📝#91: From Wall Street to Dubai

Circle is moving its global HQ to NYC. MicroStrategy buys $1.1B in Bitcoin. Standard Chartered launches crypto custody services in UAE. Blackrock becomes third largest Bitcoin holder.

Hey, it’s Marc ✌️

We now officially switched to our new domain 51insights.xyz. Bye bye “Dematerialized.xyz”. 🫡

Today we will cover crypto, macro & AI:

Crypto: Circle is moving its global HQ to NYC. Circle partners with Sony. MicroStrategy buys $1.1B in Bitcoin. Standard Chartered launches crypto custody services in UAE. Blackrock becomes third largest Bitcoin holder.

AI: Godmother of AI introduces World Labs. OpenAI launched the o-1 preview model. Adobe expands Firefly AI.

Let’s dive in 🦈

⏱️ Read time: 3min

👉 Want to get in front of 50k+ business leaders or accelerate your growth? Work with us here.

📚 Our Top Reads

Stablecoin: The Emerging Market Story. By Castle Island Ventures. Link

Humanity in the Age of AI. Stanford Business. Link

Vitalik’s Ultimatum to L2s. By SOVEREIGN FRONTIER. Link

How artificial intelligence is overcoming natural stupidity. By Enrique Dans. Link

Global Protocol Report 2024 [paywall]. Link

Boson Protocol – Real Web3 Commerce, with Web2 UX

As the next bull market emerges, so does a new crypto-rich, Web3-savvy demographic, who are demanding authentic Web3 commerce experiences. Uniquely, with Boson, you can sell physical things as NFTs, with a slick Web2 experience while running on a fully decentralized Web3 backend. No more Web3 washing is required!

🌎 Crypto & Macro

Circle's Big Apple Bet 🍏

Circle is moving its global HQ to New York ahead of a planned 2025 IPO.

Why it matters: Circle is the company behind the second largest stable coin USDC ($35B market cap) and EURC. This is a big step for circle, and an even bigger one for the US crypto ecosystem.

The goal? To position Circle at the heart of global finance, driving the new internet financial system and making stablecoins mainstream by 2025.

The new global HQ will be located on the 87th floor of 1 World Trade Center.

Be smart: Moving to NYC, Circle places itself among key players in traditional finance, enhancing partnerships and boosting its market presence before its IPO.

Meanwhile: Circle is teaming up with Sony Block Solutions Labs to integrate USDC on Sony’s new layer-2 blockchain, Soneium.

By the numbers: Founded in 2018, USDC is the world’s second-largest stablecoin with a market cap of over $35B.

What they’re saying:

“The US is about to become THE decisive leader in building and supporting this technology and financial revolution.

2024 has been a turning point year in crypto, a year when stablecoins started to truly breakout in scale, importance and usage. 2025 will be the year when this goes mainstream.”

Jeremy Allaire, CEO of Circle Internet Financial

Devil’s Advocate: Circle's NYC move boosts its image and IPO prospects, but US political uncertainty casts doubt on its 2025 stablecoin mainstream ambitions.

More Crypto Highlights:

BlackRock’s ETF now holds 357K Bitcoins, making it the third-largest holder. Meanwhile, MicroStrategy’s latest $1.1B purchase boosts its total to 1.16% of all Bitcoin, reflecting rising institutional interest. Link

Grayscale has launched the Grayscale XRP Trust, giving accredited investors exposure to XRP, the token used for cross-border payments on the XRP Ledger. Link

Standard Chartered has launched crypto custody services in the UAE, starting with Bitcoin and Ether, after receiving approval from Dubai's financial regulator. The bank aims to expand to other crypto assets and financial hubs. Link

SWIFT outlined plans to enable digital asset transactions and interlink blockchain networks, starting with multi-ledger Delivery-versus-Payment and Payment-versus-Payment on its platform. The goal is to support tokenized asset settlement with fiat, CBDC, or tokenized deposits. Link

BitMEX founder Arthur Hayes, launched the Airhead Bitcoin Ordinals collection, featuring unique inflated characters, in collaboration with Oyl Wallet. Airheads is the first Ordinals collection to use a leaderboard system tied to real-world wealth. It blends technology, art, economic philosophy, and gamification, showcasing the use cases of Ordinals.

🔵 No PRO yet? Get a PRO subscription and profit from:

Long takes with deep, data-driven, strategic industry analysis on how blockchain, AI, and gaming is impacting corporates & brands.

Access to our data room, full archive of expert analysis, podcast transcripts & cheatsheets

More exclusive content, virtual events, AMA’s with special guests & access to Marc

🪙 Regulation Highlights

A new bill introduced in the UK Parliament will officially recognize digital assets like Bitcoin and NFTs as personal property, offering greater legal protection. A UK court ruled that stablecoin Tether (USDT) is legally recognized as property, allowing it to be traced and treated like other assets. Link

U.S. Rep. John Rose introduced the BRIDGE Act to improve collaboration between the SEC and CFTC on digital asset regulations. The bill proposes forming a Joint Advisory Committee to create a balanced regulatory framework and support innovation. Link

🧠Artificial Intelligence

A New World

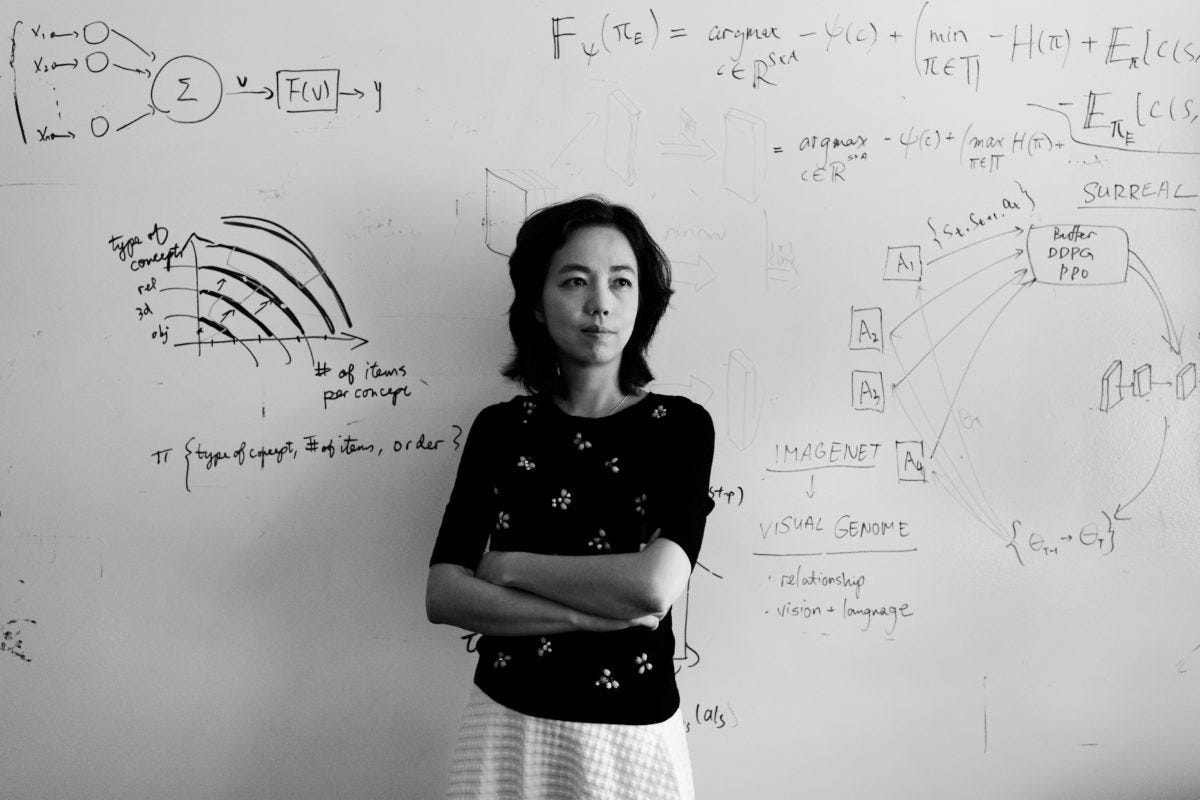

Fei-Fei Li’s (aka godmother of AI) new AI startup, World Labs, raised $230M to develop AI models that understand the 3D world, with plans for a 2025 product launch.

Initial focus: Creating and editing 3D virtual spaces with physics, semantics, and control.

Spatial Intelligence: LWMs (Large World Models) are designed to give AI the ability to perceive, generate, and interact with the 3D world, similar to how humans understand space, objects, and their interactions.

Funding: Founded by Fei-Fei Li, Justin Johnson, Christoph Lassner, and Ben Mildenhall, the startup is backed by a16z, NEA, and Radical Ventures.

Zooming out: Valuations for AI start-ups are exploding. Last week, Safe Superintelligence (SSI), co-founded by ex-OpenAI chief scientist Ilya Sutskever, has raised $1B to advance safe AI systems.

Devil’s Advocate: VCs are immensely confident in the potential of AI, even for early-stage companies. Where are they making money?

Why it matters: Spatial intelligence has multiple applications in gaming, virtual reality (VR), augmented reality (AR), and robotics. World Labs has a clear vision and can bring more realistic and interactive advancements that can bring new ways for brands to connect with consumers.

More AI Highlights:

OpenAI launched the o1-preview model series, designed for complex reasoning in science, math, and coding. It offers enhanced problem-solving abilities and safety, with options like o1-mini for cheaper, faster coding solutions. Link

Adobe is expanding its Firefly AI platform to include video creation tools in Premiere Pro, offering features like B-roll generation and timeline gap fixing. Link

💰 Money Moves

Funding Rounds:

World Labs: Unicorn AI startup raised $260M backed by Andreessen Horowitz. Link

Glean: AI-powered work assistant raised $260M with a valuation of $4.6B. Link

Tune.fm: Blockchain music startup raised $80M led by global emerging markets. Link

Other:

Amazon will invest $10.5B in U.K. data centers by 2028, expanding its cloud and AI infrastructure. This investment will boost the U.K. economy by £14B and create 14,000 jobs annually. Link

That’s all for now, folks.

The next edition on Web3 Consumer & Gaming will follow on Friday.

Talk soon,

– Marc & Team

PS: Follow us on LinkedIn and X for shorter insights.

⚡️ Amplify Your Growth

👉 Want to get in front of 50k+ business leaders or accelerate your growth? 51 Insights is your unfair advantage. We combine what and who we know to help you win:

Capturing market & mind share to increase outbound conversion rates

Shape your narrative & create qualified opportunities

Developing a go-to-market and growth strategy

Custom research reports

thanks, Marc

what do think about RWA & DePin can boost web3 space?