Beyond the Hype: Breaking Down Visa's Web3 Loyalty Solution

Why now, how it works, what it means for brands: a guide for brand leaders.

Hey, it’s Marc. ✌️ In early 2024, Visa rolled out its Web3 loyalty solution to its global network of 80m+ partners.

What’s the big deal about this? What does it mean for brands? And what are unanswered questions we should be thinking about?

Today, we’ll look at:

Why now: Visa’s strategic context

The Visa loyalty solution

What brand leaders need to know

Open questions

Ready? Let’s dive in. | ⏱️ Reading time: 6min

Discover how leading brands (including Visa) leverage Web3 to drive customer engagement. Check out the latest case studies that prove SMT increases value beyond traditional loyalty solutions. See how Web3 is helping brands acquire users, reward engagement and build true LTV.

Why now?

Why now? I see two general catalysts:

Loyalty matters

Loyalty is an emerging Web3 vertical

And a third, specific catalyst:

Visa (and other payment networks) has strategic reasons for pushing alternatives to cash back — the standard for card (debit & credit) loyalty rewards.

Let’s unpack these.

1. Loyalty Matters

First, loyalty matters.

By the numbers:

Keeping an existing customer is five to 25 times less expensive than acquiring a new one.

84% of consumers say they’re more likely to stick with a brand that offers a loyalty program.

And mature brands derive more than 85% of their growth from their most loyal customers.

For almost every business, having loyal customers is better than having non-loyal customers.

You can read the Web3 loyalty deep dive here.

2. Loyalty is an emerging Web3 vertical

Second, loyalty is the talk of the town and a big emerging consumer vertical in Web3.

In 2023, the biggest brands like Starbucks, Fiat, 7-Eleven, Alo Yoga and many more started Web3 loyalty activations.

We’ve also seen 50+ start-ups entering the loyalty space building tools, platforms, and enterprise-scale solutions for Web3 based loyalty applications.

And we’re just getting started.

Key trends this year will be:

new enterprise solutions for mass market use cases

gamification, socialization, and personalization of reward experiences

and omnichannel experiences, connecting Web3 loyalty across digital and physical and different platforms (e.g. Paris Hilton’s recent Roblox activation).

Visa’s solution is the perfect example of how all that will play together.

3. Visa’s Strategic Conundrum

Before we jump into the mechanics of card loyalty, here’s what’s happening:

Debit surpasses credit as consumers' preferred payment card. Debit card have lower “interbank fees” — a key element in the debit and credit card ecosystem (more on that below).1

New regulation might further decrease interbank fees.

Let’s break this down.

Payment networks, cash back rewards & interbank fees

The players: Merchants accept payments via cards. Banks issue these cards and manage accounts. Payment networks like Visa process transactions and set interchange rates, but do not issue cards.2

Interbank fees: Banks/issuers often use revenue from these interchange fees to fund rewards programs.

Funding rewards: The higher these fees, the more money card issuers make from merchants. This allows them to issue “more expensive” rewards to consumers. The lower these fees, the less money card issuers make from merchants. This requires them to issue “cheaper” rewards to consumers.

Cost of cash back rewards: Cash back rewards are the most popular debit and credit card rewards. They return a small percentage of the transaction amount to the cardholder. And they are costly for banks to offer, especially for debit card transactions due to lower interchange fees.

It sounds complex, but is actually quite simple (see the chart below).

New regulation

At the same time, upcoming regulation might put further pressure on already decreasing interbank fees.

Key is the Credit Card Competition Act (CCCA), a bill that has been introduced in both the US House and Senate, but it has not yet been scheduled for a vote.

Here’s why the CCCA could be a problem for cash back rewards:

Lower interchange fees: The CCCA would reduce the interchange fees that banks charge merchants. This would reduce the amount of revenue that banks have available to fund their rewards programs.

Competition from new networks: The CCCA would also create a new opportunity for new credit card networks to compete with Visa and Mastercard. These new networks could offer lower interchange fees, which would put further pressure on banks'/issuers’ profits.

Shifting consumer preferences: Consumers may become less interested in cash back rewards if they have to pay higher prices for goods and services as a result of the CCCA.

Digital Rewards: A Win-Win for Everyone

Increased use of debit cards and new regulation push down interbank fees and makes cash back rewards unattractive for card issuers.

This is why Visa is looking into cheaper alternative ways for rewarding consumers. With its new solution, the burden of rewarding shifts from card issuers to merchants/brands.

Digital rewards (like tokens or NFTs) are cheaper to create and distribute compared to traditional cash-back rewards.3

This keeps rewards coming, customers happy, and brands have new ways of engaging consumers. And it’s good for Visa too.

Web3 – just another loyalty “channel”?

Next-gen consumers are community-driven. They engage cross-brand, cross-category, and across multiple contexts. What if you could merge all your channels, from e-commerce to socials to Web3 into a connected, gamified membership?

Kazm does just that. They work with brands like Splash Sports, James Hype, Midnight Cookie Co, and Decrypt to incentivize engagement, retention, and advocacy everywhere their consumers are.

Visa’s Web3 Loyalty Solution

How it works

Here’s a short rundown of Visa’s loyalty solution launched in early January 2024:

A drag & drop platform allows brands to engage next-gen consumers, available to its over 80m+ partners, enabling:

Web3-powered, gamified campaigns (e.g. giveaways, treasure hunts, etc.) offering a blend of virtual and real-world experiences.

Branded, custodial wallets where customers can apply rewards.

A CRM + real time event triggers, incl. first-party data management.

An advanced reporting, analytics, and business intelligence suite.

The solution is powered by SmartMedia Technologies (partner of Dematerialzd), an enterprise Web3 engagement platform.

It allows brands to reward customers not only for their transactions but also for their active engagement.

Learn more on Visa’s official page here.

What’s noteworthy:

Scale: This is the first time that a payment infrastructure provider with a global customer base exploits Web3 loyalty for card payments.

Blockchain-based rewards: Unlike traditional loyalty programs, rewards live on the blockchain, are transferable, programmable, and interoperable with other merchants plugged into Visa’s loyalty solution (in theory; we still know very little about this).

Existing customer base: This isn't a stand-alone solution requiring separate onboarding but is available to Visa’s existing 80m+ partners.

Connected loyalty: Visa has built this with virtual and physical in mind, a big trend for the coming years.

Why it’s important for brands

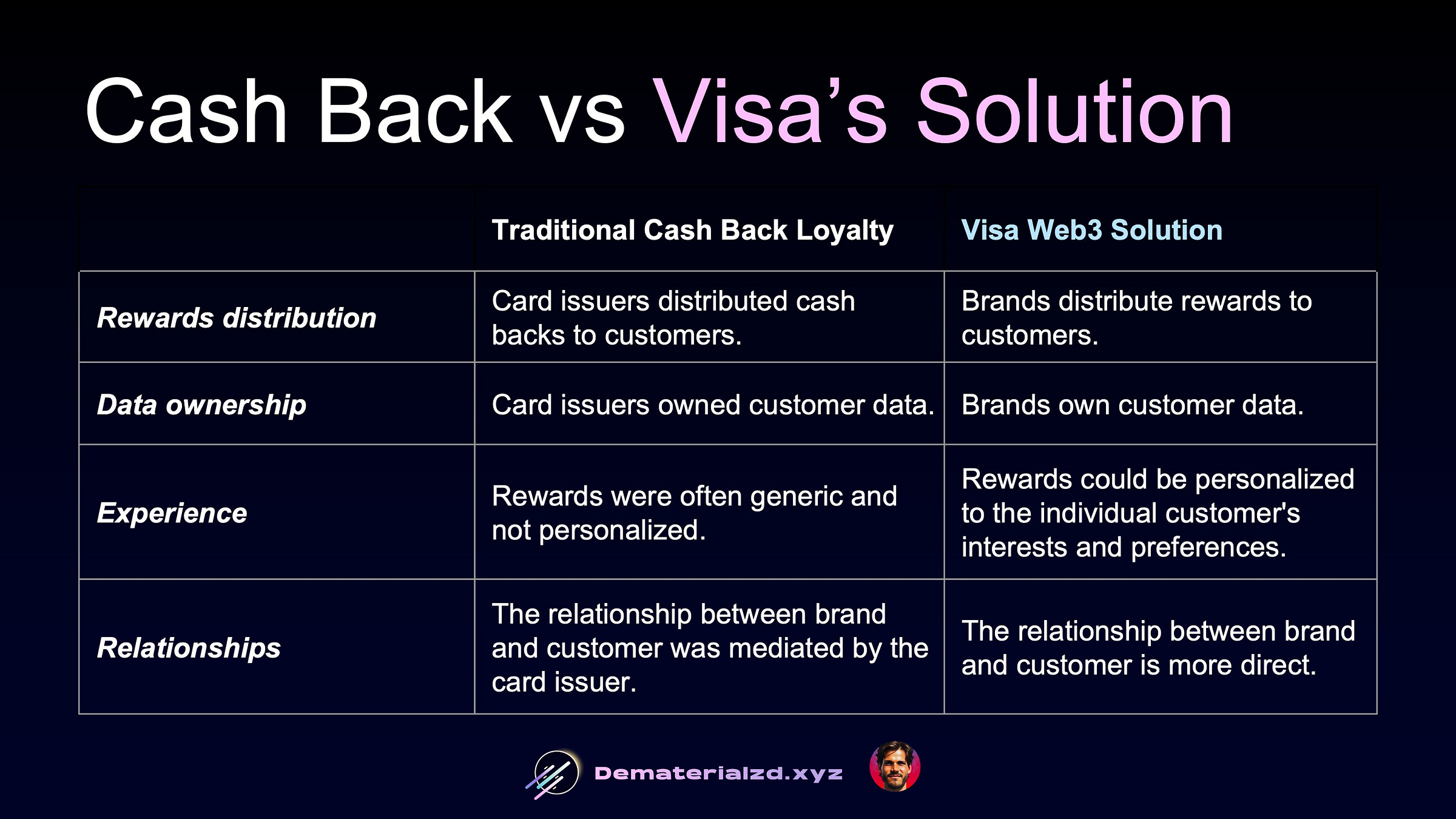

Visa's loyalty solution is designed to enable brands to reward customers directly. This is a shift from the traditional model where cash back rewards were primarily handled by the card issuer and card issuers were the sole intermediaries between brands and customers.

Brands can now interact directly with customers and reward them for their engagement and loyalty.

For brand leaders, this means that you now have access to:

Ready-made, enterprise grade tooling to design Web3-based loyalty campaigns.

The Visa loyalty network that potentially connects your brand’s rewards with other brands in the network (again, this is still very vague).

You’ll additionally get an email address for direct communication with your reward customers — a big opportunity to win back direct customer relationships.

Different types of rewards brands can issue:

Digital tickets & entries: Consumers earn entries into your sweepstakes or digital tickets to virtual or live events.

Gated digitals: VIP Access digitals to unlock perks & benefits.

Loyalty coins: Run gee-fenced scavenger hunts to pick up, earn and redeem coins for physical or digital offers & experiences.

Digital coupons: Digital coupons, collectibles & offers.

Reward transactions: Issue digital objects and experiences based on card transactions.

This solution is designed to engage next-gen customers through mobile and digital reward experiences, featuring a Web2-style UX and engaging, gamified rewards.

For consumers, this experience it’s a win when they gain access to a diverse loyalty network of multiple brands through a single interface.

Sponsor us✨

Get in front of 8,000+ of brand leaders 👀

Work with me to get your brand in front of thousands of Web3 industry leaders every week. Get in touch today or reply to this email.

What brand leaders need to know

All this comes with a disclaimer. As Visa just announced this, many details need to be fleshed out. Open questions are:

Visa’s commercial model: It appears that rewards will be linked not just to Visa card purchases, but also to other interactions with brands, like following them on social media. However, it's not clear how Visa will charge brands for this service and what benefits card issuers will reap from this arrangement.

Onboarding & UX: If you're planning a point-of-sale campaign, the process of how customers will onboard and interact with the app in-store remains vague. This will be a crucial element to get brands and customers using this.

Data and insights: Visa mentions a CRM with first-party data management. What first-data besides email addresses will brands receive? What additional insights will they get? Are they able to extract the data or combine it with their existing CRMs?

Interoperability: Visa mentions multiple times that rewards will be interoperable between brands. Are wallets self-custodial? Can consumers transfer rewards to third-party wallets? Are rewards redeemable with brands outside the Visa platform?

Join the discussion by commenting below!

Brand leaders, take note: when discussing Visa's new loyalty program, you must address these questions.

We’re early. As the program gains momentum, I expect Visa to be more vocal about these topics.

This is a small step for Visa, but a giant step for Web3 mass adoption. I’m incredibly excited to see what brands will do with this.

If you’re a brand collaborating with Visa, I’d love to hear from you.

I hope this was helpful.

Talk soon,

Marc

PS: Follow me on LinkedIn and X for shorter insights.

👉 More feedback? I would love to hear from you! Just reply to this email.

Debit card use has been trending upward, with a significant increase in preference over credit cards. In fact, 56.2% of consumers preferred debit as their primary payment card, compared to 39.5% who preferred credit.

The Federal Reserve Payments Study (FRPS) reported that non-prepaid debit card payments increased most of all card types, reaching 87.8 billion payments, or approximately 56 percent of all card payments in 2021 in the US.

Visa determines interchange fees, or interbank fees, based on a variety of factors that take into account the nature of the transaction, the type of card used, and the risk involved.

This is because digital rewards don't require the merchant to pay a transaction fee to a card issuer.