"Bitcoin's Last Stand" – ECB's misguided Take on Bitcoin

Yesterday, the European Central Bank published a damning article on Bitcoin its official blog. It’s an attack on Bitcoin from one of the biggest monetary institutions. Let’s clarify & fact check.

It’s hard not to disagree with this blog post. It’s a direct attack on Bitcoin. It’s also surprising that it was published under such a prominent name as the European Central Bank.

It adds to the famous collection of doomsayers who predicted that “Bitcoin would be dead”. Those doomsayers reappear during Bitcoin downturns, which are by now almost as predictable as the seasons.1 Here’s a great overview of previous sceptics:

I think many of the arguments are flawed. The fact that it comes from such a prominent source also warrants clarification and a fact-check.

On regulation

They write:

The current regulation of cryptocurrencies is partly shaped by misconceptions. The belief that space must be given to innovation at all costs stubbornly persists. Since Bitcoin is based on a new technology - DLT / Blockchain - it would have a high transformation potential. Firstly, these technologies have so far created limited value for society - no matter how great the expectations for the future. Secondly, the use of a promising technology is not a sufficient condition for an added value of a product based on it.

“… for an added value of a product based on it.” – uhm, what?

First, the crypto space doesn't "stubbornly" believe in "innovation at all costs", but rather in as little (and smart) regulation as possible, but not less.

They believe that crypto could fix fundamental problems of the legacy parts of our financial system. Regulation was built around a series of financial intermediaries – transfer agents, clearing houses and traditional brokers – which don’t play a part in crypto transactions. Thus, it cannot be treated with the same regulatory frameworks as legacy systems.

Second, bad regulation is notoriously hard to undo or fix.

Third, is that statement in sync with the European Blockchain Strategy, of which the ECB is a part of?

Technology is changing faster than regulation can keep up. That's why regulation and innovation need to be balanced. Here are some reasonable principles:

Adaptive regulation: Shift from “regulate and forget” to a responsive, iterative approach.

Regulatory sandboxes: Prototype and test new approaches by creating sandboxes and accelerators.

Outcome-based regulation: Focus on results and performance rather than form.

Risk-weighted regulation: Move from one-size-fits-all regulation to a data-driven, segmented approach.

It sounds nice, but it seems reasonable to me. Apparently, such a sandbox for the European Union is coming.

Statements like this justify people's worries.

The risk of over- or mis-regulation is real, while the potential net value for society is huge.

Isn't that a cause worth striving for?.

On energy

It’s also worth noting that the Bitcoin system is an unprecedented polluter.

Let’s dissect this:

Bitcoin is a "waste" of energy if you don't see its utility.2

So, what’s the utility of Bitcoin? What does it even do?

It’s easy. It lets you send and receive value to and from anyone in the world using nothing more than a computer with an internet connection.

Why is it revolutionary?

Because unlike every other tool for sending value over the internet, it works without the need to trust a middle-man. This makes it the world’s first public digital payments infrastructure. Open to all, just like the internet.

Energy sustains the Bitcoin network. Energy = security.3

Or, as Saylor puts it:

Bitcoin is the the most efficient system in the history of mankind for channelling energy through time and space.

As a comparison, the internet consumes about 10% of global energy, data centers about 2%, Bitcoin about 0.16%.

Bitcoin is not an “unprecedented polluter”. High energy consumption does not necessarily mean a high carbon footprint. It matters what type of energy energy is used. In fact, it is one of the cleanest billion-dollar industries on the planet.

Bitcoin mining is mainly powered on sustainable energy, at levels more than three times higher than the global average (>67.85% vs ~11-18%, depending on the source).

“Miners” (the guys who run the blockchain) have a game-theoretic incentive to find the cheapest energy on Earth. Their mobility allows them to find stranded renewables at low costs that would otherwise go to waste in the global power grid.

“Imagine a topographic map of the world, but with local electricity costs as the variable determining the peaks and troughs. Adding Bitcoin to the mix is like pouring a glass of water over the 3D map – it settles in the troughs, smoothing them out.” – Nic Carter

That’s about it. In fact, Bitcoin can be key to an abundant, clean energy future.

Long term, renewable energy will be cheaper than coal and gas (or already is); this means Bitcoin's energy mix will also be greener.

On social benefits

Bitcoin does not provide social benefits4

Again:

Bitcoin lets you send and receive value to and from anyone in the world using nothing more than a computer with an internet connection.

It’s permissionless, so anyone can access it.

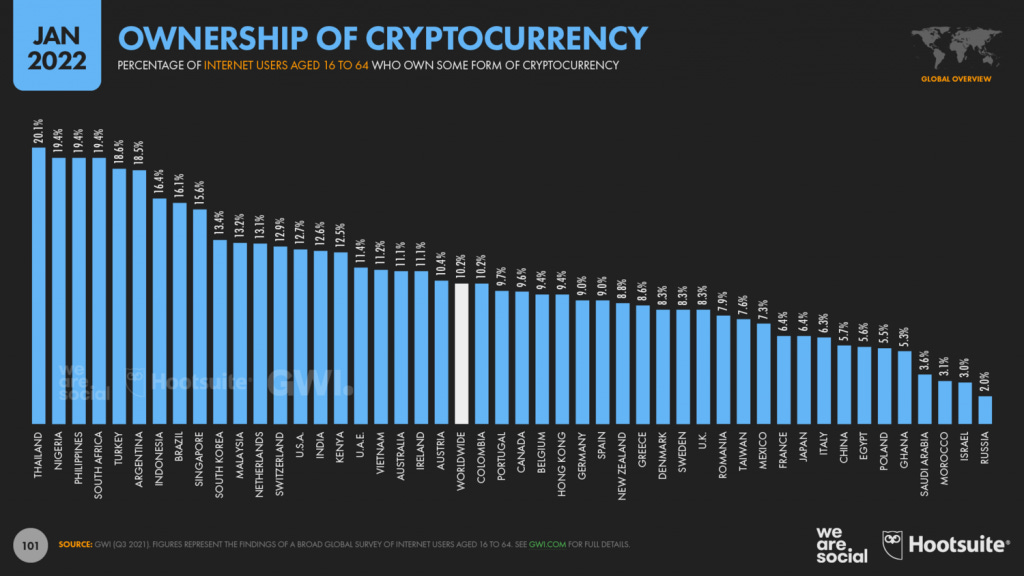

Developing countries are among the largest users of Bitcoin due to:

Bitcoin allows for cheap, secure and instant remittances (sending money to another country)

Bitcoin protects against (hyper)inflation and corruption

Lack of access to banking / financial infrastructure

First, remittances. The World Bank estimates that remittances – the money that migrants send back to family or friends in their countries of origin – can account for up to 20% and even as high as 40% of Gross Domestic Product (GDP) in many developing countries. In Haiti, 26% of its GDP comes from remittances sent by Haitians working abroad to their families back home. For workers sending money from the US, Canada, or the Dominican Republic, fees can be as high as 8-10%, adding up to $150 million in fees alone per year.

Bitcoin transactions are instant and virtually free.5

Second, (hyper)inflation, a.k.a. generational wealth. Examples of such countries are Venezuela, Brasil, Turkey, etc. History is full of failed currencies and fooled citizens who lost their money. Many people much more knowledgeable than me have already written extensively about that. I won't repeat myself.

Third, access to financial infrastructure, a.k.a. financial inclusion. Bitcoin is open, for everyone. You just need an internet connection.

After all, it’s easy to dismiss Bitcoin as a speculative bubble and unprecedented polluter with no social benefits from the first-world offices of ECB in Frankfurt, Germany.

On transactions

Real Bitcoin transactions are cumbersome, slow and expensive.

Bitcoin is rarely used for legal transactions.

Wrong. Bitcoin transactions are easy, fast, and virtually free.

This is already widely documented.

I encourage you to watch Jack Mallers’ talk for IMF on disrupting cross border payments. He explains it much better than I’ll ever can.

According to Chainalysis, the share of illegal crypto transactions between 2017 and 2021 was 0.15%. The estimated amount of money laundered globally in a year is 2-5% of global GDP, or $800 billion to $2 trillion.

On reputational risk

Promoting Bitcoin bears a reputational risk for banks

On which I would answer: “Promoting Bitcoin is an existential risk for the EZB.”

What brought us here in the first place

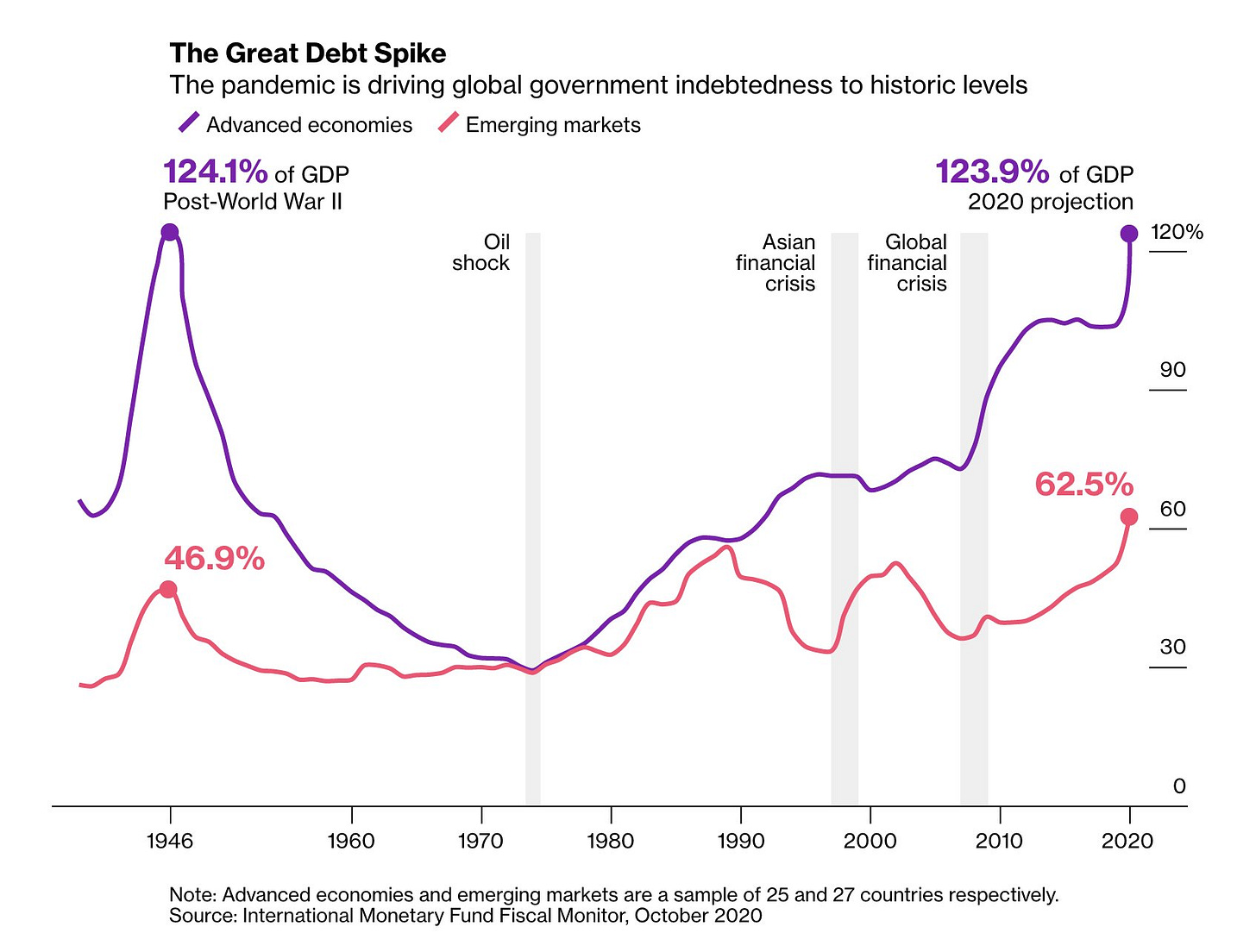

As we close, let's not forget that we are currently experiencing record inflation (Eurozone at 10% as of Nov 2022) since 30 years, unsustainably high debts, and no apparent way out.

Central banks around the world, including the ECB, have essentially crippled the proper functioning of financial markets with sub-zero interest rates, quantitative easing, and covid-19 relief programs.

Here's an excellent thread by Preston Pysh on what's happening with inflation right now:

Also consider Paul Tudor Jones' paper "The Great Monetary Inflation", in which he delves much deeper into that issue.

“Whether in Rome, Constantinople, Florence, or Venice, history shows that a sound monetary standard is a necessary prerequisite for human flourishing, without which society stands on the precipice of barbarism and destruction”

― Saifedean Ammous, The Bitcoin Standard

In short: Continued inflation shocks cripple the economy and require a higher interest rate increase going forward than normally.

Even moderate inflation erodes a country's currency's purchasing power. In fact, the USD lost about 95% of its purchasing power since the 1970s. Here’s a cool tool to play around with. But that’s a topic for another day.

You may think the value of Bitcoin is volatile, but it's nothing compared to damage done by the huge inflation rates of some currencies.

The ECB looks incredibly weak now.

Onwards

Why, after all, all that pessimism?

Let optimism propel us forward. Let opportunities arise, not problems.

At no point in history we had more tools, more technology, more knowledge available.

I’ll leave you with this quote from Oscar Wilde:

“We are all in the gutter, but some of us are looking at the stars.”

Back to building.

– Marc

As always, I’m very thankful for suggestions and feedback!

Further readings:

Ammous. (2018). Can cryptocurrencies fulfil the functions of money? The Quarterly Review of Economics and Finance. Advance online publication. https://doi.org/10.1016/j.qref.2018.05.010.

Bitcoin's energy consumption: Bitcoin Suisse. Bitcoin Suisse - Buy, Sell, Store & Earn Cryptocurrency. (n.d.). Retrieved December 1, 2022, from https://www.bitcoinsuisse.com/research/decrypt/season-2021/bitcoins-energy-consumption

Cointelegraph. (2022, March 2). How can third-world countries counter inflation using Bitcoin? Cointelegraph. Retrieved December 1, 2022, from https://cointelegraph.com/bitcoin-for-beginners/how-can-third-world-countries-counter-inflation-using-bitcoin

Peter Van Valkenburgh. October 11, 2018. (2020, June 26). The public internet needs public payments infrastructure. Coin Center. Retrieved December 1, 2022, from https://www.coincenter.org/the-public-internet-needs-public-payments-infrastructure/

ResearchFDI. (2022, July 25). The rise of cryptocurrency in developing countries . ResearchFDI. Retrieved December 1, 2022, from https://researchfdi.com/resources/articles/rising-popularity-cryptocurrencies-developing-countries/

The impact of crypto currencies on developing countries. (n.d.). Retrieved December 1, 2022, from http://explore-ip.com/2019_The-Impact-of-Crypto-Currencies-on-Developing-Countries.pdf

Wheeler, J. (2018, March 22). Leveraging bitcoin to solve Venezuela's hyperinflation. Medium. Retrieved December 1, 2022, from https://medium.com/@jonathan.wheeler/leveraging-bitcoin-to-solve-venezuelas-hyperinflation-9f60c71d380b

Header image copyright: https://www.ledgerinsights.com/ecb-execs-publish-suerf-think-tank-paper-slating-bitcoin/

Some of most famous Bitcoin naysayers:

Jamie Dimon, CEO of JPMorgan Chase: In 2017, Dimon called Bitcoin a "fraud" and said that he would fire any of his traders who were caught trading it.

Warren Buffett, CEO of Berkshire Hathaway: In 2018, Buffett called Bitcoin "rat poison squared" and said that it has no intrinsic value.

Peter Schiff, CEO of Euro Pacific Capital: Schiff has been a vocal critic of Bitcoin, calling it a "scam" and a "bubble" that will eventually collapse.

Nouriel Roubini, economist and professor at NYU's Stern School of Business: Roubini has called Bitcoin a "mother and father of all scams and bubbles" and has predicted that it will eventually crash to zero.

Paul Krugman, Nobel laureate in economics: Krugman has called Bitcoin "evil" and has argued that it is not a real currency because it is not backed by a central authority.

“The marginal cost of gold mining tends to stay near the price of gold. Gold mining is a waste, but that waste is far less than the utility of having gold available as a medium of exchange. I think the case will be the same for Bitcoin. The utility of the exchanges made possible by Bitcoin will far exceed the cost of electricity used. Therefore, not having Bitcoin would be the net waste."

- Satoshi Nakamoto

YoY, Bitcoin security increased by 73% and mining efficiency increased by 23%. The Bitcoin network has never been stronger. Link

Bitcoin originated from the idea of a private, state-independent currency conceived during the early innings of the “Cypherpunk” movement. Cypherpunk refers to a group of people in the late 1980s and 1990s, who recognized the necessity to protect people's privacy online by using cryptography:

Privacy in an open society requires anonymous transaction systems. Until now, cash has been the primary such system. An anonymous transaction system is not a secret transaction system. An anonymous system empowers individuals to reveal their identity when desired and only when desired; this is the essence of privacy.

This becomes possible thanks to the Bitcoin Lightning Network.