OpenAI: Biggest VC Deal of All Time

OpenAI has raised a megaround of $6.6B, valuing the company at $157B.

It is the largest single venture capital round ever. In May 2024, xAI raised $6B Series B with a valuation of $24B.

Why it matters: Despite leadership turnover with the exit of CTO Mira Murati and others, OpenAI has maintained to earn investors’ confidence. However, this huge influx puts a greater focus on revenue growth and commercial success to justify the investment.

Zooming in: Thrive Capital led the round with $1.2B, with the option to invest an additional $1B next year if revenue goals are met. Other investors include Khosla Ventures, Microsoft, Nvidia, and more. Apple was in talks but did not join.

The funding will strengthen leadership in OpenAI’s AI research, expand compute capacity, and build tools.

It has asked investors to avoid backing rivals like Elon Musk’s xAI and Anthropic.

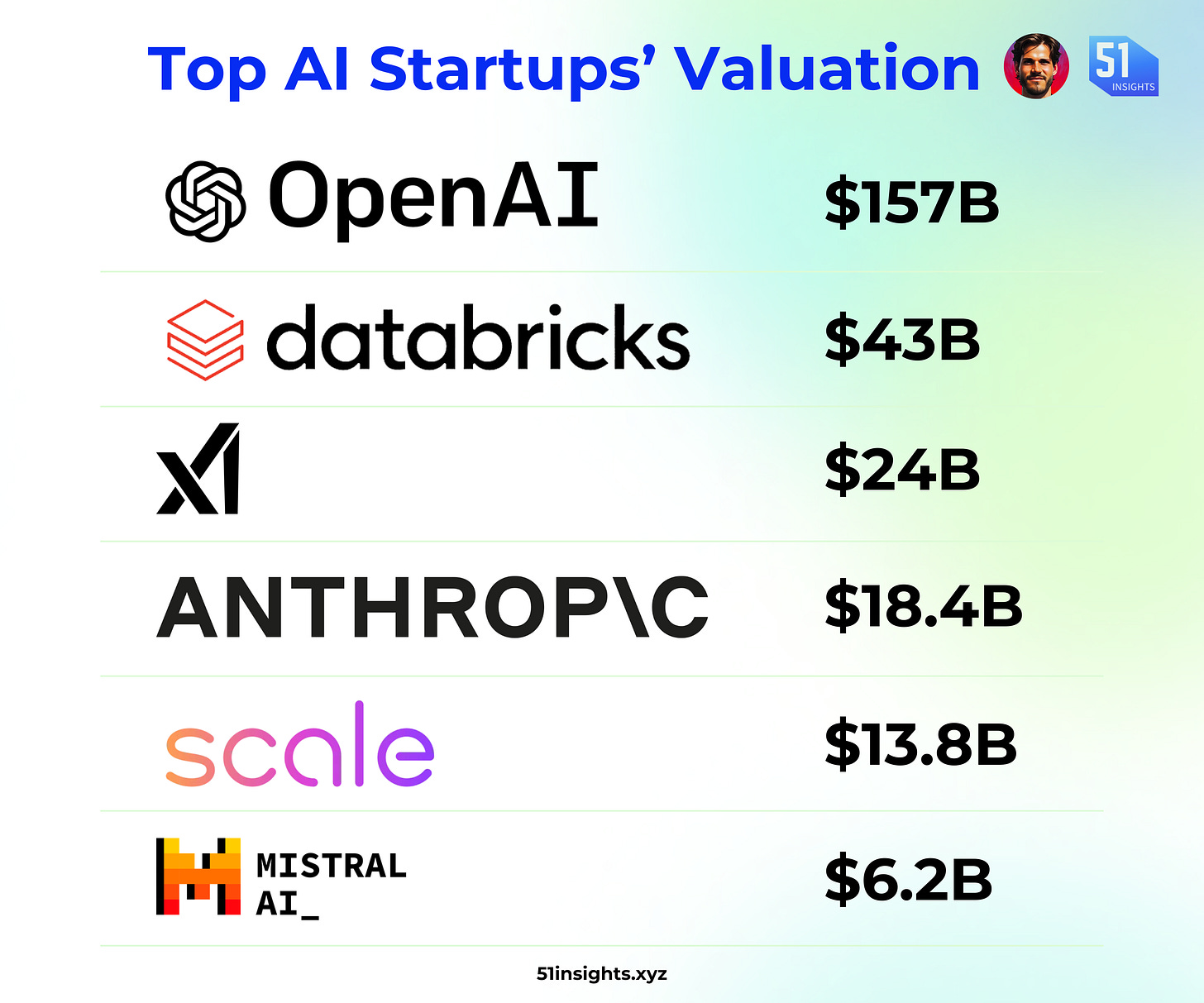

By the numbers: OpenAI has become the third most valuable venture-backed startup, following ByteDance and SpaceX.

It has the highest valuation among AI startups.

Stepping back: In January 2023, Microsoft announced a $10B investment in OpenAI over several years, gaining deeper access to AI tools like ChatGPT.

Devil’s Advocate: OpenAI is losing money. OpenAI is projected to generate $3.6B in revenue this year, with losses surpassing $5B.

ChatGPT has over 350M monthly users, but only 2.8% are paying.

OpenAI is investing close to $4B annually to maintain ChatGPT's operations.

The big picture: The company remains focused on achieving artificial general intelligence (AGI) while ramping up commercialization efforts.

OpenAI’s 10M ChatGPT users currently pay $20/month. The company plans to raise the price by $2 by year-end, with a more aggressive increase to $44 over the next five years.

It anticipates revenue of $11.6B in 2025.

OpenAI is competing with tech giants including Google, which is generating billions in revenue. While Google DeepMind has allocated over $100B in technology, OpenAI must balance Microsoft's backing with internal friction.

The company is also facing growing talent challenges as key researchers demand higher pay, while competitors like Safe Superintelligence intensify recruitment efforts.

Between the lines: Many AI companies, especially those in the early stages like xAI and Safe Superintelligence, have sky-high valuations despite limited revenue or proven business models. This could be a sign of a bubble.

👉 We are going to publish a story on the “AI bubble” next week. Subscribe to PRO to access:

The question remains: How will OpenAI find the path to profitability while resolving internal issues? Can OpenAI successfully balance its open-source roots with the demands of a profitable business model?

That’s all for today.

Talk soon,

51 Insights Research Team

PS: Before you go, here’s how we can help: Our research team & 50k+ B2B audience helps you:

Capturing market & mind share: We create enterprise-grade reports that we co-publish with you to elevate your brand, drive traffic, and amplify your B2B outbound conversion rates among corporate decision-makers.

Amplify your product: We sharpen your messaging and create qualified opportunities with research-driven, multi-channel growth campaigns.