📝#87: Old Gold vs. New Gold

Norway's and Swiss National Bank buy “bitcoin”. Optimism teases its Superchain. JPMorgan has launched its own LLM Suite for its 60,000 employees. Perplexity AI partners with Polymarket.

Hey, it’s Marc ✌️

We’re in week two of our Field Notes experiment, and the feedback has been great. Your responses to the poll show that you prefer the split format:

Web3 consumer + gaming on Fridays

Crypto, Macro + AI on Tuesdays

Here’s to another week of testing. Let us know if this new format works for you:

Today we will cover:

Crypto: National banks and sovereign wealth funds stack bitcoin. Optimism teases its Superchain. USDC tap-and-go payments on iPhones

AI: JPMorgan has launched its own LLM Suite for its 60,000 employees. Perplexity AI partners with Polymarket.

Let’s dive in 🦈

⏱️ Read time: 3min

👉 Want to get in front of 50k+ business leaders or accelerate your growth? Work with us here.

📚 Our Top Reads

The Tower & the Square. By Delphi Digital. Link

Crypto Takes The National Political Stage. By Pantera Capital. Link

Real World Assets (Ondo, BUIDL, Maple and OpenEden). By OurNetwork. Link

Polymarket's Expansion Via Partnerships, 2024 Web3 Growth Landscape. By TPan. Link

Top Brands in Immersive Commerce (PRO Resource). Link

Buy Crypto Using PayPal Balance

Traders across the U.S. and EU can now buy Bitcoin, Ethereum, Solana, and hundreds of cryptocurrencies using their PayPal account, powered by MoonPay.

🌎 Crypto & Macro

The Big Bet

Norway's and Switzerland's central banks have revealed significant holdings in MicroStrategy, with Norges Bank holding 1.123M shares and the Swiss National Bank increasing its stake by 60% to 466,000 shares.

What you should know:

MicroStrategy, known for its large Bitcoin holdings, continues to attract investment from global financial institutions.

Norway's sovereign wealth fund, also known as Norway’s Government Pension Fund Global, invested $217M in MicroStrategy as of June 30, 2024, tripling its stake over the past year, with a 0.89% ownership stake and 0.45% voting rights.

In Q2 2024, the Swiss National Bank increased its stake in MicroStrategy by 60%, holding 466,000 shares worth $63M, indirectly giving it exposure to around 540 Bitcoins.

By the numbers: MicroStrategy holds 226,500 bitcoins valued at $13.8B, making up about half of its $26.3B market capitalization.

Why it matters: This move by two prominent European central bank signals a growing acceptance and interest in Bitcoin from established financial institutions. Investing in MicroStrategy offers these central banks indirect exposure to Bitcoin without directly holding the cryptocurrency.

Meanwhile: South Korea’s National Pension Service invested $32.5M in MicroStrategy. The pension fund also holds significant stakes in Coinbase, showing its broader interest in crypto-related assets.

What are they saying:

“This is simply part of a physical index replication strategy which basically all very large institutional investors have and do. This has nothing to do with what many ppl in the comments see as an implied message that Norges or SNB is now bullish bitcoin or MSTR…“

Patrick Saner, Head of Macro Strategy at Swiss Re

The punchline: The investment of banks in MicroStrategy has similar impact as Bitcoin ETF approval. Soros Capital Management and other major firms increased their stakes in TeraWulf and Iris Energy. Additionally, Marathon Digital Holdings raised $300M to boost its Bitcoin reserves to over 25,000 BTC. This definitely highlights the growing institutional interest in Bitcoin and its potential impact on traditional financial markets.

More Crypto Highlights:

Circle's CEO, Jeremy Allaire, announced plans for USDC tap-and-go payments on iPhones, following Apple's decision to open its NFC and Secure Element to third-party developers. This move enables blockchain-based payments and broader use of digital assets and NFTs. Link

Optimism teases its Superchain, a unified platform for asset transfers, app development, and user experience across multiple chains and apps. Link

Binance has resumed operations in India after a seven-month ban by registering with the Financial Intelligence Unit (FIU-IND). The exchange's apps are back on local app stores, marking its 19th global regulatory milestone. Link

🔵 No PRO yet? Get a PRO subscription and profit from:

Weekly case studies and data-driven, strategic industry analysis on consumer Web3

Private community with exclusive content, virtual events, AMA’s with special guests & access to Marc

Access to top cheatsheets, lists & full archive

🪙 Regulation Highlights

Nigeria's Federal Inland Revenue Service plans to introduce a cryptocurrency regulation bill by the end of 2024 to address risks and boost the economy. This effort is part of broader reforms to modernize Nigeria's taxation system and align with growing crypto adoption. Link

US agencies are revising the definition of “money” to include cryptocurrencies, aiming to align reporting requirements for digital assets with traditional currencies. A final rule is expected by September 2025 to enhance transparency and prevent illicit activities. Link

🧠Artificial Intelligence

JP Morgan’s LLM Suite

JPMorgan Chase has launched its LLM Suite, a generative AI assistant powered by OpenAI, to help over 60,000 employees for tasks like writing and summarizing.

The LLM Suite functions as a virtual analyst, handling financial data, creating marketing content, summarizing meetings, and automating repetitive tasks to free up human analysts for more complex work.

It will become as ubiquitous as Zoom within the bank, with plans to expand its use across different divisions.

JPMorgan initially restricted ChatGPT due to data security; LLM Suite is implemented with safeguards to protect sensitive information.

Stepping back: J.P. Morgan Chase launched IndexGPT in May 2024, a new index family using GPT-4 to create thematic indexes for institutional clients. This tool enhances J.P. Morgan's thematic index framework, improving keyword identification and index creation.

What are they saying:

“AI is going to change every job. It may eliminate some jobs. Some of it may create additional jobs. But you can’t envision one app, one database, or one job where it’s not going to help, aid or abet.”

Jamie Dimon, JPMorgan Chase CEO

Why it matters: JPMorgan's LLM Suite showcases a concrete, real-world application of AI in the financial sector, going beyond theoretical discussions and pilot projects. This serves as a strong validation of the potential of AI to transform the financial services sector.

More AI Highlights:

Perplexity AI is partnering with prediction market Polymarket to offer news summaries and real-time probability predictions on events like elections and market trends. This move comes amid regulatory scrutiny and debate over the future of prediction markets. Link

Researchers are launching a global supercomputing network to accelerate the development of artificial general intelligence (AGI), starting with the first node in September. This network aims to enhance AI capabilities through advanced hardware and federated computing. Link

Google Meet is rolling out an AI-powered "Take notes for me" feature, powered by Gemini AI, to automatically capture meeting notes. This update, available soon for users with specific licenses, aims to boost productivity by letting users focus on discussions rather than note-taking. Link

💰 Money Moves

Funding rounds:

Chaos Labs: DeFi project raised 55M led by Haun Ventures and F-Prime Capital. Link

Sahara AI: A decentralized AI network, has secured $43M in funding, with Pantera Capital, Binance Labs, and Polychain leading the round. Link

WSPN: Payment network secured 30M funding led by Foresight Ventures. Link

Essential:The First Declarative Blockchain announced a $11M Series A Round led by Archetype, Spartan, Amber Group and others. Link

Funds:

Gate Ventures and The Blockchain Center in Abu Dhabi launch $100M Web3 innovation fund. Link

That’s all for now, folks.

The next edition on Web3 Consumer & Gaming will follow on Friday.

Talk soon,

– Marc & Team

PS: Follow us on LinkedIn and X for shorter insights.

⚡️ Amplify Your Growth

Building a Web3 business OR looking to innovate with Web3 tools? FiftyOne Labs is your unfair advantage. Powered by FiftyOne Insights, we combine what and who we know to help you win:

Capturing market & mind share with our 50k+ b2b audience

Full-stack content outsourcing

Developing a go-to-market and growth strategy

Reaching potential partners or clients

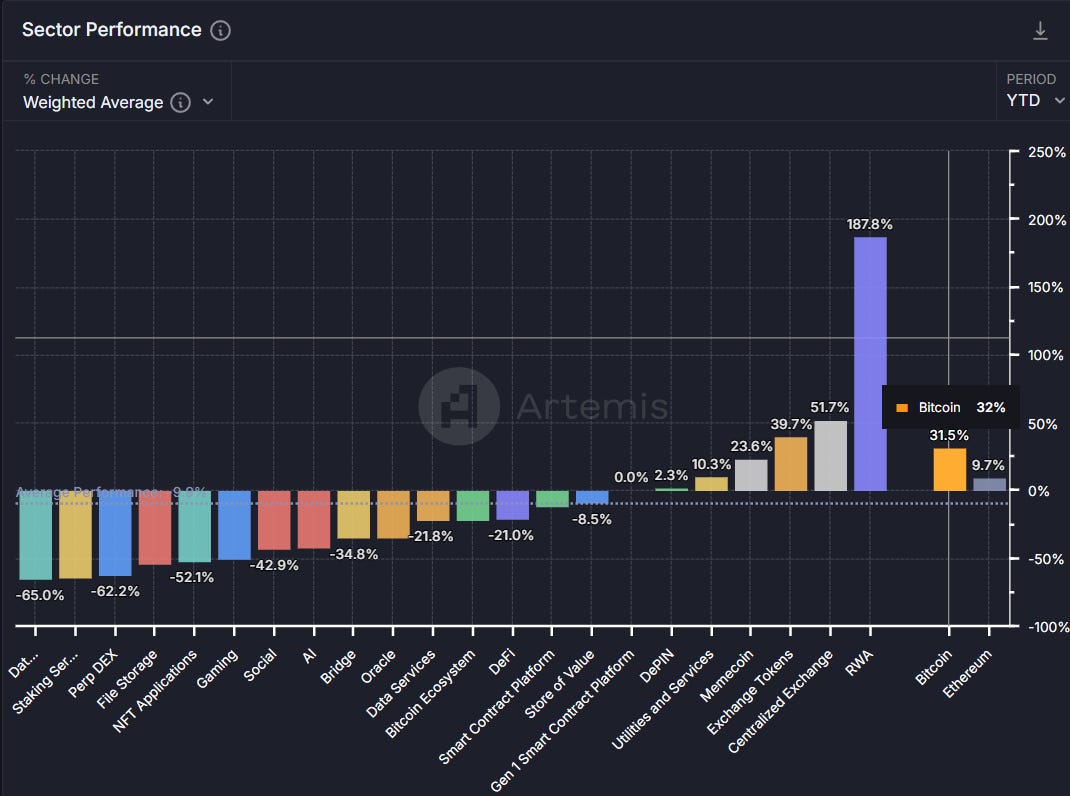

📈 Top 3 Charts to Share with Friends

Top Web3 Marketing Jobs This Week

Other jobs:

Social Media Manager, Boson Protocol

Marketing Manager (Partner Centric), Boson Protocol

Marketing Manager (Product Centric), Boson Protocol

Director of Product Marketing, Stellar

CMO, Logos

CMO, Kinetex Network

👉 Access all 50+ jobs here.