📝#92: Stablecoin for 45M Users

Token 2049 Singapore highlights. SEC approves BTC option trading. Revolut plans to launch stablecoin for 45M users. Microsoft and Blackrock launch $30B AI fund.

Hey, it’s Marc ✌️

This was a big week for crypto. Our macro & AI highlights:

Crypto: Token 2049 Singapore highlights. Major launches at Solana Breakpoint 2024. SEC approves BTC option trading. Revolut plans to launch stablecoin for 45M users.

AI: Microsoft and Blackrock launch $30B AI fund. Apple tests AI on iPhone 16 models. TikTok plans to develop AI GPUs.

Let’s dive in 🦈

⏱️ Read time: 4min

👉 Want to get in front of 50k+ business leaders or accelerate your growth? Work with us here.

📚 Our Top Reads

Scaling: The State of Play in AI. By Ethan Mollick. Link

Why GEN AI Boom Is Fading And What’s Next? By Vishal Rajput. Link

Is Tron the only L1 that has a clear product market fit? By Michael Nadeau. Link

Evolution of Crypto ft. Vitalik Buterin. By Token Dispatch. Link

What does the future of Solana look like? By Stacy Muur. Link

A Case Study on Digital Financing. By Onyx. Link

Boson Protocol – Real Web3 Commerce, with Web2 UX

As the next bull market emerges, so does a new crypto-rich, Web3-savvy demographic, who are demanding authentic Web3 commerce experiences. Uniquely, with Boson, you can sell physical things as NFTs, with a slick Web2 experience while running on a fully decentralized Web3 backend. No more Web3 washing is required!

🌎 Crypto & Macro

Key Highlights of Token2049

TOKEN 2049 in Singapore, held on September 18-19, featured prominent speakers like Vitalik Buterin, Justin Sun, Balaji Srinivasan, and Anatoly Yakovenko. But did it live up to expectations?

Key highlights:

AI x Crypto: The convergence of blockchain and AI remains a hot topic. Side discussions centered on the potential of AI in crypto and the rising valuations of AI companies,, with Bittensor as the main topic of discussion.

Blockchain and mini-apps: The concept of mini-apps was widely demonstrated by several TON builders at the event. Kaia and Line also showcased multiple use cases following the growing trend of blockchain integration with messaging platforms.

Payments and AI agents: Payment is becoming a focus of the space as a real-world use case. Builders and VCs are more focused on infra with a focus on AI, consumer, and crypto.

Devil’s Advocate: Despite more footfall this year at Token 2049, the event was more inclined towards marketing and PR than showcasing new products.

🔵 No PRO yet? Get a PRO subscription and profit from:

Long takes with deep, data-driven, strategic industry analysis on how blockchain, AI, and gaming is impacting corporates & brands.

Access to our data room, full archive of expert analysis, podcast transcripts & cheatsheets

More exclusive content, virtual events, AMA’s with special guests & access to Marc

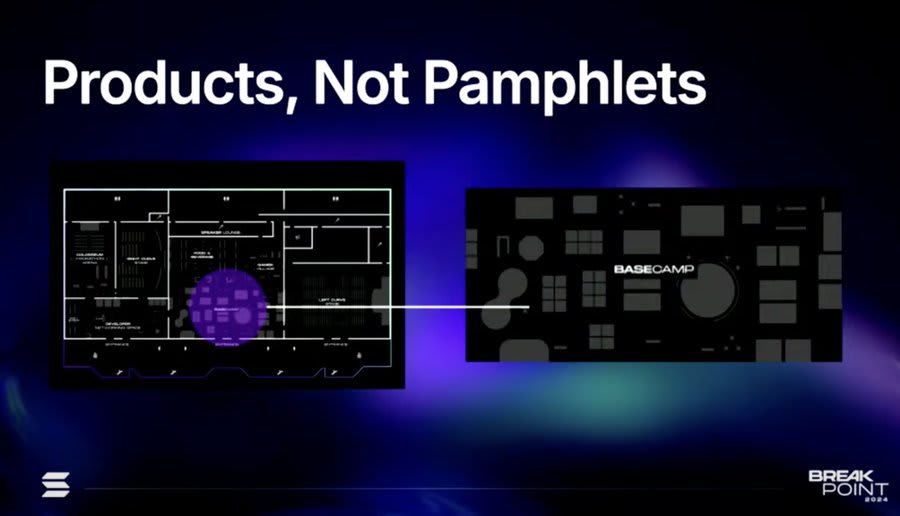

Solana Breakpoint Highlights

Solana hosted Breakpoint 2024 on September 20-21, focused on building user-facing applications.

App-first culture: Most Breakpoint speakers were app builders, with teams including Birdeye, Jupiter, Helio, Sky, Securitize, and Circle.

Solana Mobile: Solana revealed the new Seeker smartphone, launching in mid-2025. It offers upgraded hardware at a lower price, with 140K pre-orders already placed.

First L2: Zeta Markets, the Solana scaling solution, presented its demo, set to launch in Q4 2024.

Blinks expansion: Solana Blinks and Helio Pay enable Shopify merchants to sell directly on X, offering fast, secure payments via the Solana blockchain.

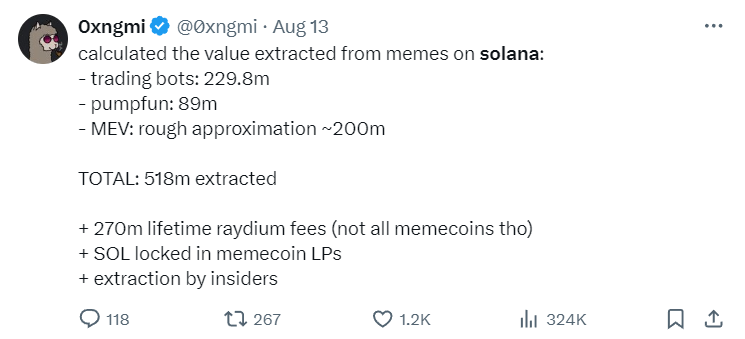

The meme effect: This year, Solana attracted millions of users with meme coins. Breakpoint 2024 also rode the meme wave with:

Bonk launching the $BONK ETP

Iggy Azalea introduced Motherland

Why it matters: Solana’s approach to creating practical solutions can potentially outpace Ethereum in mainstream adoption. Unlike Token 2049, Breakpoint highlighted a stronger interest in user acquisition and building mainstream awareness.

More Crypto Highlights:

Commerzbank is partnering with Crypto Finance AG to offer Bitcoin and Ether trading and custody services to its 11.6M retail customers. Link

The SEC has approved options trading for BlackRock's iShares Bitcoin Trust (IBIT) on Nasdaq, offering institutional investors a new way to hedge Bitcoin exposure. Link

Revolut is planning to launch its own stablecoin, expanding its crypto offerings with a compliance-first approach. The fintech company, valued at $45B, joins competitors like PayPal and Ripple in the growing stablecoin sector. Link

MicroStrategy issued $700M in bonds to buy more Bitcoin and pay down debt, continuing its aggressive BTC acquisition strategy. Meanwhile, Bhutan has quietly amassed over 13,000 BTC through state-backed mining, surpassing El Salvador's holdings. Link

👉 Want to get in front of 50k+ business leaders or accelerate your growth? Work with us here.

🪙 Regulation Highlights

The Financial Innovation and Technology for the 21st Century Act (FIT 21) aims to clarify crypto regulation by defining digital assets as either commodities or securities, assigning oversight to the CFTC and SEC. While the bill seeks to improve compliance and consumer protection, it faces challenges, including unclear jurisdiction over staked assets and potential delays in regulatory responses. Link

Australia will soon require cryptocurrency exchanges to obtain financial services licenses, extending regulations beyond digital currency exchanges. ASIC aims to clarify how major crypto assets like Bitcoin and Ether are treated under the Corporations Act to enhance consumer protection and market integrity. Link

🧠Artificial Intelligence

$30B Bet on AI

BlackRock, Global Infrastructure Partners, Microsoft, and MGX have launched the Global AI Infrastructure Investment Partnership (GAIIP) to invest up to $100B in data centers and energy infrastructure in the U.S.

Initial Funding: GAIIP seeks to unlock $30B in private equity capital, potentially leading to a total investment of $100B, including debt financing.

Open Architecture: The partnership promotes an open architecture for diverse partners, ensuring broad access to resources.

Collaboration: NVIDIA will provide expertise in AI data centers to support the initiative.

What they’re saying:

“The capital spending needed for AI infrastructure and the new energy to power it goes beyond what any single company or government can finance. This financial partnership will not only help advance technology, but enhance national competitiveness, security, and economic prosperity.”

Brad Smith, Vice Chair and President of Microsoft

Stepping back: Since 2022, Microsoft has invested in multiple AI startups, focusing on AI infrastructure, tooling, and applications. Notable investments include Mistral AI and Paige AI.

Why it matters: AI advancements demand significant computational power and energy. GAIIP, focused on AI infrastructure, brings together diverse technology resources and investment experience through its partnerships. This shows that large institutions and organizations are no longer just experimenting with AI—they're investing in it on a large scale.

Devil’s Advocate: The surge of investment in AI is also driving overvaluation, creating risks of market bubbles and misallocation of resources.

More AI Highlights:

Apple is testing AI software to enhance Siri on the new iPhone 16 models, launched on September 20. The update promises a more conversational and versatile assistant, automating tasks like writing and photo editing. Link

After leaving Apple, Jony Ive has quietly transformed a San Francisco city block into a hub for his design firm, LoveFrom, investing nearly $90M in real estate. His vision includes creating spaces for creative collaboration and developing an AI device company with OpenAI. Link

ByteDance, the owner of TikTok, is developing two AI GPUs with TSMC to reduce its reliance on Nvidia, having already spent over $2B on Nvidia's GPUs this year. The new GPUs, designed for AI training and inference, are expected to enter mass production by 2026. Link

💰 Money Moves

Funding Rounds:

The Open Network: Bitget and Foresight Ventures made a strategic investment of $30M in TON blockchain. Link

Drift Protocol: Solana-based DeFi platform raised $25M Series B led by Multicoin Capital. Link

Helius Labs: Infrastructure platform raised $21.75M led by Haun Ventures and Founders Fund. Link

Hemi Labs: The blockchain company raised $15M to develop and launch Hemi Network. Link

That’s all for now, folks.

The next edition on Web3 Consumer & Gaming will follow on Friday.

Talk soon,

– Marc & Team

PS: Follow us on LinkedIn and X for shorter insights.

⚡️ Amplify Your Growth

👉 Want to get in front of 50k+ business leaders or accelerate your growth? 51 Insights is your unfair advantage. We combine what and who we know to help you win:

Capturing market & mind share to increase outbound conversion rates

Shape your narrative & create qualified opportunities

Developing a go-to-market and growth strategy

Custom research reports

thanks Marc!