📝#86: When Wall Street meets Bitcoin

Morgan Stanley jumps on the Bitcoin ETF bandwagon, pitching to clients like it's the next big thing. Meanwhile Polymarket touched $100m in volume & AI Pins miss the mark & more.

Hey, it’s Marc ✌️

As promised, We’re back with out second edition of field notes focusing on Crypto, Macro & AI.

Why the change?

1) The notes were getting too long

2) This way, we can dive deeper into each category

We'd love to know if this new format works for you 👇

Today we will cover what we missed last week:

Crypto & Macro: Morgan Stanley starts pitching Bitcoin ETFs to clients. Grayscale launches SUI and TAO trusts. The BITCOIN Act of 2024.

AI: Humane's $699 AI Pin flopped. New GPT-4o competitor?

Let’s dive in 🦈

⏱️ Read time: 3min

👉 Want to get in front of 50k+ business leaders or accelerate your growth? Work with us here.

📚 My Top Reads

The ETH Report. By DeFi Report. Link

Stablecoins market overview. By DWF Labs. Link

Your guide to tokens. By a16z. Link

The 2024 Web3 Growth Landscape. By Safary. Link

Buy Crypto Using PayPal Balance

Traders across the U.S. and EU can now buy Bitcoin, Ethereum, Solana, and hundreds of cryptocurrencies using their PayPal account, powered by MoonPay.

🌎 Crypto & Macro

Boomers Are About to Eat Your Bitcoin 🍔

Morgan Stanley now allows its army of 15,000 wealth advisors to pitch Bitcoin ETFs to some clients – a first for a big bank.

Why it matters: The train is leaving the station. US wealth advisors manage nearly $30T. Morgan Stanley is one of the pre-eminent wealth management firms globally with $1.5 trillion in assets.

Zooming out: It took Morgan Stanley more than 10 years to get to this point.

In March 2014, they held a microfinance bitcoin event at its New York headquarters, when CEO James Gorman said the virtual currency is "totally surreal".

How did we get here?

Morgan Stanley responded to inquiries and "demands from clients".

Even better: They don't take any risk, but pitch for management fees.

Meanwhile, Goldman Sachs, J.P. Morgan , Bank of America , and Wells Fargo still prohibit their financial advisors from promoting Bitcoin ETFs.

Jamie Dimon, CEO of J.P. Morgan, still calls Bitcoin “worthless” and a “hyped-up fraud”.

But not for long. We're just getting started. Many more wealth managers will follow suit.

This boosts confidence among retail investors, as it opens the floodgates for new capital. IBIT, a spot Bitcoin ETF launched by BlackRock, has pulled in a record-setting $20B in inflows in 6 months largely WITHOUT the $30T US Wealth Advisory market thus far.

Also, it's an opportunity for founders to target these "boomers" with crypto products that blend traditional finance with DeFi.

What’s the take-away for brand leaders?

Legitimization. Crypto is not a sideshow anymore. Whether it’s payments, digital identity. onchain loyalty assets or IP – you can’t ignore it anymore.

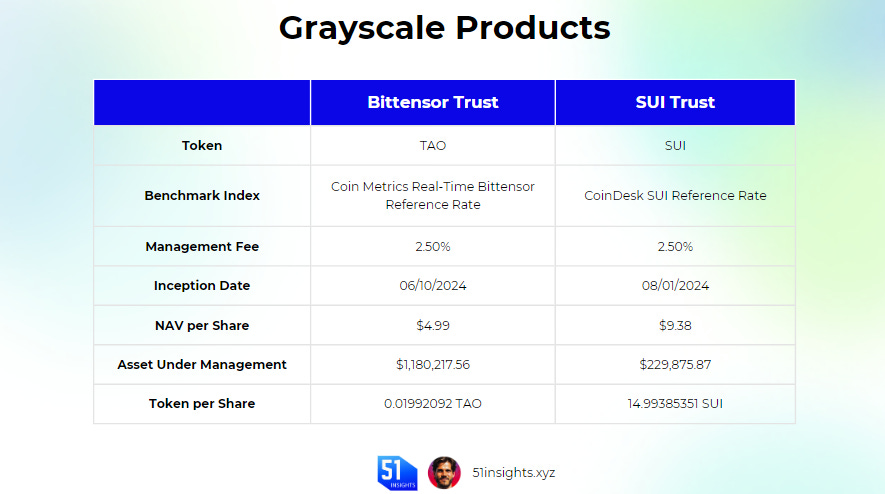

Grayscale’s New Crypto Products

Grayscale Investments, a leading digital asset manager, recently announced the launch of two new single-asset crypto funds:

Grayscale Bittensor Trust: It offers investors exposure to Bittensor (TAO token) through a security, avoiding the complexities of directly buying and storing the digital asset. The trust’s shares are designed to track the market price of TAO, minus fees and expenses.

Grayscale Sui Trust: It provides investors with exposure to SUI (SUI token) through a security, bypassing the need to directly buy, store, or manage the digital asset. The shares track the SUI market price, minus fees and expenses, on the decentralized SUI Network.

Why it matters: Grayscale is a regulated investment firm and it is bringing crypto to accredited and institutional investors through these funds. These funds give SUI and TAO credibility and legitimacy.

More Crypto Highlights:

Senator Cynthia Lummis has introduced the BITCOIN Act of 2024 to create a national Bitcoin reserve, aiming to strengthen the U.S. dollar’s global financial position. The bill faces challenges in a divided Congress and amidst the contentious 2024 Presidential race, highlighting the political divide on cryptocurrency. Link

Bybit is exiting the French market due to regulatory pressures from France's AMF, which blacklisted the exchange for operating without proper registration. Link

Polymarket crossed $100M volume in 5 days in August 2024. Link

🔵 No PRO yet? Get a PRO subscription and profit from:

Weekly case studies and data-driven, strategic industry analysis on consumer Web3

Private community with exclusive content, virtual events, AMA’s with special guests & access to Marc

Access to top cheatsheets, lists & full archive

🪙 Regulation Highlights

Judge Analisa Torres ruled that Ripple Labs must pay a $125M penalty but declared XRP is not a security, concluding the SEC's nearly four-year legal battle against Ripple. This decision significantly reduces the SEC's original $2B penalty demand by 94%. Link

The French financial regulator, AMF, has begun accepting applications for crypto asset service providers under the upcoming MiCA regulation, which will require authorization for crypto services in the EU by December 2024. The new rules are stricter than current French laws, particularly in areas like anti-money laundering and cybersecurity. Link

The Brazilian Securities Regulator, CVM, is investigating tokenization companies, requesting details about their operations and the types of tokens issued since January 2023. This inquiry has raised concerns among providers, who feel it may lead to self-incrimination. Link

🧠Artificial Intelligence

Humane's $699 AI Pin faced overwhelming returns, outpacing sales, leading to significant financial losses and internal turmoil. Despite raising over $200M and efforts to stabilize, the company struggles with negative reviews and operational challenge. Link

A new AI model, dubbed "anonymous-chatbot," has emerged in the LMSYS Chatbot Arena, showing advanced reasoning beyond GPT-4o. Speculation swirls that it could be OpenAI’s secret Q* or 'Strawberry,' potentially signaling a major leap in AI technology. Link

💰 Money Moves

Funding rounds:

Opal: High-end webcams company raised $60M Series B led by OpenAI. Link

Morpho Labs: Infrastructure company secured $50M funding led by Ribbit Capital. Link

Aidatify: On-chain AI aggregator completed a $17.5M Series A funding, led by S M Capital. Link

That’s all for now, folks. Thank you for being part of the journey.

Talk soon,

– Marc

PS: Follow me on LinkedIn and X for shorter insights.

⚡️ Amplify Your Growth

Building a Web3 business OR looking to innovate with Web3 tools? FiftyOne Labs is your unfair advantage. Powered by FiftyOne Insights, we combine what and who we know to help you win:

Capturing market & mind share with our 50k+ b2b audience

Full-stack content outsourcing

Developing a go-to-market and growth strategy

Reaching potential partners or clients

📈 Top 2 Charts to Share with Friends

Top Web3 Marketing Jobs This Week

Other jobs:

Web3 Global Marketing Administrative Assistant, Solana Foundation

Growth Marketing Manager, Perpetual Protocol

Marketing Director, Matrixport

Lead Marketing Analytics, Gemini

Head of Partnerships, Babylon

👉 Access all 50+ jobs here.

📚 What I’ve Been Reading

Expect this newsletter every Tuesday and Friday with insights, charts & analyses on market.

Short interviews offer insider views and alpha.

They’re also planning to launch a new format for zeroing in on the German speaking web3 ecosystem. Großartig!

Check them out 👇