The End of Royalty Fees for NFTs: What's next?

Last Friday, OpenSea announced an end to mandatory resale fees for artists. The move carries consequences for artists, brands, and the entire ecosystem. Here's the breakdown.

The Web3 community is in turmoil. On August 17, OpenSea said that it stops the mandatory collection of resale fees for artists.

Let’s dig in.

Dematerialzd is brought to you by NEAR.

NEAR isn't just a Layer 1 blockchain - it's the Blockchain Operating System for an open web. Unlike other next generation blockchains, NEAR was built from the ground up to be easy to build on for developers and accessible and simple to onboard for their users. Create and discover decentralized apps, and help build the future of the web, today.

The promise of NFTs

NFTs once promised that artists would earn a share every time their creation was resold, termed "royalty fees".

These fees underpinned the NFT boom of 2021/22, championing a vision of the web where creators receive due rewards, all facilitated seamlessly on the blockchain. The idea was that these fees, embedded in NFT smart contracts, would be enforceable.

In reality, royalties have largely been dead for a while, even though OpenSea tried to uphold them. Until recently.

Now, OpenSea will stop enforcing royalty fees on all new NFTs starting August 31st. More is available in the press release.

It was the final major platform to do so, leaving the community in dismay and investors skeptical.

Why did OpenSea do that?

The NFT market, in a rush to reduce fees, has witnessed a dilemma among its platforms.

With the NFT bubble deflating, marketplaces have slashed trading fees and stopped royalty enforcement to lure sellers. After all, these platforms thrive on volume; it's their lifeline. And traders? They gravitate towards the lowest fees.

Herein lies the exchange's quandary (initially outlined by David Phelps):

Target the 1% of users accounting for 99% of transaction volume.

Or cater to the 99% of users contributing a mere 1%.

This tug-of-war over royalties has stirred quite the storm among exchanges. And this is where the plot thickens.

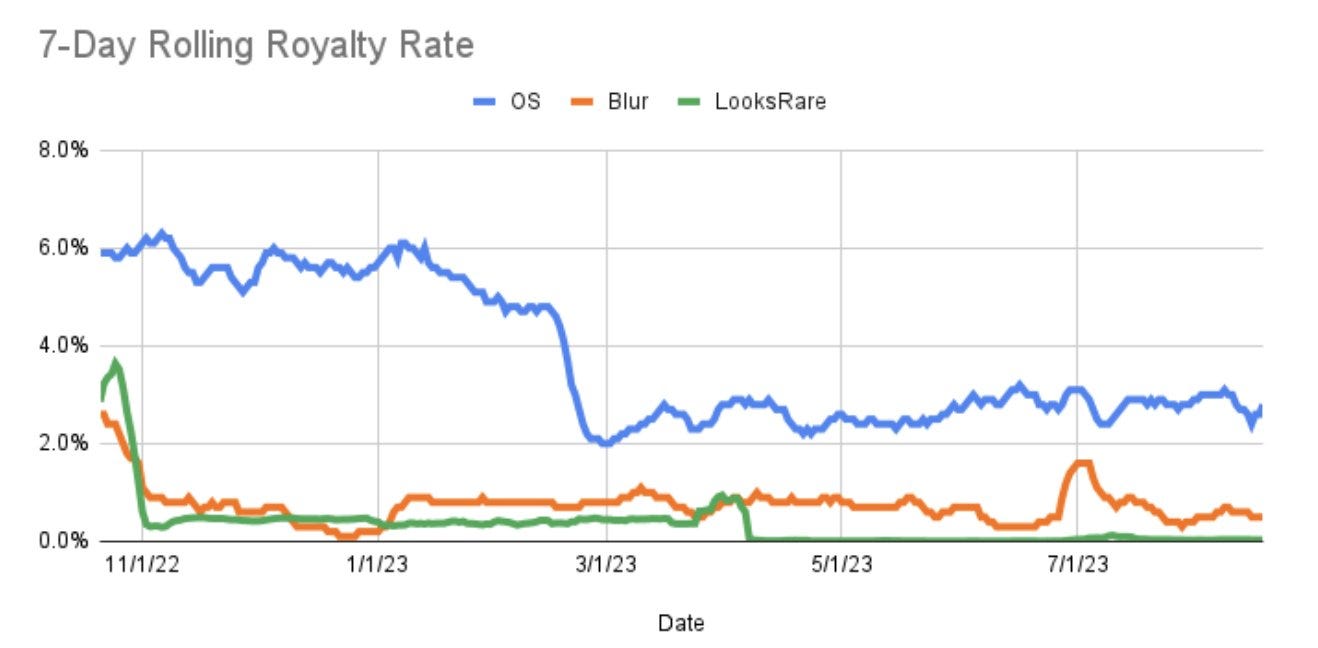

The Royalty War

Blur, now leading in NFT exchange volume, effectively wooed professional users with a refined trading interface, competitive fees, and BLUR token incentives.

In response, OpenSea introduced lower fees and launched OpenSea Pro, aiming at traders, but they didn’t touch royalty fees.

In fact, they advocated for mandatory creator royalties and started enforcing them.

OpenSea then released a royalty enforcement tool in January this year. This prevented NFTs from being listed and sold on marketplaces that offered optional royalties.

While many marketplaces complied with OpenSea’s policy, Blur did not.

This defiance led OpenSea to pivot, scrapping its mandatory royalties stance and temporarily presenting optional royalties with zero trading fees.

Now, OpenSea capitulated on royalty fees all together. In fact, they didn’t have a choice. As they were losing market share, the pressure became unbearable.

They were caught in a classic prisoner’s dilemma.

Here’s a timeline of events:

Before January 2023: Blur 0% royalties (optional"), OpenSea full royalties

January 2023: Blur 0.5% royalties

February 2023: OpenSea 0.5% royalties

May 2023: Blur 0% royalties with Blend

August 2023: OpenSea announces 0% royalties

Yuga Labs (IP holders of Crypto Punks, Bored Apes, a.o.) already announced they would stop support for OpenSea for its collections (about 25% of OpenSea’s volume.

Currently, the Web3 community is bearish on OpenSea. Many are dismayed, believing the platform should have taken a stronger position earlier, given its market lead. Additionally, OpenSea's trading volume has steadily declined over the past year.

Implications for artists & brands

First, this shift significantly disrupts creators who anchored their businesses on guaranteed royalties—a cornerstone of Web3's pledge.

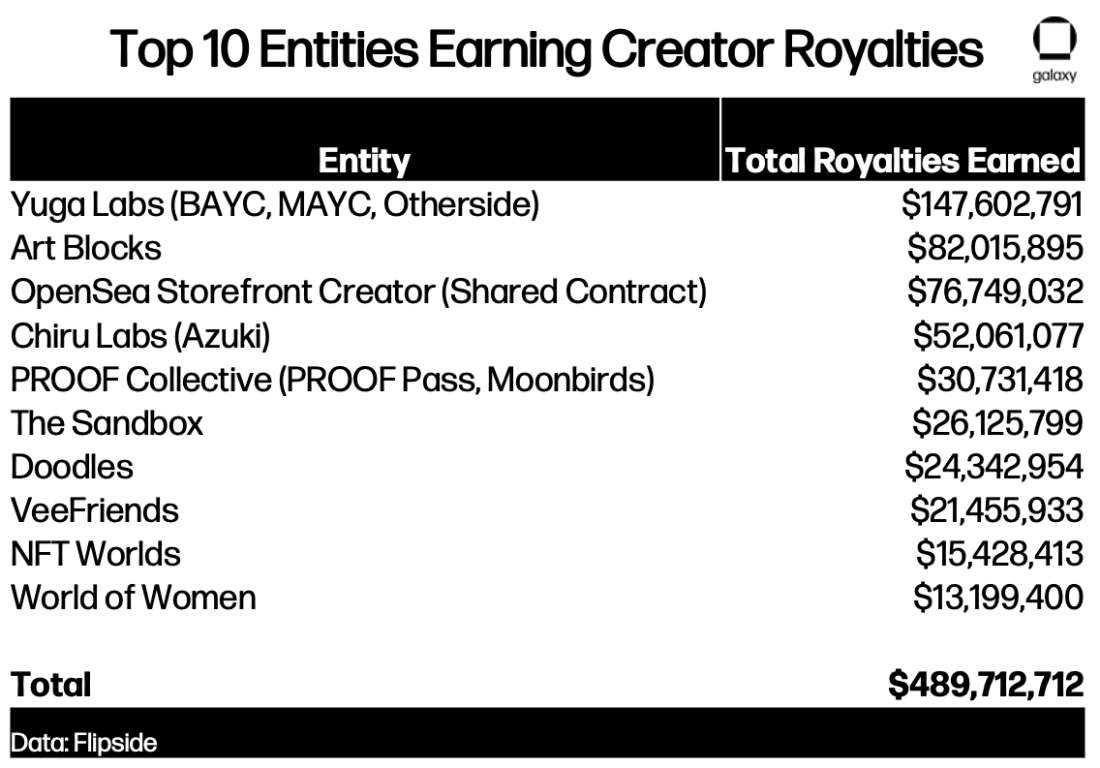

Here’s a – by now outdated, but still useful overview of what top collections earned with royalties:

Many argue that the focus on traders and lower (royalty) fees destroy NFTs' artistic and cultural esteem and crowds out creators - the ones who have built all this.

Second, this matters for brands, since a lot of NFT projects from top brands have earned millions in royalties:

⚡️ Nike: $92.99m

⚡️ Dolce & Gabbana: $557k

⚡️ Gucci: $1.6m

⚡️ Adidas: $4.81m

⚡️ Time Magazine: $3.72m

...etc.

This means that monetization has to happen somewhere else. Business cases need to be built differently. And other marketing KPIs become more important.

What’s next?

Starting points to fix this could be:

Fixing the tech so royalties can’t be avoided (e.g. the ERC-6651 standard)1

A cooperation of the biggest IP holders / collections and exchanges that enforce royalties

Free transactions for NFTs that pay their royalty and take a percentage from the royalty as the fee

Meanwhile, Beeple, arguably the most acclaimed NFT artist of our time, has a simpler answer on the royalty debate:

Do you have other ideas or questions? Please comment below!

That’s it. Back to building.

– Marc

PS: A few days after this announcement, OpenSea raised their platform fees.

Recommended resources:

NFT market overview on Dune

NFT royalties & marketplace fees on Dune

Yuga Labs impact on OpenSea and Blur usage on Dune

NFT Royalties: The $1.8bn Question. By Galaxy. Link

Zero Royalty NFTs: A Paradigm Shift in the NFT Creator Economy or Just a Speculator’s Narrative? By Spartan Labs. Link

The Rise of Blur: How it Beat OpenSea and became the #1 NFT Marketplace. By Jae Lee. Link

In the Pursuit of a Fair Art Market: From Resale Royalties to Fractional Equity. By María Fernanda Torres. Link

Artwork: Beeple’s “Everydays: The First 5,000 Days”.

ERC-6651 is a proposed standard for NFT royalties that would make it easier for creators to collect royalties on secondary sales of their NFTs. Currently, there is no standard way to do this, and it can be difficult and expensive for creators to track and collect royalties. ERC-6651 would address this by providing a way for creators to embed royalty information directly into the NFT, which would make it easier for marketplaces and buyers to comply with the terms of the royalty agreement.