📝 Web3 Field Notes#38: Big Move: SEC attacks NFTs

Just in: Lufthansa launches NFTs for all its customers. SEC loses landmark case. OpenAI goes after enterprises.

Hey, it’s Marc. I write weekly, obsessively curated insights on crypto & Web3 to help you filter out the noise. ✌️ Happy reading!

⏱️ Reading time: 4 min

Dematerialzd is brought to you by NEAR.

NEAR isn't just a Layer 1 blockchain - it's the Blockchain Operating System for an open web. Unlike other next generation blockchains, NEAR was built from the ground up to be easy to build on for developers and accessible and simple to onboard for their users. Create and discover decentralized apps, and help build the future of the web, today.

Be inspired

"One day, in retrospect, the years of struggle will strike you as the most beautiful." - Sigmund Freud

📚 Top 5 Reads

Onchain Hypercuration. By Riley Beans. Link

Gary Vee reminds us why NFTs are far from dead. (video) Link

Crypto regulatory update for July & August. By a16z. Link

SEC Commissioner Hester Peirce on regulating NFTs. Link

Brian Armstrong (CEO Coinbase) on 10 crypto start-ups he’d build today. Link

🚨 Top 4 Stories That Caught My Eye

✨ Web3 + NFTs

SEC goes after NFTs 🏛️

The SEC charged Impact Theory with offering unregistered securities by selling NFTs. The LA-based media company agreed to pay a $6.1m fine.

Punchline: This is significant. It’s the first time the SEC brought an enforcement action against NFTs – a category of digital assets that has avoided the eye of the regulators up to now (at least in the US). While the SEC bases its charges on specifics of the way Impact Theory sold its NFTs, this could potentially apply to a lot of other NFT projects too. It opens a lot of questions, as described in a personal statement by SEC Commissioner Hester Peirce (highly recommended!).

Lufthansa NFTs take flight ✈️

The German air carrier has announced the public start of its NFT loyalty program with its partner app Uptrip.

Passengers can now scan their boarding pass in the Uptrip app receive a Polygon-based NFT. These NFT can be stored a crypto wallet of their choice.

Utility goes beyond collecting: Frequent flyers who collect a complete set can redeem them for airport lounge access, flight upgrades, status, and award miles. Gamification and entertainment elements enhance the collecting experience.

The loyalty program has already attracted 20,000 registered users and issued over 200,000 NFTs since its soft launch in spring.

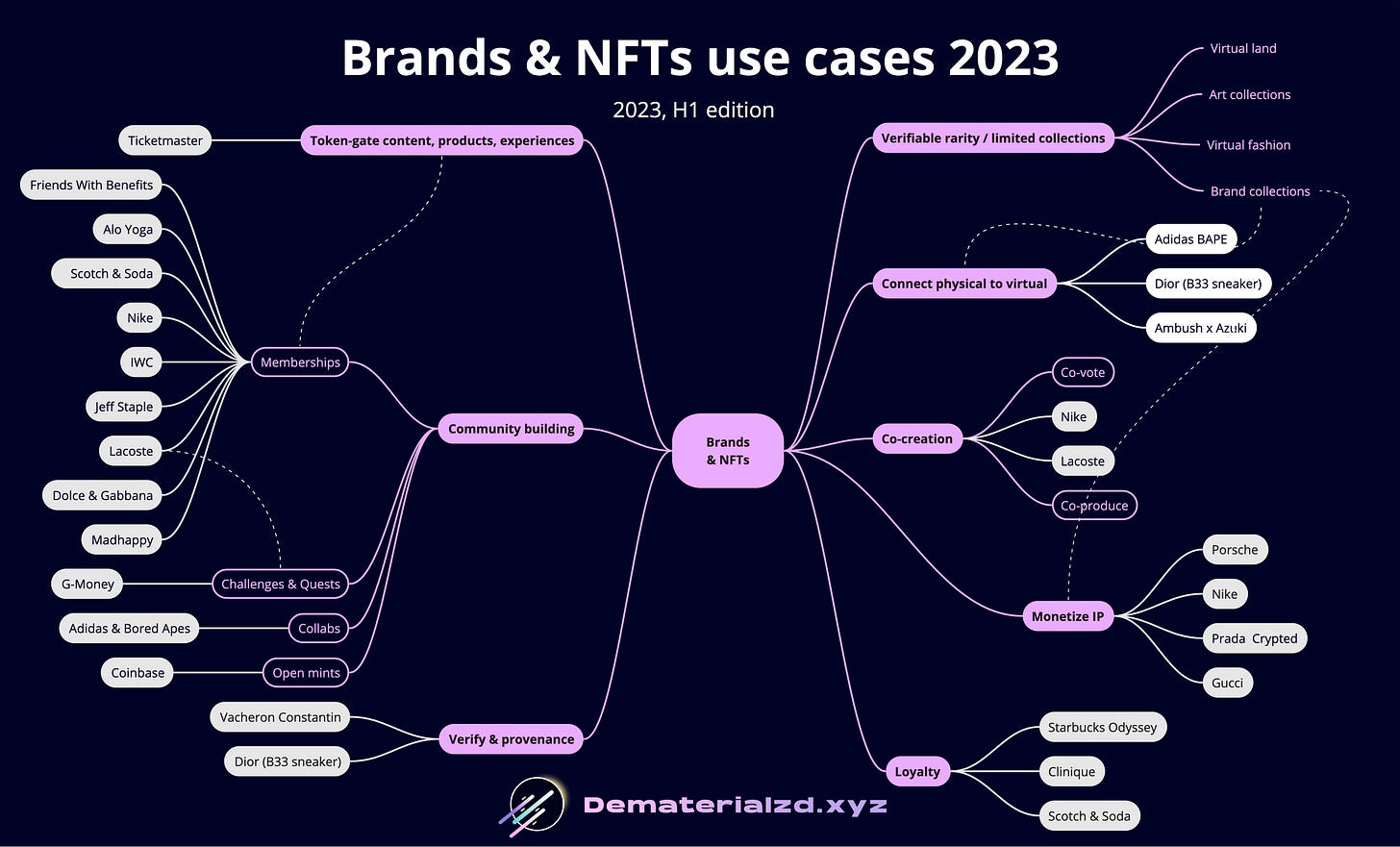

Punchline: This is a terrific example of a mass market ready, Web3 based loyalty program. Big brands such as Starbucks, Ticketmaster, Scotch & Soda, and Argentina's Flybondi are increasingly exploring interesting use cases for ticketing and rewards.

Monumental: co-creating art on-chain 🖼️

1of1, a digitally native collectors club, acquired “IX. The Monument Game” for 420.60 ETH.

Sam Spratt, the creator, used a unique storytelling game that asks viewers to become participants to complete the monumental artwork (30’000 px wide). See for yourself.

Punchline: By connecting story, community, and play, this is a great example of on-chain co-creation. What if a brand co-created the next mega-poster at Times Square or a new shoe design by including its most devoted fans in the process? These fans could give a piece of themselves to the artwork or product – and own a part of the brand’s success. Engagement supercharged.

🌎 Crypto & Macro

SEC Loses Landmark Case

The US Court has overturned the SEC's rejection of Grayscale's proposal to launch a spot Bitcoin ETF1, arguing that the SEC decision was “arbitrary and capricious” and failed to justify its different treatment of similar products. Bitcoin surged by as much as 6% on release of opinion.

The approval of spot Bitcoin ETFs just became likelier.

Yesterday, the SEC has delayed its decision on six spot BTC ETF applications to Oct 17 and 19.

Punchline: This is a major victory for the crypto industry and Grayscale, which could unlock billions of dollars from its Bitcoin trust by converting to an ETF – and potentially boost the whole crypto sector. Now, the SEC could appeal the decision; it could make Grayscale reapply; or it could allow spot Bitcoin ETFs to launch all at once, as the political pressure is building up.

🧠 AI

OpenAI launches GPT-4-powered ChatGPT Enterprise, with improved privacy, performance, and data analysis features; pricing is “dependent on each company's usage” Link

Google launches enterprise AI tools, unveils new AI chip. Link

New here? Join our 4’533 bright + avid readers by subscribing here:

💰 Money Moves

Vessel Capital launches $55m venture fund for Web3 infra and apps. Link

MoonPay launches venture arm to invest in Web3 infra, gaming, and fintech. Link

That’s all for now, folks. Thank you for being part of the journey.

Back to building! 🚀

– Marc

PS: In case you missed it: the State of Web3 in 2023.

Share your feedback in a 1min survey and receive my updated Web3 reading list for free. Your feedback helps me improve🙏. THANK YOU!

📈 4 Top Charts to Share with Friends

Artwork: IX. The Monument Game by Sam Spratt

An ETF (Exchange-Traded Fund) is a financial instrument that tracks the price of an asset or group of assets and is traded on stock exchanges. A spot Bitcoin ETF would directly hold Bitcoin, allowing investors to buy shares of the fund to gain real-time exposure to the cryptocurrency's spot market price.