📝#90: Big Bucks, No Product

Hey, it’s Marc ✌️

Today we will cover crypto, macro & AI:

Crypto: Travala partners with Skyscanner. Bridge raises $50M to simplify global transactions. Siemens issues €300M digital bond.

AI: Ilya’s Safe Supeintelligence raises $1B with no product. ChatGPT surpasses 1M paying business users. Anthopic launches Claude Enterprise.

Let’s dive in 🦈

⏱️ Read time: 3min

👉 Want to get in front of 50k+ business leaders or accelerate your growth? Work with us here.

📚 Our Top Reads

Social Media Manipulation in the Era of AI. By Rand. Link

Onchain Social. By Our Network. Link

The Rise and Fall of Venture Capital. By TNMT. Link

How the Machine Economy combining AI, blockchain, and Fintech is growing. Link

YouTube culture & trends report. By Fandom. Link

Buy Crypto Using PayPal Balance

Traders across the U.S. and EU can now buy Bitcoin, Ethereum, Solana, and hundreds of cryptocurrencies using their PayPal account, powered by MoonPay.

🌎 Crypto & Macro

Fly High with Crypto✈️

Travala, a crypto-native travel booking platform, has partnered with Skyscanner, accessing its 110M monthly users to book over 2.2M hotels across 230+ countries, using more than 100 cryptocurrencies.

The integration makes Travala discoverable alongside leading travel agencies like Expedia, Booking.com, and Agoda.

With its loyalty program, Travala enables users to earn rewards, including booking discounts and up to 10% back in Bitcoin.

Why it matters: Travala is directly targeting mainstream users, normalizing the use of cryptocurrencies for everyday transactions. It also fuels crypto tourism by focusing on crypto events and conference attendees with ease of payment and additional rewards.

By the numbers:

Skyscanner averages 80B daily searches and 29.11M monthly visits with 41.79% traffic from the United States and the largest age group being 25-34.

As of 2024, it is estimated that there are over 560M cryptocurrency owners worldwide, with 34% in the range of 25-34 years old.

What they’re saying:

“By integrating Skyscanner’s market-leading search capabilities with Travala.com’s crypto-native platform, we’re making travel planning more accessible and flexible for the growing number of travelers who prefer alternative payment methods.”

Sanja Vukik, Head of Hotels at Skyscanner

Stepping back: In 2023, metasearch engine Kayak partnered with Travala, allowing users to book over 2M properties and 600 airlines using cryptocurrencies. Before that, Travala connected directly to airlines through the NDC standard, offering competitive pricing by bypassing global distribution systems.

The Big Picture: The partnership gives Travala access to Skyscanner's massive user base, potentially attracting a large number of new customers and increasing its market share. It is also a step towards greater financial inclusion in the travel sector.

📢Hiring Alert!

New Rising Ambitions💸

Bridge, a startup led by Coinbase and Square, raised $58M to build a seamless, blockchain-based payment network.

The goal ? A stablecoin payment network to challenge traditional systems like SWIFT and credit cards.

Clients: SpaceX, Stellar, and Coinbase for global treasury management

Solution: APIs that enable seamless transfers between fiat, stablecoins, and different blockchains

Focus on Complaince: Secured licenses in 48 states, Poland, and more regions to facilitate global transactions

Why it matters: Currently, cross-border payments are slow, expensive, and riddled with complexities. Bridge enables faster, cheaper transactions through stablecoins and streamlines the complex process of converting fiat to stablecoins, making global financial services more accessible for businesses.

Examples:

A company in Brazil can use Bridge to send USDC payments to their supplier in China.

A small business in the U.S. can take payments in PYUSD from customers around the world.

By the numbers: Founded in 2022, Bridge has processed $5B+ in annual payments to date.

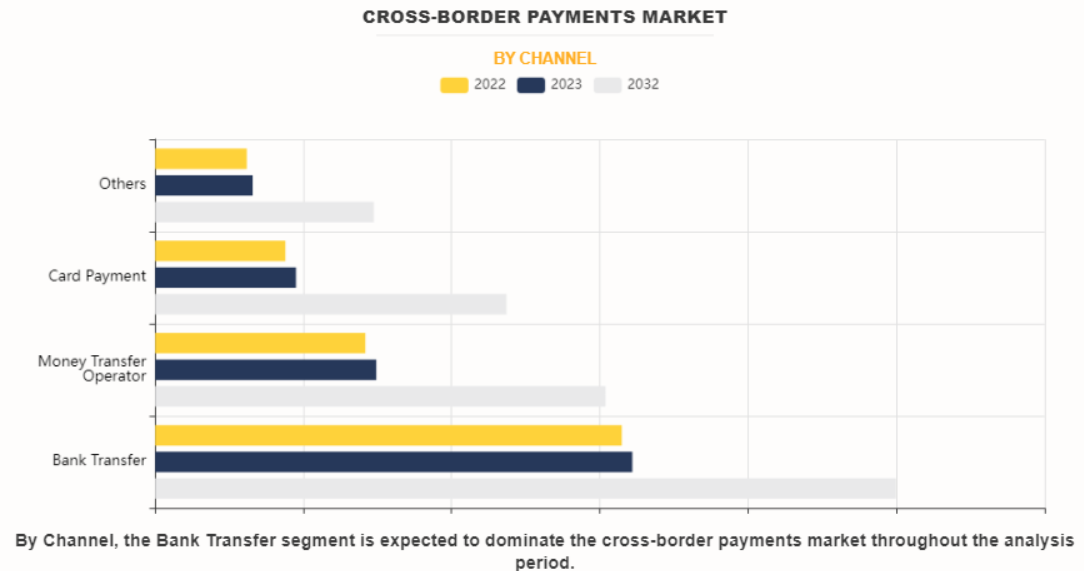

The global cross-border payments market was worth $181.9B in 2022 and is expected to grow to $356.5B by 2032.

What they’re saying:

“The work that they’re doing helping traditional businesses come on-chain is super important. All businesses are going to have all their assets on-chain, because it’s going to be faster, cheaper, and more globally available.”

Jesse Pollak, Founder of Base

The Big Picture: Bridge is off to a good start. It will have to navigate regulatory hurdles and competition from both traditional and crypto payment networks to establish a strong foothold.

More Crypto Highlights:

The SEC fined Crypto Hedge Fund Galois Capital $225K for violating the Custody Rule by storing crypto assets on non-compliant platforms like FTX and misleading investors about redemption terms. Galois agreed to settle without admitting wrongdoing, and the penalty will compensate affected investors. Link

Uniswap Labs settled with the CFTC for $175K over charges related to illegal digital asset derivatives trading. The CFTC's action underscores its commitment to regulating DeFi platforms, while some commissioners criticize the approach as heavy-handed and potentially stifling innovation. Link

Siemens has issued a €300M digital bond using a private blockchain, with settlement facilitated by major German banks including Deutsche Bank. This bond builds on Siemens' previous experience with blockchain bond issuance and demonstrates the potential for faster and more efficient transaction processing. Link

VanEck is closing its Ethereum futures ETF due to low demand, as spot Ethereum ETFs now dominate with $6.5B in assets, overshadowing the $170M in futures-based ETFs. Spot ETFs have proven more popular and cost-effective compared to their futures-based counterparts. Link

🔵 No PRO yet? Get a PRO subscription and profit from:

Weekly case studies and data-driven, strategic industry analysis on consumer Web3

Private community with exclusive content, virtual events, AMA’s with special guests & access to Marc

Access to top cheatsheets, lists & full archive

🪙 Regulation Highlights

The FCA reported that over 87% of crypto registrations were rejected, withdrawn, or refused as part of its efforts to curb fraud and enhance consumer protection. The new regulations include stricter marketing rules and a 24-hour cooling-off period to ensure clearer and fairer crypto promotions. Link

Qatar Financial Centre has introduced a new regulatory framework for digital assets, including tokenization and smart contract recognition, aiming to enhance security and transparency. It has also set standards for the safekeeping and transfer of digital assets. Link

🎙️ Power Lunch : Why is Roblox the Choice of Metaverse for Brands?

In this episode, we’re digging into Roblox and how it’s shaping the future of gaming.

Stephen Dypiangco, CEO of Metaverse Marcom , joins us to break down:

Brand Engagement: How brands connect with users on Roblox

Monetization Models: In-game purchases, virtual goods, and brand deals

Roblox vs Competitors: The fight for user attention

Influencers and Creators: The engine behind Roblox’s growth

Global Reach: Roblox’s expanding influence worldwide

The Future: What’s next for gaming, social interaction, and the metaverse

Don't miss out—register now and get ready to learn where Roblox future is headed👇

🧠Artificial Intelligence

Money Grab or Real Deal?🤖

Safe Superintelligence (SSI), co-founded by ex-OpenAI chief scientist Ilya Sutskever, has raised $1B to advance safe AI systems.

The funds will be used for computing power and talent acquisition, supported by top investors like Andreessen Horowitz and Sequoia Capital.

The company is 3 months old with no product and valued at $5B.

Why it matters: SSI's raise highlights the growing interest in advanced AI research, fueled by ex-OpenAI scientist Ilya Sutskever. Despite its secrecy about its research initiatives, its significant funding and top-tier backing with a team of 10 underscore its potential to challenge established AI leaders like OpenAI and Anthropic.

Meanwhile: OpenAI is seeking to raise funds at a valuation exceeding $100B, with Thrive Capital leading a $1B investment round. Whereas, Anthropic and xAI were both valued at close to $20bn in funding rounds earlier this year.

Devil’s Advocate: VCs are immensely confident in the potential of AI, even for early-stage companies. Where are they making money?

Zooming out: Despite its $1B funding, SSI's resources are dwarfed by the vast financial reserves of tech giants, who dominate with their extensive computing infrastructure and substantial investments in AI.

More AI Highlights:

ChatGPT now boasts over 1M paying business users, up from 600K in April, with its business and educational editions driving this growth. OpenAI's annualized revenue in 2024 reached $3.4B, but they are still losing money. Link

Anthropic is launching Claude Enterprise to offer businesses enhanced security and administrative controls, competing with OpenAI’s ChatGPT Enterprise. Claude Enterprise features a large context window and collaborative workspaces, allowing for complex data processing and teamwork. Link

Nvidia denied receiving a subpoena from the Justice Department, clarifying it only received a civil investigative demand. The probe is focusing on Nvidia's $700M RunAI acquisition and potential antitrust issues. Link

Elon Musk’s X has launched the Colossus supercomputer, using 100K Nvidia H100 GPUs for AI training, with plans to expand to 200K GPUs. Despite being operational, power and optimization challenges persist. Link

💰 Money Moves

Funding Rounds:

Safe Superintelligence: AI company raised $1B with a valuation of $5B. Link

Sakana AI: AI R&D company raised $100M led by New Enterprise Associates, Khosla Ventures and Lux Capital. Link

You.com: AI search tool and productivity platform raised $50M led by Georgian. Link

Balance(E-PAL): Gaming and social companion platform raised $30M led by Andreessen Horowitz and Galaxy Interactive. Link

That’s all for now, folks.

The next edition on Web3 Consumer & Gaming will follow on Friday.

Talk soon,

– Marc & Team

PS: Follow us on LinkedIn and X for shorter insights.

⚡️ Amplify Your Growth

👉 Want to get in front of 50k+ business leaders or accelerate your growth? 51 Insights is your unfair advantage. We combine what and who we know to help you win:

Capturing market & mind share to increase outbound conversion rates

Shape your narrative & create qualified opportunities

Developing a go-to-market and growth strategy

Custom research reports