Bitcoin in Times of Adversity

Just after Bitcoin's 13th birthday, the industry faces its most challenging time yet, smeared with scams, ponzis, and bad actors. Let’s remind ourselves where Bitcoin comes from and why we need it.

Private, decentralized, digital money

“The choice for mankind lies between freedom and happiness and for the great bulk of mankind, happiness is better.”

― George Orwell, 1984

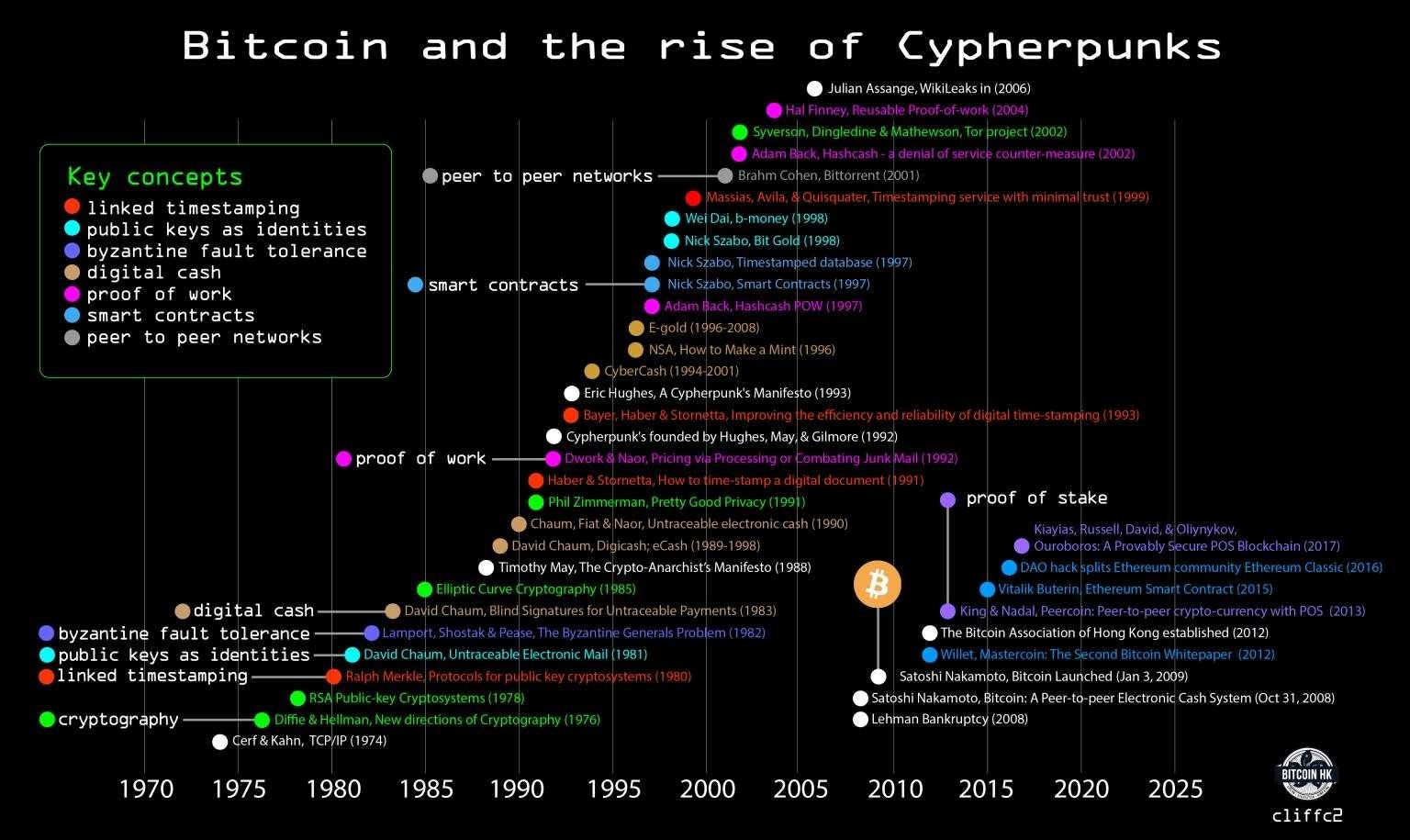

The idea of a private, state-independent currency originated from the early innings of the “Cypherpunk” movement. Cypherpunk refers to a group of people in the late 1980s and 1990s, who recognized the necessity to protect people's privacy online by using cryptography:

Privacy in an open society requires anonymous transaction systems. Until now, cash has been the primary such system. An anonymous transaction system is not a secret transaction system. An anonymous system empowers individuals to reveal their identity when desired and only when desired; this is the essence of privacy.

Long before Cambridge Analytica, long before the Great Firewall of China, long before the Snowden revelations, the cypherpunks saw it coming: A regime of online censorship and surveillance that would eclipse the open Internet.

The technical roots of Cypherpunk ideas have been traced back to work by cryptographer David Chaum on topics such as anonymous digital cash and pseudonymous reputation systems, described in his paper "Security without Identification: Transaction Systems to Make Big Brother Obsolete" (1985). Over the next several years, these ideas morphed into the cypherpunk movement.

Much the work and writings of that movement would later become the foundation of Bitcoin:

In late 2008, Satoshi Nakamoto published the Bitcoin white paper, titled a "peer-to-peer electronic cash system", to the "Cypherpunks" mailing list. He conceived Bitcoin as an alternative to the current financial system:

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

Rooted in cypherpunk history, Bitcoin community was formed around the principles of freedom, transparency, decentralization, and privacy – all of which the current financial system seemed unable to provide. If you’re not familiar with Bitcoin’s roots, you’ll never going to grasp the full beauty of it.

New narratives, same values

“Perhaps one did not want to be loved so much as to be understood.”

― George Orwell, 1984

Since then, people are constantly creating new narratives about what Bitcoin should and could be. Nick Carter once described it as a “glittering prism, refracting the opinions of observers, spitting out radically different visions of itself based on their perspectives.” That, just that, is the beauty of Bitcoin.

13 years after its inception, after over a decade of free money, record levels of inflation and debt, and rising mistrust institutions, many see Bitcoin as a valid alternative to the current financial system. Two narratives particularly stand out:

Bitcoin as a decentralized store of value

Bitcoin as an decentralized settlement layer for international payments

In part 1 of this series, I’m going to focus on Bitcoin as a store of value.

A broken system?

After 15 years of free money, the highest inflation levels in the last 30 years, ever increasing debt levels, many are asking themselves: How will this end? Let’s unpack what has been going on and if it’s as bad as it looks.

Sovereign debt crisis - so what?

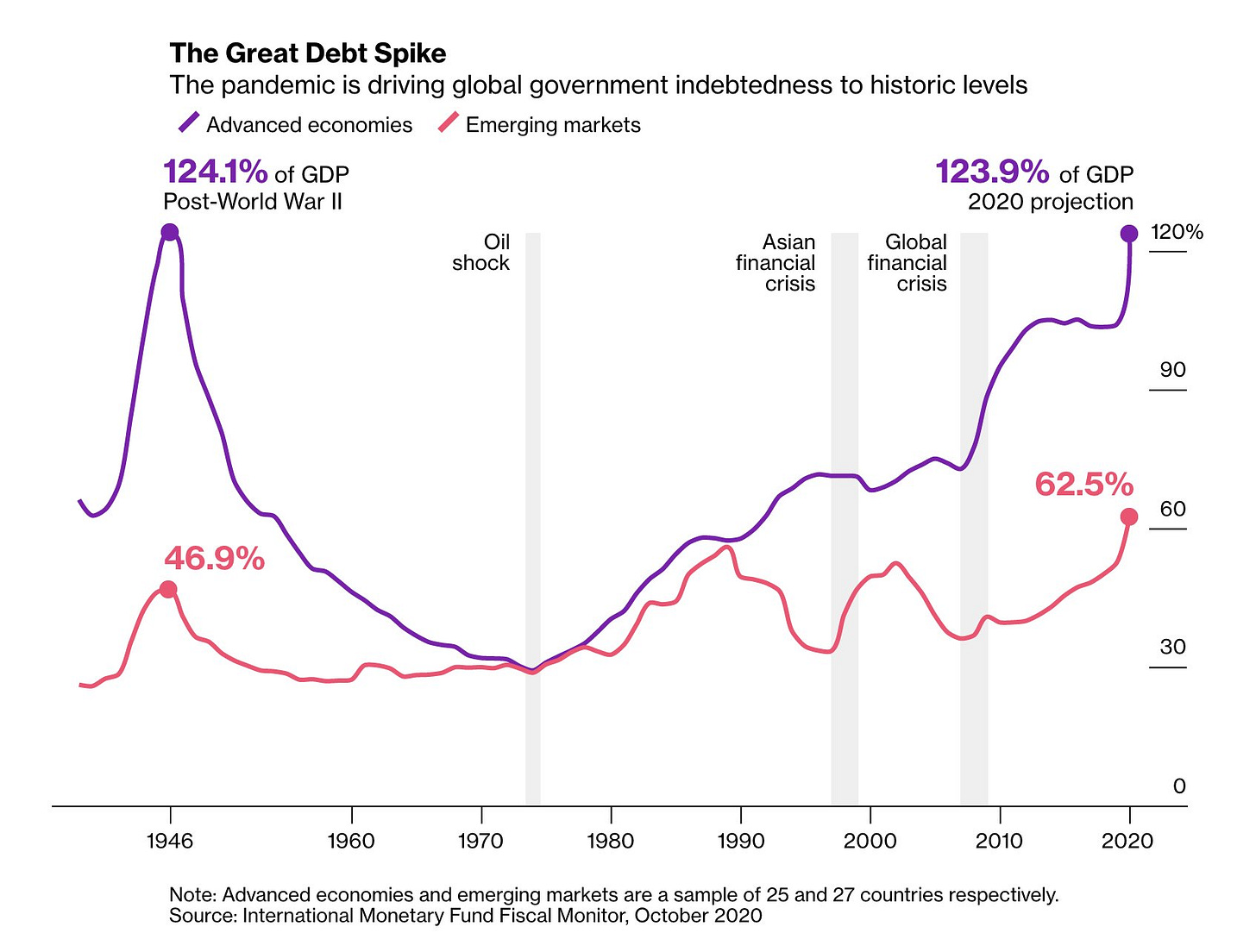

Let’s go back to October 2021, when I stumbled over a headline: "Debt levels are at record heights." I fact-checked, and it's true. Just recently we hit the $300 trillion mark.

What are "debt levels"? Debt levels refer to sovereign, corporate and private debt. Today, we focus on sovereign debt.

Sovereign debt is the sum of the government's annual deficits. Over time, it reveals how much more a government spends than it receives in revenue.

Nations finance their debt through securities. The country pays interest rates to give buyers a return on their investment. If investors believe they'll be paid back, they don't demand high interest rates. This lowers the cost of sovereign debt. If the government seems like it will default on its debt, then investors will demand a higher interest rate.

Why do countries fall into debt in the first place? (That seems like a very reasonable question).

Government spending boosts economic growth because businesses expand to meet the demand created by spending. That usually results in the creation of jobs, which has a multiplier effect on stimulating further demand and growth (see IS-LM model).

Deficit spending is a powerful stimulant because demand is being created now. The cost will come sometime in the future. Political leaders keep spending because a growing economy equals happy voters who will re-elect them. There is no reason for them to cut spending.

Covid-19 debt spike

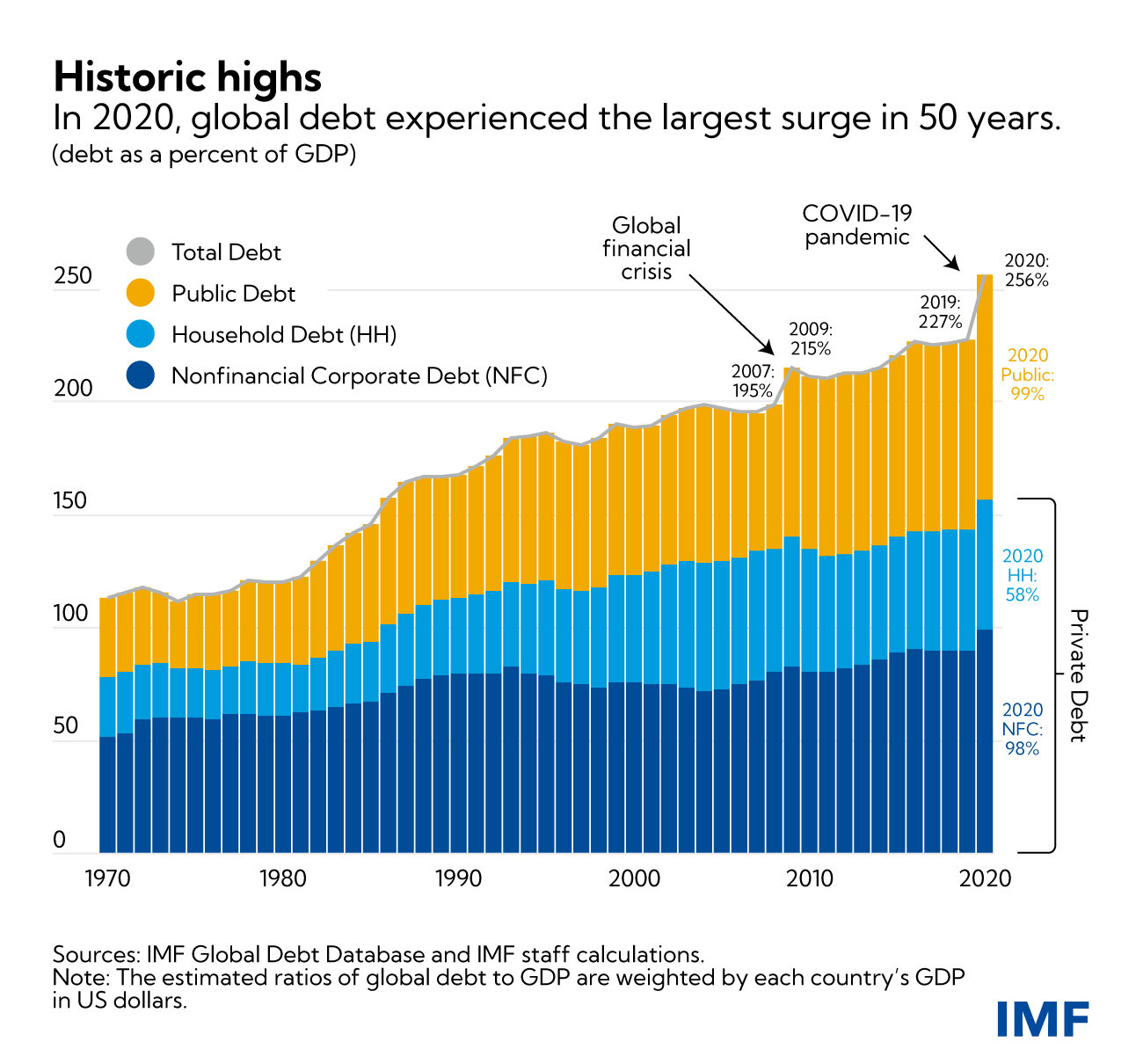

Let's look at debt levels of 2020. They were peaking. Fiscal authorities from Germany to Japan, Canada to China have spent a fortune protecting their people and defending their economies from the pandemic:

Bloomberg adds – hold your breath:

The Fed alone has added about $3 trillion to its balance sheet over the past year, similar in magnitude to its total monetary expansion in the decade following the 2008 financial crisis.

Debt levels have also increased for the private sector. Companies around the world sold $4.4 trillion of bonds in 2020, making them significantly more exposed to the risk of rising rates. Total EMDE (emerging market and developing economies) debt is at a record high of 207% of GDP. EMDE government debt, at 64% of GDP, is at its highest level in three decades, and about one-half of it is denominated in foreign currency.

So, is a high level of government debt, relative to a country’s GDP, problematic? It depends.

As long as sovereign debt remains within a reasonable level, creditors feel safe that this expanded growth means they will be repaid with interest.

The US FED, for example, with USD as the world reserve currency, could print more USD to pay off the debt. This would also inflate the dollar and make debt cheaper.

More money printing could also lead to inflation. Inflation usually leads to higher interest rates – but higher interest rates would also increase the debt burden. Here's an excellent thread by Preston Pysh on what's happening with inflation right now:

Also consider Paul Tudor Jones' paper "The Great Monetary Inflation", in which he delves much deeper into that issue.

But what if you can't print money to pay off your debt?

Let's look at the example of Greece. As a member of the European Union, it does not have a sovereign monetary policy. During the Great Financial Crisis in 2008, instead of relying on its central bank to pay off the debt, it had to cut fiscal spending, causing a recession.1 In 2015, Greece eventually defaulted on a debt of €1.6 billion to the IMF.

“As it turns out, we don't "all" have to pay our debts. Only some of us do.”

― David Graeber, Debt: The First 5,000 Years

Sub-zero interest rates - so what?

There are other reasons for debt defaults too. Most importantly: rising interest rates. Rising interest rates make servicing debt more expensive. But in order to rise rates, you first have lower them by expanding the money supply. The total U.S. M2 measure of the money supply in 1971 was around $600 billion, while today it is in excess of $12 trillion, growing at an average annual rate of 6.7%.

Bloomberg writes on January 28, 2021:

If government borrowing is a bridge to recovery, central banks are the supports. By slashing interest rates and buying more than $5 trillion of assets, they have allowed countries to borrow at a breakneck pace.

Here’s an overview of how the FED slashed rates over the last 15 years:

Pressured to inject cash into the economy, other central banks even introduced negative interest rates.

Quantitative easing, or: how addiction works

Now is the time to bring in "quantitative easing", or QE.

What is QE? It describes central banks continuing to increase the money supply by buying T-bills or other longer maturity government bonds, while the interest rate has already been lowered. Once described as “the world’s biggest economic experiment”, QE is one of the most direct measures to further inject cash into the economy.

The Bank of England explains:

We buy UK government bonds or corporate bonds. When we do this, the price of these bonds tend to increase which means that the bond yield, or ‘interest rate’ that holders of these bonds get, goes down. [...] The lower interest rate on UK government and corporate bonds then feeds through to lower interest rates on loans for households and businesses. That helps to boost spending in the economy and keep inflation at target.

The Bank of England also states that instead of boosting the real economy, QE also boosts financial asset prices, such as shares. This makes the wealthy even wealthier, and increases inequality between financial asset holders and non-holders. @charliebilello tweets in October 2021:

What's the connection between debt levels, interest rates and QE? QE pushes down short-term interest rates and makes borrowing cheaper for everyone, including the government.

What happens if interest rates start moving up as inflation takes hold? If government debt is around 125% of GDP, every %-point increase in interest rates translates into a 1.25 %-point increase in the annual deficit as a share of GDP.

To give you some perspective: During 2022 alone, the US government made $475 billion in net interest payments, up from $352 billion the prior year. By 2025 or 2026, interest payments could exceed the country’s entire defense budget of $767bn and more than a tenth of the governments current total spending.

The dangerous game with inflation

“History has shown that governments will inevitably succumb to the temptation of inflating the money supply.”

― Saifedean Ammous, The Bitcoin Standard

High inflation was likely the result of loose monetary policies (low interest rates) over the last years. In addition, the pandemic disrupted global supply and increased production costs, like wages, raw materials, energy, and transportation.

The demand for goods usually increases when the economy grows, so moderate inflation is seen as a positive sign. But when inflation expectations consistently diverge from current inflation, inflation becomes dangerous.

The World Economic Forum notes:

There is a risk that inflation expectations will eventually de-anchor, as they did in the 1970s, as a result of persistently above-target inflation and repeated inflationary shocks.

If inflation expectations come adrift, the interest rate increases required to bring inflation back to target could be much greater than those currently anticipated by financial markets. For comparison, in the 1970s, it took a doubling of global interest rates to 14% over six years (1975-1981). In 1979-1981 alone, US policy rates rose by nine percentage points to 19%. These synchronous policy rate hikes around the world did bring the Great Inflation to an end. However, they also triggered a global recession in 1982 and sparked a series of debt crises in EMDEs in the 1980s (Ha et al. 2022a, 2022b).

In short: Continued inflation shocks brick the economy and require a higher interest rate increase than normally.

Nonetheless, even moderate inflation erodes a country's currency's purchasing power. Since 1900, U.S. inflation has averaged about 3.0% per year and the cumulative effect is remarkable.

Here’s another graph that shows the declining purchasing power of FIAT currencies over time:

From January 1, 1949, to the end of June 1995, even the best national currency of the postwar period, the German mark, lost 71% of its value. The U.S. dollar lost 84% of its value during the same period. This inflation was the equivalent of a tax on currency holders.

A gloomy outlook

If you think that this systems seems broken: You’re not alone. Here are a short and long-term scenario of how this could play out.

Short-term consequences: a looming recession

The short-term options to get out of this death spiral look grim:

Keep interest rates low —> increase monetary base —> higher inflation

Increase interest rates —> bond prices decrease —> outstanding debt becomes more expensive & too expensive for some, especially EMDEs —> risk of defaults & debt crisis

Governments decrease their deficits by reducing spending or increasing taxes —> Risk of a recession (cf. Greece)

Not doing anything at all —> Further increase of debt levels —> increase of the risk of rising interest rates in the future causing defaults & debt crisis

Doesn't sound very promising, does it?

By now, it has become clear that options 1 and 4 were not options in the first place. Option 3 might still be coming.

Central banks around the world started increasing interest rates to fight ever-increasing inflation (option 2). For the fourth consecutive time this year, Powell announced the FED would raise rates another 0.75%. It's the most rapid pace of rate hikes over the last 40 years.

Simply put, higher rates mean that every dollar you earn today becomes more valuable, and every investment costs more. As investing slows down, demand for goods drops. Thus, it's no longer about if, but rather when and how bad the next recession will be.

SwissRe already predicts it for 2023:

As US inflation remains above target, the Swiss Re Institute expects the Fed will induce a recession in 2023 to avoid a de-anchoring of inflation expectations.

Similarly pessimistic is Lombard Odier:

While we expect the abrupt tightening of financial conditions caused by rampant inflation to lead inevitably to recession […]

Rate hikes might simply crush demand, while supply shortages keep prices high. Inflation is, however, slowing down according to the latest data.

Long-term consequences: the collapse of the FIAT system?

The long-term stability of the current financial system (and geopolitical world order) depends on the stability of the USD as a reserve currency. As long as the US government is able to print more money to finance its debt while keeping the trust of its investors, the system keeps working. The USD will continue to lose value to the disadvantage of the people who cannot afford or don’t have access to alternative assets.

If the US were to default on its debt, the USD would likely collapse, causing a catastrophic and unfathomable dystopia for America and the word marked by a geopolitical thunderstorm and other unpredictable consequences.

In any case, you now may wonder about viable alternatives to store your value?

A viable store of value for the digital age

“Whether in Rome, Constantinople, Florence, or Venice, history shows that a sound monetary standard is a necessary prerequisite for human flourishing, without which society stands on the precipice of barbarism and destruction”

― Saifedean Ammous, The Bitcoin Standard

Stores of values have changed over millennia, centuries and even decades. Gold has been the premier store of value for thousands of years.

The importance of trust

“Until the Civil War, a majority of the money in circulation in the United States was issued by private banks, creating a crazy patchwork of competing bills that could become worth nothing if the issuing bank went down.”

― Nathaniel Popper, Digital Gold:

“Bitcoin was, very simply, a new way of creating, holding, and sending money. Bitcoins were not like dollars and euros, which are created by central banks and held and transferred by big, powerful financial institutions. This was a currency created and sustained by its users, with new money slowly distributed to the people who helped support the network.”

― Nathaniel Popper, Digital Gold

“money that is easy to produce is no money at all, and easy money does not make a society richer; on the contrary, it makes it poorer by placing all its hard‐earned wealth for sale in exchange for something easy to produce.”

― Saifedean Ammous,

A viable store of value is not only about the financial performance, however, but also about its independence of that seemingly broken system in the first place.

“its mere existence is an insurance policy that will remind governments that the last object the establishment could control, namely, the currency, is no longer their monopoly. This gives us, the crowd, an insurance policy against an Orwellian future.”

― Saifedean Ammous, The Bitcoin Standard

“Civilization is not about more capital accumulation per se; rather, it is about what capital accumulation allows humans to achieve, the flourishing and freedom to seek higher meaning in life when their base needs are met and most pressing dangers averted.”

― Saifedean Ammous, The Bitcoin Standard

Bitcoin as a store of value

If you made it this far, congratulations!

Many describe Bitcoin as a “hedge against inflation” and as a “long-term bet against the collapse of the FIAT monetary system”, corrupted by inflation, central banks bulking up their balance sheets and gigantic debt levels that put governments on the brink of bankruptcy.

Why does Bitcoin have value in the first place?

Or, as Saylor puts it:

Bitcoin is the the most efficient system in the history of mankind for channelling energy through time and space,

Novel properties:

Trustless

Permissionless

Independent

Openly and globaly accessible

Borderless

Antifragile (https://eranshir.medium.com/bitcoin-as-the-first-anti-fragile-economical-entity-b52bc600ec91)

Here it comes: For many Bitcoiners, Bitcoin offers an alternative to being exposed to this gloomy outlook.

They see Bitcoin as an investable store of value, with its scarcity mathematically guaranteed, independent of the traditional financial system. They see it as a long-term hedge against the gradual debasement of... ok blahblah. We heard that.

But how can we actually prove it? 2

“But the volatility!” you may say. The price of bitcoin has dropped from $68'789 one year ago to $16'000 today. Further, Bitcoin’s correlation with equities increased significantly in the last 36 months during risk-off events (e.g. covid-19 outbreak, start of the war against Ukraine). It was, however, also the best performing asset over the past decade.

Michael Saylor (or Savior?), who has bought 130’000 BTC for his company’s Treasury fund, would counter cynically:

Like Bitcoin, living things are volatile. Dead things, not so much.

More importantly though, its technology and its value proposition didn’t change.

Dergigi notes:

Bitcoin isn't volatile. Human psychology is.

Human behavior is volatile. Bitcoin isn't. Consequently, bitcoin's market price can be volatile. But Bitcoin is not. The Bitcoin network has been operating continually for well over a decade. It is predictable, steady, and reliable. From that perspective, Bitcoin is the most stable thing there is.

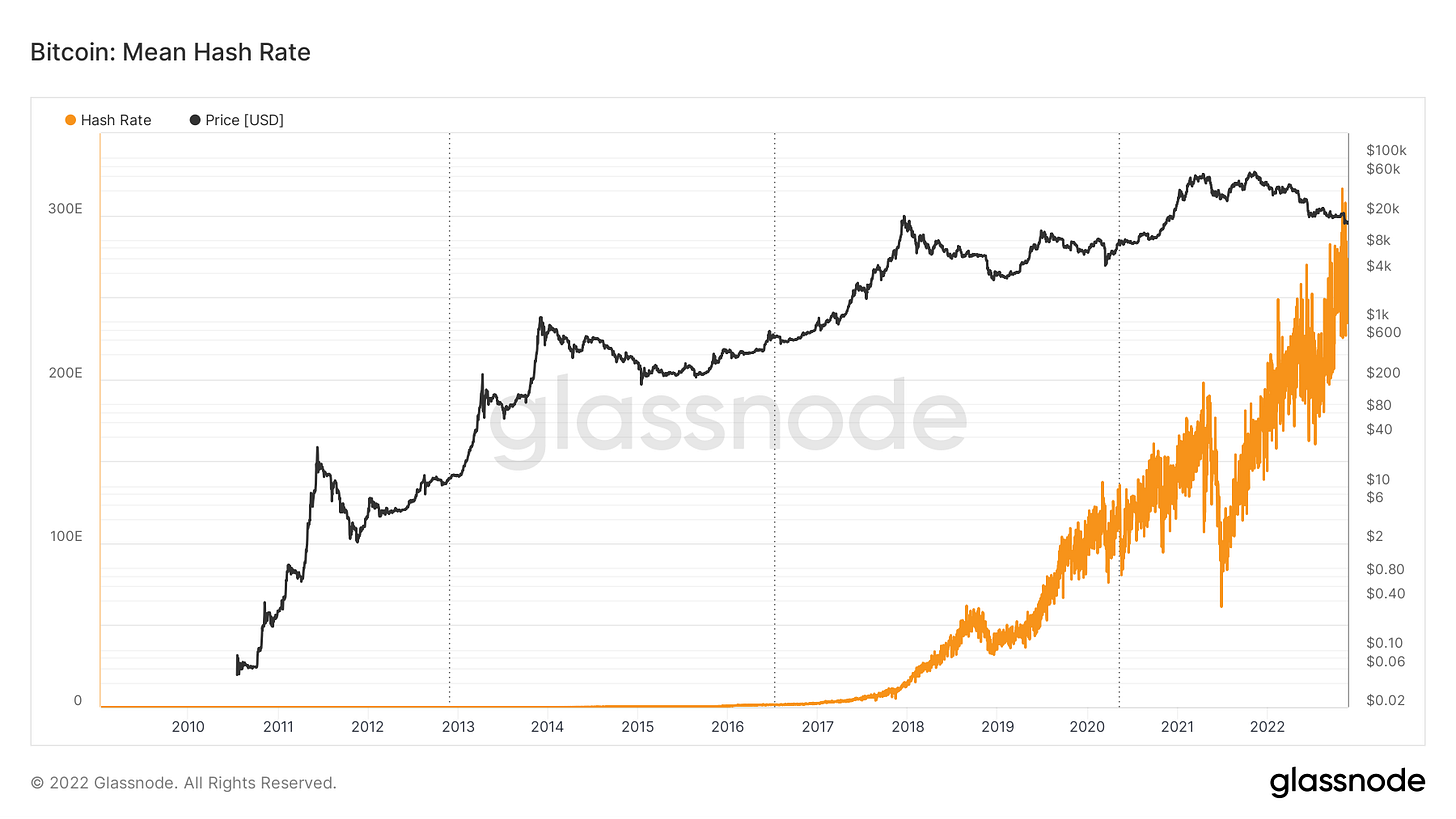

Every 10 minutes, a new block is found. Every 10 minutes, the whole system increases in reliability and stability, independent of price swings.

Meanwhile, the builders keep building. The hodlers keep hodling and the fundamentals of Bitcoin are as strong as ever:

The Bitcoin hashrate, a proxy of the network’s security, has reached all time highs just a few days ago:

The number active addresses is steadily increasing:

On November 18, Matthew Ferranti from Harvard University published a paper on the use of cryptocurrency, specifically Bitcoin, in central bank reserves. He notes:

If a central bank cannot acquire sufficient physical gold to hedge its sanctions risk, the optimal Bitcoin share rises further, suggesting that gold and Bitcoin are imperfect substitutes.

We'll find out if Bitcoin lives up to its promise as a store of value and if we can get off cheap money in the months, years, and maybe decades to come.

Achieving scarcity in digital form was Bitcoin’s great technical breakthrough.

“It’s either going to change everything, or nothing,”

― Nathaniel Popper, Digital Gold

I remain hopeful.

– Marc

PS: This analysis is by no means complete. Compared to what is yet to be said about the topics above, it's cute and simple. Any further ideas would be greatly appreciated.

PSS: In addition to being a hedge against inflation, Bitcoin can also be used as a settlement layer for the global exchange of value. More on this in another post. As always, there is still so much to unpack and learn.

Sources and further reading:

https://bitcoin-resources.com/books/

https://nakamoto.com/the-cypherpunks/

https://nakamotoinstitute.org/static/docs/cypherpunk-manifesto.txt

https://www.coindesk.com/markets/2016/04/09/bitcoin-and-the-rise-of-the-cypherpunks/

Bitcoin Is Winning the Covid-19 Monetary Revolution. (2020, November 29). Bloomberg.com. https://www.bloomberg.com/opinion/articles/2020-11-29/bitcoin-and-china-are-winning-the-covid-19-monetary-revolution?

Graeber, D.; Piketty, T. (2021). Debt: The first 5,000 Years. Melville House.

Saifedean Ammous. The Bitcoin Standard : The Decentralized Alternative to Central Banking. Hoboken, New Jersey, John Wiley & Sons, Inc, 2018.

Olivier Blanchard. Macroeconomics : A European Perspective. Pearson, 2018.

“End the FUD.” End the FUD. https://www.endthefud.org

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis (Greek: Η Κρίση), it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date.

Loss of purchasing power of FIAT currencies against gold: