📝 Field Notes #62: Virtual > Physical

Sephora goes Web3. Louis Vuitton's blockchain diamonds. Mastercard launches NFT experience. Bitcoin breaks $50k. Franklin Templeton files for spot ETH ETF. Coinbase beats estimates. Fundings & more.

Hey, it’s Marc. ✌️

This was a big week for consumer crypto with major announcements from Louis Vuitton, Sephora, and Mastercard. Next week, the space meets at NFT.Paris. I’ll be there. Meet me there or join this group!

Be inspired✨

“Brands succeed when they break through in culture. ” — Douglas Holt

From our Partners

Join the forefront of innovation with Future+!

Future+ is excited to open applications for membership. Spearheaded by Ashumi Sanghvi, founder of MAD Global, their global network connects Founders, C-Suite, and disruptors in creative culture and emerging technology. Enjoy exclusive access to events, media, and networking opportunities both in the physical and digital realms.

👉 Claim your preferential rate with this exclusive one-time offer with the code “FUTUREPLUSDEMA”.

📚 Top 5 Reads

Dissecting the points meta: best practices for user loyalty. By Li Jin. Link

Proof of taste. By Aleksija Vujicic. Link

Why are brands investing in gaming. By GEEIQ. Link

Positive Sum Design with Crypto. By Shinya Mori. Link

Headless Marketplaces: Go Where the Wallets Are. By Jesse Walden. Link

✨ Web3 + NFTs

Virtual > Physical✨

Sephora announced its Web3 platform “Sephora Universe”:

Currently invite-only, users will be able to experience a virtual world with their own avatar, discover virtual products, attend virtual events and connect with other members.

Users earn collectibles that unlock access to exclusive brand content, but collectibles are personal and cannot be purchased, transferred or sold.

The platform was developed with Shape Immersive.

Why it matters: Sephora is a $11BN retail business for beauty products with nearly 340 brands represented along with their own private label.

By the numbers: Over 80% of Interbrand’s Top 100 Global Brands have already launched immersive commerce experiences.

Be smart: Brands either build in “owned” or “open” (e.g. Roblox) virtual worlds. Key players for owned worlds are Journee, ByondXR, Spatial, Obssess, Dreamwave, or Emperia.

Punchline: Immersive commerce is a key Web3 consumer vertical. More brands will start connecting different formats and platforms, such as physical/virtual, community, and gamification, while generating a wealth of first party data.

From NFTs to Diamonds💎

Louis Vuitton partnered with Aura Blockchain to offer first ever, end-to-end traceability and certification of its new LV diamonds collection. Link

These certificates track each diamond's journey from mine to finger, including details like origin, polishing, and setting.

Zoom out: Luxury brands such as Hublot, Bulgari, Dior, LVMH or Prada are working with the Aura Blockchain Consortium to bring digital twins of their products on-chain to ensure product traceability and authenticity.

Digging deeper: Upcoming EU regulation mandate a Digital Product Passport (DPP) for product traceability and life cycle information.

Understanding the market: Aura Blockchain is not the only solution for this. Other players are EON, Arianee, or KORE Technologies.

By the numbers: The potential of tokenization is huge.

Boston Consulting Group (BCG) estimated tokenized assets could reach $16 trillion by 2030.

Roland Berger projects it to reach $11 trillion by 2030.

Punchline: Phygitals, or tokenization, is one of the big blockchain use cases for consumer brands.

More on Web3:

Mastercard launched “Pass to priceless”, a NFT-based membership program in partnership with MoonPay. Link

Magic Eden, a leading NFT marketplace, officially launches its royalty-focused Creator's Alliance with a variety of notable Web3 projects and partners. Link

Max Mara introduces new fashion virtual universe in Roblox. Link

🌎 Crypto & Macro

In the bull’s eye💥

Bitcoin is driving the market.

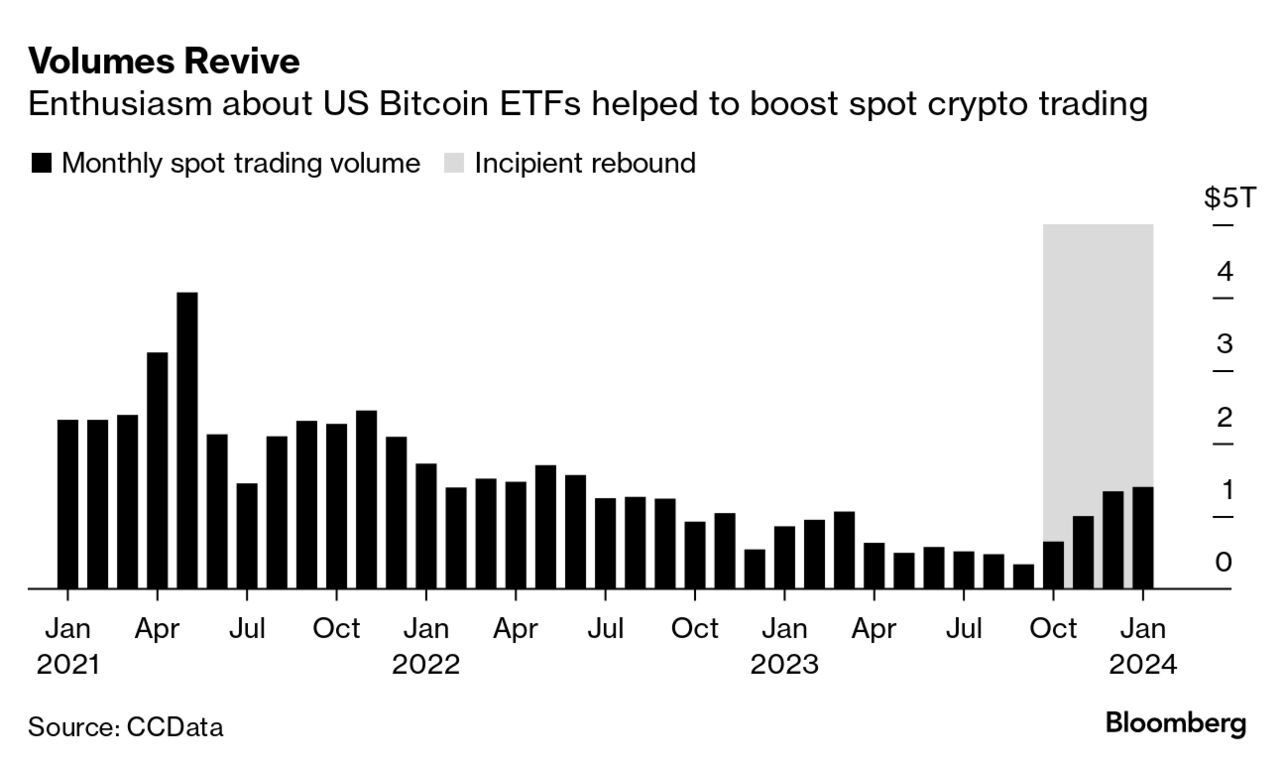

Bitcoin jumped 20% this week, surging past $52,000 to highs we haven’t seen in over 2 years.

Digital asset investment products saw inflows of $1.1BN, with year-to-date inflows of $2.7BN. AuM is at the highest level since early 2022 at $59BN.

Bitcoin saw almost 98% of the inflows.

What’s happening: Institutional investors keep buying Bitcoin with an increasingly positive investor sentiment.

Be smart: Bitcoin halving is fast approaching, which historically has correlated to a rise in price.1

The big picture: A rising tide lifts all ships.

Bitcoin has a massive trickle-down effect on alt-coins, NFTs, and digital assets in general.

More interest brings more investments, higher budgets, more brands and start-ups (cf. crypto price innovation cycle)

And it seems that we’re just getting started.

More on crypto:

Wall St. giant Franklin Templeton is the latest firm to file for a spot ETH ETF. Link

Coinbase beats Q4 estimates as transaction revenue rises to $529 million, stock Jumps 11%. Link

Crypto money laundering activity down 29% from 2022: Chainalysis. Link

Ledger & Coinbase partner to give consumers direct access to buy & sell crypto. Link

Citi Bank tests tokenization of private equity funds on Avalanche. Link

🧠AI

Creating video from text: OpenAI announced Sora. Link

US Patent & Trademark Office declares AI and robots can’t hold patents. Link

Sam Altman, CEO of OpenAI, is talking to investors to raise $5T to $7T. Link

🏗️ Start-ups & Tools to watch

LimeChain: A leading blockchain consulting & development agency with 120+ chain-agnostic devs. Link*

*partner of Dematerialzd.

💰 Money Moves

Vatom: The Web3 consumer engagement platform, announced $10M in Series B funding with a valuation of $125M. Link

Solana: Second phone crosses 100,000 presales, securing $45M for development. Link

Analog: The blockchain interoperability project raised $16M in seed funding. Link

That’s all for now, folks. Thank you for being part of the journey.

Talk soon,

– Marc

👉 PS: Join BD3, a private community of BD, Sales, & Marketing leaders driving Web3 adoption — Apply today (I’m part of it too, it’s terrific).

📈 Top 3 Charts to Share with Friend

Partner with us

⚡️ Get in front of 8k+ of Web3 industry leaders 👀

Partner with Dematerialzd to get your brand in front of thousands of Web3 industry leaders. Get in touch today or reply to this email.

👩💻 Top Web3 Marketing Jobs:

… more.

Are you hiring? Get listed here →

👉 More feedback? We would love to hear from you! Just reply to this email.

In the two-year period before and after bitcoin’s first halving, in 2012, there was about a 30,000% price increase, Rhodes says. In 2016, it was about almost 800% over that two-year period; for the 2020 halving, investors saw a 700% gain.

Man, I don’t know how you get so much information into these as often as you do. Great work, Marc!

Hey Marc,

thanks for content,

WEB3 for brands is a game changer for someone this is a win-win