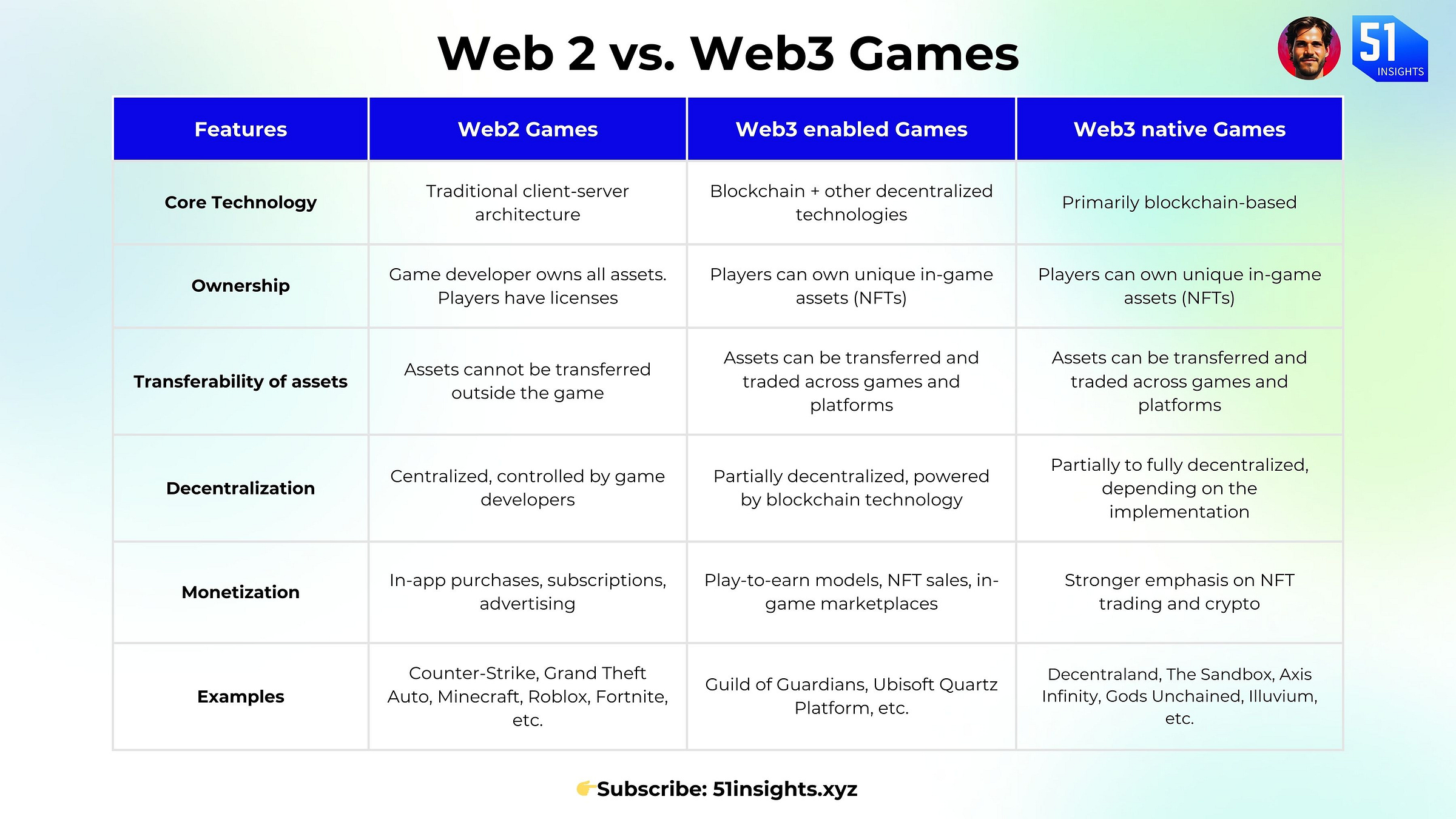

Web2 vs Web3 Enabled vs. Web3 Native games

Web3 enabled and Web3 native games are often used interchangeably:

Web3 native games emphasize decentralization, user ownership, and interoperability using blockchain.

Web3 enabled games, a subset of Web3 games, focus on asset ownership and trading and can be centralized and decentralized.

Web3 native blockchain games align with Web3 principles, while centralized ones use blockchain for specific functions but remain controlled by developers.

Key Features of Web3 Games

Web3 games shift the power from game developers to players, creating a more equitable and engaging experience.

Let’s look at 5 key features:

Ownership: Players in Web3 games own their in-game items, characters, or virtual land as non-fungible tokens (NFTs), which fosters a sense of investment and value, driving deeper engagement. Players can earn, trade, or sell these assets, creating real-world economic incentives to participate and play. Example: Players of Axie Infinity own Axies (digital creatures) as NFTs, which they can breed, battle, and trade on the marketplace.

Interoperability: Web3 games enable in-game assets to be used across multiple games and platforms, leveraging blockchain technology. This enhances the value and utility of assets, creating a more interconnected and versatile gaming ecosystem. Example: Items earned or purchased in The Sandbox can be used in other Web3 games that support the same blockchain standard (e.g., Ethereum ERC-721).

Governance: Development policies, and content moderation. In Web3 games, players influence game updates and policies through decentralized autonomous organizations (DAOs), boosting engagement and loyalty. Example: The Decentraland community governs the virtual world through the DAO, deciding on land use.

Monetization: Web3 games like Play-to-Earn (P2E) and Play-to-Airdrop (P2A) turn gameplay into a potential income source, boosting engagement and drawing a wider audience. Example: In Gods Unchained, players earn cards that can be sold or traded, allowing them to profit from their gaming skills.

Transparent and Fair Economies: Blockchain technology ensures transparency in in-game transactions, preventing fraud and manipulation. Example: Games like Gods Unchained and Decentraland build player trust and engagement by securing asset ownership and allowing players to influence the in-game economy directly.

Stepping back: CryptoKitties, launched in November 2017 by Dapper Labs, was the first game to use NFTs on the Ethereum blockchain, introducing true ownership and a play-to-earn model. After CryptoKitties, games like Axie Infinity, Decentraland, and The Sandbox gained traction, expanding the use of NFTs and blockchain in gaming.

Be smart: Financialization in gaming isn't new, but Web3 makes it more transparent and integrated by enabling open economies and property rights for in-game assets, enhancing the overall gaming experience.

⚡️ Amplify Your Growth

Building a Web3 business OR looking to innovate with Web3 tools? FiftyOne Labs is your unfair advantage. Powered by FiftyOne Insights, we combine what we know and who we know to help you win:

Capturing market & mind share with our 50k+ b2b audience

Full-stack content outsourcing

Developing a go-to-market and growth strategy

Reaching potential partners or clients

3. Web3 Gaming Ecosystem

The web3 gaming ecosystem consists of appchains, Web3 game studios, gaming NFT marketplaces, gaming projects, game tooling, and DAOs. It's built on the foundations of blockchain technology, empowering players with true ownership of in-game assets and giving them a voice in the game's development.

Web3 games often feature P2E models where players can earn cryptocurrency or other rewards for their in-game activities.

Indie games (42%) dominate the Web3 gaming landscape due to their agility, community-driven development, innovation, and financial incentives, while AAA titles (1%) like Illuvium and Ember Sword are still emerging.

Until Q3 2023, 81 gaming networks (65% gaming-specific) and 223 games were developed, indicating a strong focus on building gaming infrastructure in the Web3 space.

👉 Is your project missing? Please reply to this email with a logo and project description.

By the numbers:

Web3 Gaming Market: Valued $ 4.83B in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 68.3%, reaching $301.53B by 2030.

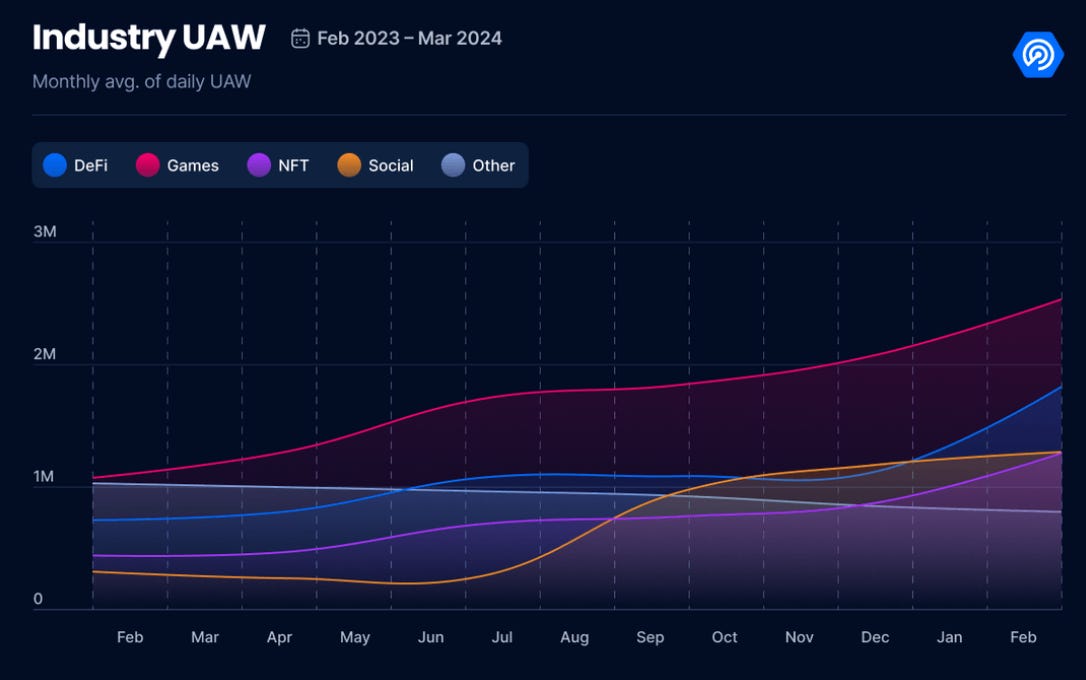

Web3 native Games: 30% of dapp activity, 2.1M daily active wallets, Polygon leads with a 429% increase in new daily wallets (1.1 million).

Daily Active Users: 3M in April 2024, despite market fluctuations.

Among the top 40 video game companies, 29 have ventured into web3, with 7 (24.1%) actively developing web3 games.

The Web3 Games Landscape

The Web3 gaming sector, while still in its early stages, is already home to over 3.1K projects, and there is a lot more to come. The space is still in the development phase and many top gaming studios are entering the space slowly.

The Web3 gaming landscape is diversifying beyond play-to-earn games, with genres like virtual worlds, collectible card games, and RPGs gaining traction.

The decentralized governance model is also becoming popular with Web3 games embracing community-driven developments.

👉 Is your project missing? Please reply to this email with a logo and project description.

By the numbers:

Indie web3 games currently dominate the market at a staggering 94%, with casual, RPG, and strategy genres leading the charge in attracting players with new strategies like P2A.

Blockchain gaming accounts for 30% of the total Unique Active Wallets in the Web3 industry

P2A games like Pixels have surpassed 600K DAU with the P2A model, competing with bigger P2E games like Axie Infinity and Splinterlands.

The play-to-airdrop strategy has doubled the activity of Polygon and Ronin chains.

Other projects that are gaining traction with P2A models: Illuvium, Nifty Island, Saga, Farcana, and others

What they are saying:

Carlos G. Pereira, Partner at BITKRAFT Ventures, one of the leading VCs in gaming with over $1B AuM:

“Gaming has always been important for some amount of younger generations for as long as games have been around. But having a platform, proliferation, and game types proliferation has allowed more people to find a game that they love. It's just a media type that people stick with.”

👉Listen to our full podcast with BITKRAFT here.

Robbie Ferguson, co-founder and President of Immutable:

“The main blockers to web3 gaming adoption have been infrastructure readiness (wallet creation) and content readiness (game development time). Additionally, the funding that went into web3 gaming over the past few years is starting to pay off, with high-quality games getting published.”

Devil’s advocate: Web3 gaming's slow mainstream adoption is due to the lengthy development cycle of quality games, compounded by evolving Web3 infrastructure and market disruptions, which often misalign with the faster expectations set by early token launches.

The Rise of “Play-to-Airdrop”

Challenges with the "play-to-earn" model are shifting the focus towards "play-to-airdrop." Blockchain-based gaming is now emphasizing gameplay mastery, skillset, interaction, and engagement.

Zooming in:

Game tokens utility: The focus has been shifted towards engagement and increasing value with two newly introduced utilities: Play-to-airdrop and verifier node sales.

Speculation and experience: Play-to-airdrop's speculative rewards incentivize developers to craft engaging games that retain players while fostering virality through airdrops.

What they’re saying: “Financialization has been around games for a very, very long time. As a matter of fact, every time that we connect a great game to the internet, um there's a parallel economy that emerges of varying sizes.” — Carlos G. Pereira, Partner at BITKRAFT Ventures

The bottom line: Blockchain games are majorly based on the play-to-earn (P2E) model and its sustainability is highly questionable. Play-to-airdrop is a new narrative but not the only narrative that can contribute to the gaming project’s success. It is a better and more sustainable alternative to the P2E model and helpful for developers (especially indie games) to create engagement with the help of token design.

To provide deeper insights, our database includes detailed information on the top 50 Web3 gaming projects. We are continuously expanding the list with added resources. Write to us to gain access to the database.

📊 Data Drop: Top 50 Web3 Games

We have curated a dataset of top Web3 games with detailed information, incl. user numbers, traction, etc. Subscribe to PRO to get free access to all the data (at the bottom of the article)👇

Web3 Gaming Investment Landscape

Over $1.5B was invested in blockchain gaming-related rounds in 2023, with $800 million dedicated exclusively to Web3 gaming

In April 2024, blockchain gaming investments soared to $988M, the highest since January 2021.

Andreessen Horowitz (a16z) is renowned for their $75M accelerator program and $600M fund targeting AI, VR/AR, and web3 games.

Sports and Metaverse-related MMO titles have significantly impacted funding activity, attracting over $1B and $990M respectively.

Venture Capital (VC) Investment in Web3 Gaming

BITKRAFT Ventures: BITKRAFT Ventures is a prominent venture capital firm focused on the gaming industry, particularly in the realm of Web3 gaming and emerging technologies. It has raised $275M for a third fund for early-stage gaming and interactive media companies investments. Once closed, this fund will bring Bitkraft Ventures’ total assets under management to over $1B.

Animoca Brands: Animoca Brands is a Hong Kong-based company that has emerged as a leading player in the Web3 gaming and metaverse space. They have invested in over 450 companies and projects, including The Sandbox, Axie Infinity, OpenSea and Dapper Labs.

Blockchain Game Alliance (BGA): While not a VC firm, BGA collaborates with various stakeholders, including VCs, to promote Web3 gaming. It has emerged as a leading organization in the Web3 gaming industry, helping to drive innovation and adoption of blockchain technology.

Web2 Going Web3

Several Web2 game developers have started exploring and integrating Web3 technology into their existing games to implement in-game digital assets, enhance player engagement, and offer new revenue streams.

Moreover, some companies are acquiring or investing in Web3 gaming studios to gain expertise and access to this growing market.

Major Web2 gaming studios are venturing into Web3, including Square Enix, Zynga, and Netmarble Games.

Let’s look at two examples:

1. Ubisoft

Ubisoft, a leading video game publisher, has been exploring the potential of Web3 gaming for several years, with a focus on integrating blockchain technology and NFTs into its games and platforms.

Ubisoft released HashCraft, a Minecraft-inspired blockchain game prototype where players can own and trade in-game assets as NFTs in 2018.

In 2021, it launched its first blockchain initiative, Quartz, which allowed players to earn and trade NFTs within the game.

It officially entered the space with the release of Champions Tactics: Grimoria Chronicles game, built on the Oasys blockchain. The game sold out its free Warlords NFTs in under 20 minutes, generating over $2M in sales, which is now trading on secondary markets.

Upcoming: Ubisoft revealed its upcoming blockchain game, Champions Tactics Grimoria, at Paris Blockchain Week, showcasing gameplay and emphasizing player ownership of digital assets. It is also planning to develop and expand the Quartz platform, integrating it into more games and offering a wider variety of Digits.

Why it matters: As a major AAA game publisher with a massive global audience, Ubisoft's experiments with blockchain-based games, despite community criticism, signal a serious commitment to this technology. Their efforts to create accessible Web3 games, like Champions Tactics (recently partnered with Double Jump.tokyo), which don't require cryptocurrency wallets, aim to bridge the gap between traditional Web2 gamers and the new Web3 ecosystem, potentially accelerating mainstream adoption, and bringing credibility and legitimacy to the sector.

2. Epic Games: Dipping Toes into Web3

Epic Games, the company behind the massively popular game Fortnite, has been cautiously exploring the Web3 gaming space.

Epic Games updated its content policy to allow blockchain games on the Epic Games Store, including those that feature NFTs and cryptocurrency mechanics.

It listed Mythical Games’ Blankos Block Party as its first NFT-based game, which closed in December 2023, to make way for the new Blankos Mobile.

By the Numbers: The Epic Games Store currently has 127 blockchain games listed on the platform, in contrast to its main competitor Steam, which has a zero-tolerance stance on blockchain-enabled games.

Devil’s Advocate: Although 69% of web3 games are free-to-play, however, only 4 out of 10 games are included in mainstream distribution platforms.

Be smart: The blockchain games are not widely adopted, but they are being watched and definitely listed on Web3 distribution channels. As Epic Games has entered the metaverse with a partnership with LEGO, Tim Sweeney, Epic Games CEO, has made it much clearer, that the state of gaming is going to change. Despite the listing of NFT games, Epic Games has not started developing web3 games but is expected to acquire a web3 game, Shrapnel.

Why it matters: Epic Games is enhancing user experience by introducing Web3 technology to mainstream games. As a leading PC game distribution platform, it shapes industry trends. Through gradual experimentation, Epic Games provides Web3 games with exposure to its 230 million users.

🔵 No PRO yet? Get a PRO subscription and profit from:

Weekly case studies and data-driven, strategic industry analysis on consumer Web3

Private community with exclusive content, virtual events, AMA’s with special guests & access to Marc

Access to top cheatsheets, lists & full archive

The Opportunities for Brands: From Attention to Profit-Sharing

As the gaming industry evolves, brands are moving beyond traditional marketing. They're now taking on integrated roles within games, creating new opportunities for growth and consumer engagement, brand loyalty, and new revenue streams:

Targeting younger audiences: Brands are aware of their future customers’ preferences. The gaming industry boasts billions of players worldwide and offers a unique platform to connect with them within immersive environments and create brand affinity.

Acquiring consumer data: With gaming, brands can collect valuable data on user preferences, purchasing behavior, and demographics. This data can be used to personalize marketing efforts, tailor product offerings, and enhance the overall customer experience.

Case Study: Karate Kombat

Karate Combat, a full-contact sports league, has adopted Web3 technology by launching a DAO and its governance token, $KARATE. This approach, combining live-action and CGI with fan-powered tokenomics, enhances fan engagement by removing third-party ads and incentivizing community participation.

So what?

The big picture: By turning their marketing budget into direct incentives for fans, they’ve pioneered a model that drives engagement and loyalty. Every sport club (and brand!) can adopt this approach, creating a dynamic, interactive ecosystem where fans not only watch but actively participate and profit.

Punchline: This isn't just a game-changer for sports. It’s a blueprint for any brand looking to foster a deeper connection with its audience.

We are going to publish a complete case study on Karate Combat next week to our subscribers. Make sure you’re signed up.

Take-Aways for Brand Leaders

While many brands have successfully ventured into gaming for marketing, some have also faced challenges and ultimately abandoned their efforts.

Reasons for Failure:

The games were developed with a primary focus on marketing rather than creating a fun and engaging experience. Example: McDonald’s Treasure Land Adventure.

Some brands failed to understand the gaming culture and audience, leading to inauthentic integrations and campaigns that felt forced or out of place. Example: Pepsi’s Pepsiman.

Some brands initially attracted good traction but failed to build a consumer connection due to the lack of a long-term gaming strategy. Example: Wendy’s Fortnite campaign

How can your brand do better?

Brands need to understand the gaming audience, create engaging and high-quality experiences, and develop long-term plans for community building and sustained engagement. Gaming marketing is multi-faceted and requires experimentation.

The one-off promotional games or campaigns without a long-term strategy can be a one-hit wonder, but will not be engaging for a more demanding gaming community.

One of the great examples is Moster Energy, which has consistently sponsored various esports teams and events but has not expanded its strategies beyond traditional sponsorships.

On top of that, Web3 technologies can be utilized as a tool to supercharge brand engagement and data collection.

Example: TON has adopted the same strategy to cater to the Telegram user base through gaming. It has made it simple to integrate branded mini-apps within Telegram and gain traction through games and incentive programs. A brand can create a mini-game for Telegram, reaching almost 1B users, 3x the amount of Roblox.

So what?

If you’re a brand leader, gaming should be on your radar. Platforms like Zepeto, Roblox, Fortnite, or Telegram have emerged as the next big consumer super-platforms with hundreds of millions of next-gen users.

This is a massive opportunity for brands to establish new, highly effective engagement and data acquisition channels.

We’ll publish deep dives on individual games, their mechanics, and how brands can take advantage of that. Make sure to be subscribed to receive it in your inbox:

📊 For access to all our research data, subscribe to PRO below. 👇

That’s it for now. Thanks for being part of the journey.

Talk soon,

– Marc & Team

PS: Follow us on Linkedin and X for more updates.

👉Want to get into gaming and accelerate your growth? Work with us here.

Keep reading with a 7-day free trial

Subscribe to 51 Insights to keep reading this post and get 7 days of free access to the full post archives.